Summary:

- I believe Nike’s long-term high-single-digit sales growth target is at risk due to boycotts in China and rising local competition from brands like Anta and Li Ning.

- Greater China represents around 17% of Nike’s sales and over 20% of profits, but sales growth has slowed since the Xinjiang cotton boycott began in March 2021.

- I recommend investors avoid or sell Nike stock as the risk of lowering their long-term growth target is imminent.

Robert Way

Investment Summary

Nike (NYSE:NKE) may not be able to meet its long-term high-single-digit sales growth target due to structural headwinds in its Greater China businesses, including Western brand boycotts and rising local competition. There is a risk of lowering the long-term sales target, which is why we encourage investors to avoid/sell this stock.

Downside Thesis

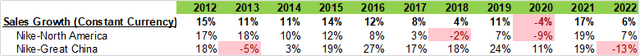

Nike’s sales have been growing at a high-single-digit to low double-digit rate annually, excluding foreign exchange, since FY11. This consistent organic growth has made Nike a favorite among growth investors. The company has also set a long-term target of high-single-digit sales growth during their capital market day.

In terms of competition, adidas (OTCQX:ADDYY) is focusing on lower price points and athleisure, while Puma is making strides in the basketball category. However, neither of these brands can truly compete with Nike in the sports goods industry.

One of the key factors for Nike’s long-term growth is its China business, which represents approximately 17% of sales and over 20% of profits. Nike’s management team has expected their Chinese business to grow at a low-to-mid teens rate.

However, the growth story in China for Nike seems to have come to an end, and achieving the long-term growth target on a group level appears unlikely. This is due to two main reasons:

1) Boycott in China

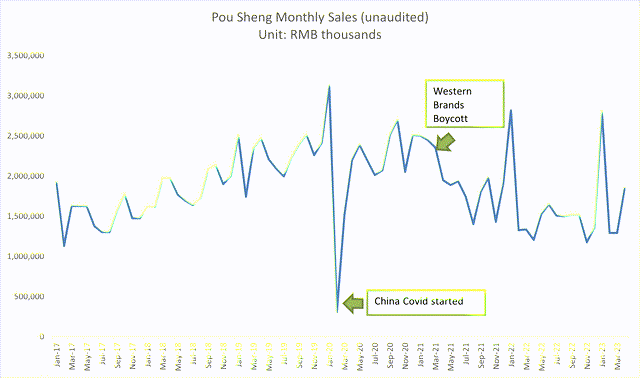

Since March 2021, Nike and other big Western apparel brands have been facing a boycott in China due to their stance against the alleged use of forced labor in Xinjiang. To assess the impact of the boycott, we analyze Pou Sheng International’s (OTC:PSHGF) monthly sales. Pou Sheng is a major wholesaler for Nike in China, with 75% of its sales consisting of Nike/Adidas products. Prior to the boycott and the COVID-19 outbreak, Pou Sheng experienced high sales growth. However, since the boycott, their sales growth has slowed down.

Pou Sheng’s investor relation website

Before the Covid breakout and Western brands boycott, Pou Sheng grew their sales at a very high pace. Since the boycott, their sales growth has been slowing down.

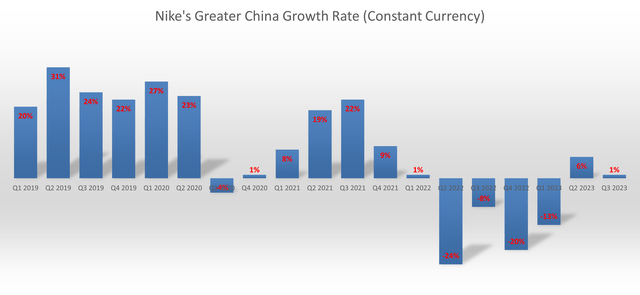

This weakness in their wholesaler’s performance has already been reflected in Nike’s own financials, as their Greater China sales growth has been weak during this period.

2) Emerging Brands in China

Nike faces strong local competition in China like Anta (OTCPK:ANPDY) and Li Ning (OTCPK:LNNGF). These brands are heavily investing in sales and marketing while launching premium and quality products. Li Ning, for instance, offers sneakers priced at over $200.

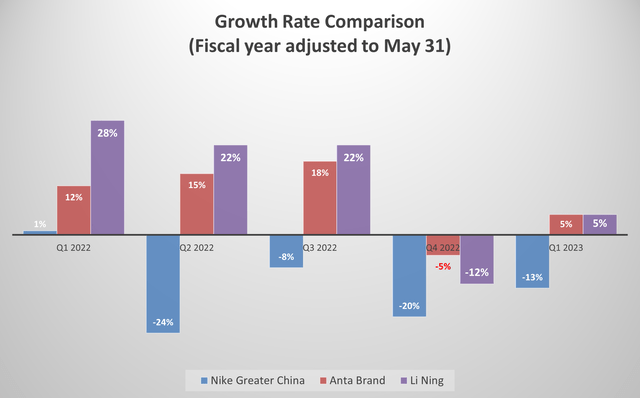

Both Anta and Li Ning have achieved sales growth rates of 15% or more in China. With the introduction of more premium products, they are likely to gain market share in the Chinese premium market, at the expense of Nike and Adidas. A comparison of sales growth rates clearly shows Nike losing the competition in China.

The chart below is the quarterly sales growth rate comparison. To have an apple-to-apple comparison, we adjusted Anta and Li Ning’s fiscal year end at the same as Nike’s: May 31. It appears Nike is losing to the competition in China.

Nike, Anta, Li Ning quarterly earnings

Recent Financial Results

In Q3 FY23, Nike’s Greater China inventory declined by 4% compared to the previous year. Revenue in Greater China grew by 1% on a currency-neutral basis but declined by 8% on a reported basis. Nike’s management team attributed this weakness to the widespread closure of retail doors caused by COVID-19.

During the earnings call, some analysts questioned Nike’s competitive landscape in China, particularly concerning local brands. However, Nike’s management team remained confident that China would continue to be a growth driver in the long run and attributed the weakness solely to COVID-19 and retail store closures.

Other Regions Growth

To better assess Nike’s long-term guidance, we need to analyze Nike’s other regions: North America and EMEA. In FY22, North America and EMEA represented 39% and 26% of Nike’s group sales, respectively.

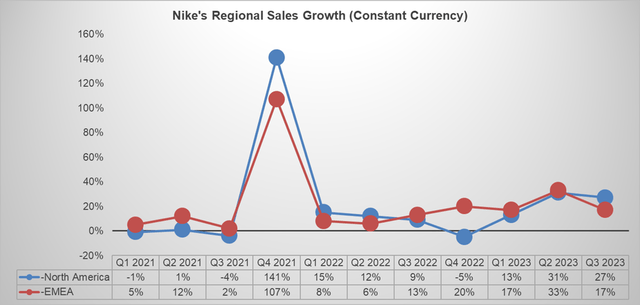

In North America, Nike’s sales were negatively impacted by the pandemic due to retail store closures. From Q1 FY23 to Q3 FY23, Nike experienced solid sales growth year over year due to weak comparisons in FY22. Nevertheless, Nike has a significant issue with excess inventory. Starting from Q1 FY23, Nike began to liquidate their excess inventory, and they expect the inventory clearance to be completed in the next two quarters. Due to the above-normal growth in FY23, I anticipate they will have weak year-over-year growth in FY24.

In EMEA, Nike witnessed strong growth across all Western European markets, including positive trends in the UK. However, considering the high inflation and Adidas’ dominant position in Europe, I assume Europe will experience normal high-single-digit growth going forward.

Valuation

We don’t think Nike can sustain their Greater China growth at low-to-mid teens.

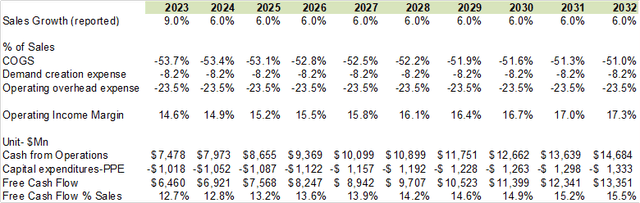

In the model, we assume their Greater China business grows at mid-single-digit instead, and their Europe and North America businesses will grow at around 6%. As such, Nike’s group sales growth rate will be normalized to 6% in our DCF model.

On the margin side, Nike’s Greater China business carries a higher margin than other regions. In FY22, Nike’s Greater China business represented 16% of group sales but contributed 34% of group operating profits. A lower-than-expected sales growth in the Greater China business would cause headwinds for Nike’s group operating margin. In our model, we assume Nike will expand their margin by 30bps each year from the operating leverage.

Other assumptions include a 10% Weighted Average Cost of Capital (WACC), a 4% terminal growth rate, and an effective tax rate of 16%.

DCF Model – Author’s Calculations

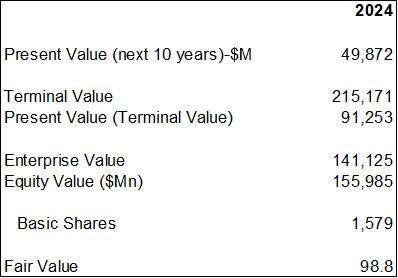

We estimate the present value of the free cash flow to the firm (FCFF) over the next 10 years to be $49.8 billion. The present value of terminal FCFF is $91 billion. As such, the enterprise value for Nike is $141 billion in total. Adjusting the gross debt and cash, the fair value for Nike is estimated to be $98.8.

DCF Model – Author’s Calculations

Conclusion

In conclusion, it is evident that one of Nike’s key growth drivers, China, is no longer as promising, and a revision of their long-term growth target is likely. The risk of lowering the target is imminent, and we advise investors to avoid investing in Nike.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.