Summary:

- My bull thesis on Chevron Corporation started in early 2022 based on a few key catalysts.

- Now, I see all catalysts have run their course under current conditions.

- To wit, its profitability has peaked, the supply-demand imbalance has found a new equilibrium point, and its valuation offers little margin of safety.

- It is also important to note that Warren Buffett has been trimming Berkshire Hathaway’s position in CVX stock over the past few quarters.

RichVintage

Warren Buffett kept trimming Berkshire’s CVX position

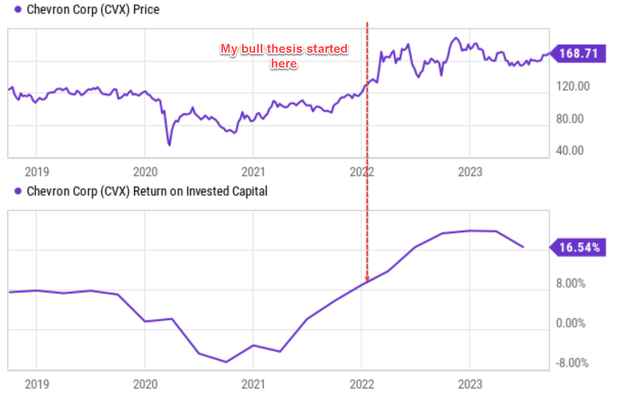

I started my bull thesis on Chevron Corporation (NYSE:CVX) in early 2022 (when its stock prices were about $130). The stock indeed delivered strong returns (more than 35% including dividends) when the S&P 500 (SP500) essentially stayed where it was. The bullish thesis is based on three key considerations (quoted below), and I have maintained my bullish position since then because I don’t see any material change in any of them:

- Profitability recovery due to oil price stabilization and travel recovery after the pandemic.

- Supply shortage due to the breakout of the Russian/Ukraine war.

- And very compressed valuation due to the market’s extremely negative sentiment toward energy stocks at that time.

In this article, I will revise and downgrade my ratings to hold. The reason is that I think all 3 catalysts mentioned above have run their course mostly by this point. To be more specific, I will argue that: A) CVX’s profitability has already reached a peak (at least temporary) by historical standards; B) the supply-demand imbalance seems to have found a new equilibrium point as the Russian/Ukraine situation drags on; and C) the valuation has expanded substantially and no longer provide the margin of safety I saw in early 2022.

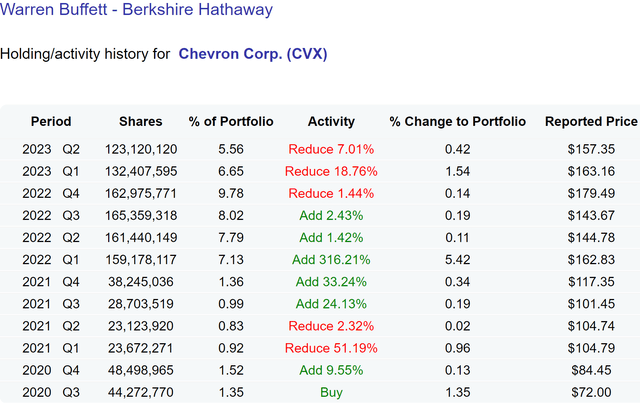

If you have been following CVX, most likely, you have been following Warren Buffett’s Berkshire position on the stock too. The chart below shows that Warren Buffett’s Berkshire Hathaway (BRK.A) has been trimming its position in CVX starting Q3 2022. In Q3 2022, Berkshire Hathaway held 165.36k shares of CVX, which represented 8.02% of its equity portfolio. After 3 quarters of consecutive trimming, Berkshire Hathaway had reduced its holdings to 123.12k, or 5.56% of the portfolio. These numbers translate into a decrease of more than 7% in the number of shares held and a decrease of ~2.5% of the weight in the portfolio, quite substantial trimmings given the size and starting weight of the position.

I do not want to claim that I know Buffett’s thinking and whether his trimming was due to the reasons I mentioned. However, it is never a bad idea to pay attention to the actions of a major stakeholder in the stock. In this case, his actions also show a rating downgrade from buy to hold in the way I see it.

CVX: Both price and profitability have peaked

The chart below shows CVX’s price and profitability measured by ROIC (return on invested capital) in the past 5 years. As seen, despite the cyclical nature of the business, CVX has been maintaining a respectable ROIC of around 8% before 2020 (which is also approximately its average ROIC in the long term). Then, due to strong headwinds (issues caused by the COVID pandemic primarily), CVX’s ROIC nosedived into the negative regime.

As aforementioned, one key consideration in my bull thesis around 2022 was the signs that I saw then for its profitability to continue recovering. Indeed, its ROIC staged a beautiful V-shape recovery as seen. Its ROIC reached the highest level in a decade in early 2023, stayed there for two quarters, and then pulled back a little to the current level of 16.5%. In the way I see it, this pullback is not a random fluctuation. I see it as a reflection that the supply-demand imbalance has found a new equilibrium point as post-COVID recovery is almost done, and the market has had plenty of time to absorb the disruptions caused by the Russian/Ukraine war.

In the meantime, the stock price has rallied to near all-time highs as seen and its valuation multiples have expanded substantially in the past 1~2 years. As such, investors need to be aware that the company’s stock is currently priced at a valuation with a thin margin of safety, as to be detailed in the next section.

CVX: Valuation signals thin margin of safety

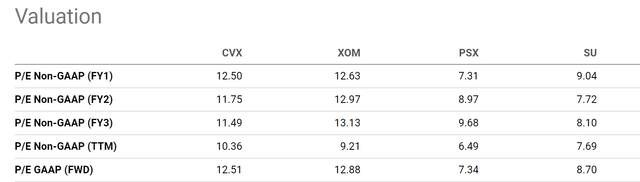

The stock’s current price-to-earnings ratio (“P/E”) is around 12.5x (on an FWD basis). Admittedly, it is comparatively low when benchmarked against the overall expensive market. However, I see a very thin margin of safety here for a couple of reasons.

First, the owner’s earning yield is relatively low. For a cyclical business such as CVX that pays steady dividends in the long term, its dividend is an excellent approximation for its owners’ earnings (that is, better than accounting EPS). As a result, dividend yield is a more accurate valuation measure in my view. As shown in the chart below, CVX was yielding about 4.52% when I published my first bull article, higher than its 10-year historical average by a good margin. But with a rapid price rally since then, the picture has reversed. The stock currently yields 3.53%, close to the lowest level in 5 years, a seen.

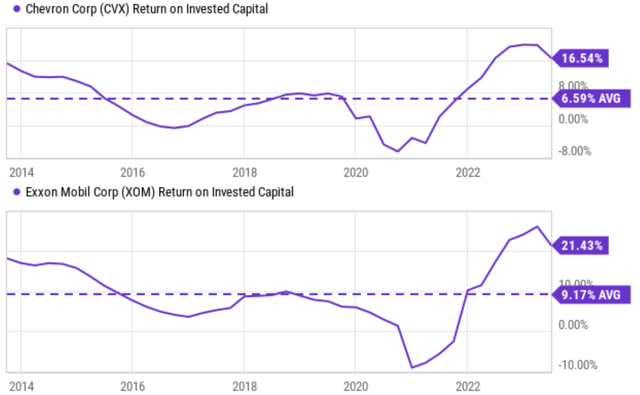

Second, the P/E seems low in its absolute numerical value but is not attractive by horizontal comparison against its peers. The next chart shows a comparison of its P/E against close peers like XOM, PSX, SU, et al. As seen, its P/E (10.3x on a TTM basis and 12.5x on an FWD basis) is on par with XOM, offering no discount. Also note that despite the almost identical P/E, CVX’s ROIC is noticeably lower than XOM, as seen in the next chart below, both currently and also in terms of long-term averages. When compared to other peers like PSX and SU, its P/E is at a sizable premium as large as 40% to 70% (12.5x FWD P/E vs. 7.3x ~ 8.7x).

Other risks and final thoughts

So far, I have focused on the catalysts in the downward direction. And to recap, the concerns I have are: A) profitability has already peaked; B) supply-demand has been renormalized; and C) valuation offers no meaningful margin of safety.

Since this is a hold thesis, there are also some strong catalysts in the upward direction. First, CVX has completed the acquisition of PDC Energy, a domestic oil and natural gas producer. The acquisition immediately adds more than one billion barrels of oil in proved reserves to Chevron’s portfolio and is anticipated to add $1 billion to annual free cash flow shortly. Such additional reserves and cash flow would be a strong immediate catalyst. In the meantime, the company keeps pursuing initiatives to expand its footprint in the lower-emission space. These efforts should also pay off in the mid to long term. A notable example involves its commercial collaboration with Bunge. The collaboration aims to address demand from the domestic renewable fuels market, which is projected to enjoy healthy growth ahead.

To conclude, I see a tug-of-war between the two positive and negative catalysts in the next 2~3 years. I do not see one side has an obvious edge over the other. As such, even though CVX is still a good investment for the long haul, I see limited return potential in the near future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.