Summary:

- Tesla, Inc. Shanghai’s capacity is 1 million units a year.

- A quarter of Shanghai’s output is exported to Europe. European antidumping measures could eliminate those sales.

- Tesla Shanghai will generate little profit at 75% capacity utilization.

- Tesla is refreshing the 3/Y. The Model 3 refresh is out; Chinese review sites pan it as too conservative and not worth the price. It won’t offset the loss of exports.

PhonlamaiPhoto

Introduction

The Core Issue

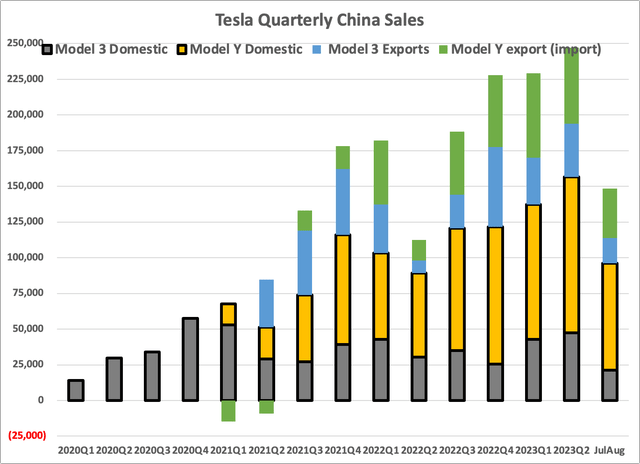

Tesla, Inc. (NASDAQ:TSLA) Shanghai’s capacity is 1 million electric vehicles (“EVs”) a year. The auto industry rule of thumb is that anything below 80% utilization is bad, which for Tesla means keeping output about 67,000 units a month. Selling that many will be challenging.

- Tesla’s domestic sales averaged only 52K a month since the elimination of Covid sanctions, but China’s EV market no longer growing rapidly. Tesla can’t count on market expansion.

- European antidumping sanctions will eliminate 25,000 units of monthly exports from Shanghai.

- The Model 3 refresh isn’t enough. Chinese car review sites pan it as minimal in extent and not worth the higher price. It won’t increase sales.

Tesla faces the dilemma all carmakers face sooner or later: it can discount to maintain sales or it can accept lower market share and face sharply higher costs. Now Tesla starts from a strong position, so this won’t necessarily render China unprofitable. But as Tesla’s single largest production site, problems in Shanghai will hurt the bottom line.

News Flash: Just before I submitted the article Automotive News Europe reported that Tesla, BMW (OTCPK:BMWYY), and Renault (OTCPK:RNSDF) are all part of the Chinese EV export probe. Renault’s Dacia Spring EV with August sales of 5,300 units is imported from China.

Organization

I stick to the sequence above. First, I look at overall auto sales and at EV sales. Second, I estimate Tesla’s exports from Shanghai to Europe. I then summarize the Chinese subsidies Europe will use to support antidumping tariffs, from which Tesla has benefitted alongside the rest of the industry. Third, I look at Tesla’s sales in China, and at whether the Model 3 refresh will materially improve their domestic sales. In the conclusion, I return to the issue of capacity utilization, and factors that might offset it.

1. Chinese Auto & NEV Sales, August 2023

The overall market

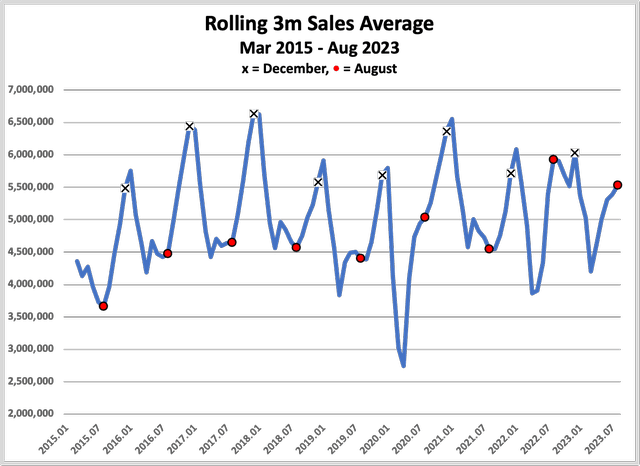

Typically the 4th quarter is the big sales period in China. This year August was up 7% over July; early September sales (Sep 1-17) at +2% (source: CPCA website) are flat relative to August. Most sales are in the last week, so that may change. Will 2023 set a record? Maybe, but not by much.

Author’s database Author’s database

Now, there are lots of issues that I address in my quarterly overviews. One is the maturation of the market, as the diffusion of ownership means the market is shifting away from first-time buyers to replacement demand and the corresponding rise of the used car market. There’s also the geographic component, the saturation of the richest markets (Shanghai, Shenzhen and the other Tier I cities and wealthier Tier II cities such as Hangzhou and Suzhou). Finally, my focus has been light (passenger) vehicles. The commercial vehicle market is very different, declining by 3.3 million units in 2022 (source: Wall Street China). The magnitude of that decline should be sobering for those who look for continuing expansion of the light vehicle market.

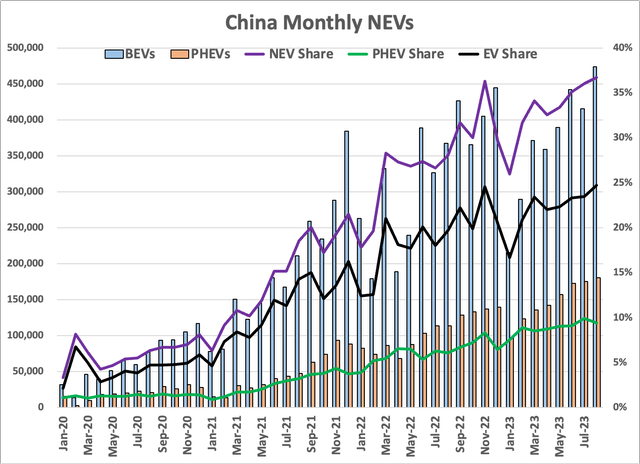

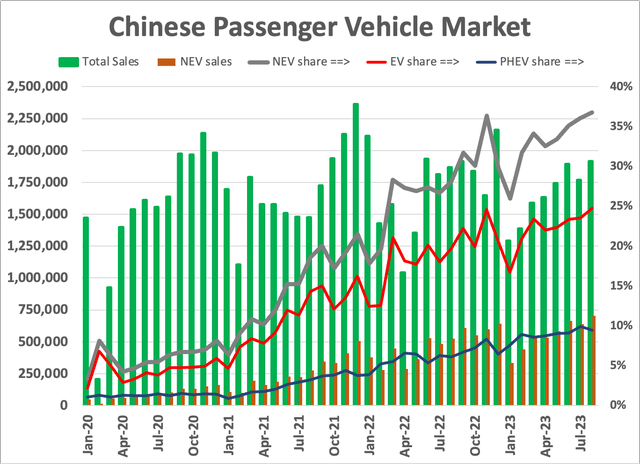

EV / NEV sales

Another issue is whether the market for NEVs (EVs + PHEVs) is expanding. The answer is yes, but slowly. EVs hit 24.8% of the market in August, edging above the previous peak of 24.6% in November 2022; PHEVs ticked down slightly. Both however set monthly sales records at 474K EVs and 181K PHEVs (and another 50K for models where my data don’t separate EVs from PHEVs, though CPCA data imply almost of those are PHEVs). It’s a large market, but the end of rapid growth means that an increase in sales of one NEV model now comes at the expense of a decline at others.

Until end-2022 sales were driven by national-level incentives. Those ceased on Jan 1st, 2023, and the rebound from consumers who bought before the end of December led to lower sales and the rise of discounting early this year. (That normalization of the market is one topic of my SA article last month on China’s EV market, along with a focus on #3 player GAC Aion.) Unlike in the U.S., however, there are many affordable NEVs on the market, and 3 million public chargers (and another 3 million private ones). That allows NEV sales to expand, now that the impact of end-2022 purchases to catch incentives before they expired worked through the market.

For discussions of my data sources, see earlier SA articles:

- China 2023 Q2 NEV Update: Focus On Guangzhou Automobile

- China EVs: Losers Will Multiply

- China’s Automotive Slowdown: Tesla And The EV Startups

Sum

The NEV market will no longer show the double-digit growth rates of the past. That’s a barrier for all EV makers, as today’s pervasive discounting is the new normal. At present only 4 firms are profitable: Tesla, BYD Company (OTCPK:BYDDF), Li Auto (LI) and Aion of Guangzhou (OTCPK:GNZUF). The Geely group may be profitable, but the complex shareholding and cost share among its many brands (Volvo, Polestar, Lynk & Co., Geometry, Zeekr) makes their analysis difficult.

2. Exports and the EU Antidumping investigation

Background

Excluding cross-border flows inside the EU and USMCA, China is now the world’s leading automotive exporter, exporting 2.1 mil passenger vehicles Jan-Aug 2023, and an additional 800K commercial vehicles. Most of those are ICEs, but in the past year NEV exports rose rapidly, hitting 650,000 units during the first 8 months of 2023 (I just got the CPCA update at pixel…). Overall, exports now account for 14% of total passenger vehicle sales, and 13% of NEV sales.

So what is the impact if Europe carries imposes antidumping surcharges on imports of Chinese vehicles, or more narrowly Chinese EVs? Years ago SAIC bought the rights to the MG brand name, and uses that for most of its exports. (I’ve visited MG and Changan dealerships in the Philippines, and Geely is well known.) It’s the top Chinese name in Europe, selling 133,00 units Jan-Aug 2023, followed by DR Motors (Chery and JAC) with 24,000 cars. Most of those are ICEs. But while BYD exported 25,000 vehicles just in August 2023, in Europe it only sold 7,000 units Jan-Aug. However, the Atto 3 went from 600 units in July to 2,500 in August; its inroads are widely reported in Europe.

The European auto industry is portraying “cheap” Chinese exports as an existential threat to a large industry, where mass market producers are already struggling to turn a profit. The coverage of the initial EU press conference named only Chinese-owned NEV producers that have announced strategies to expand in Europe. (A Chinese article uses the phrase 东邪与西毒, Eastern Evil, Western Poison.) In my view, based on decades of watching trade policy, the real target is Tesla. They are the sales heavyweight, and the export champion. Exports also potentially come at the expense of production at Tesla Berlin, another factor.

(Aside: I was working on my econ PhD when the US Voluntary Export Restraints went into effect in May 1981; various European countries implemented similar measures, and 40 years later Japanese brands remain marginal players there.)

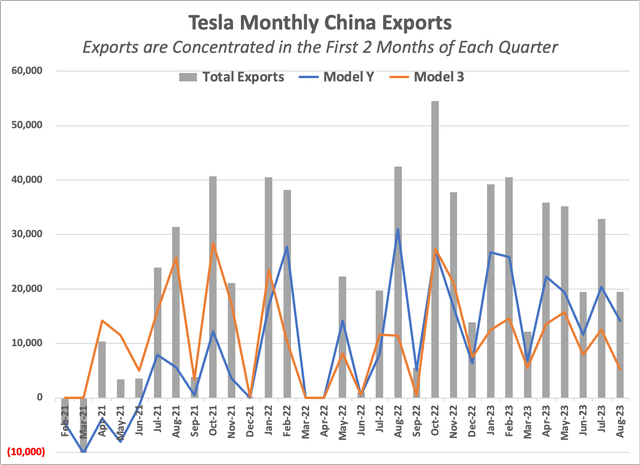

Tesla Shanghai Exports to Europe

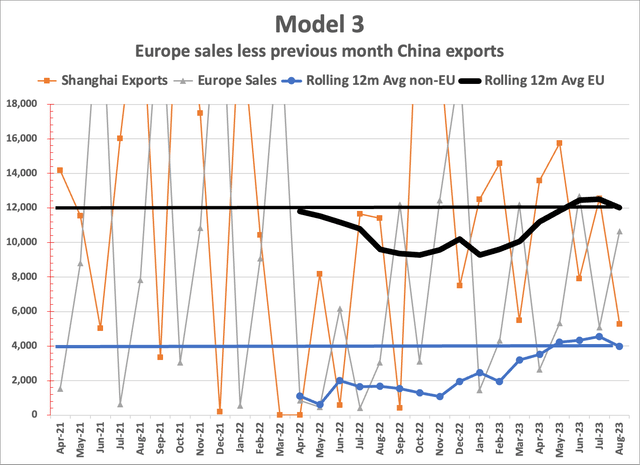

All of the Model 3 in Europe come from Shanghai; some portion of Model Ys are also imported from China. Let’s look at the available data. (I welcome anyone who follows Tesla in Europe to provide details on the Model Y there.)

Now, this is hard to interpret, given Tesla’s history of exports aiming to support end-of-quarter sales pushes in Europe and domestic end-of-quarter pushes in China. Quarterly data is more helpful; I append Jul-Aug 2023 data.

It’s obvious that exports are an important part of Tesla Shanghai’s sales. Let’s drill down into the Model 3, comparing European sales and Shanghai exports. Monthly data are noisy, so I did two things. First, it takes time to convert an export from Shanghai into a completed sale on the ground in Europe, so I calculated Model 3 exports in month X less European sales in month x + 1. I then smoothed the data by calculating a 12-month rolling of exports to Europe and (the residual) to everywhere else. The bottom line: Tesla Shanghai depends on exports to Europe for 12,000 wholesale units a month, or just under 100,000 units a year, 10% of overall Tesla Shanghai capacity. (Overall, Model 3 exports this year accounted for 45% of Shanghai Model 3 production.)

Since I don’t have data on the split between made-in-Berlin and made-in-Shanghai sales in Europe of the Model Y, I can’t do a similar calculation. (Automotive News Europe, my source for recent data, does not break down domestic versus import sales.) It’s likely though that most Model Y exports end up in Europe. So far this year Model Y exports averaged 18,400 units (and 37% of Shanghai Model Y output). To be conservative, let us assume more of those are exported to Australia and other non-European markets than the Model 3, say an average of 8,400 a month. In that case, 10,000 units a month are exported to Europe.

Net: Tesla Shanghai depends on Europe for 22,000 units a month, or 260,000 units a year. In other words, 26% of Tesla Shanghai’s capacity is devoted to production for the European market. European trade sanctions thus threaten to push capacity utilization to 76%, a major hit to the profitability of Tesla’s China operations and its overall bottom line.

Tesla as a sanctions target

Tesla has benefited from Chinese EV incentives as much as other firms, as subsidies targeted domestic producers irregardless of ownership. Automotive News (“China lavishes lots of love on EVs, from subsidies to tax breaks,” Sept 21) notes several major issues.

- Reduced taxes. Tesla got an initial tax holiday that is only now expiring. Henceforth, however, thanks to EV policy it will only pay 15% instead of 25%, an implicit subsidy. cushy deal on its factory site, financed by subsidized loans, and a total tax holiday on profits that is only now expiring.

- Producer subsidies. Tesla is second only to BYD in direct subsidies, which are based on volume. Those subsidies are subject to using made-in-China batteries, and the battery industry is in itself subsidized. (Batteries receive subsidies in the U.S. under the IRA, and Europe is implementing its own subsidies. Antidumping rules don’t make adjustments for those…)

- R&D subsidies. Those are prolific but are provided by local and provincial governments so is hard to summarize. We know, though, that the Shanghai municipal government [Shanghai is itself a province] supports its auto industry in many ways, so Tesla is likely a recipient (as are GM and VW).

- Government procurement. In much of China taxi and ride-hailing fleets are “asked” to buy local. I have no data, but I expect that is true for fleets in Shanghai, and that Tesla is a beneficiary.

Now Tesla benefited in other ways.

- It received subsidized loans.

- Shanghai provided land.

- Shanghai assisted with recruiting and training labor.

- Tesla’s biggest single market is Shanghai. Shanghai offers free license plates for EVs, a subsidy worth US$12,000 in January 2023. Similar policies are in effect in Hangzhou and 6 other markets, all important to Tesla.

If the EU crunches numbers, they will conclude that Tesla has been heavily subsidized. (Note I consulted on two U.S. antidumping cases. These are administrative procedures with rules written to facilitate finding dumping and issuing a guilty verdict. EU procedures are to my knowledge similar to those in the U.S.)

Summary

Tesla will be found guilty, and it matters. By design, a finding of dumping will generate prohibitive tariffs, and while on paper these are temporary, sunset reviews seldom result in reversal. Indeed, in 1964 the U.S. imposed a 25% tax on imported trucks as part of a set of retaliatory tariffs in the “Chicken War” with Europe. At the time only one vehicle was affected, the VW van, but under the law they were multilateral in nature, and are still in effect 60 years later. Once in place, they will in reality be permanent, and will effectively end EV exports to Europe. While aimed at China, they will likely be multilateral in nature, and so Volvo exports from South Carolina (and potential future Tesla exports from Mexico) will be hit, too. But that depends on the details of EU law, and I may be wrong.

Once an antidumping investigation is launched, it becomes an administrative procedure that politicians can’t then stop. None of the reports indicate that we are yet at that point, but I would be surprised if the matter is dropped. The only mitigating factor is that there first has to be fact-finding followed by an administrative hearing. So my expectation is that tariffs won’t be imposed until June 2024.

In other words, before the end of 2024 Tesla will no longer be able to export vehicles from Shanghai to Europe.

3. Will Refreshed Model 3 Sales Offset Reduced Exports?

The Model 3 Refresh

Tesla has been very slow to renew its product line, relying on running changes that may reduce costs but do not lead consumers to view it as a new vehicle. This is Tesla’s first new vehicle in China since the launch of the Model Y in China in February 2021, but it is only a refresh. (See my SA article on Tesla’s slow pace of new models.) In China and other markets, that often provides some PR value and boosts sales, but it is a holding measure. Unfortunately, the initial reviews in China are not favorable, and it is not generating top-of-the fold stories on automotive websites.

PR

I searched an array of Chinese automotive websites for articles on the refreshed Model 3. There were stories on turning out the 5 millionth vehicle, on mega-castings, on Tesla’s planned Mexican factory, and on Elon Musk’s antics. What was conspicuous in its absence were ones on the Model 3.

Here’s what I found. I left out the “https://www.” to keep Seeking Alpha from converting into site names.

Nothing:

- chinaautonews.com.cn

- geeknev.com

- auto.ce.cn

- icauto.com.cn

- auto.nbd.com.cn

- m.cbea.com

- xnyauto.com

- iyiou.com/search?p=汽车

- www.dongchedi.com

- auto.gasgoo.com

- chejiahao.autohome.com.cn

Minimal content:

- www.autohome.com.cn provides a photomontage of the new Model 3, similar to what the site offers for a wide array of other models.

- www.d1ev.com/news/shichang/210099 notes the regulatory filing for the Model 3 facelift as one of a list of forthcoming new and revised models

- chejiahao.autohome.com.cn provides a link in line with that for all other recent models

- news.cheshi.com provides photos of the refreshed Model 3, as well as photos of many other new and refreshed models

- auto.china.com.cn notes the Model 3 refresh but the only full Tesla story is on Model Y sales

-

news.yiche.com has a brief story with a few photos

-

www.pcauto.com.cn/nation/3945/39451815.html has photos including one of a parking lot of refreshed Model 3s awaiting shipment to Europe

Actual content:

-

newcar.xcar.com.cn has the standard set of links for recent models that include the Model 3. but it also has a link to reviews. most are old, but of note:

- 4:54 video from Sept 5, 2023 on the refresh that concludes “priced a bit high” aikahao.xcar.com.cn/video/1789227

- 1:33 from Feb 26 so too early to have details www.xcar.com.cn/bbs/viewthread_bj.php?tid=175509

- from Sept 1, 2023 a table comparing old and new Model 3 specs xcar.com.cn/bbs/viewthread.php?tid=99326816 but no evaluation of the refresh

- 163.com/auto/article/IEHR0EC80008856V.html is

- a comparative review of the refreshed Model 3 with the new Geely-group Geometry G6.

- my translation “… of cars currently on the market, from the exterior design to the interior details, to intelligent vehicle functionality, the Geometry G6 is competitive [against the refreshed Model 3] for those who don’t have to have the latest – and at half the price.”

- https://nev.ofweek.com/2023-09/ART-71008-8460-30611020.html has a long article

- minor changes, makes sense to be conservative as current version sold well.

- but price ↑ almost 元30,000 [$4100]. complaints about that online, sales only strong for lower price version, and bloggers insist price must be no more than 元19.99 [or 元60,000 lower than at present].

- it won’t fly!

So, to date the Model 3 hasn’t made a splash. That may change, but there’s nothing to indicate that the refresh will have a major impact, much less lead to a long-term sales splurge that might offset the potential loss of exports to Europe.

Now a Model Y refresh is also in the works. There’s mention of it, but no details are public and so it is not yet receiving media attention.

Model 3 Sales Trend

This, of course, matters because despite discounting, Model 3 sales peaked in 2020, when the EV market was much smaller. It’s the poor cousin to the Model Y, which has outstripped it in sales from 2021Q3, that is for the last 2 years.

The Model 3 refresh is a holding action. But holding for what? The CyberTruck is not yet on the market, but that is a vehicle targeted at U.S. suburbanites. The pickup truck market in China is small and rural, and Tesla has announced no plans to produce it in Shanghai. It won’t help capacity utilization.

The Model Y is a much stronger product, and the refresh may actually help hold up sales. That will not eliminate the challenge of maintaining capacity utilization at Tesla Shanghai.

4. Summary

I don’t see any mitigating factors. Instead I painted an optimistic case, based on the current negative news on the Chinese economy not affecting car sales.

To date the real estate sales decline is greatest in Tier III cities, and not in the wealthier Tier I cities that are the major market for Tesla and the other more expensive NEV models from firms such as NIO (NIO) and XPeng (XPEV). The financial institutions that have stopped allowing households to redeem their deposits are ones more focused on selling their high-yielding savings products in lower-tier cities. The falloff in construction has led to lots of job losses, but in China such workers are not purchasers of new vehicles. Similarly high unemployment among new graduates does not directly affect the demographics who buy new vehicles. Many prefectures and lower-tier cities are in fiscal stress, but that has not yet led to job cuts. In other words, the upper middle class hasn’t yet felt the economic downturn. And if Xi has his way, that will continue to be the case.

Nevertheless, the coming year will remain challenging for China’s auto industry. Many of the new entrants (such as Li and the Geely group) will have new plants coming into production. Most of the new entrants have sales far below capacity, so face immense pressure to discount. As I’ve detailed elsewhere, over a dozen NEV entrants have already closed their door. (See the article here).

Discounting will not go away. The over 50% drop in lithium prices in China this year lessen the pain, but since it lowers the cost for everyone in the market it doesn’t change the competitive dynamic. Tesla will not be immune to the pressure to continue discounts as it struggles to maintain current capacity utilization.

That is not good news for current investors, as shares are priced for growth with high profits. Instead, at least in China, Tesla will not be growing until it can launch totally new product appropriate to the market, even as it loses the European export market that accounts for much of its capacity in Shanghai.

============

I will have Q3 data mid-October. Since I have just written about GAC Aion and about Tesla, I add to my quarterly update an analysis of another major Chinese NEV players, with BYD, Li and the Geely group next in the queue.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.