Summary:

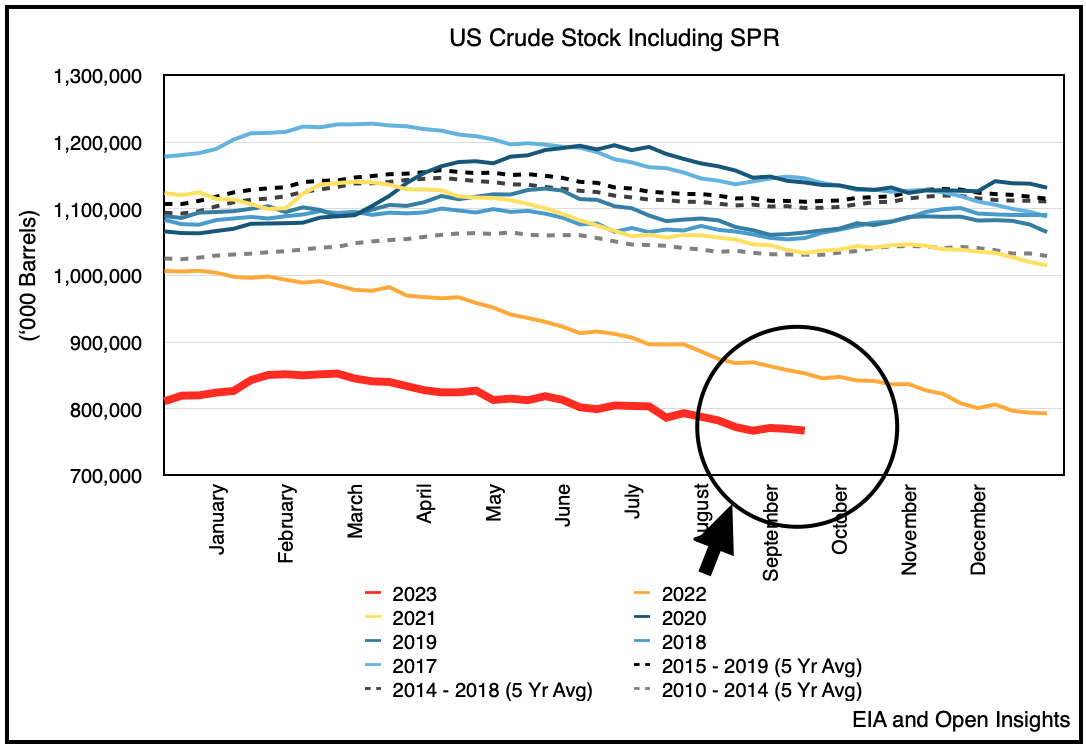

- U.S. crude inventories including the Strategic Petroleum Reserve have been steadily decreasing since the peak of the COVID-19 pandemic in 2020.

- Chevron has the strongest balance sheet in the industry and the capital discipline needed to buy assets at favorable prices.

- It has raised dividends for 36 straight years and has plenty of room to continue that trend.

jetcityimage

Owning energy stocks can be like riding a roller coaster with no idea of when the ups and downs will come or how long they will last.

While leveraged exploration and production companies provide the most thrill, the reasonably valued integrated oil giant Chevron Corp. (NYSE:CVX) offers a ride you can stay on for multiple turns without throwing up.

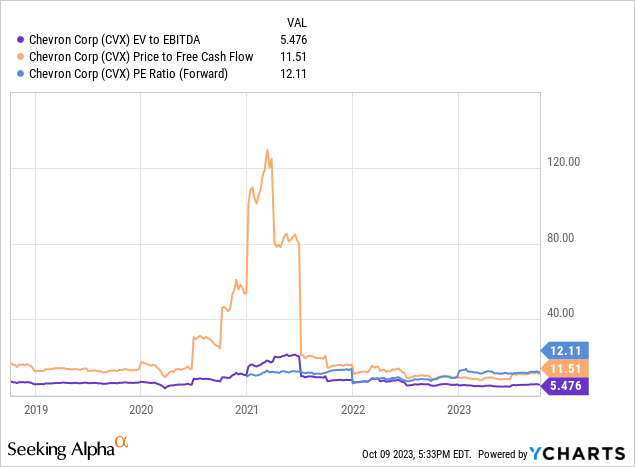

Fair Valuation

The forward price-earnings ratio of 12.1 is way below the S&P 500 (SPX) ratio of 19.1. This lower multiple is typical of oil and gas stocks, which have been out of favor due to volatility and climate change concerns.

The shares are in the middle of their 52-week range and sell for less than the Morningstar fair value estimate of $172.

The chart shows that except after the COVID-19 oil bust of 2020 when free cash flow all but disappeared, Chevron has had low, attractive ratios.

Chevron management assumes a 12% return on capital at a base price of $60 realized barrel, far below recent prices. The company can operate normally even when Brent crude is at $50, executive vice president Nigel Hearne said:

“Our company, given the discipline that we do have, has upside leverage and downside resilience. So, at $50 Brent, we cover both our dividend and our capital program. We have a very strong balance sheet, with net debt less than 10%. That positions us really well to work in that volatile and uncertain space.“

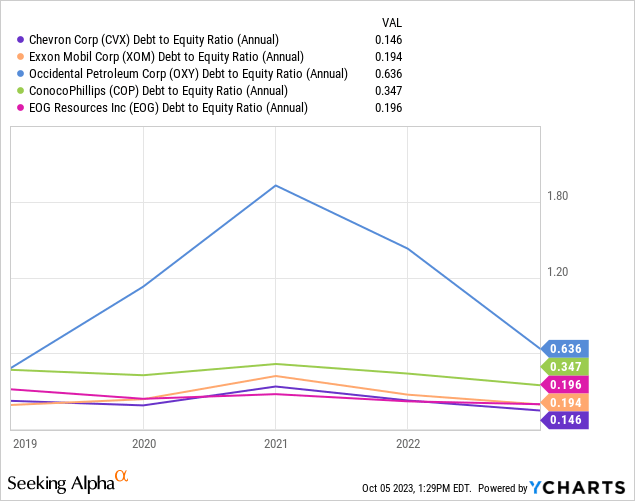

Strong Balance Sheet

With interest rates rising, the market has been punishing companies that need to finance their growth. Chevron has a sterling balance sheet, with a debt-to-equity ratio below 15 percent, the lowest among the largest U.S. oil producers:

After backing out cash, the net debt ratio is only 7%. Why is this important? Because oil prices, while in a multi-decade upward trend, fluctuate widely. Any company that knows where and how to stick holes in the ground can make money when prices are high. But companies with a strong balance sheet also benefit when prices are low, by buying distressed competitors.

Capital Discipline

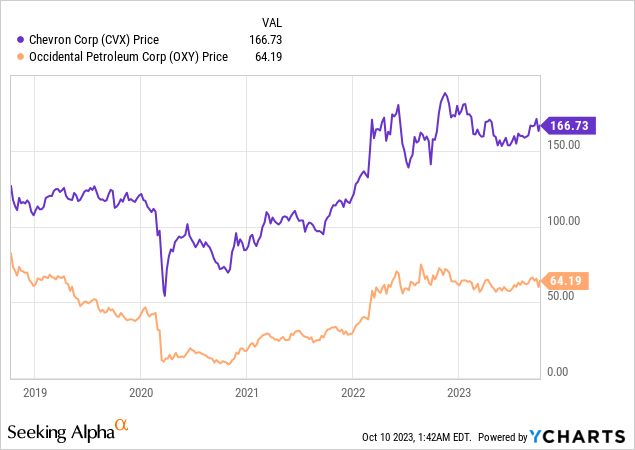

An example of Chevron’s capital discipline is how it withdrew from its tentative deal for Anadarko Petroleum in 2019, allowing Occidental Petroleum to take the bidding war (with Warren Buffett’s assistance) rather than pay a price it viewed as excessive. The company came out of the deal with a $1 billion kill fee.

But, when prices and valuations collapsed in 2020, Chevron was quick to buy Noble Energy, with complementary assets in the Permian and DJ basins, for only $5 per barrel of reserves.

Contrast that with Exxon Mobil’s (XOM) recent deal to buy Pioneer Natural Resources for $59.5 billion. With PXD having 2.4 billion barrels of proven reserves, that works out to nearly $25 a share. Obviously, a lot of other factors besides reserves go into a valuation, but the difference of 500% can’t be ignored.

While the 2021-22 rise in oil prices led to an S&P-leading rise in Occidental shares over that period, Chevron stock has still done better since the 2019 battle. And that’s the point–owners of Chevron don’t have to time the oil price cycle correctly to profit in the long term.

Edge in Venezuela

Chevron is the only U.S. oil company that holds a waiver from U.S. sanctions to produce in Venezuela. The Biden administration is negotiating to reduce sanctions in return for some semblance of a return to democracy. According to Bloomberg, Chevron has plans to drill new wells in 2024.

Venezuelan production is particularly profitable at the refining end because the country produces the heavy grades of crude that Gulf refiners need to balance out the light grades and even lighter condensate that comes from fracking in the Permian Basin.

Outlook for Oil Prices

The draining of U.S. crude inventories since the COVID peak in 2020 becomes clear when one takes the weekly Energy Information Agency figures and adds the government’s Strategic Petroleum Reserve, as done here:

U.S. oil inventories including SPR. (Open Insights )

Oil prices depend on factors outside U.S. control, such as Saudi policy and Mideast war fears. Still, given the tight domestic supplies, the more likely direction for oil prices is up when seasonal driving demand resumes next spring.

Production And Earnings Growth

The company plans to increase production at a compound annual rate of 3% through 2027. It has profitable opportunities in the Permian Basin, Colorado’s DJ Basin, Argentina, the Gulf of Mexico, Kazakhstan, and elsewhere, but limits its expansion through capital discipline. It expects a free cash flow of $5 billion a year by 2025. Upstream earnings per unit are expected to grow 50% at flat prices over the next five years, according to Hearne.

Steady Dividend Rises

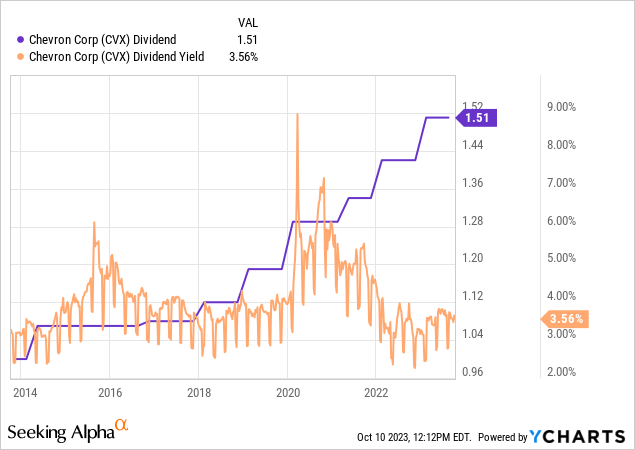

Chevron has a forward yield of 3.62%, which is lower than others in the sector mainly because its stock is valued more highly. It has made raising dividends its top financial priority, with 36 consecutive years of increases, one of only two energy companies along with XOM on the dividend aristocrats list.

In a recent conference call, CEO Mike Wirth said the company has raised dividends at a compound annual growth rate of 6% for the last 15 years, including a 6% rise this year. “Our dividend growth per share has been double that of our closest peers.”

Since oil is a cyclical business, CVX manages to keep the dividend growing in downturns by keeping a lot of cash on hand and adjusting its capital return by reducing or eliminating share buybacks when necessary. This year, swimming in cash from last year’s high prices, the company tripled its share buyback plan to $17.5 billion a year.

Risk Factors

The main short-term risk is a decline in oil prices due to a weak economy, as during the 2020 COVID-19 crisis. The process was self-correcting, however, as drilling reductions quickly followed and demand rebounded.

There is plenty of political risk, ranging from government actions that would stop production in Venezuela to delays in Kazakhstan expansion to a war-induced LNG shutdown in Israel to strikes in Australia. The company has decades of experience managing risks and is diversified enough that any single crisis doesn’t make much of a change in the overall outlook.

The biggest risk is a global move away from oil and gas as the climate-change energy transition continues. The International Energy Agency believes demand will peak by the end of the decade, but OPEC vociferously disagrees and remains bullish.

“In its 2023 World Oil Outlook report, OPEC indicated that by 2045, the world will need 116 million barrels of oil per day (bpd), up from 99.6 million bpd in 2022, and about 6 million bpd more than what it predicted last year.1 It pointed to growth in China, India, and other countries in Asia, Africa, and the Middle East. It also sees increases over the next several years.“

My view is that increases in the standard of living of lesser-developed countries will more than offset consumption declines in industrialized nations. In addition, growing tensions between the U.S. and its allies and the China/Russia/Iran axis will cause both sides to not make dramatic reductions in fossil fuel consumption that could endanger their economic output, often a decisive factor in wars.

Energy transition risks are also mitigated by the company’s pledge to invest $10 billion by 2028 in carbon capture and greenhouse gas reduction projects.

Conclusion

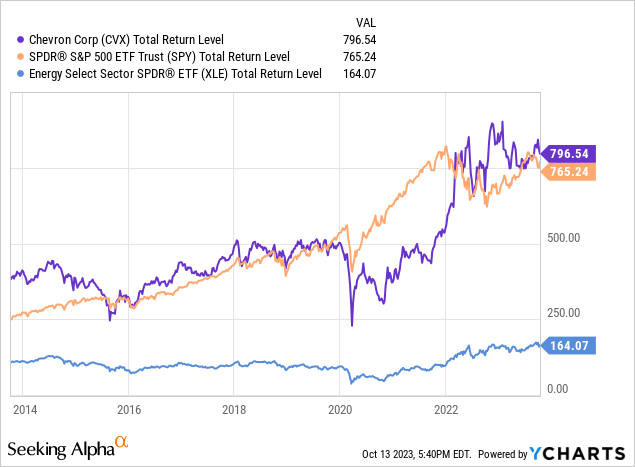

A long-term chart shows Chevron’s total returns have been comparable to those of the S&P 500 ETF Trust (SPY) and much higher than the Energy Select Sector SPDR (XLE).

Chevron is a long-established compounder of cash flow and dividends. It is not the most high-flying stock to own when oil prices rise, but is able to take advantage of bad times to build its reserves. It’s one of the few energy stocks one can keep under the pillow and not worry about losing sleep.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.