Summary:

- Two close friends, Bill Gates and Warren Buffett, disagree on the future of big oil stocks.

- So far, Buffett has been on the right side of the bet with his Chevron Corporation position. And the thesis here is twofold.

- First, I will argue that Buffett does not win this round because he luckily picked Chevron.

- I will argue the oil sector is in general attractive and will use both Chevron and Exxon Mobil Corporation to make my point.

- Second, I will argue that both companies feature all the hallmarks that Buffett looks for: a wide moat, a wide margin of safety, and long-term sustainability.

Dimitrios Kambouris

The Investment Thesis

Two good friends, Bill Gates and Warren Buffett, sharply disagree when it comes to big oil companies. Gates has been very vocal about his pessimistic view on big oil stocks. For example, at the COP26 climate summit, he mentioned that:

Some of these giants will fall. You know, 30 years from now, some of those oil companies will be worth very little.

There are certainly good reasons to support his point of view. For example, it is very reasonable to believe that the world is shifting towards cleaner and more sustainable forms of energy, which could reduce the demand for oil and ultimately lead to lower profits for oil companies. And Gates has been putting money where his mouth is. Gates has not only been a strong vocal advocate for renewable energy, but he has also invested heavily in companies working on new forms of clean energy, such as nuclear fusion and advanced battery technologies.

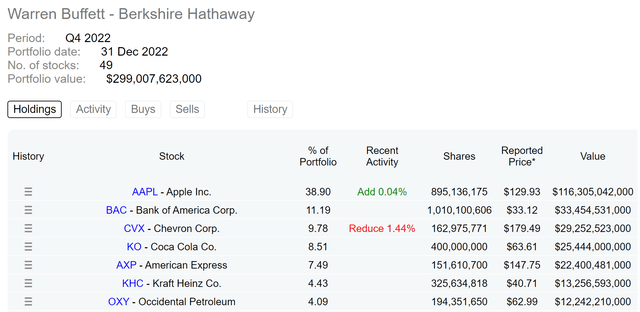

Meanwhile, Buffett has a different stance on the matter. Although he may be less vocal about his views on the future of energy, his actions speak volumes. According to the latest F13 disclosure (shown below), Berkshire’s equity holdings now feature two major oil companies in its top 7 holdings. To wit, Chevron Corporation (NYSE:CVX) now represents the third largest position, with a total worth of almost $30B, and exceeded Buffett’s legacy holding such as Coca-Cola (KO) and American Express (AXP).

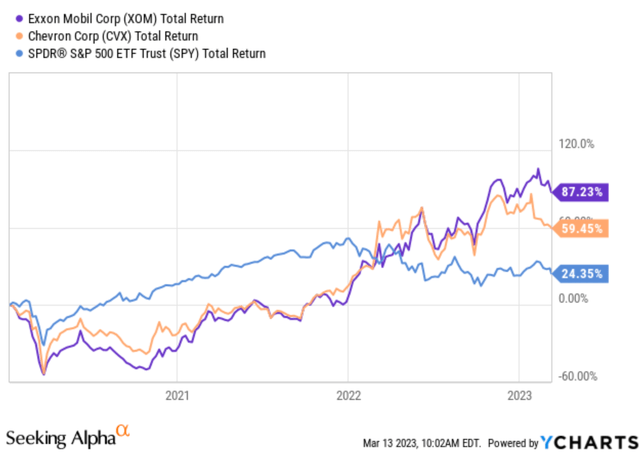

So far, Buffett has been on the right side of the bet as seen from the chart below. Since Q3 of 2020, when Berkshire’s F13 first disclosed Buffett’s accumulations of CVX shares, oil stocks have been among the best-performing assets. To wit, CVX delivered a total return of almost 60% since then, dwarfing S&P 500’s 24%. During the past year of 2021, oil stocks have been the only sector that has posted sizable positive returns in an otherwise miserable market.

And this leads me to the main thesis of this article. In the remainder of this article, I will argue that:

- Buffett does not win this round because he luckily picked CVX (or Occidental (OXY)). I will argue the oil sector is in general very attractive. And I will use both CVX and Exxon Mobil Corporation (NYSE:XOM) to illustrate how attractive this sector is.

- More specifically, I will argue that both are companies that have the kind of moat that Buffett looks for. Both Chevron and ExxonMobil have significant resources, including access to reserves and refining capacity, which may give them a competitive advantage over smaller players in the industry.

- And also, I will also argue that long-term investors like Buffett should ignore the short-term fluctuations in oil prices and other macroeconomic factors that can affect the industry. These random fluctuations are less important than the long-term fundamentals of these companies.

All told, my thesis really is that Buffett’s bet is not only the right one so far, it is also very likely to be the right one in the long term too.

XOM and CVX: reserves and moat

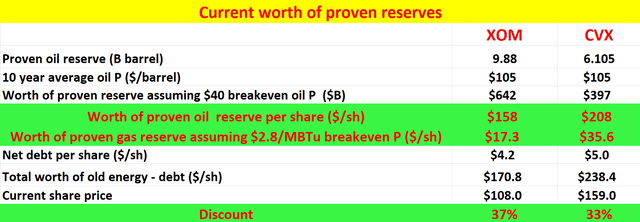

As just mentioned, both CVX and XOM have vast reserves and refining capacity, which forms a moat filled with crocodiles. The chart below presents the current value of XOM and CVX’s proven reserves. Specifically, XOM’s proven reserve for oil is about 9.88 billion barrels, while CVX’s proven reserve stands at 6.11 billion barrels. Over the past 10 years, the average oil price has been $105 per barrel (I will explain later why $105 oil prices are a compressed and conservative price and why they could increase in the future). Even at this average price, assuming a so-called breakeven oil price of $40 per barrel, XOM’s proven oil reserve is worth $642 billion, and CVX’s is worth $397 billion.

Yet, both companies are currently for sale at a discounted share price, offering a wide margin of safety – another hallmark for a winning bet in the long term. As also shown in the chart below, the value of their proven oil reserve would be $156 per share for XOM and $206 per share for CVX, based on XOM’s 4.07 billion outstanding shares and CVX’s 1.91 billion outstanding shares, respectively, as of this writing.

Moving on to their proven natural gas (“NG”) reserves. The analysis of NG is more intricate than that of oil due to the complexity of the natural gas business (my earlier article provided a more dedicated discussion on their NG business). Using an average natural gas price of $5 per MBTu over the past 10 years and a breakeven production price of $2.8 per MBTu, XOM’s proven natural gas reserve is worth approximately $17.3 per share, while CVX’s is worth around $35.6 per share.

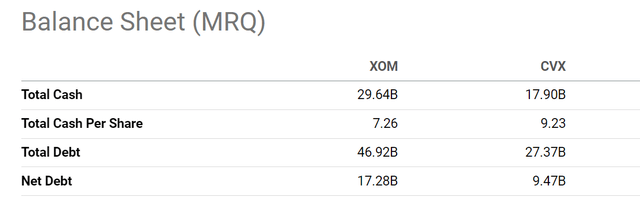

Finally, let’s take out their liabilities. According to Seeking Alpha data (see the next chart below), XOM’s net debt is currently $17.28 billion (translating into $4.2 per share) and CVX’s is $9.47 billion (translating into $5.0 per share).

As a result, the current net value of their proven oil and NG reserve (i.e., the reserves less the net debt) is ~$171 per share for XOM and about ~$238 for CVX. At their current stock prices of ~$108 and $159 as of this writing, these numbers imply a margin of safety of more than 30% for both stocks.

Why $105 oil price is conservative?

As mentioned earlier, a key parameter used in my above analysis is a $105 oil price, the average over the past 10 years. And to a lesser extent, the next key parameter is the $5 NG price because their NG reserves is comparatively smaller than their oil reserves. And next, I will explain why these parameters are on the conservative side.

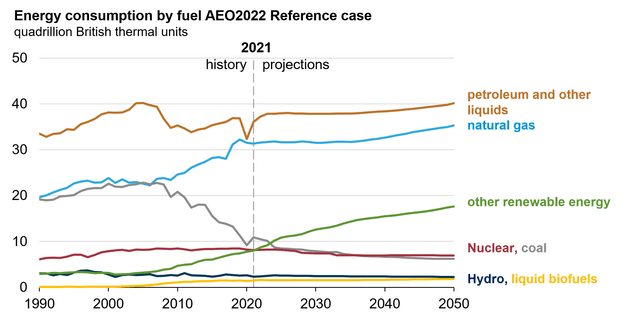

My analysis is largely based on the outlook provided by the U.S. Energy Information Administration (“EIA”). More specifically, on the Annual Energy Outlook (“AEO”) for 2050 recently published by the EIA. According to the AEO (see the chart next), Renewable energy is projected to be the FASTEST-GROWING segment, but petroleum and NG will continue to be the most-consumed sources of energy in the U.S. through 2050.

So, Bill Gates could be right in placing his bets on renewables, the rapidly growing segment. However, that does not automatically make the “old energy” a bad bet – especially at the discounted prices we are seeing now. While renewables will rapidly grow (projected by the green line), it’s important to note that they start from a low base level, and our total energy demand will grow rapidly at the same time. The net result is that the demand for “old energies” such as petroleum and gas will remain robust for decades to come.

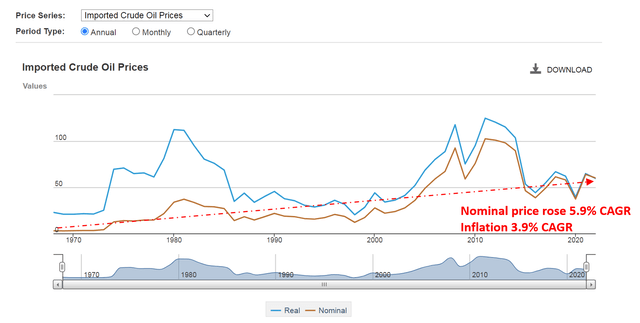

With the robust demand ahead, I foresee oil and NG prices to rise at least in tandem with inflation, which is a conservative assumption in itself. Because oil prices and NG prices historically (see the next chart below) have been outpacing general inflation with a good margin in the long term. To wit, oil prices have been rising at 5.9% CAGR over the past 50 years. In contrast, the inflation escalator has been averaging 3.9% CAGR. In case you are curious about this – a 2% CAGR difference means a 260% difference in the end price after 50 years.

Source: U.S. Energy Information Administration (EIA)

Near-term catalysts, risks, and final thoughts

Besides the above long-term fundamentals, I see both companies (and the energy sector as a whole) enjoying several short-term tailwinds as well. The current commodity prices are very favorable to both companies given the supply-demand shortage caused by the Russian/Ukraine situation. And the healthy production further helps with their volumes (e.g., the production ramp-up at Permian Basin for XOM). In the meantime, leadership at both places remains focused on controlling costs. For example, XOM has been effective with cost control through the structural reorganization of smaller business units to boost operating efficiency. Since 2019, annual expenses have been lowered by $7 billion thus far, putting the company within arm’s reach of its $9 billion target cost reduction. All told, I am very optimistic that both XOM and CVX are poised for another hugely profitable year in 2023.

Investments in Exxon Mobil or Chevron do face several risks in the current business and political landscape, ranging from environmental regulations, technological disruptions, and reputation risks. Increased awareness about climate change has led to the development of regulations that incentivize the use of renewable energy, which is a major threat to traditional energy segments. Compliance with these environmental regulations can be costly and time-consuming, which can affect the profitability of these companies. As technology advances (such as those Gates heavily invested in), old energy companies face the risk of being left behind and losing market share to newer, more innovative companies.

To conclude, Bill Gates could be 100% correct on the future of renewables. I won’t be surprised to see renewables remain the fastest-growing segment in the energy space for decades to come. And my thesis is that, even if this happens, it does not automatically make “old energy” stocks a bad investment. A good investment has two key parts – buy the right stocks and buy them at the right prices.

I view leading oil companies like Chevron and Exxon Mobil as providing both under current conditions. They have a sustainable moat with their vast reserves and refining capacity. And they are for sale at substantially discounted prices even under conservative assumptions – by only considering their proven reserves and ignoring all their other assets and income streams.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.