Summary:

- As a Dividend Aristocrat, Chevron could fit well with my goal of building a sustainable and growing stream of passive income.

- The company’s capex and acquisitions should drive healthy growth in the future.

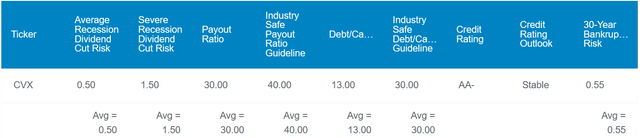

- Chevron’s modest leverage and industry leadership earn it an AA- credit rating from S&P on a stable outlook.

- The supermajor appears to be trading at a 6% discount to fair value.

- Chevron could double the S&P in the next two years and outperform by as wide of a margin over the coming 10 years.

A Texaco-branded Chevron gas station. hapabapa/iStock Editorial via Getty Images

My primary objective as an investor is to build a viable and rising stream of passive income. Why dividend growth investing?

The idea is that this approach will hopefully help me meet/exceed my monthly expenses through passive income. At that point, I will be free to keep doing what I currently am doing without worrying about money as much.

I also figure that if my portfolio produces ever higher amounts of passive income, capital appreciation will also eventually follow. That would be the cherry on top of the fudge sundae in my opinion.

How do I plan on reaching the promised land of investing? There’s the all-important living below my means aspect. By American standards, my tastes are probably among the simplest out there. Beyond the essentials that we all take for granted and an internet connection, I don’t need or want much.

That allows me to steadily build up capital for investing, which raises the next question: What do I do with it? I aim to load up my portfolio with the most qualitative, proven businesses on the planet.

Chevron (NYSE:CVX) is a Buffett-owned business that I have had on my watch list for years now, but I have never pulled the trigger. When I stop aggressively building up my emergency fund and resume investing (likely in February 2024), I hope to add Chevron at some point next year. Please allow me to unpack the company’s fundamentals and valuation to explain why.

Chevron’s 4% dividend yield is currently about 10 basis points higher than the 3.9% yield of the 10-year U.S. treasury. Not to mention that it is nearly triple the 1.5% yield of the S&P 500 (SP500). Suffice it to say, that Chevron’s dividend is competitive in even a high rate environment such as this one.

Better yet, the company’s payout appears to be rather safe. For one, the 30% EPS payout ratio is well below the 40% EPS payout ratio that rating agencies consider safe for Chevron’s industry.

Additionally, the company’s 13% debt-to-capital ratio clocks in at less than half of the 30% industry safe guideline put forth by rating agencies. Thanks to this low payout ratio and modest debt load, Chevron is rated AA- on a stable outlook by S&P. For context, that’s just three notches below a perfect corporate credit rating. That implies the probability of Chevron going to zero over the next 30 years is just 0.55%.

Due to these nearly impeccable fundamentals, Dividend Kings pegs the risk of the company cutting its dividend in the next average recession at only 0.5%. This is the lowest allowed probability for Dividend Kings’ dividend cut risk metric. The chance of a dividend cut in the next severe recession remains low at just 1.5%. That’s only a touch more than the absolute minimum dividend cut risk of 1% for a severe recession for even the most reliable dividend payers.

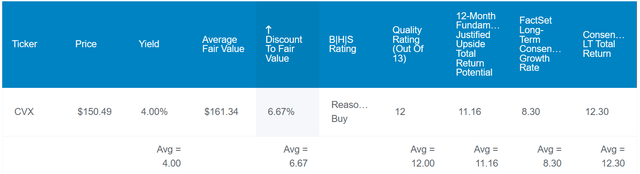

Chevron is an excellent business, which also looks to be undervalued. Using historical valuation metrics such as dividend yield, Dividend Kings estimates that shares of the supermajor are worth $161 each. Relative to the current $152 share price (as of December 20, 2023), this would represent a 6% discount to fair value.

If Chevron matches the growth consensus and its valuation reverts to fair value, here are the total returns that it could deliver to shareholders in the coming 10 years:

- 4% yield + 8.3% FactSet Research annual earnings growth consensus + a 0.6% annual valuation multiple expansion = 12.9% annual total return potential or a 236% cumulative 10-year total return versus the 8.6% annual total return of the S&P or a 128% cumulative 10-year total return

Chevron Is Positioning Itself For The Future

Chevron Q3 2023 Earnings Press Release

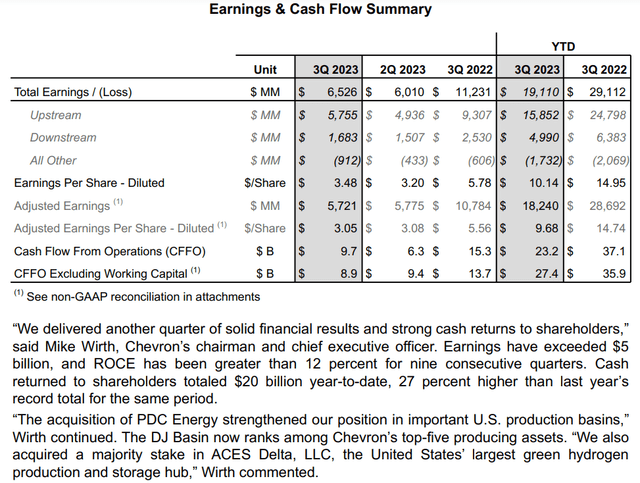

Considering the circumstances, Chevron’s third quarter ended September 30 was decent. The company’s total revenue of $54.1 billion was down by 18.8% year-over-year, but this did beat the analyst consensus by $1.1 billion.

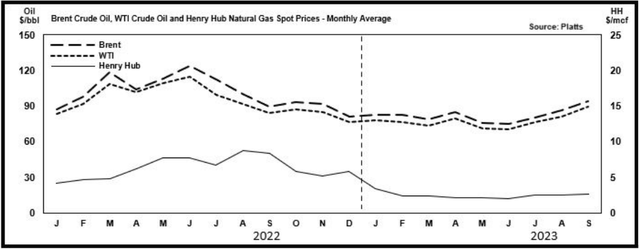

It would only make sense that Chevron’s total revenue was lower by as much as it was in the third quarter. As the illustration above demonstrates, energy prices have largely trended down and to the right over the last year and change. For example, West Texas Intermediate crude oil averaged $95 a barrel throughout 2022, peaking around the summer (the year-ago period for Q3 2023). Now, WTI crude oil is around $75 a barrel. The same was true for natural gas spot prices, peaking in Summer 2022 at roughly $9. That made for a difficult comparison period for Chevron.

Unsurprisingly, the company’s non-GAAP EPS of $3.05 during the third quarter was 45.1% lower than the year-ago period. This missed the analyst consensus by $0.64.

However, it wasn’t all bad news for Chevron. Most prominently, the company upped its net oil-equivalent production by 4% over Q3 2022 to over 3.1 million barrels daily. This was fueled by the $7.6 billion acquisition of PDC Energy earlier this year.

Global natural gas production was relatively flat. That’s encouraging, given the drop in natural gas prices was much more precipitous than in WTI crude oil.

Chevron’s 3% compound annual growth rate target in production through 2027 also isn’t just for the sake of upping production (slide 8 of 55 of Chevron’s October 2023 Investor Presentation). The company’s return on capital employed was above 12% for the ninth consecutive quarter. Such an ROCE figure in a volatile industry in which Chevron operates shows that the company has historically been a prudent steward of capital. This alone is part of why I give the company the benefit of the doubt on the acquisition of Hess Corp. (HES). For a more in-depth explanation of why it could be a smart move, I would refer readers to Michael Fitzsimmons’ recent article on the acquisition.

Chevron also remains a financial fortress. The company’s interest coverage ratio through the first nine months of 2023 was a whopping 75.8. Operating in an unpredictable industry, this is a robust interest coverage ratio that can service Chevron’s debt in just about any operating environment.

Free Cash Flow Can Support Solid Dividend Growth

Chevron has upped its dividend for 36 consecutive years, which comfortably earns it the distinction of being a Dividend Aristocrat. In just the last five years, the company’s quarterly dividend per share has surged 34.8% higher to the current rate of $1.51. That’s good enough for a 6.2% compound annual growth rate.

Chevron also looks like it has many more years of dividend growth left in the tank. This is because the company generated $11.7 billion in free cash flow through the first nine months of 2023. That’s even with a $3 billion-plus uptick in capital expenditures to $11.5 billion over the year-ago period. Against the $8.5 billion in dividends paid over that time, this suggests Chevron’s dividend is secure (details sourced from page 7 of 163 of Chevron’s most recent 10-Q filing).

Risks To Consider

Chevron is a world-class business. However, the company has risks that should be considered by investors.

The company should have the next few decades to pivot to being an alternative energy business. Chevron’s $8 billion in forecasted lower carbon investments and $2 billion in carbon reduction projects through 2027 will be a good start to the goal of leading energy into the future. But it’s important to note there are no guarantees that these investments will pay off. If Chevron can’t successfully transition toward the future of energy, its fundamentals could deteriorate and the investment thesis could break.

Another risk to Chevron is the magnitude of its $60 billion deal for Hess. Studies have shown that the majority of M&A activity destroys shareholder value. Chevron has proven itself to be exceptional at creating value for shareholders, but that doesn’t exempt it from the possibility of executing a failed acquisition.

Finally, investors must be comfortable with the cyclical nature of Chevron’s business. If somebody is going to own the business, they must be able to live with the peaks and troughs that arise in its operating and financial results.

Summary: A Warren Buffett Favorite At A Discount

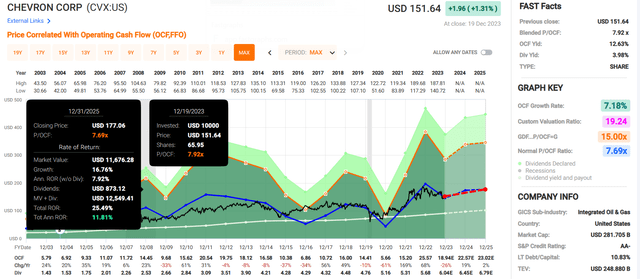

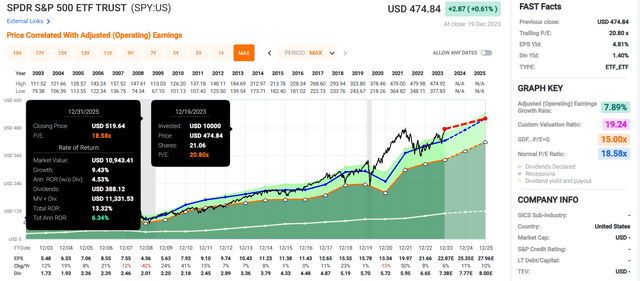

FAST Graphs, FactSet FAST Graphs, FactSet

Chevron is a growing business with a conservative balance sheet that’s committed to shareholders. Although Berkshire Hathaway (BRK.B) has been trimming its position of late, the supermajor remains the company’s fifth-largest holding, valued at $16.8 billion.

Chevron’s blended P/OCF ratio of 7.9 is just a bit more than the historical P/OCF ratio of 7.7 per FAST Graphs. If the company grows as anticipated and falls to its average valuation multiple, cumulative total returns could be 25% through 2025. That’s nearly twice as much as the 13% cumulative total returns that the SPDR S&P 500 ETF Trust (SPY) is expected to generate through 2025. This is why I believe shares of Chevron are a buy right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.