Summary:

- Chevron delivered a robust Q3 earnings report. However, the underlying energy markets have weakened further through Q4.

- Despite that, CVX continued its upward momentum, as its recent momentum surge saw it take out its June highs.

- However, we explain why investors need to be very cautious here. Coupled with slowing growth moving ahead, a material re-rating is increasingly unlikely.

- Maintain Sell.

JHVEPhoto

Thesis

Chevron Corporation (NYSE:CVX) investors have recently been cheering the leading oil and gas company as it surged rapidly from its September lows and re-tested its June highs.

Remarkably, the momentum spike occurred while WTI crude (CL1:COM) and Henry Hub natural gas futures (NG1:COM) remained well below their 2022 highs. Therefore, the bifurcation should be considered a cause for concern, given the price action in the underlying energy markets. We believe the underlying markets are at a critical juncture as buyers attempt to retake lost vital support levels to maintain their bullish bias.

Hence, investors need to be prepared for more challenging operating performance ahead, as it’s not reasonable to expect Chevron to keep delivering such remarkable growth rates consistently.

Also, we gleaned that CVX’s valuation has moved well ahead of its peers and industry. Coupled with price action that warrants significant caution given the sharp spike, we urge investors to consider cutting exposure here.

Maintain Sell.

CVX’s Valuation Is More Expensive Than Peers Now

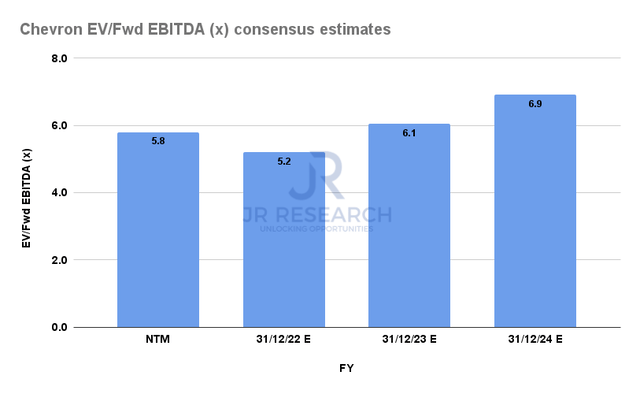

CVX Forward EBITDA multiples consensus estimates (S&P Cap IQ)

Even the bullish Street analysts don’t expect Chevron to keep posting such robust profitability growth moving ahead. As a result, Chevron’s adjusted EBITDA is expected to peak in FY22 before falling through FY23.

We believe it could explain why the market has “refused” to re-rate CVX higher, given potentially lower profitability moving ahead.

As seen above, CVX last traded at an NTM EBITDA multiple of 5.8x, above its FY22 multiple of 5.2x. Notably, CVX’s FY24 EBITDA multiple of 6.9x is discernibly higher than its NTM multiple.

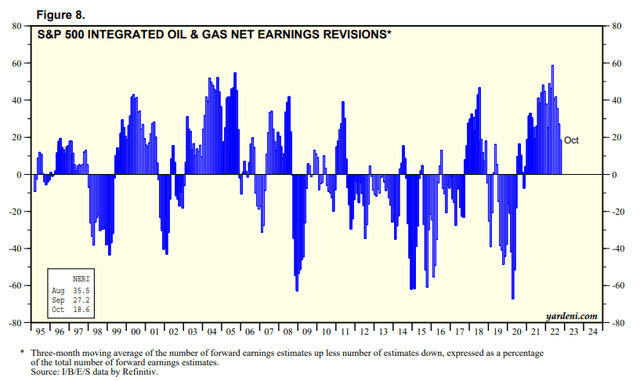

S&P 500 Integrated oil and gas industry net earnings revisions % (Yardeni Research, Refinitiv)

Moreover, industry analysts are still very bullish on the industry’s prospects, as they continued to revise their earnings estimates upward through October. Hence, we believe the market is likely reflecting the potential for earnings compression if demand destruction worsens from the current levels.

As a result, CVX’s NTM EBITDA multiple is still below its 10Y mean of 6.2x. Notwithstanding, it has already surged ahead of its oil and gas peers’ median of 4.4x. Its NTM normalized P/E of 10.3x is also ahead of its industry forward P/E of 9.8x.

Therefore, there’s no discernible valuation advantage from CVX’s current valuation to suggest a further re-rating is justified, given worsening macro risks.

CVX: Peak Growth In FY22 Before Falling Through FY24

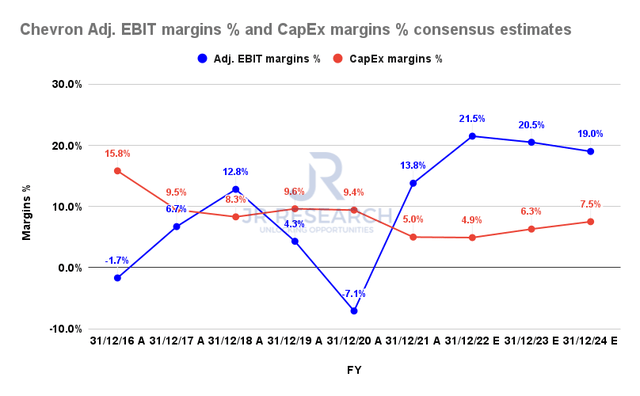

Chevron Adjusted EBIT margins % and CapEx margins % consensus estimates (S&P Cap IQ)

As seen above, Chevron’s adjusted EBIT margins could move lower through FY24, even though it remains above its pre-COVID metrics. Even though these estimates could be potentially revised downward if the demand outlook worsens further, we still expect energy supply/demand dynamics to remain tight.

However, the Street’s estimates on its CapEx margins could be lower than what the company guided, which could affect its free cash flow (FCF) projections.

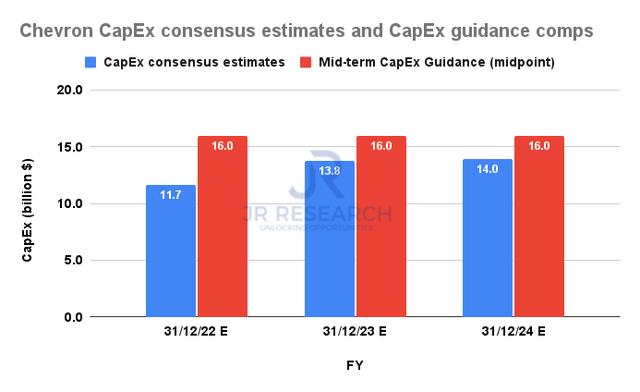

Chevron forward CapEx comps (S&P Cap IQ)

The current Street consensus for its FY23 CapEx of $13.8B is well below the company’s $16B midpoint guidance. Furthermore, Chevron highlighted that it’s possible to move toward the higher end ($17B) of its guidance range.

Is CVX Stock A Buy, Sell, Or Hold?

Analysts probed management on whether the company considered a more aggressive buyback program given its strong FCF generation. Notably, its NTM dividend yield of 3.2% is also on the low side compared to its industry average of 4.1% (according to S&P Cap IQ data).

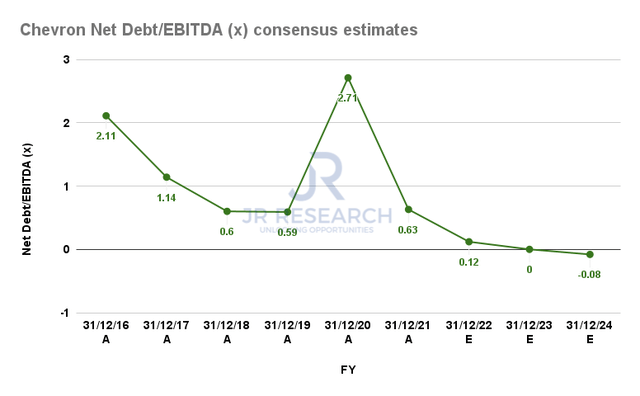

Chevron Net Debt/EBITDA consensus estimates (S&P Cap IQ)

Management accentuated that its focus remains to clear its debt first and make the necessary CapEx investments before returning capital through buybacks or dividend raises.

We believe it demonstrates the astuteness of CEO Mike Wirth and his team. The consensus estimates indicate that Chevron’s Net Debt/EBITDA multiple could continue moving lower with the company’s capital allocation priorities.

As such, it should help to boost its earnings profile, lifting shareholder value by reducing its interest expense.

With the surge in CVX prices through 2022, we believe management also sees the potential for a price correction that could offer better opportunities for the company to be more aggressive in buybacks moving ahead. Wirth also suggested what he thought could be a more appropriate buyback program for Chevron, as he articulated:

We could have a larger buyback program today. Absolutely, if we wanted to just peg our net debt ratio at a higher level. But I think our shareholders would appropriately question that strategy as not being across the cycle. So we’re setting the buyback at a level that allows us to maintain it across the cycle when prices do correct. (Chevron FQ3’22 earnings call)

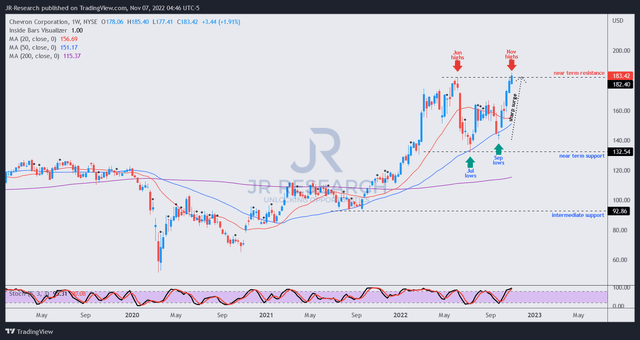

CVX price chart (weekly) (TradingView)

With CVX having re-tested its June highs while the momentum in the underlying energy markets remains tepid, we urge investors to be extremely cautious here.

Furthermore, the surge from its September lows appears to be shaping up as a potential bull trap that could ensnare CVX bulls at the worst possible moments.

Hence, we urge investors to consider using the rally to cut exposure here. More conservative investors can await a validated bearish reversal price action before selling.

Maintain Sell.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!