Summary:

- Chevron’s acquisition of PDC Energy highlights the valuation differences that give Chevron a shopping advantage.

- The positive reaction of the market to the acquisition announcement may mark a coming change in market attitudes towards these acquisitions.

- The Chevron acquisition appears to be bolt-on but the two operations are large enough that the usual bolt-on synergies may not be that large.

- The rapid technology advances enable larger well production and more productive intervals to add safety to the “bargain” part of the acquisition story.

- Investors should expect more acquisition announcements in the future as long as Chevron has a premium valuation to upstream competitors.

bjdlzx

(Note: This article was in the newsletter on June 3, 2023.)

Chevron (NYSE:CVX) is going to acquire PDC Energy (PDCE). This is one of the more favored operations in the Colorado area because it is in rural Weld County and so avoids the headlines that some other operators have made with the encroachment of cities to the oil patch. Even though PDC Energy managed to avoid those headlines, it could not avoid the “Colorado discount” or even the small company discount (your choice) from the major valuations. Because of the difference in valuations in the market right now, Chevron is getting a very accretive deal even though it is all stock.

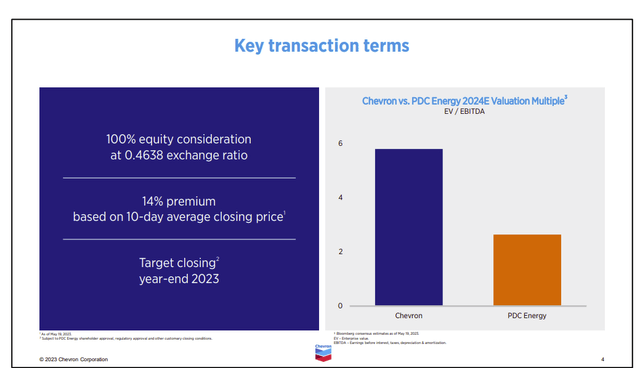

Chevron Valuation Compared To PDC Energy Valuation (Chevron Announcement Of PDC Energy Acquisition Presentation And Comments)

Chevron could and did offer a slight premium to the price of PDC Energy stock. But the gap in valuations is so large that this will benefit Chevron shareholders from the start. In fact, the valuation difference is so large that Chevron could have paid a larger premium and the deal still would have been accretive.

The market reacted positively to the news of the combination. That marks a huge psychological break to the market attitude about oil and gas combinations. For the longest time the market has demanded no premium for these combinations, or it sends the stock of the offering company plummeting.

This happened earlier when Baytex Energy (BTE) announced the acquisition of Ranger Oil (ROCC). The stock of Baytex Energy fell roughly 20% which stunned some of the investors and then slowly climbed back. This happened despite the fact that the deal will be accretive for Baytex immediately. Right now, it seems to be an attitude unique to the oil and gas industry. The Chevron deal announcement may signal the beginning of a change in this attitude.

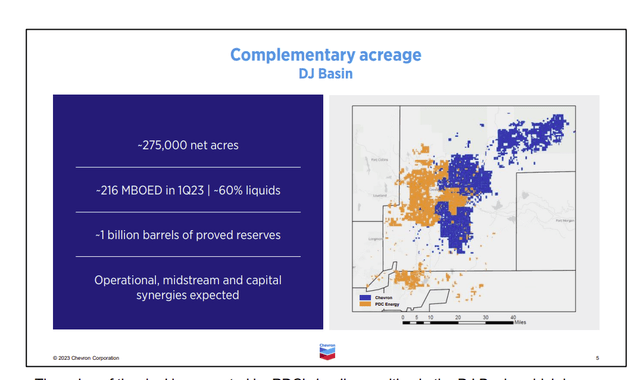

Chevron And PDC Energy Colorado Acreage Position (Chevron Announcement Of PDC Energy Acquisition Presentation And Comments)

Clearly the PDC Energy acreage does present some acquisition savings as it is right next to the Chevron acreage. Investors should not expect massive savings as these two positions are very large.

Similarly, PDC Energy has some Delaware Basin acreage that is extremely valuable. It is definitely not the majority of its operations. But Chevron can add to its position in the Delaware Basin through this acquisition.

Chevron is large enough that any one basin is probably not a dominating situation on the whole company. The integrated nature of Chevron’s operations further diversifies the company from any one area affecting the company valuations. All of this diversification (and superior financial rating) have led to that higher valuation first shown in the article.

But this gives Chevron an advantage anytime it makes a deal for just about any company in the industry in that the deals are practically “guaranteed” to be accretive unless management makes a huge error. As a result, investors should expect Chevron to continue shopping as long as this valuation gap persists.

Another advantage for Chevron is that it can grow earnings and production faster through well-chosen acquisitions than it can organically. Chevron is so large that the logistics of faster growth are daunting. But an acquisition of a well-run company is a completely different story and can often aid growth plans.

Chevron does not have the huge growth story that Exxon Mobil (XOM) does with Guyana and probably Suriname. That is not to say it is not without its own sizable discoveries. But Exxon Mobil has a unique situation that is not easily duplicated by other majors. Chevron can, however, offset that advantage by doing exactly what it is doing.

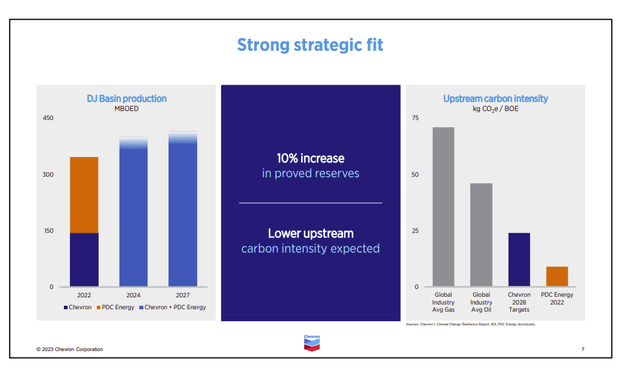

Chevron And PDC Energy Combined Future Growth Plans (Chevron Announcement Of PDC Acquisition Corporate Slide Presentation And Comments)

Weld County is very supportive of the oil and gas industry. In fact, this location really has no issues at all with the state of Colorado. So, the growth shown above is probably conservative. Weld County is located close to the Wyoming border. Wyoming is extremely supportive of the oil and gas industry. So, the location provides an avenue of growth should the Colorado population continue to grow enough to cause more industry growth to be problematic.

Interestingly, California has long had an oil and gas industry under a few cities. Those cities collect income from their “assets” while the state benefits from the production as well. The operator that I can think of for this situation has long been California Resources (CRC). If Colorado manages some similar agreement in the future, the industry outlook could be very bright for the state as well no matter the population growth. However, something like that would take some cool heads and very logical (and careful) planning.

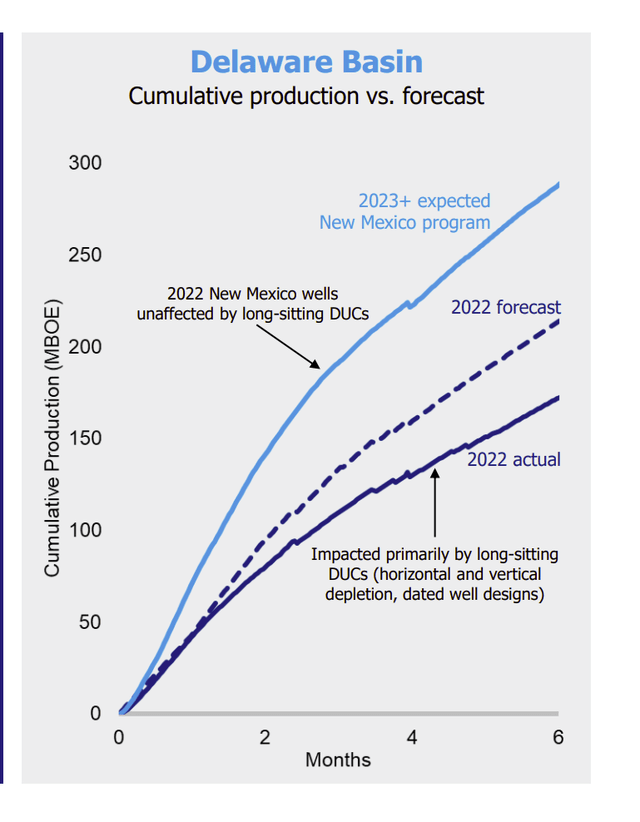

Chevron Well Production Advances In The Delaware Basin (Chevron Corporate Presentation May 2023)

One of the other things that makes a lot of these deals look cheap is the continuing technology advances that allow for more production in the future from new wells than was the case in the past. Even if the market views a purchase as expensive, the continuing advancement of technology often turns that purchase into a bargain over time because technology is currently advancing that quickly.

I follow companies that have doubled well production over the last five to seven years. Believe me, the costs of those wells have not advanced anything close to that if the costs advanced at all. Combine this with the fact that these same advances often make other intervals commercial. These properties then end up producing so much more than anyone could have foreseen at the time of the purchase. These rapid technology advances make it hard for any company to be wrong with an acquisition.

Key Takeaways

Chevron made an accretive acquisition of PDC Energy. This is easy to do in the current market environment due to the gap in valuations between upstream competitors and integrated majors in the industry. Investors should probably expect more acquisitions in the future as long as the gap persists.

The acquisition has an advantage in that most of the acreage is located in Weld County Colorado, which is a rural county that has long supported the industry. Therefore, conditions are favorable for more production growth in the future.

There is also a minor Delaware Basin holding of PDC Energy that can be combined with the Chevron position.

Most upstream acquisitions have an additional safety measure in that technology keeps advancing to make wells more productive and periodically these advances make more intervals commercial. The result is acquisitions often produce far more and for much longer than anticipated at the time of the acquisition.

In the current environment, Chevron is likely to benefit more than many in the industry from current conditions. Therefore, it can be considered a buy consideration for those that want to consider an integrated major.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTE, XOM, ROCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Chevron and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.