Summary:

- Nvidia Corporation’s strong earnings report and guidance were overshadowed by concerns about the “China impact.”

- But China doesn’t make up a large portion of data centers or hyperscaler capacity, allowing the rest of the world to easily fill any void from China.

- Capacity initially planned for the 800-series AI accelerators can be moved to its flagship chips and sold into the supply constraint environment.

- Nvidia’s bull thesis remains intact while remaining less expensive than AMD, with better growth and higher gross margins.

blackdovfx

I always find it suspicious when a company is on a complete tear and some piece of the narrative is pulled out and held up well above the rest of the fundamental equation. This happened with NVIDIA Corporation (NASDAQ:NVDA) following its Q3 earnings report a few weeks ago. The company continued to blow away estimates both for the reporting quarter and with its guide, yet those in the financial media held up the “China impact” as some massively bearish talking point. When one looks at the general data center landscape and large demand profile, Nvidia’s bull thesis lives on with or without China. In the end, not only is the “China problem” not a problem, but Nvidia is the less expensive investment in the artificial intelligence (“AI”) space.

I’ll briefly recap the quarter and the guide, discuss what the export restrictions mean from a product standpoint, and move into the level of impact from China, or lack thereof.

Evaluating The China Impact

Based on the company’s performance over the last few quarters, there’s an undeniable inflection happening in the AI space. Nvidia’s growth over the last year has been extraordinary, especially for a company as large as it is. In FQ3, revenue grew over 205% year-over-year and 34% quarter-over-quarter. This isn’t some small, high-growth company; we’re talking about revenue going from $5.93B to $18.12B over 12 months. You can’t ignore this, even if you don’t believe in AI or Nvidia’s potential. And to top it off, guidance for FQ4 continues to push quarter-over-quarter growth while year-over-year revenue growth is expected to come in at 230%.

Now, you likely know all of this, and I’m boring you. But even without looking at the China factor, growth is still barreling ahead. I find reviewing the basics can reinforce what may be obvious but forgotten when a narrative takes a wrong path.

But before I get into the China aspect directly, I want to review where most data centers are and where the capacity resides. It provides a better high-level picture of what the world is looking at in terms of data center installs and the AI transformation within it.

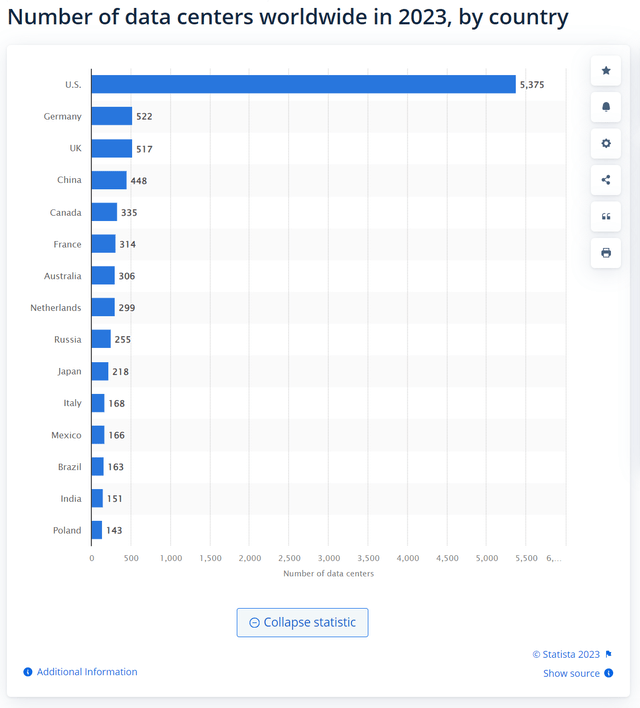

Unsurprisingly, the U.S. leads all nations in the number of data centers with no competition – it’s not even close. The U.S. accounts for 57% of all data centers worldwide. Germany has the next highest, accounting for 5.5% of all data centers. China is fourth and accounts for 4.8%.

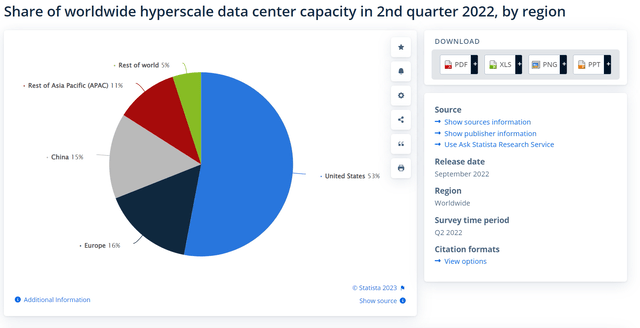

Regarding hyperscaler capacity, as of a year ago, the U.S. accounted for 53%. Europe was second at 16%, while China comprised 15% of capacity.

Why do I bring this up? Because the massive opportunity for data centers lies primarily outside of China. The U.S., far and away, is the most significant opportunity for AI accelerators anywhere in the world.

Now, you could argue China’s intentions with AI accelerators are not for data centers or hyperscaler capacity, and I wouldn’t have a good counterargument. There’s likely a piece of this where China buys AI accelerators for military or non-business use but fronts its intentions elsewhere. However, this isn’t a calculable argument, and estimating this would be nearly impossible. Therefore, I must rely on most of these being bought by hyperscalers and data centers. Even if it’s a front for military use, the invoice is legit and the numbers for China’s data center capacity are what they are.

The “New” Export Regulations

Moving on to the latest export regulations from the U.S. government, we get to the matter at hand.

The brief background is the export regulations now restrict even the A800 and H800, which were designed to comply with the first set of regulations. A license is now required to ship these and other products to several countries, notably China. The impact is significant enough for management to call it out and be asked about it later on its recent earnings call (emphasis added):

Our sales to China and other affected destinations derived from products that are now subject to licensing requirements have consistently contributed approximately 20% to 25% of Data Center revenue over the past few quarters. We expect that our sales to these destinations will decline significantly in the fourth quarter.

– Colette Kress, CFO, Nvidia’s FQ3 ’24 Earnings Call.

But here’s what isn’t apparent and what isn’t going to show up in region estimates. Countries on this restricted list, like China, still pull on the demand profile. While it may not appear on Nvidia’s list as sold to China, the bigger picture shows China still receives banned AI products. The black market is rife with these cards, and A100 and H100s are still making their way in. The volumes aren’t the same as if Tencent (OTCPK:TCEHY) was buying cards in bulk through normal channels, but chips delivered to neighboring countries are still making their way in. It fills the demand plane even if not directly sold to China or Chinese firms.

The other aspect is the demand picture is so vast and so deep that other regions outside of the restricted list are filling the void for what isn’t getting there. While this situation may have impacted short-term order fulfillment, the constrained supply will be absorbed by those waiting in line for their orders.

Nonetheless, there is an impact since some of these products are “China-specific” with products like the 800 series. Other customers around the world don’t want those products since they were already in line for the full-performance H100 product. This means the 800-series chips are repurposed for other products or written off. We’ll see what the inventory situation is for these after this current quarter, but logically these were not high volume relative to the flagship chips.

Doesn’t Slow Down The Demand Big Picture

There might be a short-term hit due to the export regulations, but I don’t see it as the entire 20-25% of revenue, nor do I see whatever the actual number is as not being offset by other regions clamoring for their orders.

Management was directly asked this question during Q&A (emphasis added):

But with the absence of China for our outlook for Q4, sure, there could have been some things that we are not supply-constrained that we could have sold, but kind of we would no longer can. So could our guidance had been a little higher in our Q4? Yes.

– Colette Kress, CFO, Nvidia’s FQ3 ’24 Earnings Call Q&A

Again, the demand is so tight it can redirect to other regions and customers. I estimate FQ4’s China impact on guidance was roughly $0.5B-$1.0B. So, instead of the $20B guide, it could have been up to $21B. However, beyond the short-term, this is quibbling over rounding errors.

But here’s why the China story is overblown and doesn’t throw off Nvidia’s next several quarters. Even with a China impact on a potentially notable level, the counter story is far more impactful.

Demand for our Data Center platform where AI is tremendous and broad-based across industries on customers. Our demand visibility extends into next year. Our supply over the next several quarters will continue to ramp as we lower cycle times and work with our supply partners to add capacity.

– Colette Kress, CFO, Nvidia’s FQ2 ’24 Earnings Call (emphasis added).

Absolutely believe the Data Center can grow through 2025. And there are, of course, several reasons for that. We are expanding our supply quite significantly.

[…]

…we’re at the beginning of a basically across-the-board industrial transition to generative AI to accelerated computing. This is going to affect every company, every industry, every country.

– Jensen Huang, CEO, Nvidia’s FQ3 ’24 Earnings Call (emphasis added).

That’s better translated as we have an order book extending to the end of calendar 2024. Countries – actual governments – are looking at internal AI build-outs and configurations for their own use.

Many countries are awakening to the need to invest in sovereign AI infrastructure to support economic growth and industrial innovation…[W]e are working with India’s government…to boost their sovereign AI infrastructure…And French private cloud provider, Scaleway, is building a regional AI cloud based on NVIDIA H100 InfiniBand and NVIDIA’s AI Enterprise software to fuel advancement across France and Europe.

– Colette Kress, CFO, Nvidia’s FQ3 ’24 Earnings Call (emphasis added).

So, clearly, demand is not an issue, and the China vacuum, however big or small it is, will be closed by the continually expanding use cases cropping up each month. There might be a short-term hit due to the specific chips for China not being desired elsewhere, but I don’t see it as the entire 20-25% of revenue, nor do I see whatever the actual number is as not being offset by other customers clamoring for supply.

The other end of this picture is the 800-series chips are no longer compliant; therefore, Nvidia can shift the supply of 800-series chips to H100 chips, making up for the revenue lost by them. This, of course, assumes Nvidia won’t have a new China-compliant product. But even if it does, it should take a back seat, as a new product would take a few months to release, and capacity added later can make room for it. For now, capacity for its flagship leading product takes priority, hence the expectation for offsetting the impact.

More Noise, More Unsubstantiated Narrative

So two questions are left: is there an impact from the export restrictions? Sure, there’s no doubt Nvidia can no longer ship certain products specifically designed for the region from the last export control. But is the impact as significant or as jarring as the narrative? Not even close. The demand picture is far more than China, as Nvidia doesn’t rely on China for the total addressable market, or TAM, and build-out of AI. With massive amounts of demand around the world, this road is far more extensive than China.

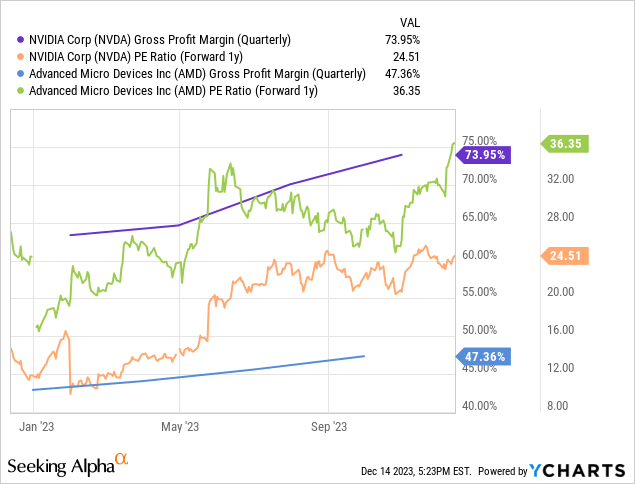

The truth is, Nvidia, due to its growth this year and the expectation its growth will not stop in 2024, is cheaper than peers, chief among them Advanced Micro Devices (AMD). AMD only expects just over $2B in AI accelerator revenue, yet it trades at a significantly higher forward P/E than Nvidia while it has far lower gross margins.

Is Nvidia expensive? Not when compared to its lesser AI competitor. Better GPU chip or not, Nvidia is selling massive amounts of AI accelerators and software with gigantic growth. Meanwhile, AMD isn’t expected to match just one quarter of Nvidia Graphics – that’s the retail channel – revenue with its yearly AI sales.

But Nvidia’s margins are about to plummet with competition (sarcasm)!

AMD is the only competitor, and $2B in 2024 revenue is likely what Nvidia will miss out on due to the China export ban. And, by the way, AMD wasn’t immune to the China ban and its revenue either, signaled by its Chinese division restructuring. Moreover, Nvidia’s margins aren’t about to go to 47% and match AMD’s. Nvidia’s were never that low in recent company history. They were over 56% a year ago, well before the AI accelerator demand picked up while the company’s revenue growth was negative.

All this to say, even if Nvidia’s restriction to sell to China is meaningful – which it isn’t – its valuation is already quite lower than its only other viable AI chip peer. With a much bigger runway and a higher sales magnitude, Nvidia has remained a very reward-sided investment.

China or not, Nvidia Corporation has more growth and AI sales to come.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name and then sign up to be a free member of my investing group Tech Cache. You’ll get more free content from me, no paywall, and no credit card. If you want the trading strategy and technical chart analysis of the article you just read, step up to being a paid subscriber with a two-week free trial and read it immediately.