Summary:

- Chevron is expected to announce its Q2 2023 financial results on July 28th, with preliminary results indicating positive performance, causing shares to rise by 2%.

- The company’s profits per share exceeded analysts’ expectations at $3.20, translating to a net income of $5.78 billion, despite a significant drop in energy prices.

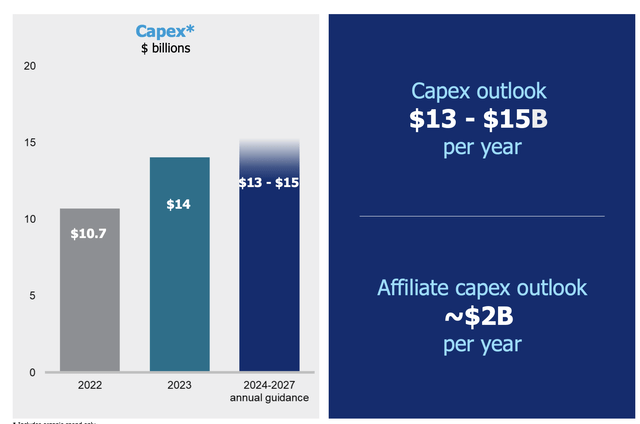

- Chevron is making significant investments in alternative energy projects and plans to spend about $14 billion on capital projects this year, up from $10.7 billion in 2022.

- This is preparing shareholders for the future, and CVX is achieving this while continuing to reward them directly.

zhengzaishuru

A rather big and significant day is coming up for energy giant Chevron (NYSE:CVX). Before the market opens on July 28th, the company is expected to announce financial results covering the second quarter of the firm’s 2023 fiscal year. A lot has transpired regarding the company recently, including the announcement of a multi-billion dollar acquisition. Very likely, with a lot going on in the economy and a lot transpiring with the company itself, investors were nervous leading up to the earnings release. The good news is that, in a surprise announcement, the company made public some preliminary results covering the second quarter. This coincided with a shakeup involving the firm’s top brass. Although it’s unclear exactly how the management change will impact investors in the long run, the data provided by management was positive enough to cause shares to close up 2% for the day.

Chevron exceeded expectations

Whenever I look at a company’s financial results for a quarter that was just announced, the first thing I like to do is focus on the headline news. This is the first thing that investors gravitate toward following an announcement. And at the very top of the list here we have revenue. Leading up to the earnings release, analysts expected the company to report sales of $47.88 billion. This would have represented a significant decline over the $68.76 billion in revenue the business reported for the second quarter of its 2022 fiscal year. Unfortunately, management did not report sales figures yet. So whether or not the company can deliver on this is anybody’s guess at this time.

When analyzing the behemoth, there are two primary operating segments that investors should focus on. The first is the Upstream segment that deals in the exploration and production of energy products, as well as some transportation activities, processing, liquefaction, and more. And the second is the Downstream segment that handles the refining and related activities of the company. Almost certainly, the bulk of the weakness for the company will involve its Upstream segment. And this will likely be driven by a decline in the price of oil and natural gas.

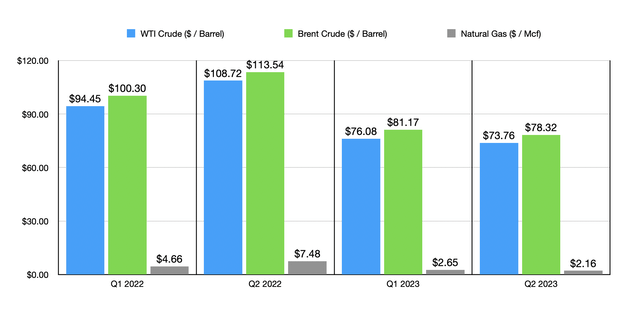

To see what I mean, we should touch on how energy prices have changed over the past year. During the second quarter of 2022, WTI crude prices averaged $108.72 per barrel. By comparison, WTI crude prices are $73.76 per barrel the same time this year. Brent crude prices followed a similar path, dropping from $113.54 to $78.32. Natural gas prices also took a tumble, going from $7.48 per Mcf to $2.16 per Mcf.

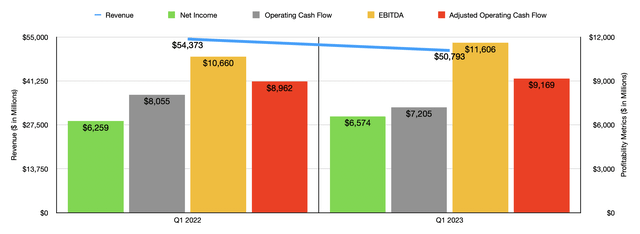

A drop in pricing is practically a guarantee of a drop in revenue for the Upstream segment. Now, investors who look at the data from quarter to quarter might point out that the drop from the first quarter of 2022 to the first quarter of 2023 was nowhere near as bad as the anticipated drop for the second quarter this year compared to the same time last year. Revenue declined from $54.37 billion to $50.79 billion. That’s a decline of only 6.6% compared to the 30.4% currently expected. And this is in spite of the fact that, as the chart above illustrates, there was a tumble in energy prices from the first quarter of last year to the first quarter of this year. But the percentage drop was nowhere near as large as from the second quarter of last year to the second quarter of this year.

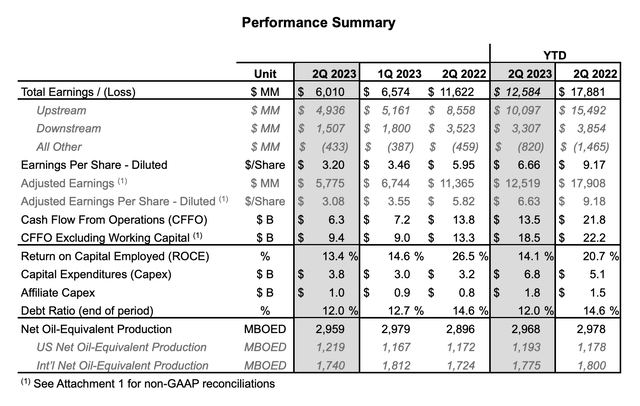

On the bottom line, however, we do have some solid numbers provided by management. Leading up to the earnings release, analysts anticipated profits per share of $2.98. Even though this would translate to a rather large $5.66 billion in net income, it would still represent a significant decline compared to the $5.95 per share, or $11.62 billion, that the company reported the same time last year. Even though profits did decline, they actually came in a bit higher than this at $3.20 per share. That translated to adjusted net income of $5.78 billion.

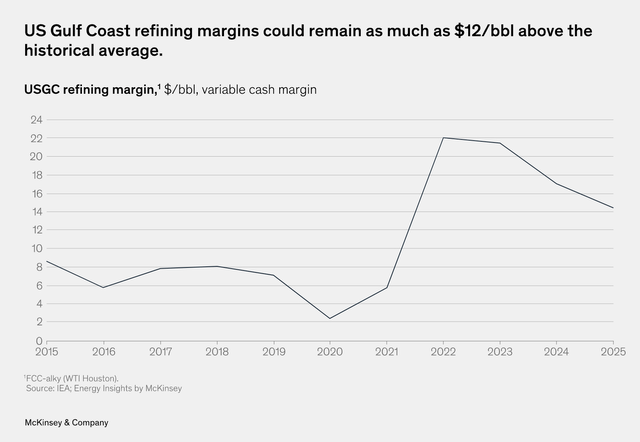

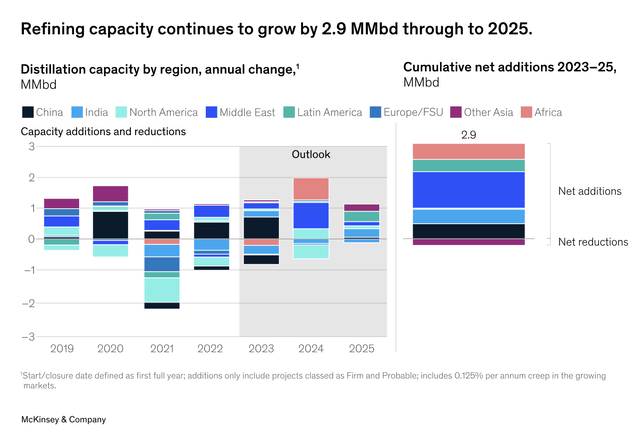

The vast majority of the pain on the bottom line came from the company’s Upstream segment. A plunge in energy prices, offset modestly by a 2.2% increase in overall production for the company sent segment profits down from $8.56 billion to $4.94 billion. Interestingly, there was also some pain when it came to the Downstream portion of the business. Profits here actually fell from $3.52 billion in the second quarter of 2022 to $1.51 billion at the same time this year. This downside was actually very surprising to me because, leading up to the earnings release, I was of the opinion that the picture for the company would still remain appealing on this front. It is true that we have seen a contraction in refining margins over the past several months. They have gone from their historical average of around $7 per barrel to a high of $22 per barrel late last year. But even today, they are elevated. And according to a report from consulting giant McKinsey & Company, US Gulf Coast refining margins, at least, are expected to average around $19 per barrel from 2022 through 2025.

In addition to oil production rising, a change in net refining capacity over the coming years should pull these margins down some. According to the data provided, net refining capacity from 2023 through 2025 is expected to grow by about 2.9 million barrels per day. That’s after taking into consideration 1.5 million barrels per day associated with shutdowns and conversions that will largely be split between Europe, Japan, and the US. However, this impact should be more than offset by three million barrels per day of increased refined product demand. Because of this and in spite of the expectation that overall oil output will increase over the next few years, Gulf Coast refining margins should average around $19 per barrel between 2022 and 2025. That provides a great deal of time for companies like Chevron to generate cash flow, even if the environment won’t be as bullish as it was last year.

Odds and ends

There were some other interesting data points provided by management. For starters, the firm did reveal operating cash flow. During the quarter, this came in at a rather low $6.3 billion. That’s down from the $13.8 billion reported the same time last year and it stacks up negatively against the $7.2 billion that the company reported during the first quarter of this year. The good news is that if we adjust for changes in working capital, we actually get a reading of $9.4 billion. That’s still down from the $13.3 billion reported last year, but it’s slightly higher than the $9 billion reported during the first quarter.

Outside of the financial data here, management did disclose some other interesting and important points. During the quarter, for instance, management oversaw $4.4 billion worth of share repurchases, which comes out to roughly 27 million shares. That brings the total share repurchases up to almost 50 million for the first six months of 2023. This puts the company well on its way to achieving the $10 billion to $20 billion worth of share buybacks that it is targeting this year. The company also paid out $2.8 billion worth of dividends to shareholders, bringing aggregate cash allocated toward rewarding shareholders up to $7.2 billion.

I understand how many investors feel about their distributions. This is especially true when you are talking about people who are in retirement and who rely on distributions first for a steady and reliable income. As a younger investor personally, I would prefer that management allocate this capital toward some growth initiatives. The growth initiatives I talk about have less to do with traditional energy projects and more to do with projects that will pave the way for the company’s success in the long run.

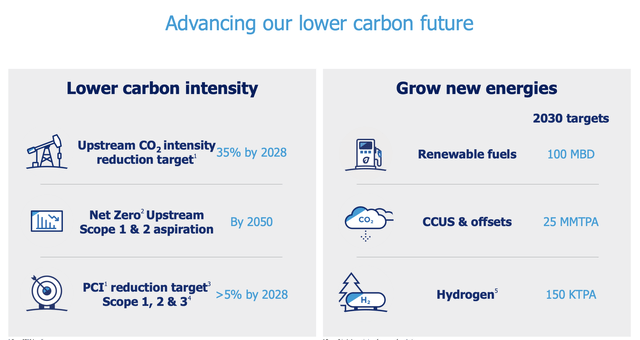

Outside of the headline news items, there are some other things that investors would be wise to pay attention to. At the top of mind would be the company’s strategy on capital allocation. In an effort to grow production by about 3% per year and in trying to focus on alternative investments like carbon capture, utilization and storage, as well as on things like RNG (renewable natural gas) and hydrogen, management plans to spend a significant amount of capital moving forward. They will have to if they want to reach their targets. By 2030, for instance, the company wants to be able to produce 100,000 boe (barrels of oil equivalent) of renewable fuels per day. They are targeting 25 million tons per annum of carbon capture and other offsets. And they are aiming for 150,000 tons per annum of hydrogen.

All of these initiatives and more have the company planning to spend about $14 billion on capital projects this year alone. This would be up from the $10.7 billion that was spent in 2022. And from 2024 through 2027, management is anticipating between $13 billion and $15 billion each year in capital expenditures. Naturally, these initiatives might have investors worried about the company’s ability to be able to reward shareholders more directly. The good news is that management has been very transparent about what their objectives are on that front.

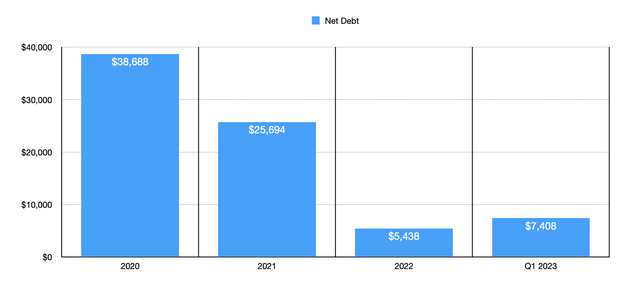

Another item investors should at least keep an eye on for when the company does report results will be debt since they did not provide details on it during the release of their preliminary results. Spending more tends to translate to the need for additional debt, especially if the company is buying back stock instead of issuing it. The good news is that Chevron has a good track record on this front as well. Net debt for the company declined from $38.69 billion in 2020 to $5.44 billion in 2022. It did increase some to $7.41 billion during the first quarter of 2023. But one quarter a trend does not make. If cash flows do come lower and if management does not change their guidance when it comes to spending, buying back stock, or other factors, debt must invariably rise in my view. Given how large the company is and the cash flows it generates, this would not necessarily be an awful thing. But it would be wise to continue to watch the leverage situation just in the unlikely circumstance that it gets out of control.

There are two final things that need to be brought up. First, management disclosed that they expect the acquisition of PDC Energy (PDCE) to be completed in August. That is a quick turnaround that exceeds my own expectations, but it’s great to see that management doesn’t see any issues with the deal going through. Lastly, as I mentioned earlier, management revealed a major shakeup at the firm. Pierre Breber, Chevron’s CFO, will be retiring next year and will be replaced by Eimear Bonner. Bonner is a Vice President at the firm. She also serves as the CTO and President of Chevron Technical Center. The announcement also details other changes in management, but none of them are as large as this one.

Takeaway

Based on all the data provided, it seems to me as though Chevron, while definitely facing a more difficult year than it did last year, is doing better than analysts anticipated. In the long run, the firm will need to continue to make significant investments in order to transform itself. But the results experienced so far and many of the decisions made by management so far should be worked upon in a favorable light. Given these factors, and assuming that nothing comes out of the woodwork when the rest of the financial data for the quarter is revealed when management announces financial results on July 28th, I would argue that the company makes for a decent ‘buy’ candidate at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!