Summary:

- Chevron Corporation is growing production organically and by acquisition with the newly announced PDC Energy, Inc. pickup. We will take a quick look at the PDC deal in this article.

- Cost control is a key aspect of the company’s outstanding financial performance.

- We think Chevron Corporation is attractive at current levels for growth and income.

RichVintage/E+ via Getty Images

Introduction

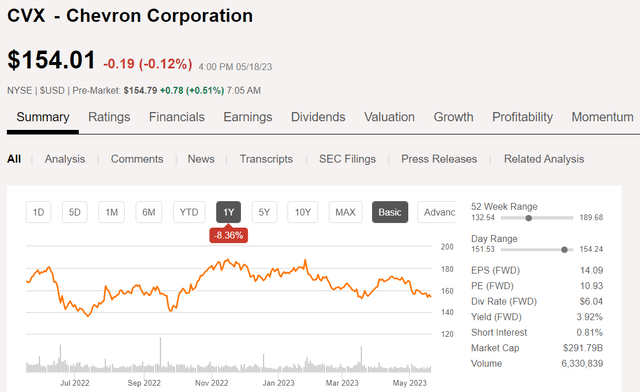

Chevron Corporation (NYSE:CVX) is trading near all-time highs and is scaring some investors and authors on Seeking Alpha. We think these concerns are overblown and investors who are long the stock should look through the current weakness driven by short-term oscillations in oil prices and stay the course.

CVX price chart (Seeking Alpha)

CVX is a beast that should grind out superior results with WTI in its current trading range of $70-$80 per barrel. If WTI moves higher later this year, as I have postulated, due to a generally improving economy, falling supplies, and (perhaps) declining shale production, the company could generate stellar returns. Ahead of CVX investors lie substantial capital returns in the form of stock buybacks and annual dividend increases, and possible continued growth in the company’s stock price.

In this article, we will discuss why I am so bullish on the company, and am recommending investors hold their positions at current levels. Additionally, if continued weakness should chip away at the share price before my thesis kicks in, we will establish a price point for accumulating or initiating a new position in the company.

The thesis for CVX

We have discussed the company a few times in the past, always at cheaper prices than now. My last article focused on one of their key growth areas – The Permian basin – and if it has been a while since you read it, you may want to brush up on it. Particularly since it has a good acreage footprint for the company, post the Noble Energy acquisition.

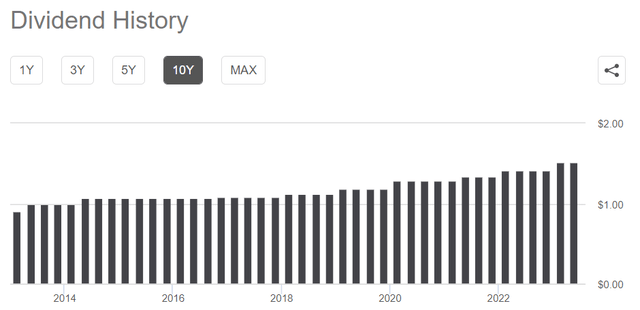

If you know anything about integrated-Upstream, Midstream, Downstream-refining and chemicals, and Marketing, oil and gas companies, you know CVX. Their CEO, Mike Wirth, is a regular on the weekly financial chat shows, doing his bit to spread the industry’s message. CVX is a global operator with footprints in most major petroleum basins, and has taken the soundest position possible on carbon capture and renewables. The company has a very shareholder-friendly approach to capital returns and was one of a few companies who didn’t break faith with investors when the industry was struggling a few years ago and cut their dividend.

Integrity and vision are words that come to mind when I think of CVX’s management. They value their relationship with their stockholders and respect the fact that thousands of them are individual investors who rely on that divvy check to help meet their monthly nut. They could have cut when most other companies did, but they had the vision to realize a rebound was coming and borrowed nearly $20 bn to meet their obligations. Integrity and vision.

CVX dividend history (Seeking Alpha)

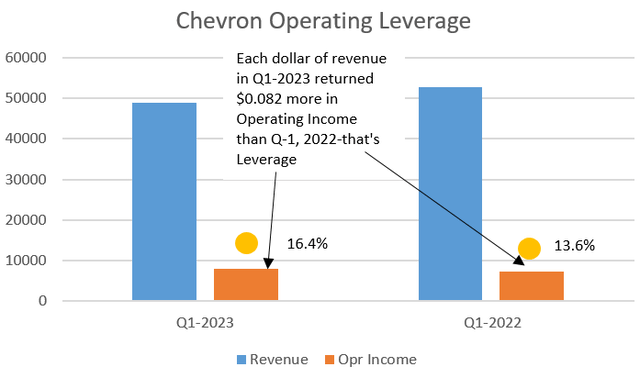

When I say the company is a “beast,” what am I talking about? Let’s start with Operating Leverage. The question arises, how do they do that? The answer lies…

CVX Operating Leverage (Data Seeking Alpha/Chart by author)

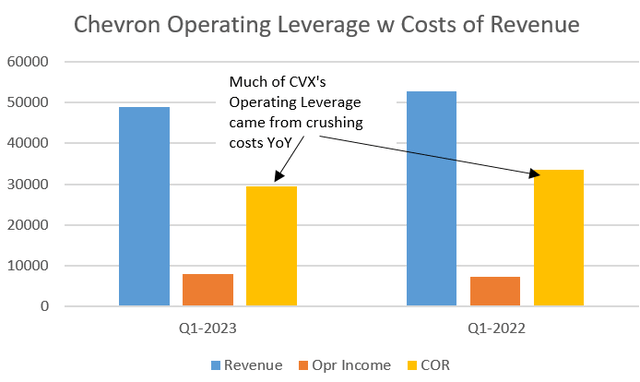

in tightly controlling fixed costs. Let’s look at the chart again with one more column added. What it tells us is that CVX in the face of inflation, supply chain restraints, and a host of other challenges actually reduced Costs of Revenue YoY.

CVX Opr Lev with COR (Data Seeking Alpha/Chart by author)

I’ve worked with Chevron in the past, in California back in the 1980s and in Australia in 2014. One tenet that exemplifies the company is a relentless drive toward flawless execution. On a drilling fluids project for their Wheatstone DW development, I spent nearly two years assuring the CVX asset team that we had the optimal fluid for their wells. That’s just an example of how CVX challenges themselves and supplier to drive out cost and inefficiency from their operations.

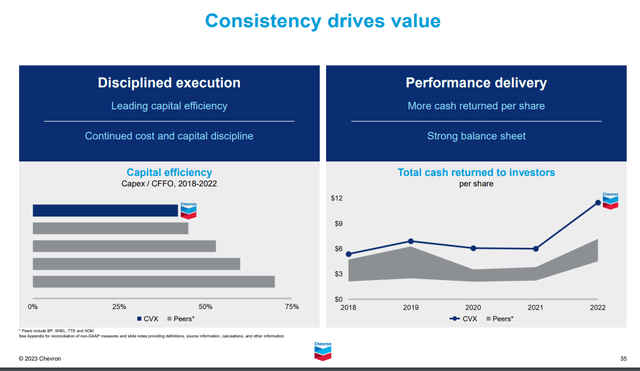

Another metric used to evaluate capital efficiency is to divide capex by Cash from operations. This slide below shows them being ahead of large rivals Shell plc (SHEL), BP p.l.c. (BP), and TotalEnergies SE (TTE). In CVX’s case, one dollar of capex is driving $2.30 in CFO. I would be surprised if CVX wasn’t leading this pack. Notably, they excluded Exxon Mobil Corporation (XOM), another company about which we’ve written favorably in recent times, from the comparison. It’s understandable, as XOM is returning $3.01 in OCF for each dollar of capex.

Catalysts for CVX

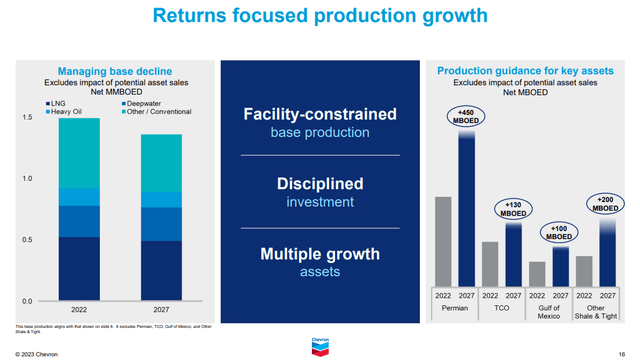

Number one is the Permian basin. CVX has plans to grow Permian output by 450K BOEPD in the next two years to 1 mm BOEPD. I think that will come as a combination of drilling and new acquisitions. The M&A talk has died down since the rumors about XOM and Pioneer Natural Resources Company (PXD) have apparently come to naught. It will flare up again – as far as the M&A talk, there are too many five to ten billion dollar companies with 50-100K BOEPD of production for it not to. CVX can get there by drilling, but they will need more rigs to do it.

SWAG – the company grew production from 2021 to 2022 by 85K BOEPD to 692K, and forecast exiting 2022 at 700-750K BOEPD. Let’s be optimistic and say they hit that 750K, company owned, non-op, and royalty. That’s a rate of growth of about 11% for the two-year period (’21-’23). If we extend that out, +75K in 2023, and 82K in 2024, sometime in 2025 CVX starts pumping a million a day out of the Permian. To exceed their decline of 40% per year, they’ve got to put on new wells generating 375K BOEPD this year, and incrementally more each year after. To get to their 2023 target of 825K by year end, CVX needs to POP 375-400 wells and use 18-20 rigs this year, 20-23 in 2024, and 25+ in 2025 onward. It’s rat race, but it can be done.

Or they could just buy PXD. Or 4-5 smaller players. The point is they can get one million BOEPD out of the Permian.

Quick disclaimer. I was using EIA data some of this “guesstimation.” CVX has some pretty good rock, and I am sure many of their wells exceed the new well average in the DPR. That being the case:

- I could be off on the decline rate for CVX rock. But, again, I’d rather worst-case it.

- My estimates for production growth are conservative and will probably be exceeded.

- In that event, my SWAG on rigs is probably high.

All of this is a positive.

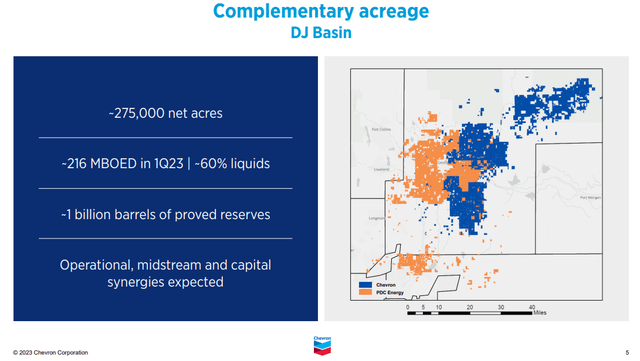

Newsflash

I had no sooner finished this article when news broke of the CVX deal to acquire PDC Energy, Inc. (PDCE) for their Denver-Julesberg basin acreage. As you can see, this is definitely a “bolt-on” for their established position in this play.

The all-stock deal has an enterprise value of $7.6 bn-including debt, and is expected to add ~$1 bn to FCF for FY-2024, assuming a closing in late 2023. It also brings them 216K BOEPD of new production and a billion barrels of 2P reserves, for an acquisition cost of $7 per barrel. CVX will issue approximately 41 mm new shares to close the deal, raising their float about 3%. A point worth noting is it is way cheaper to drill on Wall Street with today’s depressed equity prices.

Gulf of Mexico

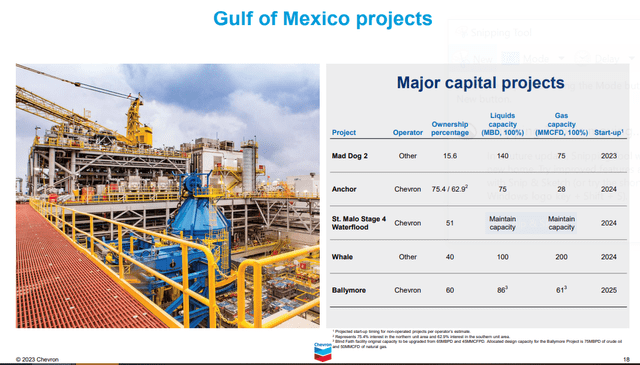

CVX looks to gain about 130K BOEPD out of the Gulf of Mexico (“GoM”) with the projects shown below, and others still in FID. CVX has a deep bench in the long cycle, low decline GoM deepwater. The advantage for them here is the 30+ API gravity GoM crude is desperately needed in Gulf Coast-GC, refining, and generating this blend stock for the vapors produced from shale-API 40-50, saves on feedstock cost in their GC refineries-Pascagoula, and Pasadena.

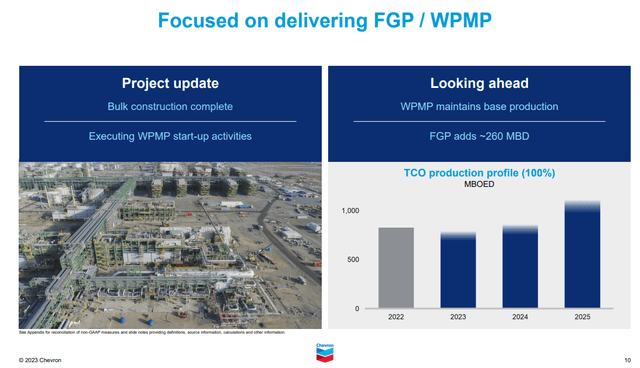

TCO-Tengiz-Chevroil JV

CVX has been involved in Kazakhstan since 1993 to operate the Super-Giant Tengiz (25 bboip) and a smaller adjacent field, Korolev (1.8 bboip). The TCO JV plans to increase production in an area of the world that desperately needs new sources with Russian production embargoed by the west. TCO will be producing 1-million bopd by 2025, and should find ready markets.

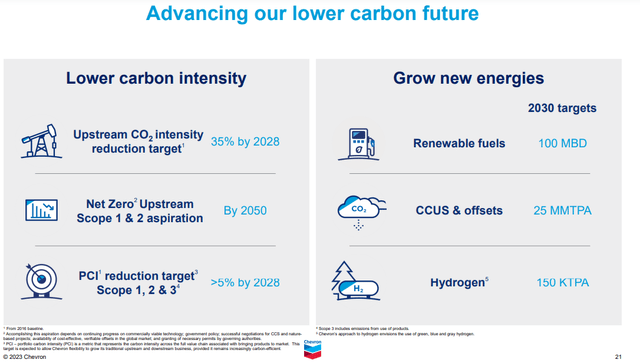

Green, low carbon stuff

I think it’s important to note what is missing from the slide below, windfarms, and solar panel farms. These have and are proving to be expensive debacles for Shell and BP, and their shareholders will one day rue the billions tossed down these rabbit holes. Chevron is taking the smart approach with renewable fuels-largely forms of ethanol. There are existing and ready markets for this stuff, and government kick-backs, rules requiring it in gasoline, make it a sound business as Iowa corn farmers and giant conglomerates like Archer-Daniels-Midland Company (ADM) have well learned.

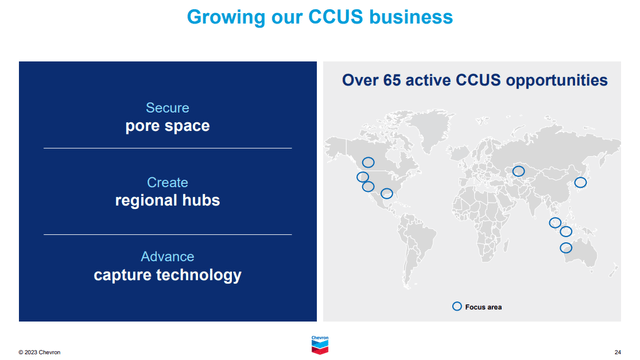

Co2 injection is the smart way to play the craze to shuffle this gas off to eventual sequestration. The government pays you. Generators pay you. It’s like the guy with a parking lot next to the airport. You’ve got to put that car somewhere to get on the plane. Like the parking lot analogy, if you’ve got pore space, you’ve got the deal, as the slide below notes.

The technology is largely field proven over decades of injection into played out oil reservoirs, around the world. Although CVX in Australia is learning what they already knew…producing and injecting are two entirely different things, and sometimes life just deals you a bad hand. I’ve discussed the pros and cons of this technology along the GC and revenues that might be derived from it previously in the Talos article, back in March. Please give it a read for more information, if you’d like it. As the slide below shows, CVX has ample opportunities globally to deploy their expertise in this area.

Risks for CVX

On the E&P side, low gas prices are a risk for the company. Fortunately, these seem to have bottomed recently, rebounding 30% this month alone. They also have the chemicals business, much of which uses gas and NGL’s as feedstock for various molecules and products.

There are risks in the Permian strategy as well. In order to obtain their goals, the company must drill relentlessly and cut costs every chance they get. Chevron’s expertise in this area de-risks this to a degree, but the law of large numbers will kick in here someday.

Climate risk is always with the big companies. Their 100+ year old brand makes them a target for the climate action types and government entities looking for a payday. It is inevitable that one day CVX will be saddled with paying for some elitist’s seawall in Martha’s Vineyard. Not to worry, though, they will just raise prices, as the cigarette companies have done.

Your takeaway

I think I’ve laid out a compelling case for the company. CVX managers are masters of their craft and continuously wring cost out of their operations. They are committed to rewarding shareholders with buybacks around $17.5 bn per year, and an attractive dividend that is well funded with cash flow. They have cut long-term debt – the Darth Vader of balance sheets – by 50% in the last couple of years, and have $15 bn in ready cash. I think CVX could also supply capital growth from current levels.

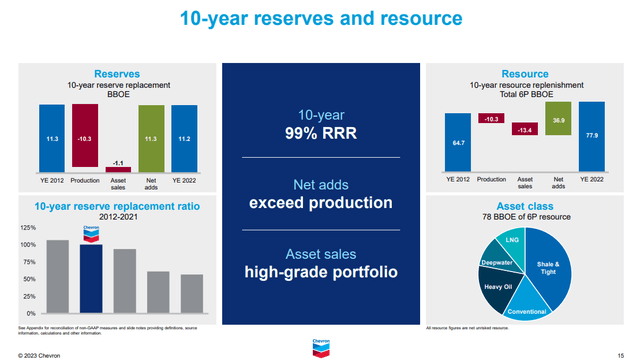

CVX has done a good job with reserve replacement, essentially keeping them flat over a ten year period. That’s not bad given their size and the fact that they are producing ~ a billion BBOE annually, and putting them second in line to you know who.

CVX is trading on an EV/EBITDA basis at 6.4X, a little higher than many companies we endorse, but only Chevron is Chevron. I calculate these reserves being produced at a range of 3 mm BOEPD to 3.8 mm BOEPD in 2027 and remaining flat for another 5 years beyond that will generate $568-686 bn in discounted OCF, or about 2X the company’s enterprise value today. For reference, that’s more optimistic than the company by a factor of 2.5, but this is all smoke and mirrors anyway, and my number is reasonable.

The seagulls are high on CVX, while ranking it as Overweight. Price targets for Chevron range from $161-$218, with a median of $188. EPS estimates have moved down from $3.85 to $3.29. Last quarter they beat estimates handily, coming in at $3.55, and my expectation is Q2 will be a repeat. The difference amounts to about a billion dollars in EBITDA for the quarter, and that by itself would justify a move toward that median point of $188.

Over time, if Chevron Corporation sticks to its plan of knocking down the share count by $17-20 bn annually, the share count could be in the 1.3 bn range, theoretically boosting value by 30%. Obviously with the PDC deal, the company has taken a side step on this commitment, but I am for anything that preserves cash. Holders of CVX stock for the next decade should collect between $75-$98 per share in dividends, reducing their cost by half to ~2/3 at today’s prices.

Bottom line, if you feel the world will still need oil and gas 10 years from now, Chevron Corporation is a company you want to own. I remain long the company and am using dips, like one we have now, to add to my position incrementally, and am taking dividends as stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.