Summary:

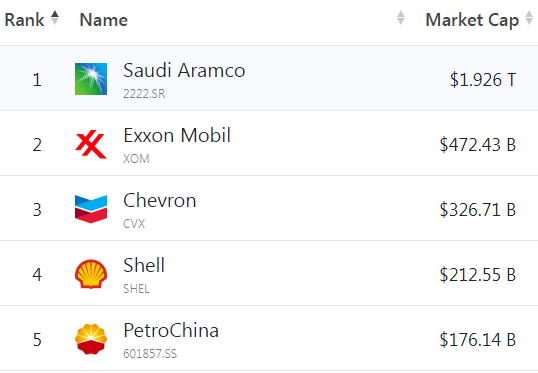

- Chevron is the 3rd largest oil company by market value in the world behind only Saudi Aramco and Exxon.

- Chevron’s stock performance over the last year has been anemic.

- Chevron has a $75 billion share buyback in place.

- Over the last 5 years, Chevron’s share price has generally followed the price of oil.

- Stock analysts and quants are pretty much neutral on Chevron.

JHVEPhoto

Overview

Chevron Corporation (NYSE:CVX) has a Total Return (including dividends) of only 4% in the last 12 months. That compares to a negative -4% for the S&P 500 (SPY). The question for investors at this point in time is if this is a reasonable investment return or whether investors should be on the lookout for better performance going forward.

Chevron is the 3rd largest oil company by MV (Market Value) behind only Saudi Aramco (ARMCO) and Exxon (XOM).

companiesmarketcap.com

I have held Exxon and Suncor (SU) in my Turnaround Stock Advisory portfolio since 2020, but have never held Chevron. I explained why I chose Exxon over Chevron last year in this article “Exxon Vs. Chevron: Which Is The Best Investment Choice After Q1 Results?“

In this article, we will look at Chevron’s prospects for the next year to try and determine the price direction out to 2024 as compared to the last year.

CVX Stock Key Metrics

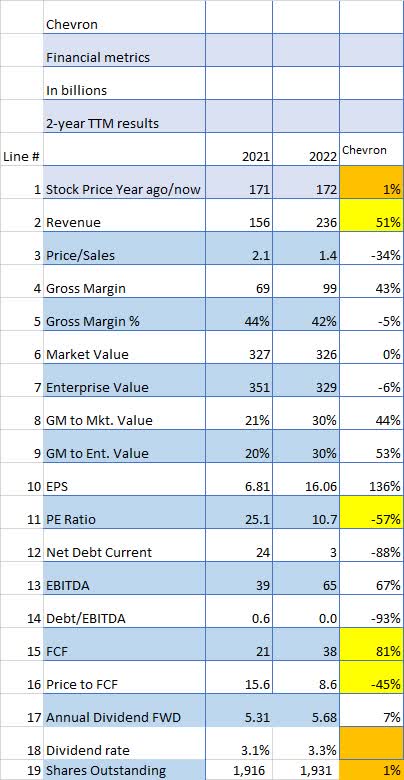

Let’s look at Chevron’s financial metrics comparing the latest TTM (Trailing Twelve Months) with the previous year. In Chevron’s case, the TTM coincides with the 2021 and 2022 fiscal years ending December 31.

We can make a reasonable comparison of today’s value versus last year’s value. Once we have made that comparison, we will make an attempt to see how the coming year may play out.

Seeking Alpha and author

One quick look at the financial metrics table above comparing 2021 to 2022 shows enormous improvement in results for Chevron over that time period.

I have highlighted in yellow the items I consider the most positive compared to the other items. The orange items are those that are questionable from an investment standpoint.

Chevron’s price (Line 1) has increased by only 1% over the last 12 months despite an increase in Revenue (Line 2) of 51%. Gross Margin (Line 4) is also up significantly but at a lower percentage (43%) than Revenue. This would imply operational efficiencies were somewhat muted over that 1 year time period.

However, the PE Ratio (line 11) is much lower at about 10x compared to 25x a year ago.

And finally, FCF (Line 15) surged 81% in 2022 over 2021 lowering the Price to FCF from 15.6x to 8.6x.

With all of their 2022 financial success, an investor could question the rather meager dividend rate of 3.3% (Line 18).

And in spite of Chevron’s $75 billion buyback commitment, the share count actually went up in 2022 compared to 2021 (Line 19).

At the current market value of $326 billion (Line 6), the $75 billion buyback would lower the share count by about 23%, a significant amount for investor consideration. The only question is over what time period would those purchases be made?

How Did Chevron’s Share Price compare to oil prices?

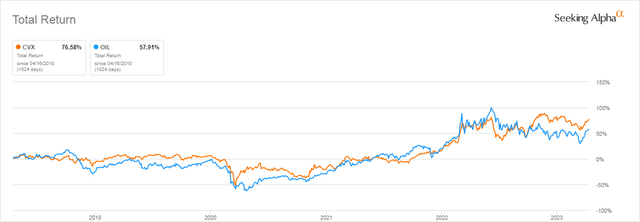

A good way to visualize Chevron’s price performance is to compare it to oil prices over the same period of time.

The chart below shows that despite a steady, consistent drop in oil prices over the last year, Chevron’s share price outperformed oil prices.

Over longer time periods, Chevron’s price pretty much matched the volatility of oil prices as the following 5-year chart shows.

So from an investment standpoint, oil prices have historically been the dominant determinant of Chevron’s price.

What Do Analysts Think?

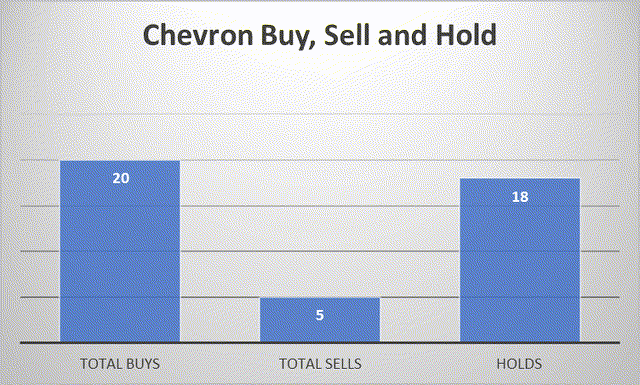

Wall Street and Seeking Alpha analysts are very positive on Chevron with 20 Buys versus only 5 Sells. However, Holds are at 18 almost as high as Buys.

Quants were more positive about Chevron last summer and fall with a Buy rating over most of that time period. However, since December 2022, quants have had a consistent Hold on Chevron.

Quants seem less enthused about buying Chevron than analysts do.

How Does Chevron Compare To Other Oil-related Stocks?

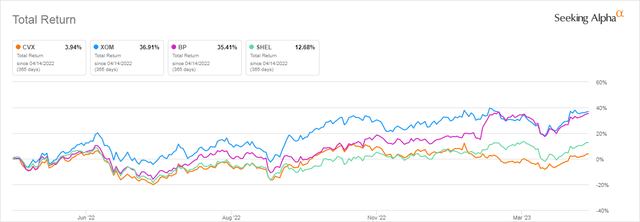

A legitimate question when looking at any stock is to compare its potential with other stocks in the same market sector. If we look at Chevron’s performance over the last year and compare it to other large market value stocks in the oil sector over the last year, (Exxon, Shell, BP) we can see Chevron has performed poorly compared to the other three with a total return (including dividends) only at 3.9%, little more than its dividend rate of 3.3%.

Another good comparison is with the Energy Select Sector SPDR ETF (XLE) which includes all the oil majors in one ETF.

It is easy to see once again that Chevron has not performed as well as the oil sector in general has performed over the last 12 months.

Is CVX Stock A Buy, Sell, or Hold?

Obviously, there are risks with a Chevron investment. For example, if the oil price falls to $50 a barrel, Chevron will still generate huge amounts of cash flow but will certainly not be able to maintain its current share price even with the buybacks. The other big risk for oil companies is regulatory.

But based upon all the information above, it is easy to see that Chevron has not performed as well as an investment as its major competitors have.

Considering the poor performance relative to competitors and the large number of Holds from analysts and quants I rate Chevron a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.