Summary:

- Chevron Corporation’s recent stock price correction has created an entry opportunity for investors looking for a dividend stock.

- Chevron has a strong dividend record, attractive valuation when adjusted for growth and yield, and a history of share buybacks.

- All meeting or surpassing Peter Lynch’s criteria for picking dividend stocks.

Mario Tama

Thesis

Readers following our writings know that we have been long-term bulls for Chevron Corporation (NYSE:CVX). We have been arguing for a bullish thesis on the stock since early 2022, when the stock price was in the $130 range. Its stock price then rallied robustly and reached as high as $185 in early 2023. Since then, the stock price has suffered a correction of around 19% (see the chart below). And the thesis of this article is to argue that such correction has created an entry opportunity for this superb dividend stock.

Given the emphasis on dividends, in the remainder of this article, I will build my thesis largely around the framework Peter Lynch developed for screening dividend stocks. The Lynch framework has been detailed in our other writings and only a recap is provided below. As to be seen later, this seemingly simple framework actually provides a holistic assessment of a given stock.

- Dividend record. Of course, since we are talking about dividend stocks, long records of regularly raising dividends are always a plus. Lynch prefers to see a 20 to 30 years record or regularly raising dividends.

- Valuation. Most people are familiar with the earnings growth rate (the PEG ratio) and Lynch prefers a PEG of around 1x or below. For dividend stocks, he also developed a modified PEGY ratio, which stands for Price/Earnings to Growth and Dividend Yield. We will see that CVX offers a very attractive PEGY ratio.

- Share buybacks. And Lynch recognized the importance of share buybacks (an aspect many dividend investors overlook). Buyback is a clear indicator of financial strength (the company has extra cash flow that exceeds CAPEX) and management confidence in their existing business (so they chose to buy back than expand into new segments).

1. Dividend record

The Lynch framework places an emphasis on dividend record for a good reason. Consistency is the key here. A consistent dividend record in the long run speaks volume of the staying power of the stock and its moat.

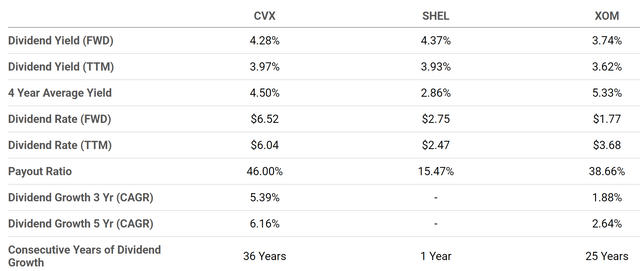

On this front, CVX has one of the strongest records. As seen in the chart below, it has been raising its dividends for 36 years consecutively thus far, surpassing Lynch’s criterion of 20~30 years.

2. Valuation

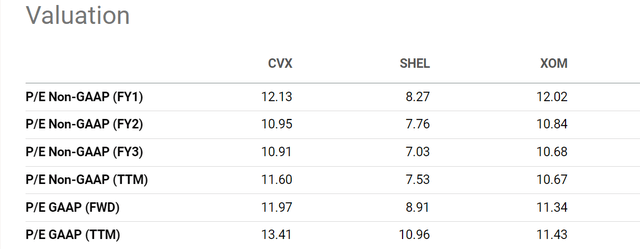

Admittedly, when we just look at the simple P/E ratios, CVX is not the stock that offers the most attractive valuation. As seen in the chart below, CVX now trades at 12.1x on an FY1 basis, a multiple higher than many of its peers both in the U.S. and especially abroad.

However, Chevron’s valuation is much more attractive when properly contextualized. And since I am following the Lynch framework, here I will use the Lynch PEGY ratio for this purpose. Furthermore, I will use CVX’s dividend growth rate to approximate its earnings growth rate. Given CVX’s 36 years of consecutive dividend growth record, I will argue that this is a very justifiable assumption.

Accepting this assumption, the chart in section 1 shows that CVX’s dividend growth rate was 6.16% on a CAGR basis in the past 5 years and 5.39% in the past 3. CVX’s current dividend yield is 4.28% on an FWD basis. As such, its PEGY ratio works out to be 1.16x if we plug the 5-year CAGR and 1.25x if we plug in the 3-year CAGR. In either case, it is quite close to the ideal 1x pick that Lynch promotes and far more attractive than many of its peers (say Exxon Mobil (XOM)).

3. Share buybacks

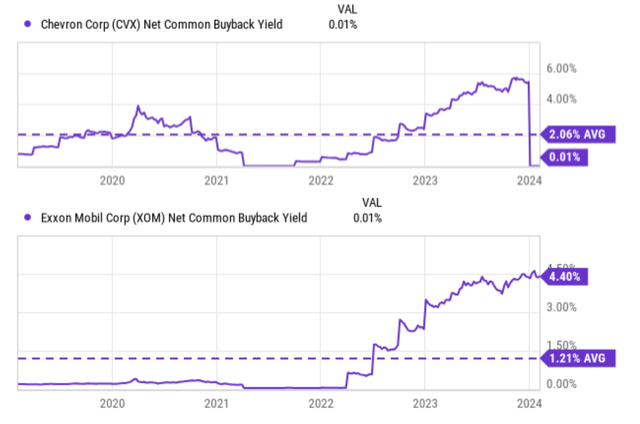

Historically, CVX has systematically shrunk its outstanding shares through consistent buybacks. As seen in the chart below, in the past five years alone, it has maintained an average buyback yield of 2.06%, effectively boosting shareholder returns by an average of ~2% annually and far higher than XOM’s 1.21%. To paraphrase Lynch, such buybacks are a very loud way for CVS to say that “We like our stock, too!”

Other thoughts and final verdict

In terms of risks, CVX faces risks that are generic to the energy sector, such as macroeconomic uncertainties, environmental regulations, et al.

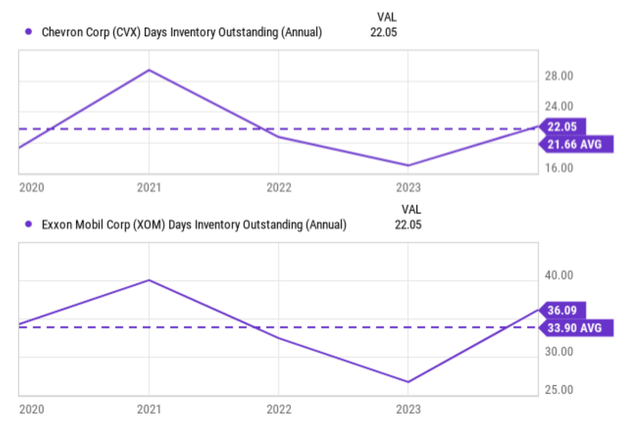

Here, I will focus on an aspect most investor overlook: inventory. As seen in the chart below, CVX current inventory sits at 22.05 days (top panel). It is a level that is on par with its long-term historical average but is significantly lower than close peer like XOM. There are several advantages to maintaining a low inventory for a company. A lower inventory helps to reduce carrying costs and improves cash flow. Less inventory means less money tied up in storage, insurance, handling, and other carrying costs. Lower inventory frees up cash that can be invested in other areas like marketing, research & development, or expansion. However, maintaining a sizable inventory in the oil industry comes with several unique risks due to the inherent nature of commodities and the volatility of energy prices.

Oil and natural prices exhibit significant swings, and holding a sizable inventory could expose CVX to potential risks. An oil price fluctuation (say a swing from $80 per barrel to $60) could cause balance sheet risks. A sizable inventory could also cause carrying/operating costs such as storage fees, insurance, security, and potential quality degradation. These costs eat into profits, especially if prices are falling.

All told, my thesis is that under current conditions, Chevron Corporation offers more positives than negatives. In a nutshell, I see a dividend king at an attractive valuation thanks to recent corrections. In particular, when adjusted for its dividend yield, share buybacks, and growth rates, CVX currently offers very appealing valuation both in absolute terms (PEGY ratio is close to Lynch’s ideal 1x pick) and also in comparison to its close peers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.