Summary:

- Chevron Corporation’s latest earnings indicate that the company is overvalued, making it a poor investment.

- The Tengizchevroil expansion project is nearing completion and should benefit Chevron, but it is not expected to have a significant impact on the company’s overall performance.

- Chevron’s growth in the Permian Basin is expected to slow down in the long term, indicating limited potential for future development.

Mario Tama

Chevron Corporation (NYSE:CVX) is one of the largest global energy companies, with a market capitalization of more than $300 billion. The company has been supported by rising oil prices, however, we feel that the company is now overvalued with its latest earnings. As a result, that makes the company a poor investment.

Chevron Earnings

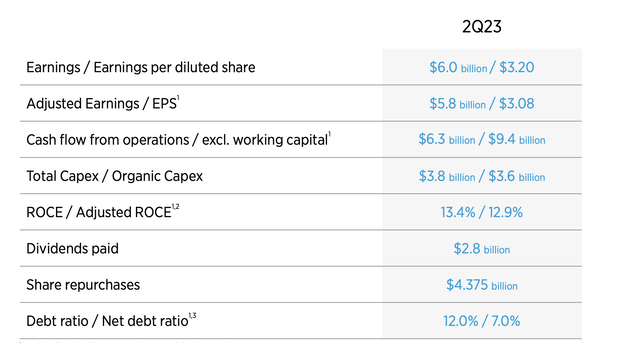

The company had reasonably strong Q2 earnings, although in relation to a market cap of more than $300 billion.

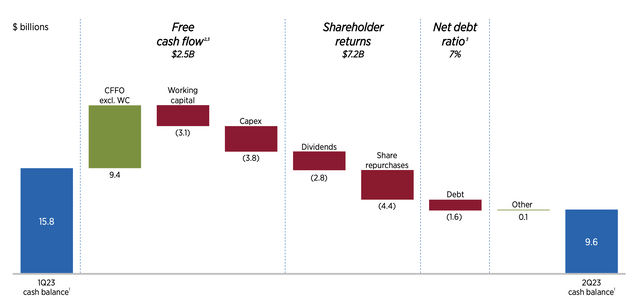

The company earned $5.8 billion in adjusted earnings. CFFO was $6.3 billion, which was a mere $2.5 billion in free cash flow (“FCF”) post capital expenditures. The company’s dividend is an almost 4% yield, which is partially covered by its FCF but not completely. The company also repurchased $4.4 billion in shares in the quarter, pushing up its debt.

However, the company’s 7% net debt ratio is incredibly manageable. Still, it’s worth noting that the company’s shareholder returns, which annualized at roughly 10%, are draining cash from the bank.

Chevron Tengiz Expansion

The company does have a few projects under its sleeve, including the Tengizchevroil expansion.

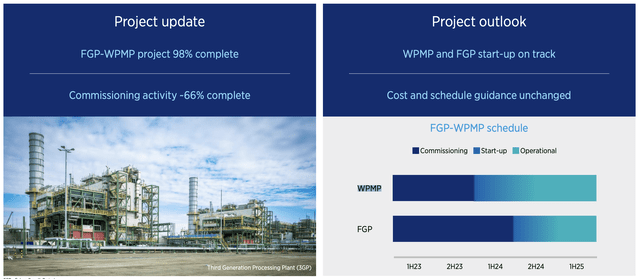

The massive multi-decade project is finally nearing completion, with the project 98% complete and commissioning 66% complete. The company is hoping that the project will start up in late-2024 to early-2025. Tengizchevroil has a nameplate capacity of 600 thousand barrels a day, and this massive $45 billion expansion project will push that to 1 million barrels / day.

Chevron, with a 50% stake, will be the largest beneficiary. Across a 20-year time period, the capital cost of the expansion is a massive $15 / barrel, showing the scope required as costs have gone up. The project will benefit Chevron, but long-term we don’t expect it to be massive needle mover.

Chevron Permian Basin Potential

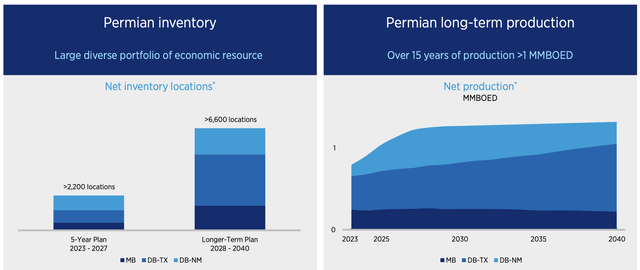

Another area of growth for the company, which has been touting for years, is the Permian Basin.

However, that growth will tap out too, showing the struggle of new developments. The company has roughly 800 thousand barrels / day in current production that it expects will grow to roughly 1.1-1.2 million barrels / day before peaking. That’s strong growth that’s high margin oil and the company has almost 10 thousand locations to support that into 2040.

This shows the company’s growth pipelines are expected to slow down over the long-term as locations get worse.

Chevron Portfolio and Financials

At the end of the day, what matters is Chevron’s financials, which we discussed above.

The company earned $2.5 billion in FCF after continuing to invest in its business. Production is expected to grow, so it’s not like that capital spending is completely worthless. However, at the same time, the company’s sustaining capital to maintain production remain a high % of that.

The company’s $7.2 billion in share repurchases along with debt repurchases pushed its cash position down more than 40% in a single quarter. This spending isn’t sustainable for the company long-term, its dividend isn’t even sustainable without a decline in the company’s capital spending. Given the company’s valuation, the supported returns are in the single-digits.

That’s a tough return to offer versus the long-term S&P 500 (SP500) returns and the volatility of the crude oil industry.

Thesis Risk

The largest risk to our thesis is crude oil prices. The company has an incredibly strong portfolio of assets and a history of strong operations. If crude oil prices go up from current levels, and remain high, the company’s strong portfolio of operations making it incredibly profitable. That could justify the company’s current valuation, although even then, there are other investments.

Conclusion

Chevron has an impressive portfolio of assets and an exception management team. The company is almost done with the Tengizchevroil expansion, although Kazakhstan’s obligations to OPEC+ could potentially delay full production being achieved here. The company is growing Permian Basin production, but even that’s expected to top out in a few years.

The company’s true issue is the valuation assigned by the market, especially when almost risk-free savings accounts can pay 5+%. The company’s capital spending is pushing FCF negative after its dividend of just under 4%. The company is aggressively re-purchasing shares but using its cash pile. Overall, Chevron Corporation is simply overpriced, making it a poor investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.