Summary:

- Chesapeake Utilities has entered into an agreement to acquire Florida City Gas from NextEra Energy in an all-cash transaction.

- The acquisition aligns with Chesapeake Utilities’ growth strategy and will significantly increase its natural gas operations in Florida.

- This all makes for an intriguing opportunity, and shares look attractive enough to warrant optimism moving forward.

WanderDrone/iStock via Getty Images

On September 26th, after the market closed, news broke that utility company Chesapeake Utilities (NYSE:CPK) had entered into an agreement to acquire Florida City Gas, a subsidiary currently owned by NextEra Energy (NYSE:NEE) in an all-cash transaction. This maneuver might seem risky given the size of the asset relative to the current market capitalization of Chesapeake Utilities. But when you look at management’s rationale and when you consider the solid track record of growth that Chesapeake Utilities has achieved, the transaction does make a lot of sense. This is yet another example of good, forward-looking thinking that management has engaged in and, while shares of the enterprise aren’t the cheapest, they are appealing enough to warrant a slightly bullish outlook moving forward.

Looking into Chesapeake Utilities

Before we dig into the specifics of the acquisition that Chesapeake Utilities is making, it might be helpful to have a better understanding of the company itself and the quality of the operation that management has created over the years. This will help us set the groundwork for why this latest acquisition is a logical step for the enterprise. Founded in 1947, Chesapeake Utilities has slowly grown its business into a nice, but fairly small, utility operator. The company currently has operations spread throughout North Carolina, South Carolina, Florida, Delaware, Maryland, Pennsylvania, Virginia, and Ohio. It fashions itself as an energy delivery company that engages in the distribution of natural gas, electricity, and propane. It’s also involved in the transmission of natural gas, and the generation of electricity and steam.

The company has two different operating segments. The first of these is called Regulated Energy, while the second is called Unregulated Energy. Individuals familiar with the utility space we’ll understand the differences between these two segments just by their names. There are many differences between these two types of operations that investors should be aware of if they decide to get into the utility space. But one of the most significant involves rates that are charged to customers.

The Regulated Energy segment, for instance, derives revenue that’s based on rates that are regulated by the PSC in the states in which it operates and by FERC when it comes to some of the company’s assets. These rates are largely determined by the company’s operating costs, financing costs, and they have baked in them a certain amount on top of this in order to capture a reasonable return for shareholders. Unregulated Energy, meanwhile, can charge a market rate based on what the company believes customers will pay and this is typically in a market in which there are multiple utility providers.

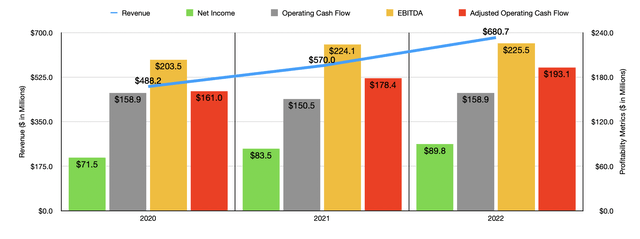

In recent years, the management team at Chesapeake Utilities has done a really good job of growing the company, both on its top line and on its bottom line. Take revenue for instance. Between 2020 and 2022, sales expanded from $488.2 million to $680.7 million. The revenue expansion for the company occurred across both of its operating segments. As an example, during this three-year window of time, revenue under the Regulated Energy segment jumped 21.7% from $352.7 million to $429.4 million. Meanwhile, revenue growth under the Unregulated Energy segment was 84.1%, taking sales up from $152.5 million to $280.8 million.

With the increase in sales came higher profits as well. Net income, for instance, grew from $71.5 million to $89.8 million. It is true that operating cash flow remained in a fairly narrow range between $150.5 million and $158.9 million. But if we adjust for changes in working capital, we get an increase from $161 million to $193.1 million. Meanwhile, EBITDA for the enterprise grew from $203.5 million to $225.4 million.

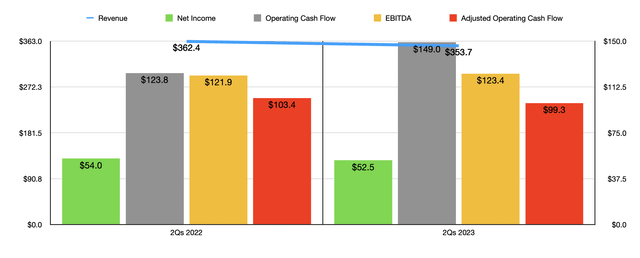

Even though the company has done well to grow in recent years, that doesn’t mean that every window of time will represent a period of growth for the enterprise. In fact, the current fiscal year has been a bit challenging. Revenue actually fell in the first half of the year, declining from $362.4 million last year to $353.7 million this year. The Regulated Energy portion of the company was actually a bright spot, with revenue continuing to climb. From the first half of 2022 to the first half of this year, sales under that segment expanded by 10.6%. Continued pipeline expansion projects, Base rate growth, and organic growth in the company’s natural gas distribution operations, all combined to push revenue up here. Unfortunately, the Unregulated Energy segment more than offset this, with sales dropping from $154.8 million to $123.9 million. The big driver here seems to have involved lower customer consumption that management chalked up trade combination of warmer weather and the conversion of propane customers to the company’s natural gas distribution services.

It should come as no surprise that profits did not really increase during this time. Net income, for starters, dipped from $54 million to $52.5 million. It is true that operating cash flow jumped from $123.8 million to $149 million. But if we adjust for changes in working capital, it actually fell from $103.4 million to $99.3 million. And finally, we have EBITDA. It actually rose slightly from $121.9 million to $123.4 million.

A Solid Deal

As you can see, Chesapeake Utilities is an enterprise that is interested in continued growth. And it’s not afraid to make acquisitions in order to achieve that growth. In fact, across both segments combined, the company benefited to the tune of $26 million when it came to revenue for 2022 compared to 2021. And when it does come to acquisitions, it’s fairly common for utilities to buy assets that are either overlapping with their own or that are close to their own. In theory, this densification of business and clustering of resources should create additional operational efficiencies and increase the likelihood of the company capturing attractive returns for the energy it provides.

To further its growth objectives, the management team at Chesapeake Utilities locked in a deal to acquire Florida City Gas from NextEra Energy you know a deal valued at $923.4 million. All of this will be in cash. Even though I say that this deal will be an all-cash transaction, the amount of cash and cash equivalents that Chesapeake Utilities has on hand right now is only about $4.2 million. So to cover this cost, the firm plans to issue around $400 million in the form of equity while taking on $550 million in long term debt. Specifics have not been provided at this time. But based on the current share price of the firm, we are looking at just under 4 million units being issued as part of the deal. This will result in dilution for shareholders of around 18%.

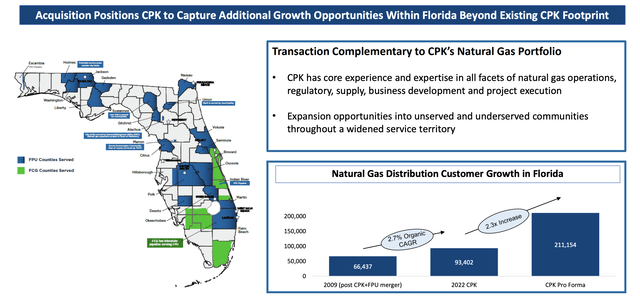

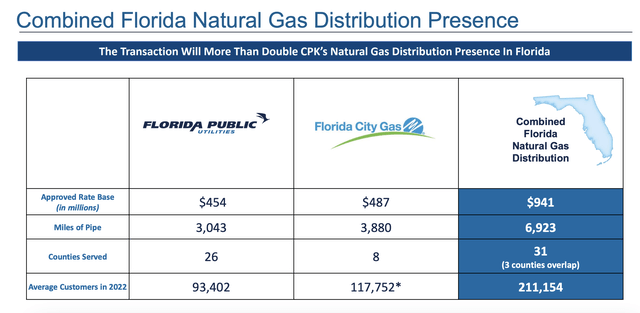

The particular assets being acquired include approximately 3,800 miles of distribution main and 80 miles of transmission pipe. Collectively, the assets serve around 120,000 natural gas customers spread across eight different counties in Florida. This purchase will more than double the company’s natural gas operations in Florida. And upon completion in the final quarter of this year, it’s expected that around 60% of the company’s utility net plant and operating income will come from its assets in Florida. That’s up from the 45% at present.

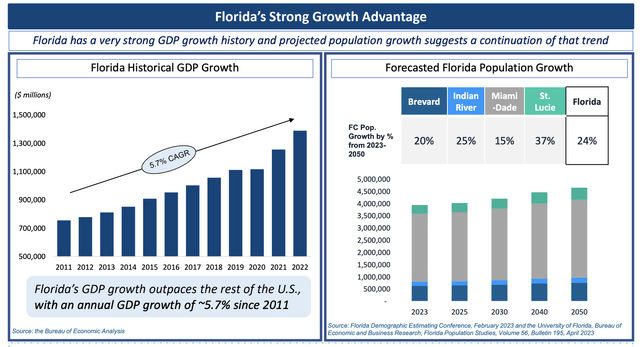

In addition to already having a sizable presence in Florida, there’s another reason why Chesapeake Utilities would be interested in investing in that state. The fact of the matter is that Florida is one of the fastest growing states in the country. The absence of income taxes, combined with warm weather, has proven to be especially alluring to those in retirement or near retirement. From 2011 through 2022, GDP for the state has grown at an annualized rate of about 5.7%. That compares to about 2.9% per annum for the US as a whole. A good portion of the GDP growth has been driven by population growth. And that population growth is expected to continue. From 2023 through 2050, it’s anticipated that the population in Florida should grow by roughly 24%. Over that same window of time, the population of the US as a whole should grow by a more modest 15%.

In fact, management is so optimistic about this transaction that they have revised their entire outlook for the next few years based on it. In 2023, the rate base for Florida City Gas was $487 million. Going into 2024, that should increase by $23.3 million. Florida Public Utilities, which Chesapeake Utilities owns, has a rate base of $454 million. And that should increase next year by $17.2 million. There should be a combined rate increase of $40.5 million, taking the firm’s Florida assets from $941 million this year on a pro forma basis to $981.5 million next year.

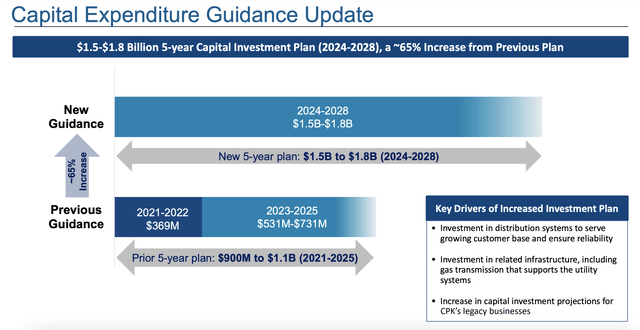

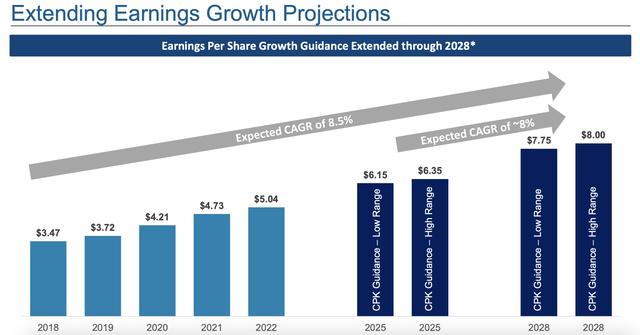

The purchase of Florida City Gas brings with it, on its own, the opportunity for around $500 million of incremental investment opportunities over the next five years. Already, management had indicated in the past that it was the company’s goal to spend between $900 million and $1.1 billion on capital projects between 2021 and 2025. The new five year plan, covering from 2024 through 2028, has that number now coming in at between $1.5 billion and $1.8 billion. The end goal here is to take annualized growth in earnings per share up by 8% from 2025 through 2028. In 2022, the company generated profits per share of $5.04. The ultimate goal is to get that to between $7.75 and $8 in 2028.

Even though we don’t know the specifics of the debt arrangement or exactly how many shares of the company will be issued as part of the transaction, we do have this earnings guidance to work with. And it is unlikely that the number of shares issued will be radically different and if we assume the company’s current share price as the price used to determine the quantity that’s ultimately issued. In addition to this, if we pull back from management’s guidance for earnings for 2025, essentially deflating those profits by the annualized growth rate of 8% that management is forecasting for, we should get earnings per share next year, inclusive of this acquisition, of about $5.79. With the increased share count, this should translate to net income of roughly $126.2 million. Using this approach, making some estimates for this year, I figured that the company should, next year, generate operating cash flow of roughly $268 million and EBITDA of $330 million. All of this is based on assumed earnings this year of $87.3 million, assumed operating cash flow of $185.4 million, and assumed EBITDA of $228.3 million.

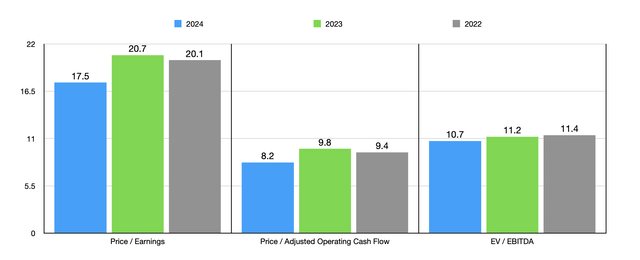

Based on these figures, you can see how the company is priced on a pro forma basis for 2024. The chart above also shows pricing for 2023 and 2022, both without factoring in the purchase of Florida City Gas. On an absolute basis, shares may not look all that appealing relative to earnings. But I would say that they look fairly attractive when it comes to cash flow. In the table below, meanwhile, I compared Chesapeake Utilities to five similar companies. On a price to earnings basis, it ended up being the most expensive of the group. When it comes to the price to operating cash flow approach and the EV to EBITDA approach, I found that four of the five companies ended up being cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Chesapeake Utilities | 20.7 | 9.8 | 11.2 |

| Northwest Natural Holding Company (NWN) | 13.5 | 5.4 | 8.7 |

| Suburban Propane Partners (SPH) | 10.6 | 4.3 | 9.7 |

| Spire (SR) | 13.1 | 11.6 | 10.8 |

| RGC Resources (RGCO) | N/A | 8.5 | 23.3 |

| ONE Gas (OGS) | 17.1 | 1.9 | 10.9 |

Takeaway

Based on the data that has currently been provided, I would say that Chesapeake Utilities is a solid prospect at this point in time. Shares are a bit pricey relative to similar enterprises, but they look reasonably priced on an absolute basis. This particular transaction opens up the potential for some nice growth in the years to come, with the company benefiting tremendously from the location of the assets it’s picking up. Meanwhile, NextEra Energy is set to receive a nice chunk of cash that it can use for its own endeavors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is a service geared toward investors who are interested in keeping track of oil and gas E&P firms. It offers its subscribers cash flow deep dive analyses into a portfolio of 36 different E&P companies of all sizes, as well as periodic sensitivity analyses. The world of E&P companies is incredibly volatile and understanding how healthy these firms are and how well they can stand up in different environments can result in attractive returns, especially in an environment where oil and/or gas prices are elevated.