Summary:

- Exxon has been performing well compared to Chevron.

- The latter has better yield and dividend growth.

- One of these two stocks is way overvalued, however.

peshkov

Written by Sam Kovacs

Introduction

Since OPEC+ surprised the markets with a production cut, WTI crude has been comfortably trading at above $80.

While this is a cause of a lot of concern for the US as it will add stickiness to inflation, and increase the likelihood of a recession, one thing is clear:

OPEC+ and Russia will not even consider the US’ demands to increase production.

As such, despite a rocky start for oil stocks in 2023, lately they’ve been performing well, which has sparked many to ask if Chevron (NYSE:CVX) or Exxon (NYSE:XOM) is the better dividend stock to maintain exposure to a sector which is flush with profits.

In this article I will be considering both investors through the eyes of a dividend investor, and the conclusion might not be what you expected.

Recent developments

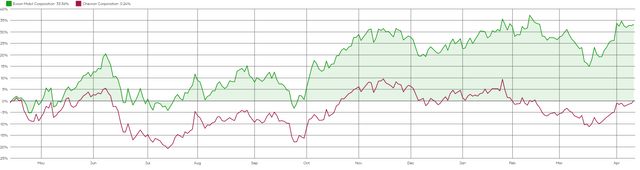

Exxon has performed a lot better than Chevron during the past 12 months, the former is up 33%, while the latter is flat.

XOM vs CVX (Dividend Freedom Tribe)

During the past 3 months, XOM is up 1.78%, while CVX is down 4%.

During the past 6 months, XOM is up 17%, while CVX is up 7.7%.

Based on these 3 return periods, XOM has a momentum score of 94 while CVX has a momentum score of 70.

Our momentum score is a simple factor combining these 3 periods and ranking all US stocks based on them.

In other words, XOM has better momentum than 94% of stocks, while CVX has better momentum than 70% of stocks.

A report from Scotiabank’s Paul Cheng suggested that XOM’s outperformance might be coming to an end as XOM has higher exposure to refined products, which he believes will reach an inflection point in the second half of the year, while CVX has higher leverage over the price of oil which will be favorable given the recent cut.

Both stocks had great years in 2022.

CVX generated record free cash flow of $37bn, generated a ROCE of 20%, and paid down debt in every quarter.

XOM did somewhat better generating a ROCE of 25%.

But as dividend investors, this is not all that matters.

Our dividend philosophy

Our take, is that as a dividend investor you are investing in stocks which will generate the best income somewhere down the lane.

If you’re retiring in 10 years, you might be maximizing income for in 10 years, whereas if you’re already retired, you might be looking to get sufficient income to cover your expenses, and enough growth to fend off pesky inflation.

For every stock we give our best guess on what dividend growth might be for the next few years.

I say our best guess, because it is even more complicated to predict dividend growth than earnings growth. Why? Because humans interfere. The board of directors will vote for yearly increases and they will do it not only based on the company’s ability, but also their perception of how the market will react to the increase.

This past year, we saw many dividend stocks grow their dividend below trend, especially when the stock price was down, as management didn’t believe generous increases would make any dent in market perception of the stocks.

So we guess based on: payout ratios, past dividend growth rates (it is highly unlikely that a stock which has grown at 2% for the past decade will switch to double digit dividend growth. Conversely a high growing dividend stock shows that if possible management will try and maintain aggressive growth), and finally future outlook.

We will then attempt to buy stocks at prices where the yields are high enough to entice us given our growth estimate. You’ll see how we do this in the article.

Finally if a stock gets extremely overvalued, we’ll sell it and buy another undervalued stock.

Doing this increases our income. How? If you buy a stock which yields 4%, and it doubles, it now yields 2%. Bar any taxes, you can sell it, buy another 4% yielding stock, and you’ll double your income.

Bargain! Of course we’re not looking to double our income on every transaction, only to maximize the dividend potential of our portfolio. This means we might sell a 2% stock and replace it with another 2% stock if we think the latter is better value and will grow its dividend at a higher rate.

Dividend profiles: XOM vs CVX

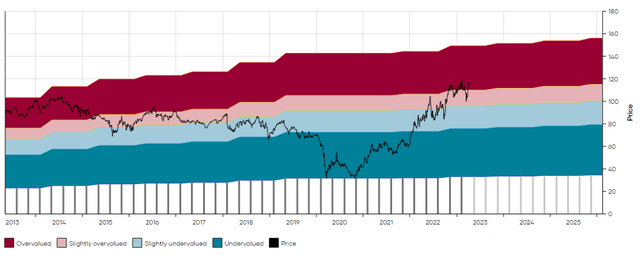

Exxon currently trades at $116 and yields 3.14%. This is below the 10 year median dividend yield of 3.74%, which is marked by the limit between the pink and the light blue areas on the DFT Chart (previously called MAD Charts) below.

XOM DFT Chart (Dividend Freedom Tribe)

In fact, as you can see, the stock price is in the red area, which suggests it yields less than it did 75% of the time during the past decade. That 75% line between pink and red represents a 3.3% dividend yield.

During the past 10 years, XOM has increased its dividend at a 4.8% CAGR, but that has decreased to 3.4% during the past 5 years. This past year, XOM increased by exactly 3.4%.

The earnings payout ratio is currently very low at 27%.

It is quite reasonable to say that XOM could generate 4% dividend growth going forward.

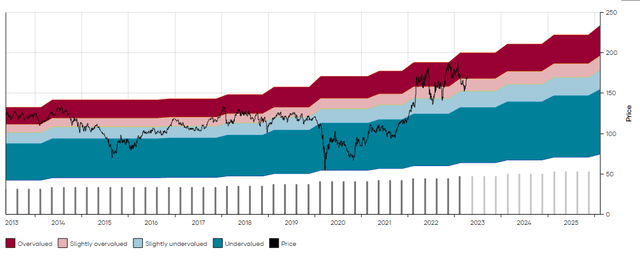

Chevron currently trades at $169 and yields 3.57%, which is also below its 10 year median of 3.96%. It also trades at a yield which is lower than 75% of the time in the past decade.

CVX DFT Chart (Dividend Fredom Tribe)

They are currently paying out 31% of earnings.

During the past decade they have grown the dividend at a 5.3% CAGR, quite close to XOM’s, just marginally higher.

But unlike XOM the dividend CAGR has increased in the past 5 years to 6.2%. This year’s increase came in at 6.3%, nearly double XOM’s increase.

It is conservative to say that this trend of 5-6% will continue, we will use 5% growth as our baseline.

Note that the payout ratios are low due to the extremely high prices of oil in the past year.

While we believe that Oil will likely stay high for quite a while, we also know that over time this can quickly revert, as we brutally experienced in 2020.

For that reason, we do not believe that these companies will go bonkers on their dividend increase, and instead prefer to pay down debt and buy back shares (which reduces the payout ratio).

Dividend growth in line with the past trend seems to be the way.

Now how do we use the combination of dividend yield and growth to compare XOM and CVX on an apples to apples basis, given the 0.37% differential in yield? (Which might seem inconsequential but does equate to an extra $3700 yearly on a million dollar portfolio.)

The answer is, we run a simulation.

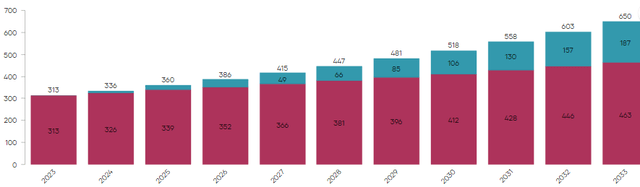

We project these stocks dividends on a $10K investment, assuming dividend reinvestment for 10 years.

If you’re not reinvesting dividends, because you’re already retired, you can follow on with the red bars on the charts below which exclude the extra dividends from reinvested dividends.

For XOM, if we invest $10K at the current price, and reinvest dividends every year assuming 4% dividend growth, and assuming a constant yield of 3.14%, then in year 10, you could expect $650 in yearly dividends, of which $187 would come from the reinvested dividends.

XOM Dividend Projection (Dividend Freedom Tribe)

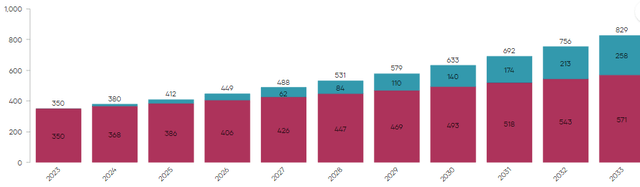

On the other hand, if you invest $10K in CVX at the current price, and reinvest dividends every year assuming 5% growth and a constant dividend yield of 3.5%, then in year 10, you could expect dividend income of $829, of which $258 would come from dividends reinvested.

CVX Dividend Projection (Dividend Freedom Tribe)

So it is clear that CVX has a better overall dividend profile.

But does that mean CVX is particularly attractive?

We’d say no.

We have a minimum threshold of 8% of original amount invested in year 10 to be considered a “good” income opportunity, and a 10% in year 10 is considered a “great” income opportunity.

So XOM would not pass the filter for “good” while CVX barely passes it.

However, given that the current price of CVX is one which is much higher relative to its dividend than it is in the past, we estimate that there is elevated risk for your capital in buying now.

We try and avoid as much as possible to have our capital tied up in stocks which go down (I stress the as much as possible bit, as stocks will invariably go up and down), as this makes us inflexible in selling positions to rotate into better opportunities.

This is not to say both stocks could not go up more. In a past article, we addressed that:

Could Exxon go up more? Sure. If it returned to its market highs relative to its dividend it could go all the way up to $150. But there is no margin of safety embedded to the current price, which means that you’re investing with unnecessary risks.

As such, at the Dividend Freedom Tribe, we currently have CVX marked as a “hold” and XOM marked as a “sell“.

Conclusion

Energy stocks have had a good run, but I do not think it is over. The conditions are good, the stocks are making a lot of money. Valuations have adjusted to reflect this in XOM and CVX over the past couple of years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We just told our members about the best Oil & Gas dividend stock…

The first thing you want to do is hit the orange "follow" button, so we can let you know when we write more dividend related articles.

If you want to get our top Oil & Gas pick join the Dividend Freedom Tribe! FREE for 2 weeks.

Our model portfolios are ahead of the market, and our community of nearly 900 members is always discussing latest developments in dividend stocks.

Our model portfolios are ahead of the market, and our community of nearly 900 members is always discussing latest developments in dividend stocks.