Summary:

- Despite their decline in market cap, oil majors like Chevron still have significant physical assets and revenue streams that rival many large tech firms and nation-states.

- Chevron’s size, stability and attractive valuation makes it attractive to dividend investors as a prime candidate for compounding.

- Chevron, in particular, is a good investment option due to its track record, commitment to decarbonization, and strong capital return policy, regardless of potential recession risks.

- There are increasing chances for significant share price appreciation if recession is avoided. If it is not, price weakness can be used to lock in a higher yield.

Joe Raedle

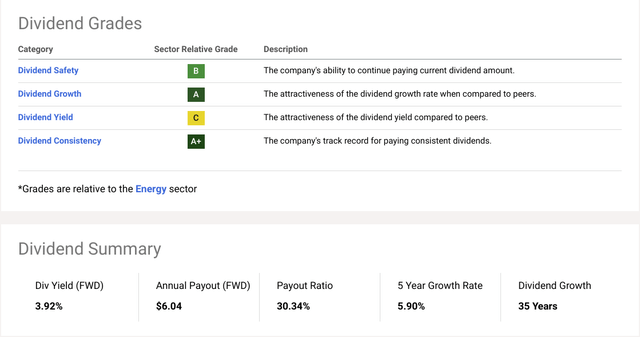

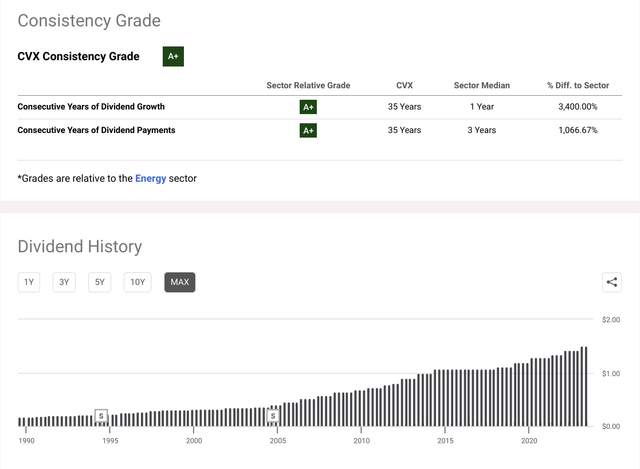

In Chevron’s (NYSE:CVX) most recent earnings call, one of the analysts on the line asked about the company’s dividend. Of course, this firm is a dividend aristocrat that has continued to deliver through thick and thin, but I thought the confidence and straightforwardness of his answer were telling:

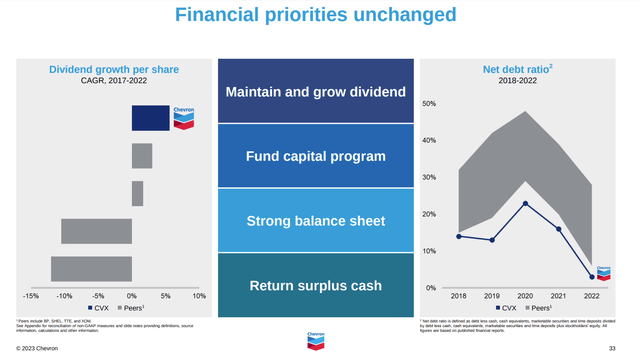

On dividends, I would say our track record should speak for itself. Of course, these are decisions that are made by the board each year, but we’ve got 30 — 36 consecutive years now of higher payouts over the last five years. Our dividend growth per share has been double that of our closest peers. So we’ve sustained this not over the long haul, but also in the short term through the volatile period of time that we’ve seen. Our dividend track record, I think stands very well. -Mike Wirth, Chevron CEO

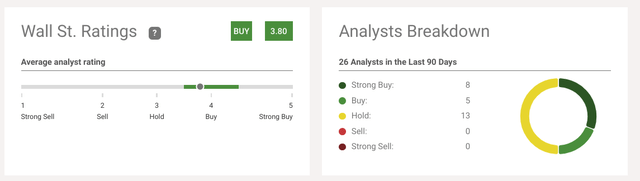

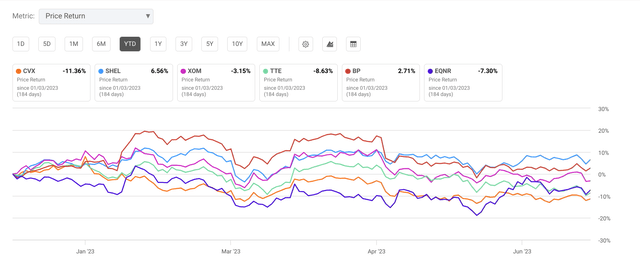

Chevron has lagged behind its oil major peers pretty dramatically since the post-COVID recovery, but I think that might be about to change. While Exxon’s (XOM) aggressiveness has paid off and will likely continue, there is room for Chevron to catch up in a more defensive environment. The stock has recently been upgraded by both RBC Capital Markets and JP Morgan.

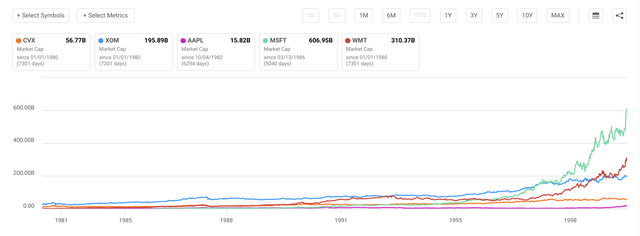

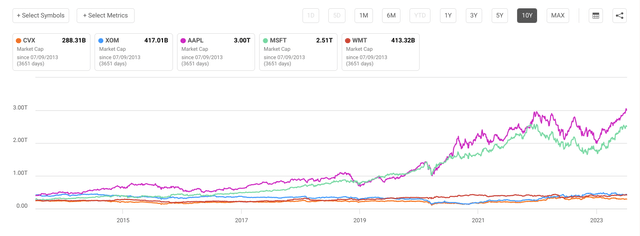

Many investors who have entered markets more recently may not grasp the sheer size and scope of the oil majors, given their steep decline in market cap over the years. Before the 2000s, oil companies were usually more significant than any Technology firm. Of course, that began to change at the end of the decade.

Notice how WMT marketcap stays stable (Seeking Alpha)

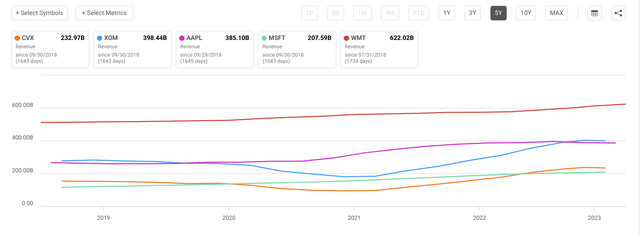

However, it is essential to remember that the physical assets of these prodigious firms rival that of many formidable nation-states. They also have armies of qualified engineers and specialized personnel. Indeed, these companies are so large they are a barometer of the economy. Revenue is a metric, for instance, that casts these companies in a very different light:

Well, would you look at that? Chevron has more revenue than Microsoft (MSFT), Exxon (XOM) has more revenue than Apple (AAPL), and Walmart (WMT) has more revenue than all of them! In this light, you can see how secure Chevron’s and Exxon’s cashflows are compared to other prodigious companies in our economy.

You can see that despite the harsh rhetoric on both sides of the Energy debate, there’s no realistic situation where Exxon and Chevron go to zero without you having many more significant problems than your portfolio being red. An attractive capital return policy is also more of a priority given the unique drivers of their reputational risk than perhaps any other industry.

This is important when investing in Total Return because the oil majors’ massive size and entrenched competitive position is a majorly attractive feature for dividend investors. It’s even more attractive when management genuinely competes for the interest and loyalty of these investors.

Many newer and younger investors might focus solely on price appreciation, but I believe this is a significant mistake, and this stock pick will show why. The firm’s commitment to dividend growth through even the most challenging times demonstrates how you can sleep sound owning this name.

Massive stocks with entrenched competitive positions allow you to approach your investment in a way that mitigates the potential for adverse outcomes, so long as you have a long time horizon. When you own a large dividend, stock price weakness becomes not your bane but an opportunity to accelerate compounding and lock in a higher yield.

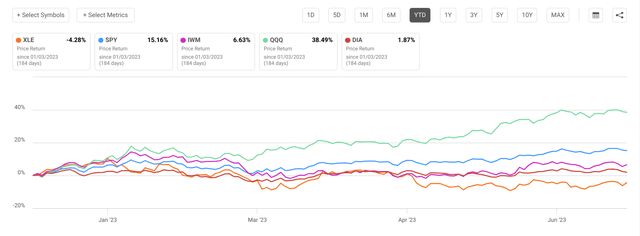

I recently did a piece on three of my favorite Energy dividend stocks. Still, this particular stock has a unique opportunity for price appreciation since it’s more beaten down than its peers. There’s potential for solid performance if commodities catch up to performance in other cyclical stock market areas like Consumer Discretionary.

Energy has been a laggard this year after its best-ever performance last year. And with building uncertainty as to whether we are about to enter a recession, I think it makes a lot of sense to initiate a position in Chevron (CVX) or add to one if you already own some of the stock.

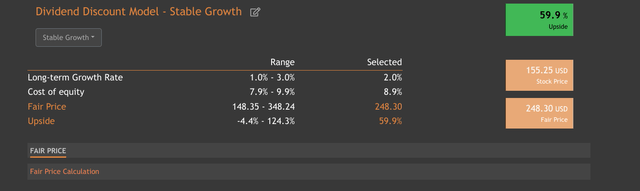

Valuation Shows Potential for Price Appreciation

Chevron got a little ahead of its skis after the best annual performance for its sector in history, but now it has become more attractively valued. Howard Marks says he never waits for a “bottom” to buy an undervalued stock. Given Chevron’s strong balance sheet and increasingly viable efforts at clean energy projects, I think it’s a good time for long-term investors seeking compounding to buy the stock.

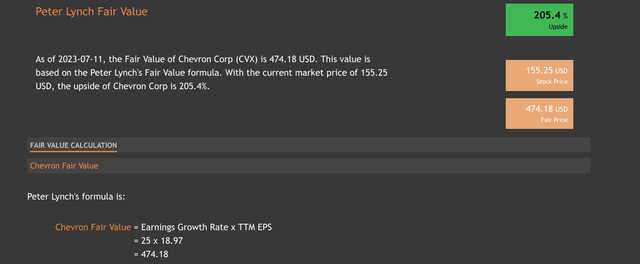

As you can see, the firm has a lot of room for upside when you value it intrinsically based on its future dividend cashflows, but what stuck out to me was how advantageous this firm is priced when using the Peter Lynch Fair Value Method.

Of course, Chevron’s financial management style matches Mr. Lynch’s preferences for companies with cash positions and lower debt levels than peers. Of course, this might be somewhat mitigated if you think we are at the end of the cycle. Energy companies are notoriously cyclical, but you can see that CVX is still priced very low in terms of Price/Cash Flow and EV/Sales.

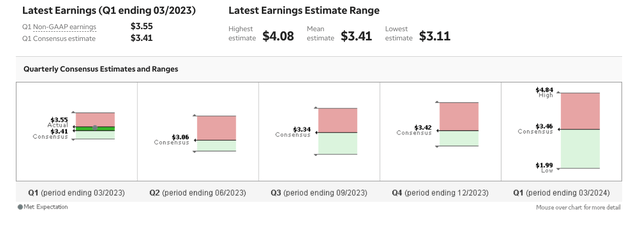

The stock has been underperforming its peers on a YTD basis, but I think that will reverse in a big way if we avoid recession. Increasingly there is mounting evidence this will be the case. The expectations for earnings could be too low if we avoid a recession.

So, we are in a period of unprecedented economic uncertainty after the pandemic. Many contradictory and confusing data have flummoxed Fed economists, stock researchers, and the bond market. However, the question of whether or not we avoid recession is very crucial for the performance of Chevron. Right now, it seems to be priced as if there is an upcoming recession.

And while this is a trough year for energy earnings after the spectacular 2022 performance, the unanticipated strength in the economy and a recovery in depressed natural gas prices could help the stock find gains in the coming quarters.

Why Buying Chevron Has Good Risk/Reward for Long-Term Shareholders

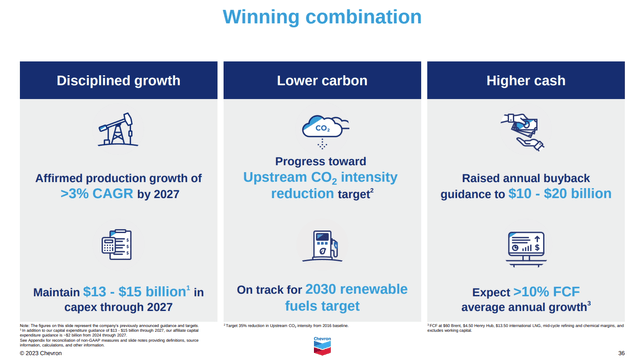

Even in a recession, though, Chevron is battle tested. After navigating two existential crises, the company is hardy and is a genuine leader in decarbonizing technologies. The firm has shown a more specific commitment to decarbonization earlier than some peers, which could also ingratiate it during a coming period of likely regulatory relief.

Adding Chevron’s great dividends, track record, and overall premier capital return policy means you can afford to wait through risks. I think it’s a great time to initiate a Chevron position if you haven’t already or if you have a long time horizon:

- If we avoid recession, the convergence of seasonal tailwinds for natural gas will be exceptionally accretive to Chevron’s earnings.

- The oil majors will benefit, and the bumper earnings for quarters could continue for the rest of 2023.

- If a recession does occur, you can use price weakness to accumulate a more prominent position with higher yields to benefit from compounding when prospects for share price appreciation improve.

- Chevron has had seven straight quarters of 12% capital return and has outshone peers regarding dividend growth.

- Regulatory relief for the oil industry has become a key legislative priority for Republicans, and Chevron’s clean energy initiatives give it cover.

So, in other words, if you buy Chevron and there’s price weakness on the heels of a recession, I would also consider this an opportunity. If you have a lot of time, you have most of what you need to be a successful investor in companies with capital return policies like Chevron’s.

The key to owning Chevron for dividend holders is that it’s proven its mettle through the worst that previous history and cycles have thrown at it, and it has demonstrably made itself even more impervious to the cyclical activity that defines its business.

Risks and Where I Could Be Wrong

The Energy industry is hazardous, and this risk can be elevated when there is a lack of clarity regarding our current position in the economic cycle. It could alter my thesis if the inverted yield curve proves prophetic and a nasty recession brings oil prices down very far. In the extreme but also the unlikely circumstance of severely adverse economic contraction, it is possible that the dividend could be interrupted.

But, again, the record of the firm’s commitment to making capital return policy sacrosanct is admirable and speaks for itself, as the title of this piece says. The Seeking Alpha Quant Grades are not showing the most favorable conditions for the stock across several metrics. Still, I would also argue that based on intrinsic valuations, the firm clearly shows strong potential for compounding.

I think the most significant risk is regulatory and economic, but the regulatory risk is less acute in the short term and represents a longer-term catalyst. In the short term, the Energy industry appears to be getting more legislative priority from the Republican side of the aisle than in years, which should mitigate short-term overreach by activist groups.

With the Biden Administration focused on supporting our Ukrainian Allies and undermining Russia, it is hard to miss what a strategic national asset the Energy industry has been. But there are a lot of risks stalking the market, and Chevron is still cyclical despite its relatively resilient nature. So the following risks becoming worse could all threaten my thesis and cause pain for Chevron.

- Escalation in Ukraine or Taiwan.

- Fed Policy Error.

- Banking Issues Worsen.

- Return of Inflation.

- CRE meltdown.

- Write-downs of Private Assets.

Of course, ongoing issues with OPEC could prove problematic if relations deteriorate with its members or if they ratchet up the competition against their American rivals.

Conclusion

Chevron is a titan of American industry and has been a capable steward of shareholders’ interests over decades. It has proven its long-term reliability for discerning shareholders who don’t let emotions and the undulations of economic fortune deter them from building wealth. There has been difficulty for professional investors and economists in determining where in the economic cycle we are. In this instance, I think it will work to Chevron’s advantage.

As you can see, there is a wide range of earnings estimates for the company, and this suggests to me that in the event of a soft landing from the second most aggressive Fed tightening cycle in history, the earnings potential of this firm will most likely have been significantly underestimated by consensus. Given the incredible dividend record and superior dividend growth, this is a great entry point for longer-term investors into Chevron.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.