Summary:

- The Energy sector has the highest combined dividend yield and buyback yield at 8.0% as of December 31, 2023, and Chevron now sports a 4% dividend yield.

- Chevron is undervalued, in my view, and has a strong management team focused on delivering shareholder value.

- With oil prices in the mid-$70s, about $30 above its breakeven price, stock price momentum remains soft.

- I outline key price points to monitor ahead of Q4 earnings due out in early February.

Mario Tama

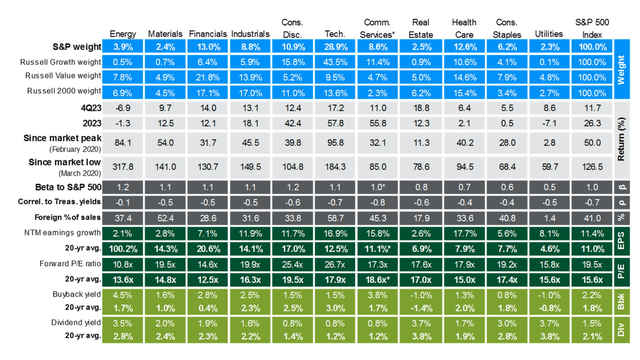

Looking for value and yield in 2024? The Energy sector continues to sport strong shareholder yield. Each month I review the JPMorgan Guide to the Markets, and there is a particular chart that should catch the eye of investors. The area of the market with the highest combined dividend yield and buyback yield is far and away the Energy sector at 8.0% as of December 31, 2023.

I have a buy rating on Chevron Corporation (NYSE:CVX). I see shares as undervalued while its management team continues to put the shareholder front and center.

Energy Sector Sports an 8.0% Total Shareholder Yield

JPM GTM

According to Bank of America Global Research, CVX is a US-based integrated oil and gas company, with worldwide operations in exploration and production, refining and marketing, transportation, and petrochemicals. In E&P, operations are globally distributed, including North and South America, Africa, Asia, and Europe.

The California-based $283 billion market cap Integrated Oil and Gas industry company within the Energy sector trades at a low 11.3 forward 12-month operating price-to-earnings ratio and pays a high 4.0% dividend yield, according to Seeking Alpha. Ahead of earnings due out in early February, the stock has a low 23% implied volatility percentage and carries a modest 2.1% short interest, up from about 1% last summer.

Back in October, Chevron reported a mixed third quarter. Non-GAAP EPS of $3.05 fell short of the Wall Street consensus of $3.69, though top-line results were better than expected – revenue of $54.1 billion, down 19% from year-ago levels, was an impressive $1.1 billion beat. The company made an acquisition that helped drive worldwide net oil-equivalent production higher by 4% versus the same quarter in 2022.

The bottom-line miss was due primarily to weakness in the US refining market, and downstream earnings for CVX took a hit as a result. Lower oil and gas prices during the period and some troubles related to the PDC merger were headwinds. LNG prices globally were also much weaker compared to the middle of 2022. Overall cash flow of $8.9 billion was seen as a light number, too, and while the firm was still buying back shares, the pace of share repurchases slowed.

For 2024, the management team expects total spending of about $19 billion, with $16 billion in capex, and strong dividend payouts considering a Brent oil breakeven price near $45 per barrel. Its acquisition of Hess should help free cash flow in the out years. The recent $4 impairment news should not be a major issue going forward as it appears to be a one-time event, and the stock didn’t react very much to the news.

Key risks include lower oil and gas prices, as well as high volatility in commodity pricing, poor execution on new projects and recent M&A moves, troubles with its capex plans, and additional adverse regulatory announcements.

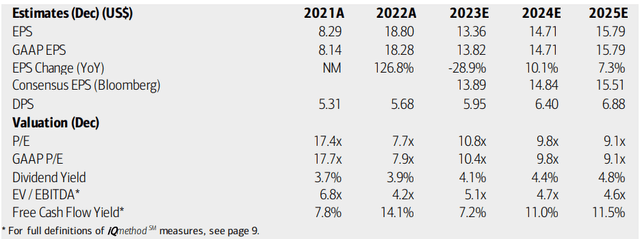

On valuation, analysts at BofA see earnings having fallen sharply in 2023 following 2022’s year of abnormally high oil and gas prices. Per-share profits are expected to rise this year, though the current consensus outlook, per Seeking Alpha, shows just mid single-digit year-on-year EPS growth for the current year. Top-line growth trends are likewise lackluster – flat this year and down 5% in 2025.

Dividends, meanwhile, are forecast to rise at a steady pace over the next several quarters while free cash flow turns better by the out year. With an EV/EBITDA multiple less than half that of the broad market, shares appear cheap.

Chevron: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

If we assume $14 of normalized non-GAAP EPS and apply the stock’s 5-year trailing earnings multiple of 13.5, then CVX should trade near $189, making it significantly undervalued today. Moreover, you must consider that the Energy sector as a whole sells at the cheapest P/E of any sector, so the group is likely a value play this year on an absolute basis.

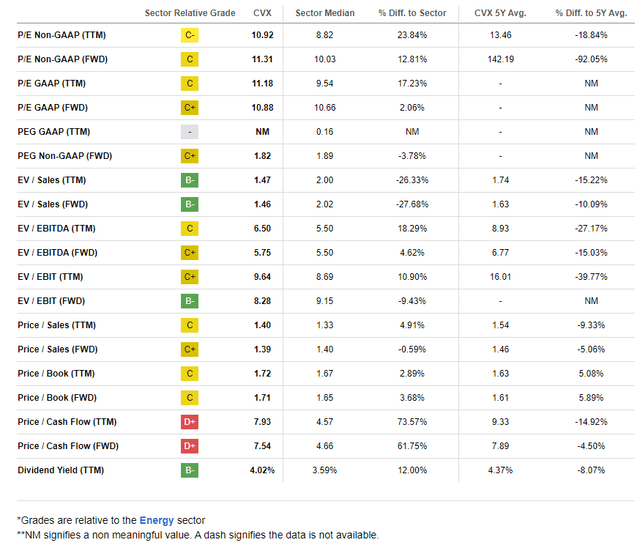

CVX: Mixed Valuation Metrics, Strong 4% Yield

Seeking Alpha

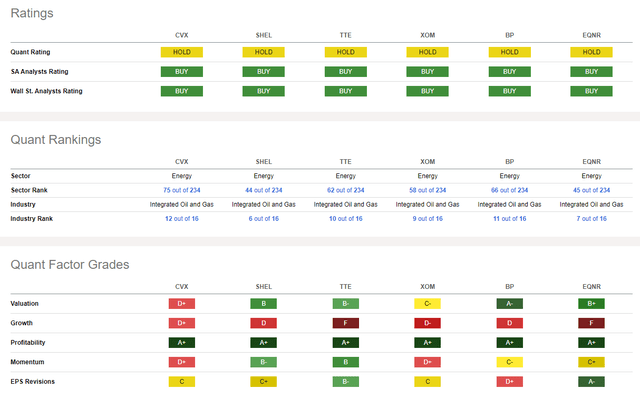

Compared to its peers, CVX features a somewhat poor valuation grade as you can find some single-digit P/E integrateds, particularly overseas in Europe. I assert that those could be even better value candidates, so long as they have ample free cash flow trends and engage in shareholder-friendly activities.

For Chevron, its growth trajectory is not all that impressive, but if oil prices hang in the $70-$80 per barrel range, the profits should still be decent. What’s more, CVX has very strong profitability trends amid very weak share-price momentum which I will detail later in the article. Finally, EPS revisions show 16 downward revisions to only six upward revisions in the last 90 days – the recent impairment news hopefully puts some bad news behind the company.

Competitor Analysis

Seeking Alpha

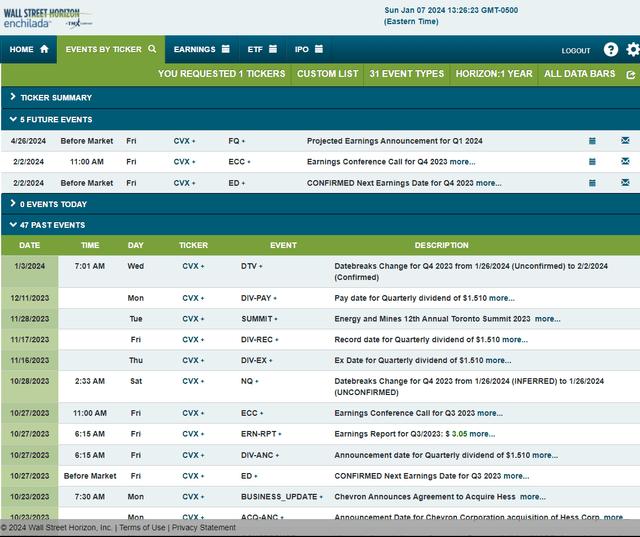

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q4 2023 earnings date of Friday, February 2, before the open with a conference call later that morning. You can listen live here. No other catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

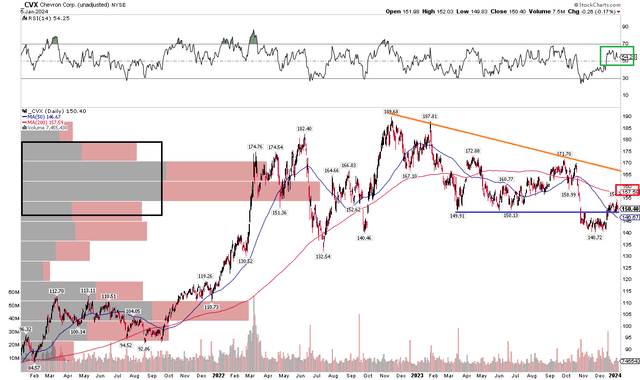

The Technical Take

Since I last reported on Chevron, the stock has not done a whole lot. Notice in the chart below that shares fell under support at the $150 mark, dropping to next support at the September 2022 low of $140. The bulls managed to bring CVX back above $150, and it’s hanging there now while oil prices oscillate in the low to mid $70s. With a high amount of volume by price in the current zone, it may be an ongoing choppy trade until the stock can rally through a downtrend resistance line currently near $165.

Also take a look at the long-term 200-day moving average – it is negatively sloped, suggesting that the bears are in control. Also, shares are below that key moving average and the 50dma is below the 200-day, too. But with decent RSI momentum, seen at the top of the graph, there has been some improvement in momentum over recent weeks. Longer-term, the double top from March last year and this past September, near $172, is another possible area of selling, below the all-time high of $190 notched in late 2022.

Overall, it is trendless price action in Chevron, and the stock has been a relative laggard over the past year.

CVX: Shares Bouncing Around $150, Neutral Technical Signs

Stockcharts.com

The Bottom Line

I reiterate my buy rating on Chevron. While the momentum and technical situations are not ideal if you are a bull, its valuation is attractive, and the company continues to generate strong free cash flow with dividends and buybacks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.