Summary:

- Chevron is improving its process of selling noncore (and often older) production, which is expected to benefit shareholders more than previous sales.

- The company’s strong balance sheet allows it to hold properties until market conditions improve, potentially recouping at least some losses from previous write-offs.

- Chevron’s acquisitions and plans for growth make it a strong buy for both growth and income investors.

- The common stock also has some recovery potential.

- EQT received quite a bottom when Chevron sold natural gas properties at the bottom of the market a couple of years back.

Jeremy Poland

Chevron (NYSE:CVX) recently announced the beginning of the sale process of some (or all) of its Duvernay production. This is a big improvement over some of the sales actually executed in the past. In a previous article, I noted that Chevron wrote down some natural gas properties and then turned that paper loss into a big real loss by selling those properties to EQT (EQT). Exxon Mobil (XOM) on the other hand waited to sell the same type of properties until the recovery was well underway, as it has many times in the past. The current Chevron sale is likely to do a lot better for Chevron shareholders than any bottom-of-the-market sales.

Hopefully, Chevron management “cleans house” in the current market. This is not so much about timing sales to hit the exact market top of good prices as it is about avoiding obviously hostile conditions that lead to at least close to maximum losses.

Chevron has a very strong balance sheet. Therefore, management can definitely hold properties that need to be sold until market conditions are much better than they were a couple of years back. There is every chance that the sale cost shareholders billions (because the write-off was that big). Whereas, waiting for better market conditions likely would have recouped at least some of that write-off.

EQT reported paying roughly $700 million for properties that were on the books for far more until the write-off. Management crowed about the deal ever since. Credit EQT management for getting a good deal. But also note that the Chevron sales of noncore properties had to improve.

The problem with write-offs is that companies often use very conservative assumptions to maximize the write-offs. This then leads to better-than-expected profits on the remaining book value. So, the accounting game is to be very conservative with the write-offs while taking a more aggressive stance with what is left. This minimizes noncash charges like depreciation because the assumed life or reserves is on the aggressive side. This “game” allows for a lot of charge-offs in poor years, followed by “brilliant” performance during the recovery and later years.

The market attempts to counter this by valuing companies over the whole business cycle profitability. That is not always a success, as the current environment shows some thermal producers “taking off”. The thermal crowd often has high breakeven points and the lower average profitability that goes with it. But the “game players” win if the market gets enamored with the profits while forgetting the big losses.

Chevron is large enough to change its policies going forward by making sure everything that could possibly be sold gets sold during the current market conditions. Then like other companies such as Exxon Mobil, there is no need to sell anything during a time of very weak prices. It can be worth a lot of money to Chevron shareholders going forward should this practice prove to be the case in the future.

Comparing To Third Quarter

Chevron had a whole lot of temporary issues in the last conference call that appeared to have some effect on the stock price. Investors should look for those issues to begin to fade with the current fourth quarter conference call about to report.

There was a combination of delays and cost overruns in the Kazakhstan project. That is a fairly major project for the company. However, there was nothing going on there that could not be resolved to bring things back on track. Chances are very good the company will be involved in this project for years to come. Therefore, management is likely to learn from what happened and use that knowledge to the advantage of shareholders in the future.

Another big item was the acquisition of Hess (HES) by the company. Along with that acquisition comes the joint venture with Exxon Mobil in Guyana. The next-door neighbor, Venezuela, has been making all kinds of noises about that. But the United States and Great Britain have a presence, while Brazil now has troops along its border with Venezuela. That should be enough to put a stop to anything resembling an action by Venezuela. Besides, Venezuela only sent 5,000 troops to the border. That is a symbolic level rather than an actual threat level. Lately, things have been rather quiet. But there is likely to be more saber-rattling (at best) as Venezuelan elections approach for what appears to be a very unpopular government.

The last thing that upset the market was overall prices obtained. But many of the large companies like Chevron “take what they can get” at the time of the sale. Management explained that a lot of what happened was timing. That timing was unfortunate. There is also likely to be future quarters where the reverse is true.

The Stock Price

All of this tanked the stock price in this very momentum-based market. The fact is that many of us were praying for the current price environment that is now regarded as either low pricing or weak pricing.

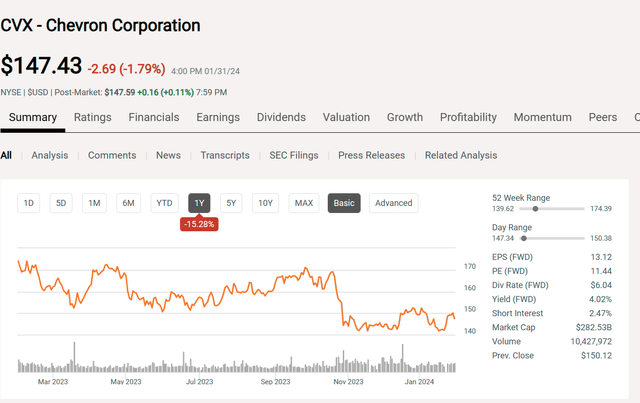

Chevron Common Stock Price History And Key Valuation Measures (Seeking Alpha Website January 31, 2024)

Even with the rally, the current stock price is well below the previous highs. The stock may face some near-term headwinds because the purchase of Hess will be for stock. Chevron has made some other acquisitions as well in the past few years. The stock price should recover the lost ground to make it to higher high prices in the future. This assumes that management will continue to successfully build the business through opportunistic acquisitions and slow growth.

If shareholders believe that management will be growing production and that the acquisitions were at least reasonable, then there is every chance this business will grow from the acquisitions with single digit growth from the strategy well into the future.

The sales of non-core properties often reduce costs while lowering the corporate breakeven points. Not every single deal has to be correct or “perfect” for there to be future growth. All that has to happen is the benefits need to outweigh the deficiencies. For a company with Chevron’s history and reputation, that is very likely.

The large integrated companies have the balance sheet and the presence to beat back the market expectations of return of capital. Therefore, a company like Chevron is likely to grow production. That growth will be aided by opportunistic acquisitions. The stock price obviously has some recovery potential (unless you think the business will suddenly shrink for some reason).

Meanwhile, the plans to grow the business should lead to low double-digit returns from the dividend and slow growth. That makes this company a strong buy for growth and income investors. The low risk level of a company with a high debt rating combined with the integration may make the returns appeal to a wide variety of investors.

The oil and gas industry tends to outperform a choppy market. The price-earnings ratio shown above is one of the lowest of the major companies I follow in this market for a large company like this. The risk that a company like this “turns south” is very low.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HES EQT XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.