Summary:

- Chevron Corporation is seen as a strong long-term investment due to its robust cash flow, promising oil and gas production growth, and shareholder-friendly management.

- Chevron’s future outlook is positive, with management expecting oil and gas production to grow by 3% or more annually through 2027.

- A conservative valuation estimates Chevron’s intrinsic share value at ~$173, while an optimistic valuation places it at ~$217.

- Chevron is in the process of acquiring PDC Energy Inc. through an all-stock deal worth $7.6 billion by enterprise value, which will significantly enhance its resource base.

hapabapa/iStock Editorial via Getty Images

Chevron Corporation (NYSE:CVX) is a great capital appreciation idea over the long haul due to its strong cash flow generating abilities, past efforts to improve its balance sheet, promising oil and gas production growth outlook, and shareholder friendly management team. In a recent article, Chevron Is A Respected Dividend Aristocrat; Likely Future Payout Increases (link here), I covered some of the reasons why I’m a big fan of the name and in this article I will expand further on that thesis with an eye towards Chevron’s capital appreciation upside. Optimistically, I value Chevron’s equity at ~$217 per share and I will cover how I derived that figure in this article.

Financial Overview

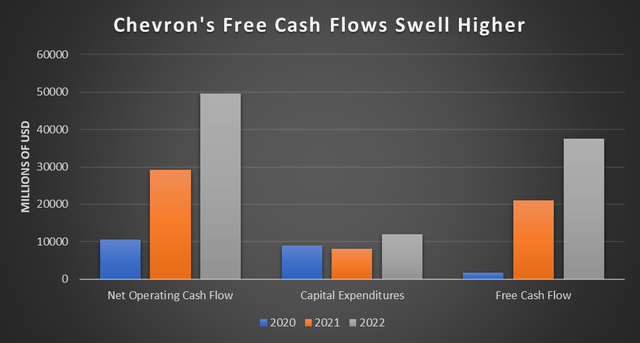

I define free cash flow as net operating cash flow less capital expenditures. This is the money that companies can use to organically pay out dividends, buy back their stock, make acquisitions, and improve their balance sheet strength. Companies must be able to fully fund their capital expenditure requirements organically in order to be able to sustainably reward investors. In the upcoming graphic down below, I highlight how Chevron’s annual free cash flows swelled higher from 2020 to 2022 as the global energy market recovered, with an eye towards rising crude oil prices during this period.

Chevron is a free cash flow cow. (The author, with data from Chevron Corporation)

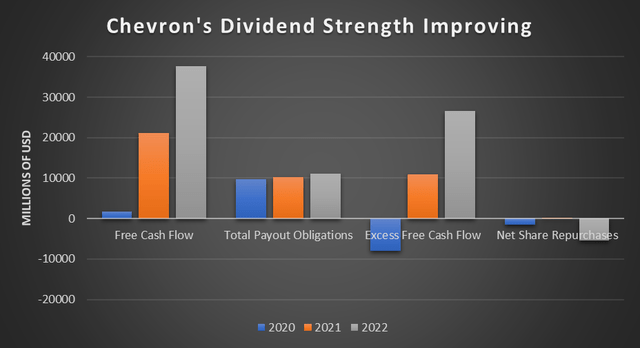

Chevron’s capital expenditure expectations are on the rise as the company intends to grow its oil and gas production base. Management intends to spend ~$17 billion covering the firm’s capital expenditures in 2023, up sharply from the ~$12 billion spent in 2022. In the current crude oil pricing environment, Chevron should remain a free cash flow cow. The company generated $37.6 billion in free cash flow in 2022 while spending $11.1 billion covering its total payout obligations, with some of its $26.5 billion in excess free cash flow (free cash flow less total payout obligations) going towards covering $5.4 billion in share repurchases.

As Chevron’s free cash flows swelled higher, its dividend strength (ability to fully fund its payouts) improved considerably. I define Chevron’s total payout obligations as its cash dividends to shareholders and its “net contributions from (distributions to) noncontrolling interests.” In the upcoming graphic down below, you can clearly see the improvements in Chevron’s dividend strength over the past few years. The company’s excess free cash flows have allowed the company to not only steadily grow its dividend (Chevron has grown its annual per share payout over the past 35+ consecutive years) but also buy back a material amount of its stock. Effective April 1, Chevron replaced its old repurchase program with a new $75.0 billion buyback authorization.

Chevron’s strong free cash flows enable the firm to reward investors via sizable dividend payouts and share repurchases. (The author, with data from Chevron Corporation)

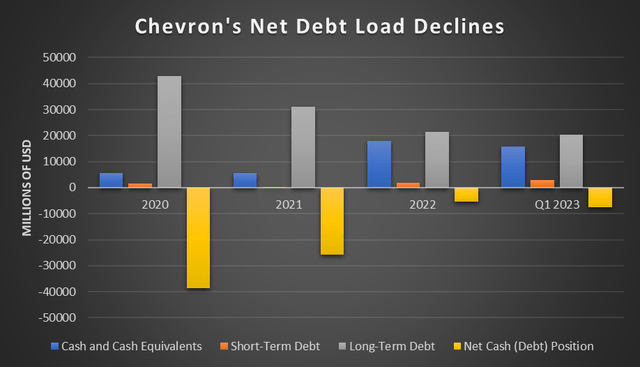

Another reason why Chevron’s dividend strength has improved in recent years is due to management’s efforts to repair the company’s balance sheet (I, II). This was primarily done by Chevron paying down its long-term debt while building up its cash and cash equivalents position. At the end of March 2023, Chevron had a $7.4 billion net debt position and ample liquidity on hand due to its $15.8 billion in cash and cash equivalents position on the books. Chevron has more than enough liquidity to meet its near-term funding needs.

Chevron’s net debt load has declined materially since the end of 2020. (The author, with data from Chevron Corporation)

I’m providing this backwards looking data to highlight where Chevron’s financials have trended in recent years and what management’s capital allocation priorities look like.

Looking Ahead

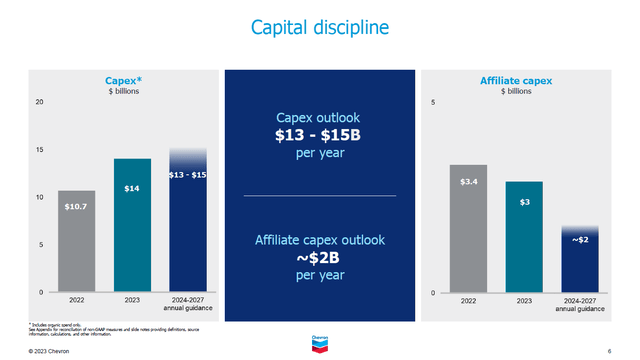

The pace of Chevron’s capital investment activities has an outsized impact on its free cash flow generating abilities, as does the price of crude oil given its upstream segment (which extracts raw energy resources from the ground) is its largest generator of cash flow. While Chevron’s capital expenditures are rising sharply in 2023 versus recent levels, management expects the firm’s capital investments will plateau over the coming years at ~$15-$17 billion (when including affiliate capital expenditures). However, that guidance was provided before the news broke in May 2023 that Chevron was acquiring PDC Energy Inc. (PDCE) through an all-stock deal worth $7.6 billion by enterprise value. If that deal closes, Chevron’s annual capital expenditure expectations through 2027 will rise to ~$16-$18 billion, which at the midpoint is flat with expected spending levels this year (meaning Chevron’s capital expenditures are still expected to plateau in the medium-term even if its PDC Energy deal is completed by the end of this year as currently envisioned).

Assuming Chevron follows through, its free cash flow generating abilities should be greatly enhanced in the medium-term as management is guiding for substantial oil and gas production growth during this period as new producing assets come online. Greater oil and gas production levels combined with generally flat capital expenditure expectations should provide its free cash flows with a powerful tailwind.

Chevron’s capital expenditures are expected to be broadly flat in the medium-term versus expected 2023 levels. (Chevron Corporation – May 2023 IR Presentation)

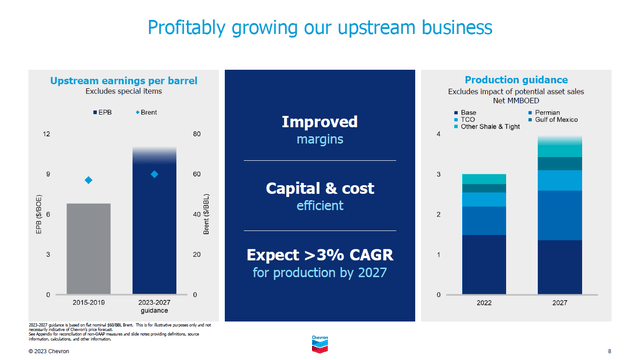

Chevron is guiding for a 3% or greater compound annual growth rate (‘CAGR’) through 2027 in its oil and gas production. Forecasted declines in its base production (mature assets naturally see their output levels shift lower as reservoir pressure declines) is expected to be more than offset by expected growth in output from Chevron’s Permian Basin, Kazakhstan (via the Tengizchevroil or TCO venture), various unconventional plays (shale and tight oil), and US Gulf of Mexico assets. Furthermore, efforts to reduce its administrative expenses in recent years by reducing its headcount and moving to sell its headquarters in California, along with operational improvements (drilling and completing wells faster, boosting well productivity, and technology investments), are expected to significantly enhance Chevron’s profitability levels at any Brent futures pricing point (with Brent being the premier international crude oil pricing benchmark).

Chevron expects to grow its upstream production while improving its margins going forward. (Chevron Corporation – May 2023 IR Presentation)

A combination of oil and gas production growth, flat capital expenditure expectations, margin improvements, and contained financing expenses (due to its total and net debt load declining materially in recent years) should see Chevron generate substantial free cash flows going forward. Please note that Chevron’s guidance doesn’t include the impact of potential acquisitions and divestments in the future.

For instance, Chevron is reportedly looking to sell off a small portion of its Permian Basin position. However, that potential divestment would have a negligible impact on its upstream operations as Chevron has a massive 2.2 million net acre position in the Permian (a prolific oil and gas producing region that stretches across Southeastern New Mexico and West Texas) that produces several hundred thousand barrels of oil equivalent per day.

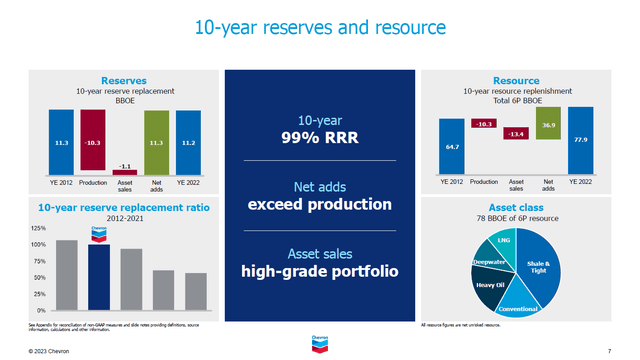

Reserves

Chevron has done a tremendous job over the past decade building up a substantial resource base to develop. At the end of 2022, its 6P resource base stood at 77.9 billion barrels of oil equivalent (‘BBOE’), up from 64.7 BBOE at the end of 2012. However, this is different than its proved reserves, which stood at 11.2 BBOE at the end of 2022, down marginally from 11.3 BBOE at the end of 2012. Whether Chevron is able to economically develop its resource base and grow its proved reserves base will come down to a variety of factors including operational execution (bringing projects online and on-time is essential), the trajectory of raw energy resources pricing, operational and technological improvements (such as boosting the estimated ultimate recovery rates of shale wells and reducing downtime via digital investments that spot problems before they become a bigger issue), and other considerations.

Chevron has a sizable resource base that should support its cash flow generating abilities over the long haul. (Chevron Corporation – May 2023 IR Presentation)

Maintaining a large resource base is essential to supporting Chevron’s long-term cash flow generating abilities. Over the past decade, Chevron has produced enormous amounts of oil and gas and divested a significant amount of assets yet its proved reserve base has more or less stayed flat due to its exploration successes and ability to boost recovery rates across the shale patch. Acquisitions, such as its past deal for Noble Energy that closed in October 2020 or its pending all-stock deal for PDC Energy, are part of Chevron’s strategy as it concerns growing its resource base. Acquiring PDC Energy will add significant production, resources, and acreage to Chevron’s existing positions in the Permian and the DJ Basin (in Colorado). Chevron sees the PDC Energy deal growing its proved reserves by roughly 10% for an acquisition price of ~$7 per barrel of oil equivalent.

Reportedly, Chevron is considering entering Algeria’s upstream industry, with an eye towards the country’s natural gas resources. Chevron is also active in Argentina’s upstream industry, particularly in the prolific Vaca Muerta shale play. Any success in Algeria, a country known to be rich in oil and gas, could significantly improve Chevron’s proved reserves base. In Argentina, where Chevron already has had plenty of successes, new pipelines and other energy infrastructure should help keep the momentum going in the right direction and potentially allow Chevron to book additional reserves via future development and appraisal activity. These are just two examples of how Chevron intends to continue locating new resources to develop.

Valuation

Through a discounted free cash flow model, one could conservatively estimate the intrinsic value of a share of Chevron at ~$173 and optimistically value shares of Chevron at ~$217. Here is how I obtained those figures:

Conservative Valuation

Normalized free cash flow of ~$20.1 billion (average from 2020-2022)

Roughly 1.9 billion diluted common shares outstanding at the end of March 2023

Net debt load of $7.4 billion at the end of March 2023

10% discount rate and a 4% perpetual growth rate (the perpetual growth rate takes into account forecasted growth in Chevron’s oil and gas production and profitability improvements, justified further by using a lower normalized free cash flow figure by taking its 2020 performance into account, which was a brutal year for energy firms)

$20.1 billion divided by 0.06 (10% discount rate less 4% perpetual growth rate) = $335.6 billion

Less $7.4 billion net debt load = $328.2 billion

$328.2 billion divided by 1.9 billion diluted shares outstanding = ~$173 per share

Optimistic Valuation

Normalized free cash flow of ~$29.4 billion (average from 2021-2022)

Roughly 1.9 billion diluted common shares outstanding at the end of March 2023

Net debt load of $7.4 billion at the end of March 2023

10% discount rate and a 3% perpetual growth rate (I reduced the perpetual growth rate after using a higher normalized free cash flow figure by excluding Chevron’s 2020 performance but keeping its stellar 2022 performance, which was a great year for the energy sector)

$29.4 billion divided by 0.07 (10% discount rate less 3% perpetual growth rate) = $419.7 billion

Less $7.4 billion net debt load = $412.3 billion

$412.3 billion divided by 1.9 billion diluted shares outstanding = ~$217 per share

With shares of Chevron trading hands near $157 per share as of this writing, there is room for significant capital appreciation upside in the current raw energy resource pricing environment. Its pending acquisition for PDC Energy should have a positive impact on Chevron’s intrinsic value as the operational overlap between both firm’s assets lends credence to the idea that the deal will add ~$1 billion to Chevron’s annual free cash flows (when assuming $70 Brent and $3.50 Henry Hub pricing) once factoring in synergies ($100 million in operating cost synergies and $400 million in capital expenditure synergies, both of which appear to be on an annual basis) and other factors.

Concluding Thoughts

Chevron is a tremendous enterprise that offers investors ample capital appreciation upside in the current environment. There are some downside risks to consider such as Chevron’s net debt load, the capital-intensive nature of its business model, the inherently volatility of raw energy resources pricing, geopolitical risks, and potential changes in taxation and regulatory regimes in regions where the company operates. With that in mind, Chevron is well-positioned to navigate any headwinds with its cash flow generating abilities firmly intact, and I’m a big fan of the name.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.