Summary:

- The OPEC+ cut triggered the rally in Brent spot prices, similarly lifting CVX’s stock prices at the same time.

- Given the potential contribution to its FCF generation in 2023, we are not surprised by the optimism currently embedded in its stock price.

- In the recent Investor Day, CVX also highlighted its ambitious 2027 plan of expanding its output by +33%, while similarly growing its FCF generation at a CAGR of 10%.

- However, with market analysts expecting a new normal in Brent prices at the mid $80s through 2026, we reckon CVX may record an improved FCF CAGR of up to 15%.

- Combined with the likely resilience of petroleum products through 2050, the CVX stock may continue trading at a premium in the intermediate term, in our opinion.

akinbostanci

The CVX Forward Investment Thesis

We have been hopeful of scooping up Chevron (NYSE:CVX) at our preferred entry points in the $130s/ $140s range at the previous July 2022 support, for an improved margin of safety.

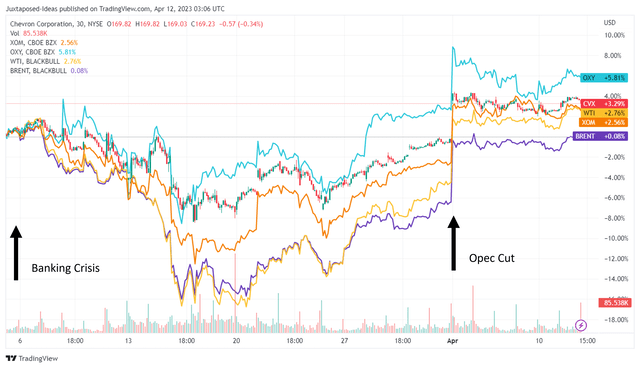

CVX, XOM, and OXY 1M Stock Price

However, it is also apparent that the recent optimism surrounding the OPEC+ cuts has triggered a rally in Brent/ WTI spot prices and CVX’s/ Exxon Mobil Corporation’s (XOM) / Occidental Petroleum Corporation’s (OXY) stock prices along with it, which had previously been decimated by the recent banking crisis.

Anyone interested in a more detailed backstory to these events may refer to our previous Petrobras (PBR) coverage here, since we will not be rehashing it in this article.

Meanwhile, CVX recently had an Investor Day on March 01, 2023, presenting its aggressive annual capital investments of up to $15B (+40.1% from FY2022 levels of $10.7B) through FY2027. This is attributed to the projected expansion in its production output to 4M (+33% from FY2022 levels of 3M) Barrels of Oil Equivalent per Day [BOED] by then.

The company’s annual capex guidance of up to $5B in the Permian Basin is not surprising either, in our opinion. This is because the region may contribute up to 1.2M BOED (if not more) from the second half of the decade, naturally lifting the region’s annual Free Cash Flow generation to $5B (+150% from FY2023 levels of $2B) by FY2027.

The Permian’s outperformance may also partly contribute to CVX’s improved upstream earnings by potentially over +50% through FY2027. This is on top of the region’s exemplary Return On Capital Employed [ROCE] of up to 29% (+3 points from FY2022 levels of 26%) at the same time, based on a $60 Brent spot price.

Despite the increase in planned capex, the company is also aggressively guiding for an expansion in FCF generation at a CAGR of 10% through 2027, attributed to its strong production growth and cost efficiency thus far.

Thanks to the OPEC+ cuts, we believe we may see CVX record an improved quarterly FCF generation of up to $7.5B from FQ2’23 onwards, if Brent spot prices remain stable in the mid $80s. This is compared to its FCF generation of $8.6B in FQ4’22, based on the average Brent prices in the mid $90s.

In the long term, we may also see the company deliver improved FCF generation through 2027 if spot prices remain elevated, against its original guidance at Brent prices of $60. The Bloomberg Consensus already projects new normalized Brent prices of up to $96 in 2023, while averaging around the $85 range through 2026, compared to the pre-pandemic average of $65.

These factors point to the potential upward rerating in CVX’s FCF generation from $13.2B in FY2019 to $26.5B in FY2027 at a CAGR of 15%, compared to the original projection of up to $21.5B based on a CAGR of 10%.

Combined with the robust balance sheet at cash/ equivalents of $17.9B (+215.6% YoY) and net debts of $3.07B (-87.7% YoY) by the latest quarter, it is unsurprising that the company continues to aggressively expand its production output, while similarly generating stellar cash flow.

We agree with Mike Wirth’s strategy, the CEO of CVX, who committed to sustained “exploration efforts as long as there is a market for it,” at the recent CERAWeek conference. The sentiment is mirrored by Jean Paul Prates, the CEO of PBR, in that the global transition to net zero carbon emissions will go hand in hand with a sustained increase in fossil fuel production over the next decade.

The International Energy Agency [EIA] estimates that the global oil demand will remain elevated through the decade, with demand peaking by 2030 at 103M Barrels Per Day [BPD], compared to 2022 levels of 99.4M BPD. Nonetheless, the agency also expects the global oil demand to stay stable at 102M BPD through 2050, despite the global decarbonization efforts thus far.

The EIA has a similar outlook for natural gas, with global demand remaining elevated at 4.4T cubic meters by 2050, compared to 2021 levels of 4.2T and 2030 projections of 4.4T. Much of the global demand is attributed to China’s and India’s slower transition to Net Zero Emissions by 2060 and 2070, respectively, compared to the EIA’s ambitious global target by 2050.

It is also important to highlight that the oil and gas industries are still expected to power up to 47% of the world’s energy demand by 2050 (based on the EIA’s most realistic scenario). This is partly attributed to the robust demand for petroleum products, one that is similarly offered by CVX under its petrochemicals segment in partnership with Phillips 66 (PSX).

Daniel Yergin, a leading energy analyst, highlighted:

What people don’t realize is how much else oil and gas go into. If you’re wearing a North Face jacket when you’re outdoors because it’s cold, it’s a polyester polyurethane nylon product. It’s virtually all an oil product. If you fly in a 787 jet, the body of that plane is a carbon product. If you’ve ever taken Tylenol in your life, it’s an oil product. You just go down this list and it’s so much more pervasive than you realize. It’s in many ways a building block of the world in which we live. (Canadian Energy Center)

Most importantly, even if the world achieves its ambitious Net Zero Emissions by 2050 (based on stated policies), oil and gas may still comprise up to 36.5% of the total global energy demand then, suggesting a continued reliance on conventional energy sources despite the transition to renewables.

In any case, CVX has similarly invested in renewable fuels (biomethane/ feedstock), with a projected production output of up to 100K BPD (100% from 2022 levels) and 40K MMbtu of renewable gasses (+1100% from 2022 levels) by 2030.

Furthermore, the management hinted at the modest profitability of its renewable fuels, largely attributed to its investments in Geismar, Louisiana, and Bayou Bend on the US Gulf Coast. Combined with its excellent projection of the New Energies business generating $600M in EBITDA by 2025 and $1B in cash flow from operation by 2030, we reckon its diversification toward renewables remains sufficiently profitable.

Particularly, up to 40% of CVX’s power consumption in 2023 will also be generated through renewables such as wind and solar, suggesting its highly strategic path toward decarbonization.

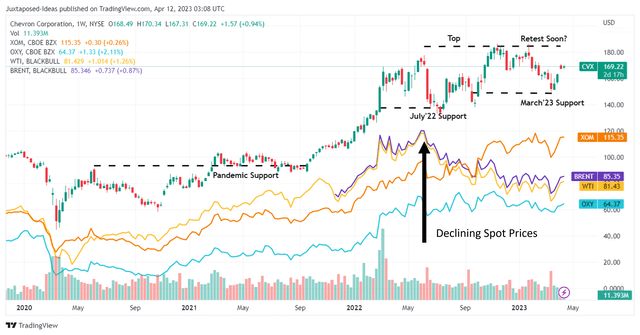

CVX, XOM, and OXY 3Y Stock Price

Therefore, is CVX a buy here, given the interesting insights offered in the recent Investor Day? Not so fast, in our opinion. The stock is obviously trading at a premium, priced nearer to the speculative crude spot prices of $100s, instead of the current $80s. The same disconnect is visible in XOM and OXY’s stock prices, despite the notable gap in the moderated WTI and Brent spot prices.

There are also minimal reasons for income investors to add at these levels. Based on the stock’s annualized dividend of $6.04 in FY2023, we are looking at a reduced forward yield of 3.56%, compared to its 4Y average yield of 4.53% and sector median of 4.38%. As a result, we are reiterating our Hold rating on CVX, despite the robust tailwinds for FCF generation in 2023.

Combined with the fact that the stock is trading above our preferred entry price for an improved margin of safety, interested investors need to exercise prudence here, in our view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.