Summary:

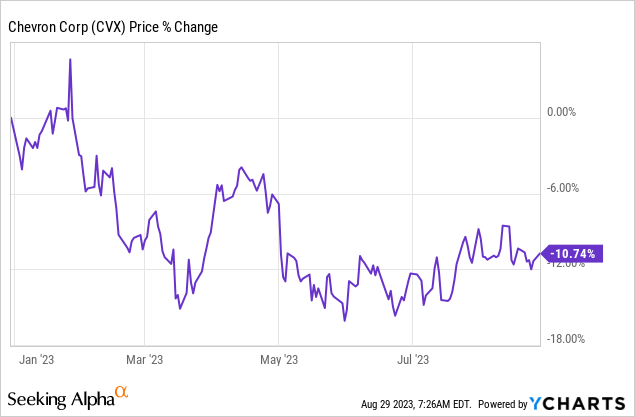

- Chevron’s earnings have been boosted by soaring energy prices in FY 2022, but as prices consolidate, the company’s earnings prospects have deteriorated.

- CVX is now already deep into an earnings contraction. Chevron’s Q2’23 free cash flow did not cover shareholder returns.

- With falling EPS estimates and valuation risks, investors should be cautious.

JHVEPhoto

Chevron (NYSE:CVX), as a major energy producer, benefited from favorable market trends in FY 2022 that caused petroleum and natural gas prices to surge. On the back of soaring energy prices, Chevron has been able to post record profits last year, but energy prices have started to consolidate and the energy firm’s earnings prospects have deteriorated. Considering that petroleum and natural gas prices are in a down-trend and that Chevron reported steep declines in earnings and free cash flow in Q2’23, I believe Chevron has considerable downside potential in a lower-price world. While Chevron is currently trading at a P/E ratio of 11X, earnings expectations are still cyclically inflated, in my opinion, which exposes investors to EPS revision as well as valuation risks!

Chevron: in the midst of an earnings contraction

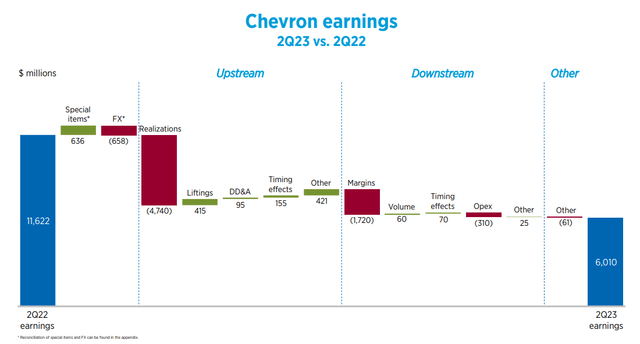

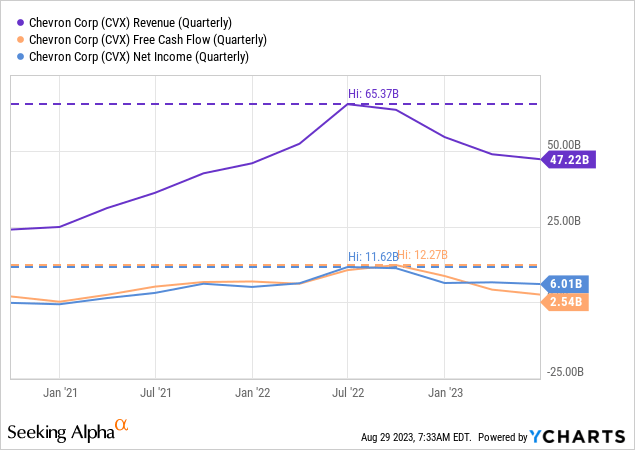

Chevron benefited initially (in FY 2022) from Russia’s invasion of Ukraine in the sense that the military confrontation between the two countries resulted in a sharp upward repricing of energy products, especially petroleum. As a result, Chevron’s earnings exploded higher and the energy producer generated record earnings in the second-quarter of FY 2022: Chevron earned $11.6B in last year’s second-quarter compared to just $6.0B in Q2’23. With total earnings declining by almost half and falling three times in the last four quarters, an earnings contraction is already here and well established. Considering that earnings are in the midst of a contraction, I believe there is a significant risk of analysts lowering their EPS projections, especially if the U.S. economy were to fall into a recession.

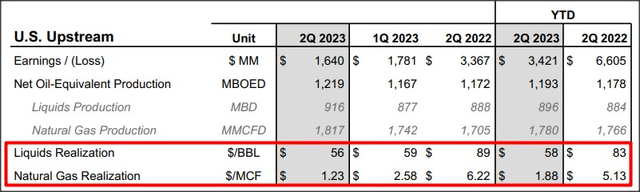

Chevron’s earnings contraction is driven chiefly by lower average prices for its energy products, especially in the natural gas business. Average natural gas prices in Chevron’s U.S. production business declined a massive 80% year over year to just $1.23 per MCF in the second-quarter. Petroleum prices also declined, but not nearly as significantly: average liquids prices fell 37% year over year to $59 per barrel. Exxon Mobil (XOM) saw similar developments in its business in the second-quarter.

The decline in average prices can be seen in every major metric of Chevron’s business, including revenues, free cash flow and net income and the contraction of free cash flow is a very serious problem for the company. In the second-quarter, Chevron generated $2.5B in free cash flow, showing a 76% year over year decline, but the company returned $7.2B to shareholders, including $4.4B in stock buybacks. Given the contraction in free cash flow, it would be best for Chevron to scale back its stock buybacks. The company announced a $75B stock buyback earlier this year which I believe was misguided considering that earnings/free cash flow have started to contract and that shares are expensive.

Ambitious goals depend on price stability, earnings estimate risk

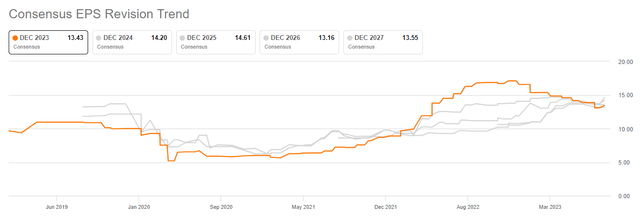

Chevron laid out an ambitious plan to grow its free cash flow (estimated 10% FCF growth annually, Source), but this goal will only be achievable, in my opinion, if energy prices remain high. In the long term, energy prices have always consolidated and not remained at 10-year highs for long. As a result, I believe investors must expect growing pressure on Chevron’s earnings estimates… which have already begun to drop sharply. Analysts have lowered their earnings estimates for Chevron’s FY 2023 twenty times in the last 90 days which compares against upside EPS revisions of three.

Chevron’s valuation compared to rivals

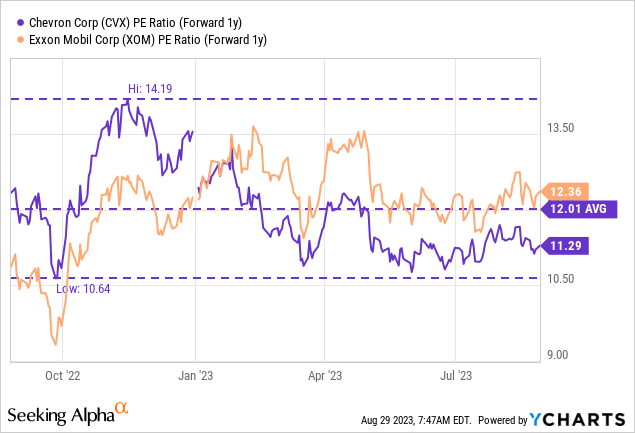

Exxon Mobil and Chevron are the two largest integrated energy companies in the United States which makes them bellwethers for the entire industry. With EPS estimates falling drastically, however, Chevron’s P/E ratio should be expected to rise going forward and investors should not be misled by the firm’s low P/E ratio of 11.3X. In a normalized price environment, I believe Chevron could earn $9-10 per-share annually which, at a current price of $160, translates to a “real” P/E ratio of 16-18X. I believe CVX would be fairly valued at a 13X P/E ratio (based off of normalized earnings), implying a fair value range of $117-130.

Exxon Mobil is currently trading at a P/E ratio of 12.4X, but also based off of cyclically inflated EPS expectations. As a result, I rate Exxon Mobil as a sell as well.

Risks with Chevron

The biggest risk for Chevron is a continued decline in production segment price realizations which in the second-quarter negatively affected the company’s earnings results. A major recession could compound this problem. Additionally, unions in Australia are threatening to shut down Chevron’s liquefied natural gas facilities if the company doesn’t meet their wage demands which could further add to earnings pressure in the near term.

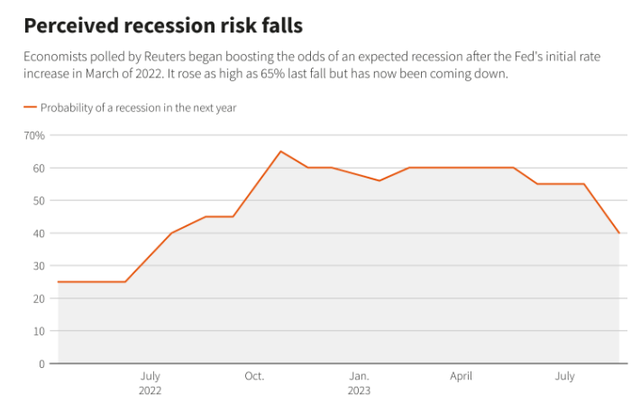

However, a recession may ultimately not materialize which would benefit Chevron and petroleum prices. According to Reuters, the recession probability has fallen lately. The avoidance of a recession could prop up energy prices and lead to a reversion of Chevron’s earnings and free cash flow trend.

Final thoughts

Since Chevron is experiencing an earnings contraction due to falling average prices for petroleum and natural gas, I believe investors are facing a material amount of valuation risk. Chevron may be trading at 11X FY 2024 earnings, but earnings estimates have fallen sharply in FY 2023 and Chevron posted its third quarter in a year of falling earnings. Chevron also spent much more on buybacks than it earned in free cash flow in Q2’23, suggesting that Chevron should cut back on buybacks altogether. A global recession may put further pressure on earnings estimates as well as Chevron’s cyclically inflated valuation. In summary, I believe the risk profile is not attractive for Chevron at this point!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.