Summary:

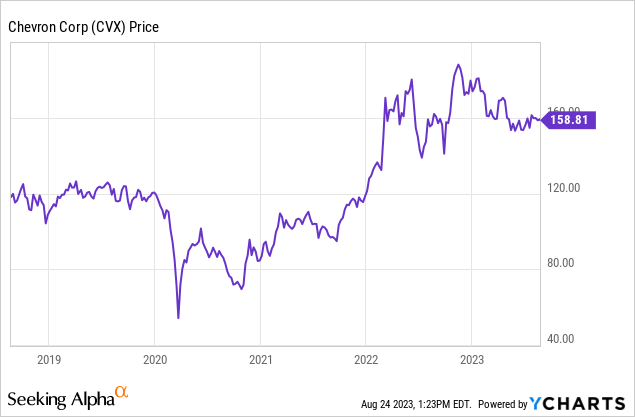

- Chevron has been one of the best performing stocks in the market since early 2021, offering investors total returns of 72.56%.

- The company’s recent second quarter earnings report showed strong performance, beating expectations on both earnings per share and revenues.

- Chevron has a strong balance sheet, a commitment to maximizing shareholder returns, and a track record of raising dividends, making it an attractive investment option.

JHVEPhoto

There is more than one way to maximize investment return. While many investors focus most on capital gains, dividends and also can also provide solid overall returns as well. While the S&P 500 (SPY) and most of the broader indexes performed very well over the last 2 decade, markets have generally flatlined over the last couple years. Picking individual companies has been the more profitable approach during this time period.

One of the best performing sectors in the overall market since price began to rise significantly starting in early 2021, is energy. The best performing large cap energy stock within this sector is Chevron (NYSE:CVX).

Chevron has been one of the best performing stocks in the market since early 2021. The oil producer has offered investors total returns of 72.56% since March of 2021. The S&P 500 has offered investors total returns of just 17.99% over that same time period.

I last wrote about Chevron in November of 2021 when the oil producer was a $115 stock. The company has offered investors total returns of 47%, while the S&P 500 is down during the same time period. I am changing my rating of Chevron today from buy to strong buy. Even though Chevron is up significantly over the last 2 years, the stock has gone nowhere in the last year as oil prices have fallen from the highs made during the Russia-Ukraine war. Chevron is the best run major integrated US energy producer, and the company has both a very strong balance sheet and the right energy portfolio in the market today. The stock also still looks cheap after consolidating over the last year. Chevron should be able to offer investors both consistent and inflation-adjusted income over the next decade. The stock should offer solid total returns as well.

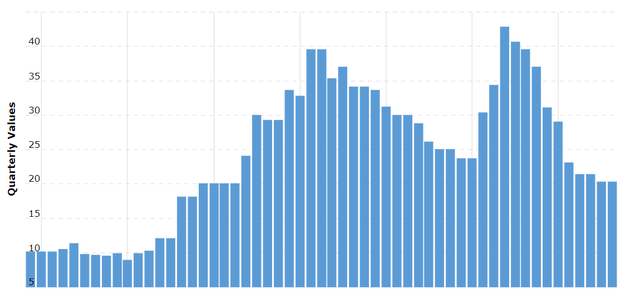

Chevron’s recent second quarter earnings report showed again how strong the company’s core operation are right now. The energy producer reported GAAP earnings of 3.20 per share, and revenues of 48.9 billion. Chevron beat on the top and bottom line, with earnings per share beating expectations by $.20 a share, and revenues beating expectations by $900.81 million. Management also reported strong production numbers, with Permian Basin production alone up 11% year-over-year. The company also continues the strong commitment to maximize shareholder gains with the reporting of a record $7.2 billion of shareholder distributions in just the last quarter. Chevron paid out dividends of $2.8 billion, and bought back $4.4 billion in shares, in the second quarter.

Chevron gets nearly 77% of revenues from upstream operations, and nearly two thirds of these upstream operations are from oil production. The leading energy producer also only has a negligible renewable energy portfolio. Chevron has said the company plans to invest $10 billion in renewable energy by 2028, but the leading energy producer is a $297 billion dollar company, these are small capital allocations.

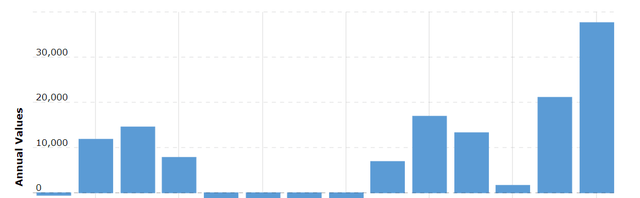

Chevron has a very strong balance sheet and management is committed to maximizing shareholder returns, the company should continue to return record amounts of cash to shareholders if oil prices stay at or near the current level of just over $80 a barrel. The price of Brent Crude Oil today is $83.05 a barrel. Chevron has $9.51 billion a share in cash on the company’s balance sheet, and operating cash flow is $41.27 billion. The company has $21.51 in debt and a debt to equity ratio of 13.50%.

A chart showing Chevron’s cash flow (Macrotrends)

The company has $21.51 in debt and a debt to equity ratio of 13.50%. Chevron has reduced the company debt by nearly 50% in just the last several years.

A chart showing Chevron’s debt (Macrotrends)

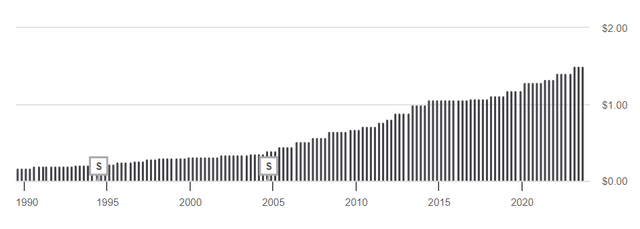

Chevron also has an impressive record of repeatedly raising the company’s dividends. Management has raised the dividend by 70% over the last 10 years, and that was even with oil prices remaining at low levels between 2016 and 2020.

A chart showing Chevron’s dividend history (Seeking Alpha)

Predicting commodity prices in the short-term is always tenuous, but there are multiple reasons to believe oil prices will remain high over the next several years.

The average decline rate per year globally of oil fields is also 6%, Russian oil exports remain limited, and the energy industry is also still recovering from an extended period of significant underinvestment from 2016 to 2020 when prices were often at low levels. The recent bombing of key infrastructure in the Crimea, as well as the continued counter offensive by Ukraine, continue to suggest this conflict is unlikely to end anytime soon. Upstream investments in the energy sector have also fallen from $700 billion a year in 2014, to between $370 billion to $400 billion today. The IAEA is forecasting global demand for oil to increase by nearly 2% this year from 2022 levels. Oil demand is supposed to continue to grow by about a half a percent a year from now until 2030. The Energy and Information Administration also recently updated the agency’s forecast for crude oil prices in 2023 to $79 a barrel.

This is why Chevron still looks undervalued at 11.96x likely forward earnings. The energy producer currently trades at 1.57x expected forward sales and 8.95x forward EBIT. The industry average is 2.19x forecasted forward sales and 9.96x predicted forward EBIT. Even though Chevron trades at a premium to the sector at 11.96x expected forward earnings, this company has significant better oil and gas production numbers and much stronger balance sheet than most of the company’s peers. Chevron’s strong production numbers are a significant part of the reason why the company has been able to consistently return record amounts of cash to shareholders without any compromises elsewhere.

Different kinds of investors focus on various goals and multiple types of investments. Still, there is no one way to invest. Management should also continue to have a lot of flexibility to be able to maximize shareholder returns with oil prices at current levels. Chevron is the best run major integrated oil company in the United States, and the company should be able to deliver strong income and solid overall returns for years to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.