Summary:

- Chevron has nearly doubled since I first laid out my investment thesis, all the while negative sentiment remained high.

- Exceptionally strong business fundamentals provide the management with the necessary tools to improve its existing competitive advantages.

- Short-term volatility is to be expected, however, remaining focused on the long-term competitiveness of the business is more important.

CHUNYIP WONG

Flashback to early 2021: Share prices of high-growth and technology companies are making new highs. Excitement is running high and investors are piling into the hottest areas of the market, without thinking too much about business models, profitability, competitive advantages and return on invested capital.

At that time, Chevron (NYSE:CVX) and many other well-run businesses were in no-go territory for most retail investors as narrative driven investment philosophies were not made to conceive an investment thesis outside of the latest and hottest stocks.

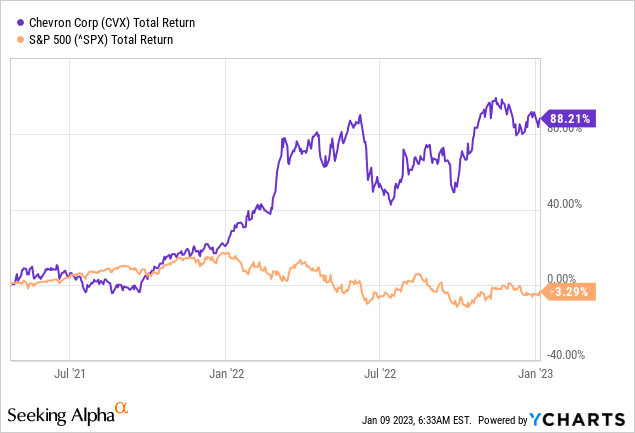

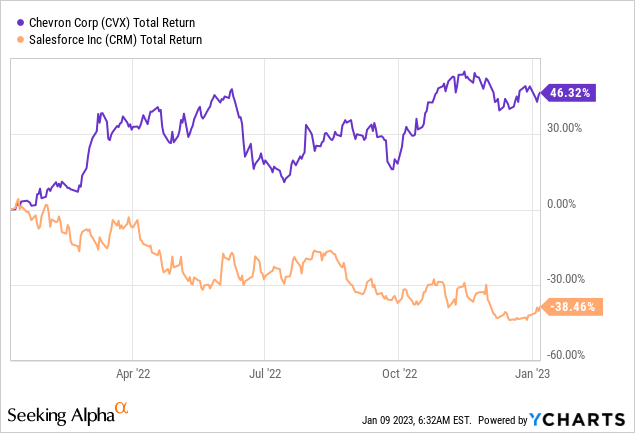

Contrary to the popular opinion, I took a long position in Chevron and explained why the company is well-positioned to perform, in spite of the ongoing industry headwinds. Although it didn’t get the attention that a thought piece on Tesla (TSLA) would have gotten back then, Chevron delivered 88% total return since April 2021, while the broader market fell by more than 3%.

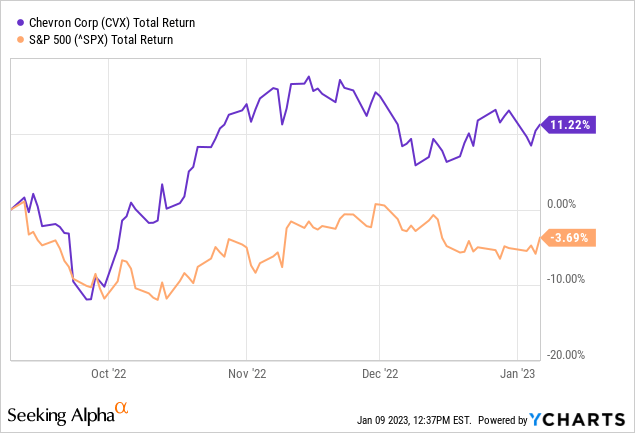

Back in September of last year, I also took a deep dive at Chevron for my subscribers of The Roundabout Investor, where I outlined a detailed thesis on why the company was attractive even as it traded at all-time highs.

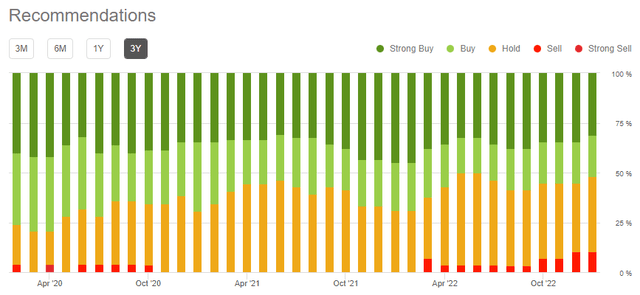

Interestingly enough, analysts’ sentiment has not changed materially in the past few years. As a matter of fact, if we aggregate all the recommendations given by Wall Street Analysts, the sentiment has actually gotten worse.

Chevron (Seeking Alpha)

The negative narrative around Chevron has shifted from a business that is heading to extinction to one that will be challenged as recession hits and demand for its products falter.

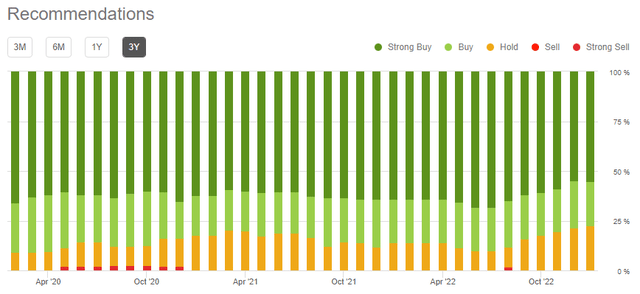

At the same time, the sentiment around businesses that have seen their share prices plunge and are now facing problems is still near an all-time high. Take for example Salesforce (CRM), a stock which I have been warning about since December of 2020 when it was trading near all-time highs.

Salesforce (Seeking Alpha)

And while sentiment around these two companies has been vastly different, Chevron delivered nearly 50% return over the past year alone, while Salesforce fell by almost 40%.

Of course, as one share price is falling it certainly becomes less risky and vice versa, however, the entrenched sentiment of analysts and retail investors alike have been their worst enemy in 2022 and I don’t see a reason for this to change in 2023 either.

Firing On All Cylinders

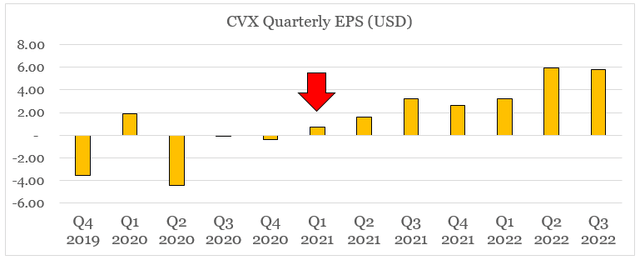

While fears of a deeper than currently expected recession are well-grounded, Chevron continues to generate record high earnings on the back of its strong business model and management team that remained focused on achieving sustainable and high return on capital, as opposed to managing the business on a quarter-by-quarter basis.

prepared by the author, using data from Seeking Alpha

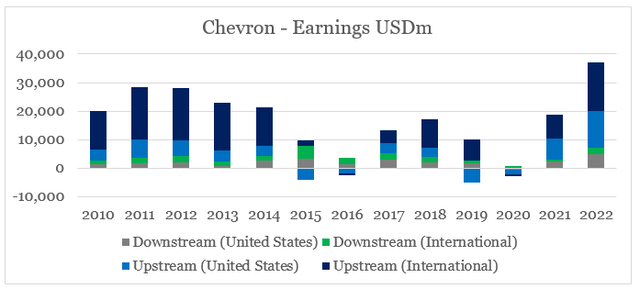

On an annual basis, Chevron’s major business units are firing on all cylinders with the upstream segment being by far the biggest contributor to the company’s record high earnings.

prepared by the author, using data from Seeking Alpha

Strong Positioning To Deliver In The Long Run

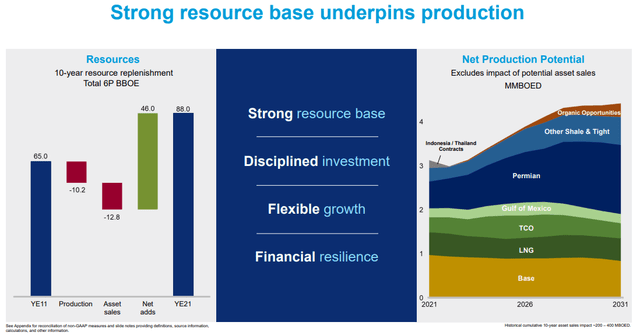

After a decade of record high capital expenditure, in spite of all the industry headwinds, and efforts to improve efficiency, Chevron is now among the best-positioned global energy companies to grow production and invest in new technologies.

We’re more capital and cost efficient than we’ve ever been.

Source: Q3 2022 Earnings Transcript

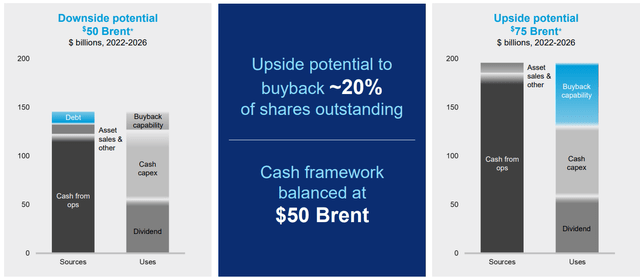

Chevron Investor Presentation

On a cash flow basis, the company is well-equipped to face more industry headwinds, while not compromising dividend payments and planned capital expenditures.

Chevron Investor Presentation

Priorities of the management also remain unchanged with dividend payments and investments to secure long-term competitive advantages of traditional and new businesses being by far the most important ones over the coming years.

I’ll just point out that we increased our dividend 6% earlier this year. We’ve been growing our dividend at a compounded annual growth rate of 6% for 15 years. And that is our first financial priority. So there’s a lot of tension on the buyback, but it’s clearly our fourth priority after sustaining and growing the dividend, investing to grow both traditional and new energy businesses, maintaining a strong balance sheet. And as Mike said, we intend to do it across the cycle for multiple years.

Source: Q3 2022 Earnings Transcript

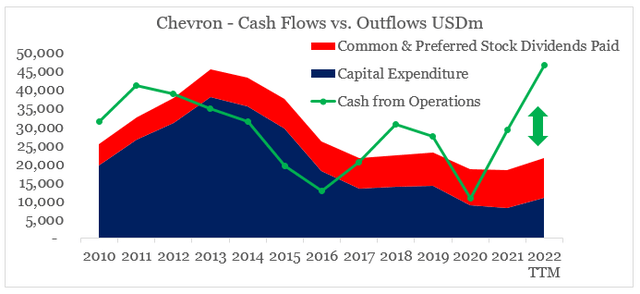

And while cyclical swings are to be expected in the Oil & Gas sector, Chevron’s high cash flow allows for a major ramp-up in capex and consistent growth in dividends over the coming years.

prepared by the author, using data from Seeking Alpha

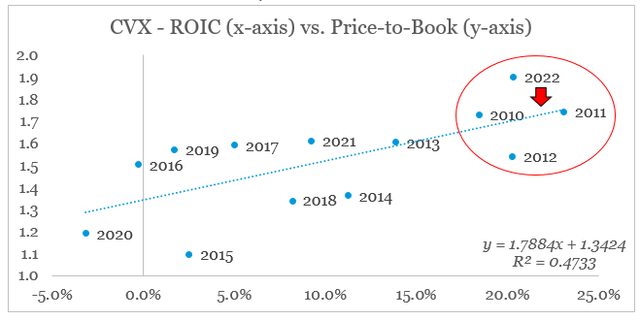

In terms of valuation multiples, Chevron’s share price now trades at record high premium to its book value which makes investors worried of a pullback in the short-run. If we compare the P/B ratio to the company’s Return on Invested Capital, we should also note that a short-term repricing is possible.

prepared by the author, using data from Seeking Alpha

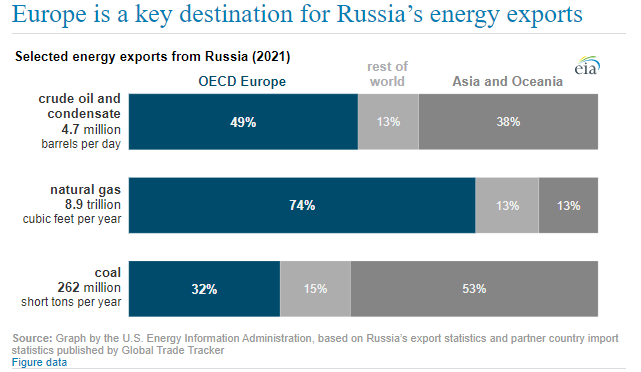

And while this is enough to scale most short-term speculators, they once again are missing the forest for the trees. In spite of all the near term volatility, Chevron is once again achieving record-high return on capital and would play a major role in a world where energy security and sustainability would be paramount.

U.S. Energy Information Administration

Conclusion

After a year of exceptionally high returns, Chevron could face near-term volatility, but there are strong reasons why long-term investors should not fall victim to narratives and market speculations. First and foremost, recent downturns in the Oil & Gas space have allowed Chevron to significantly improve its efficiency and focus on high return on capital projects. It has also become a major pillar in guaranteeing energy security of the United States and its partners internationally. While returns in 2023 are unlikely to be as high as they were back in 2021 and 2022, I expect the company to continue to outperform the market.

Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.