Summary:

- Chevron Corporation’s dividend growth story is supported by favorable energy prices and expected production growth at key upstream assets in the US and Kazakhstan.

- The company’s strong cash flow generation should allow it to cover future dividend obligations and share buybacks, even when considering expected increases in its capital investment levels.

- Chevron has a relatively strong balance sheet with ample cash on hand to meet its near-term funding needs.

- Over the past 35+ years, Chevron has grown its annual per share dividend, indicating future payout increases are likely.

Joe Raedle/Getty Images News

Chevron Corporation (NYSE:CVX) is a rock-solid income generation idea as the Dividend Aristocrat has increased its annual payout over the past 35+ years during good times and bad. Back in January 2023, Chevron pushed through a 6% sequential increase in its payout (boosting its quarterly dividend to $1.51 per share or $6.04 on an annualized basis) and as of this writing, shares of CVX yield a nice ~4.0%. As oil futures are hovering around $70 per barrel, Chevron should continue to print vast amounts of earnings in the current environment. Favorable energy prices along with meaningful production growth out of key upstream assets in the US and Kazakhstan should drive Chevron’s cash flows higher going forward, enabling the energy giant to continue growing its payout over the long haul.

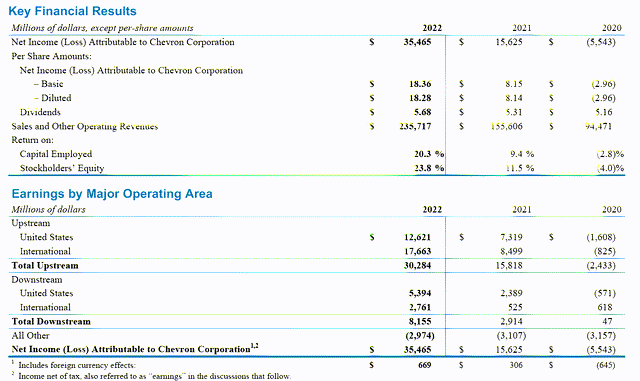

Financial Considerations

Most of Chevron’s earnings and cash flows come from its upstream operations, the part of its business focused on extracting oil, natural gas, and natural gas liquids from the ground. Its downstream operations (primarily represented by its refineries, petrochemical plants, and gas stations) acts as a natural gas hedge when raw energy resource pricing turns lower (expect during extenuating circumstances such as the COVID-19 pandemic). Chevron’s upstream and downstream operations are supported by its marketing teams (the division that buys and sells various energy products across the globe) and its energy infrastructure (known as its midstream operations).

Most of Chevron’s earnings and cash flows are generated by its upstream operations. (Chevron Corporation – 2022 Annual Report)

In 2022, which was a particularly good year for energy producers, Chevron generated $37.6 billion in free cash flow (defined as net operating cash flow less capital expenditures). That was stacked up against the $11.1 billion Chevron spent covering its total payout obligations (cash dividends to shareholders and net contributions to non-controlling interests) along with $5.4 billion covering its share repurchases last year, activities that were fully covered and then some by its organic free cash flows.

Please note that in January 2023, Chevron also announced a new $75.0 billion share buyback program, and that share repurchases compete for capital against its dividend. As Chevron is a cash flow cow in the current energy pricing environment, the company should continue to generate more than enough free cash flows to cover its dividend obligations (with room for growth) while buying back its stock, even when factoring in expected increases in its capital investment levels.

Chevron intends to spend around $17.0 billion covering its capital expenditures this year, up from $12.0 billion in 2022, as the energy giant is investing heavily in its growth opportunities. That includes affiliated capital expenditures as well and capital expenditures for Chevron’s consolidated assets. At the end of March 2023, Chevron had $15.8 billion in cash, cash equivalents, and short-term marketable securities on hand versus $2.9 billion in short-term debt and $20.3 billion in long-term debt, good for a net debt load of ~$7.4 billion. The company has ample liquidity on hand to meet its near-term funding needs.

Here I will caution that while Chevron’s outlook is bright, the company runs a capital intensive business and has a net debt load. The need to invest heavily in the business on an ongoing basis (capital investments also compete for capital against its dividend) and the lack of a net cash position are key downside risks for Chevron, though these are risks that I view as manageable given its large cash position and strong cash flow generating abilities.

Permian Growth

Chevron is pouring billions into developing its vast position in the prolific Permian Basin, which stretches across Southeastern New Mexico and West Texas. Due to its longstanding presence in the region, Chevron has roughly 2.2 million net acres of leaseholds in the Permian with ~75% of that having either no royalties or low royalty payments which significantly enhances its economics (as Chevron keeps a larger chunk of wellhead revenues instead of having to split a sizable chunk of those revenues with royalty owners). By 2025, Chevron aims to produce 1 million barrels of oil equivalent (‘BOE/d’) from the region (that appears to be a net figure).

It’s important to note that the initial production declines within the first year from horizontal wells that are hydraulically fractured (this is known as the “fracking” process and often these assets are referred to as unconventional) can range from 40%-80% depending on the development strategy utilized and the formation being targeted. However, these are wells that can be brought online relatively quickly as compared to conventional plays (within months not years) and are readily repeatable opportunities.

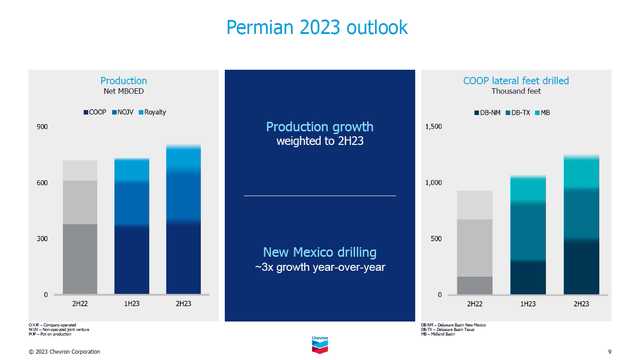

Though constant drilling and completion activities are required to maintain and grow unconventional production bases, this process can generate meaningful production growth rather quickly. In the right raw energy resource pricing environment, the cash flows these assets throw off can easily exceed cash flow inlays (capital investments plus operating expenses). Chevron’s global oil and natural gas production levels declined by 3% year-over-year during the first quarter of 2023 due primarily to the sale of its Eagle Ford position and contract expirations in Thailand. Looking ahead, its upstream division should see production growth resume as the company expects its Permian operations to post significant output growth during the second half of 2023 (due to the timing of well completions and other factors).

Chevron’s output growth in the Permian Basin is weighted towards the second half of 2023 due to the timing of well completions and other factors. (Chevron – First Quarter of 2023 IR Earnings Presentation)

During the first quarter of 2023, Chevron produced just over 0.7 BOE/d net during out of the Permian Basin. Its ambitions to add an additional ~0.3 million BOE/d net to its production base by 2025 via Permian output growth should have a meaningful impact on its financial performance. Chevron produced around 3.0 million BOE/d net during the first quarter of 2023 across its global asset base.

New Asset in the US GoM

In April 2023, first-oil was achieved at the Mad Dog 2 development in the US Gulf of Mexico. The goal of the ~$9 billion project is to extend the producing life of the Mad Dog oil field by adding a production platform with up to 140,000 gross barrels of daily oil production capacity to the operation. BP plc (BP) is the operator of the asset with a 60.5% stake in the venture alongside Woodside Energy Group (WDS) with a 23.9% stake and Chevron with a 15.6% stake. While Chevron owns just a slice of this asset, the oil-rich nature of these production streams and the significantly lower production decline rates seen at conventional assets versus unconventional wells (those developed via fracking activities) should see the Mad Dog 2 venture churn out sizable cash flows for Chevron for years to come.

Kazakhstan Upside

Chevron owns a 50% interest in the Tengizchevroil (‘TCO’) joint-venture in Kazakhstan alongside Exxon Mobil Corporation (XOM) which owns the remaining 50% stake. TCO is developing the massive onshore Tengiz oil field and the smaller Korolev oil field, with the former housing 25.5 billion barrels of oil in place and the latter housing 1.6 billion barrels of oil in place. Both of these fields have been producing oil for some time and various developments have steadily increased the production capacity of this asset. As the Tengiz oil field has a lot of sour gas, meaning natural gas with a relatively high sulfur content, TCO has had to develop processing facilities to extract that sulfur from the gas.

Once extracted, that sulfur is then sold as a separate product to industrial and commercial buyers. Back in 2008, the TCO venture completed the Sour Gas Injection and Second-Generation Plant expansion. That brought the production capacity of the facility up to 600,000 gross barrels of crude oil and almost 0.8 billion cubic feet of natural gas per day (along with some sulfur as well).

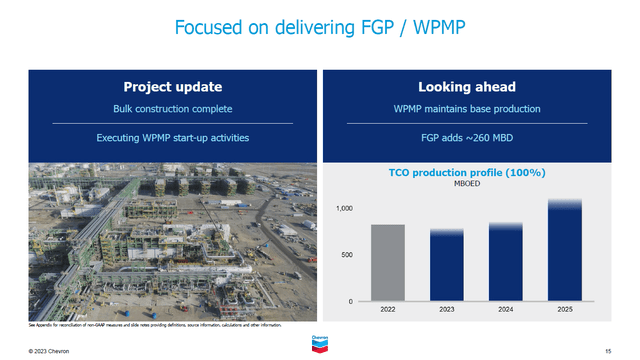

Looking ahead, TCO is working on the integrated Future Growth Project – Wellhead Pressure Management project which will add 260,000 gross barrels of crude oil production capacity to the Tengiz oil field. This endeavor aims to lower wellhead flowing pressure while boosting pressure to the inlet requirements as energy resources are routed to six processing trains, which is expected to boost recovery rates (meaning TCO can extract more of the existing crude oil resources in place). Commissioning and start-up work has already begun at this expansion, providing Chevron with another major near-term production growth catalyst.

Chevron’s 50% interest in the TCO venture in Kazakhstan represents a major production and cash flow growth driver for the firm. (Chevron Corporation – May 2023 IR Presentation)

Concluding Thoughts

Production growth in the Permian Basin and Kazakhstan along with the uplift provided by the Mad Dog 2 project coming online in the US Gulf of Mexico should help drive Chevron’s cash flows higher going forward, when assuming constant raw energy resource pricing levels, as its upstream output shoots higher. That in turn will enable Chevron to continue rewarding investors via sizable dividend increases over the coming years as the Dividend Aristocrat reaps the spoils of its past and ongoing investments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.