Summary:

- Exxon’s recent takeover of Pioneer has generated excitement for additional domestic O&G consolidation. However, I would argue that Exxon was late to the party.

- Chevron has arguably been much more successful at M&A, buying both Noble Energy and PDC Energy at much more attractive valuation levels. For shareholders, this certainly matters.

- Today, I’ll take a quick look at Chevron’s PDC Energy acquisition and give a preview of Chevron’s Q3 earnings, which are due out on Oct. 27.

- Bottom line: Chevron has been a nimble and efficient actor in the M&A space. A 14x multiple on estimated FY24 earnings equate to a stock price of $200+. CVX is a buy.

Mario Tama

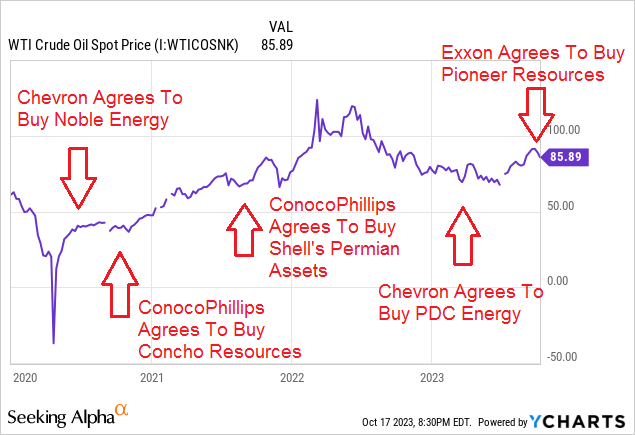

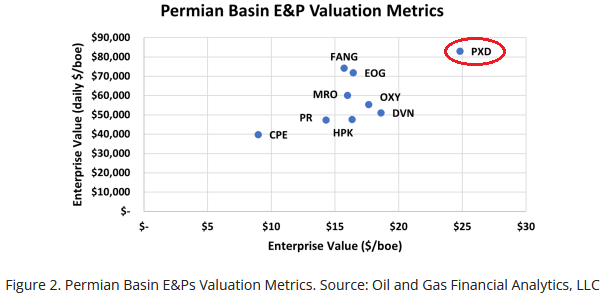

Major consolidation in the shale patch continued with Exxon’s (XOM) recent announcement to buy tier-1 Permian producer Pioneer Resources (PXD) in a $60 billion all-stock transaction. As shown in the graphic below, Exxon was arguably late to the party considering Occidental Petroleum (OXY) bought Anadarko Petroleum back in 2019 and both Chevron (NYSE:CVX) and ConocoPhillips (COP) took advantage of the pandemic downturn to announce significant deals when the price of WTI was much lower. Today I’ll take a brief look at Chevron’s deal to acquire PDC Energy and what investors can expect from Chevron’s Q3 earnings report, which is due out on Oct. 27.

YCharts

Note: Red Annotations By The Author

The PDC Deal

Chevron closed the $6.3 billion all-stock PDC Energy acquisition on Aug. 7. Including the assumption of debt, the enterprise value of the transaction was $7.6 billion. Using Chevron stock for the transaction was wise for Chevron shareholders considering that – at the time the agreement was announced – CVX was trading at an EV/EBITDA multiple more than 2x that of PDC.

What Chevron got for its money also was impressive:

- Over 1 billion boe of high-quality proved reserves. That equates to a 10% increase in Chevron’s proved reserves base at a cost of only ~$7/boe.

- The deal was expected to be accretive to all significant financial metrics within the first year of closing with an expected $1 billion in incremental annual free-cash-flow at WTI=$70/bbl and HenryHub=$3.50/Mcf.

- Chevron expects to achieve an estimated $500 million in combined annual operational and cap-ex efficiencies from the deal.

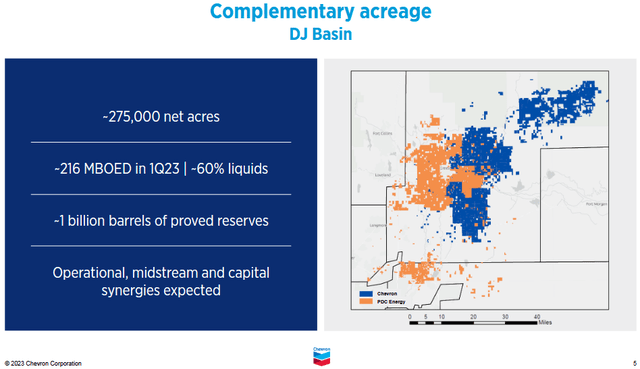

While PDC Energy owned 25,000 net acres and 28,000 boe/d of production in the Permian Basin, this deal was primarily a consolidation of the two companies’ Denver-Julesburg acreage (i.e. the “DJ Basin”):

The graphic above was taken the Chevron’s PDC Acquisition Presentation and shows the extremely complimentary footprints of the two companies’ DJ Basin leaseholds. As can be seen in the graphic, PDC held 275,000 net acres in the play and had 216,000 boe/d of low-carbon intensity production (zero flaring) in Q1, of which ~60% was liquids. On the Q2 conference call, Chevron’s CEO Mike Wirth said:

When we close PDC, we’re going to be producing 400,000 barrels a day in the DJ Basin.

It also was noted on that conference call that PDC had a very front-end loaded capital program this year – meaning the PDC assets will be spinning off significant free-cash-flow for Chevron during the second half of the year.

Bottom line: PDC Energy was an extremely attractive deal for Chevron shareholders and gives the company a diversified and strong runway for growth in the DJ Basin in addition to the company’s tier-1 position in the Permian Basin.

Q3 Earnings Preview

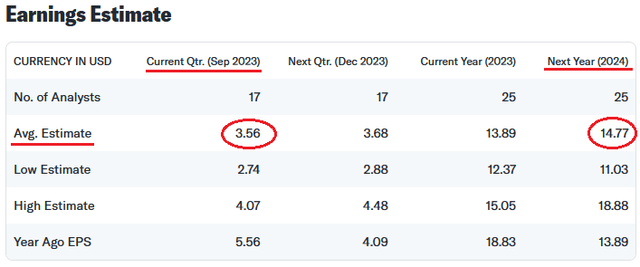

Since the PDC deal closed on Aug. 7, almost two thirds of PDC’s quarterly production will have been on Chevron’s books for Q3. Per Yahoo Finance, current earnings estimates for Chevron’s Q3 results are shown below:

For Q3, the average earnings estimate is for $3.56/share. That would be down considerably from the $5.56 Chevron earned in Q3 last year when oil and gas prices were significantly higher due to the impact of Russia’s war on Ukraine and the resulting breaking of the global energy supply chain. However, it would be an improvement from the $3.20/share Chevron earned in Q2 when the company generated $2.5 billion in free cash flow.

With the addition of PDC production, I suspect Chevron will announce Q3 production was well over 3 million boe/d. As far as I know, this will be the first time Chevron has quarterly production of over 3 million boe/d.

The Dividend

For full-year 2023, the above earnings estimate of $13.89/share obviously bodes well for shareholders in comparison with Chevron’s current $6.04/share dividend obligation. That is, I suspect shareholders will – at a minimum – receive at least the 6% dividend increase that Chevron announced last January (along with its $75 billion stock buyback plan).

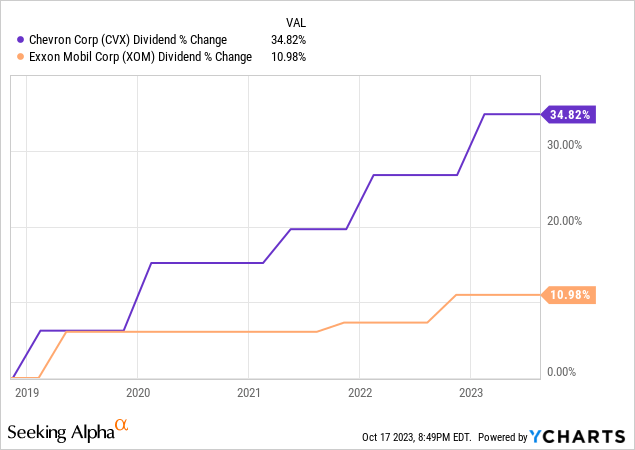

Note that Chevron has delivered superior dividend growth as compared to Exxon over the past five years:

That’s likely due to Chevron’s arguably superior management team and the fact that CVX has consistently held a much stronger balance sheet as compared to Exxon. That balance sheet strength enabled Chevron to raise its dividend in 2020 and make a well-timed acquisition at pandemic lows while Exxon was borrowing money just to pay its existing dividend. Over the past few years, Chevron has also proved itself to be a much more efficient operator as compared to Exxon.

In addition, Chevron has been much more timely when it comes to making acquisitions. Exxon’s ill-fated XTO debacle cost its shareholders dearly when the bottom fell out of natural gas prices and the XTO assets could not even cover the dividend obligation on the Exxon shares the company had issued to fund the XTO transaction. That transaction was a primary reason that Exxon’s total returns for an entire decade were negative and led to institutional investors and money managers to support three Engine #1 nominees to Exxon’s Board of Directors (see How Tiny Engine #1 Was Able To Turn Exxon Around).

More recently, note that Exxon paid a rich price for Pioneer:

RBN Energy

The $25/boe Exxon paid for Pioneer’s proven reserves is more than 3x what Chevron paid for PDC Energy and 5x what Chevron paid for the proven reserves of Noble Energy (less than $5/boe). In my opinion, EOG Resources (EOG) would have been a much better choice.

Summary and Conclusion

Chevron remains my top pick among global super-major oil and gas companies. The company maintains a rock-solid balance sheet, has excellent growth prospects in the Eastern Mediterranean, Permian Basin, DJ Basin, and the Gulf of Mexico, is generating very strong free cash flow, and is shareholder friendly with excellent dividend growth and a massive share buyback program.

According to the EPS estimates shown above, Chevron is expected to earn $14.77/share next year. A 14x multiple equates to a stock price of $200-plus (+18% from the current $169). Add in Chevron’s 3.6% yield and investors can expect a strong 20%-plus return over the next 12 months while also protecting their portfolios from inflation and geopolitical turmoil.

Chevron is a buy.

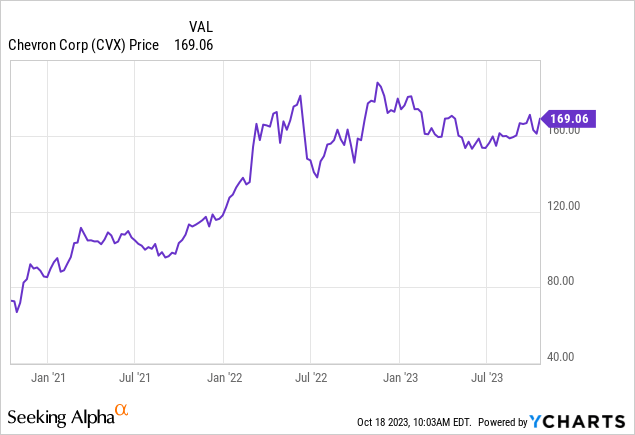

I’ll end with a three-year chart that shows Chevron stock consolidating a base around the $160 level. I would argue the stock is on the cusp of a breakout that will easily (and likely quite quickly …) take the stock to $200/share. That is especially the case given the current geopolitical environment and the fact that, combined, Russia and Saudi Arabia are still holding millions of bbls of crude oil off the global market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COP, CVX, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.