Summary:

- Cisco Systems, Inc. has demonstrated stellar financial performance with wide free cash flow margin over the past decade.

- The company’s capital allocation approach is very shareholder-friendly, with massive buybacks and a strong track record of dividend growth.

- Cisco is well-positioned to capture long-term growth opportunities, as a significant portion of the world’s population still lacks internet access.

Sundry Photography

Investment thesis

Cisco Systems, Inc. (NASDAQ:CSCO) profitability is stellar, and I am impressed by the fact that despite a massive business scale and low revenue growth, the management can still deliver profitability metrics expansion. The company pays attractive dividend yields and has a strong track record of dividend hikes. I also like how the company navigates the harsh environment by delivering double-digit solid YoY revenue growth.

Despite full Internet penetration in the developed world, about a third of the world’s population still does not have access to the Internet. It is a big long-term growth opportunity for Cisco, and its vast scale and exceptional level of execution make it firmly positioned to capture positive secular shifts. All in all, the stock is a “Strong Buy” for investors who are seeking a low-risk opportunity.

Company information

Cisco Systems is a global leader in communications equipment that designs and sells a broad range of technology that power the Internet.

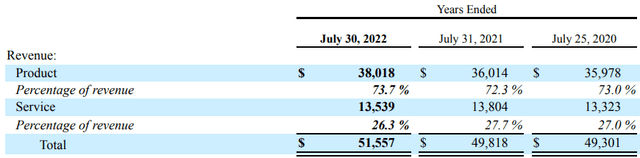

The company’s fiscal year ends on the last Saturday of July. According to the latest 10-K report, CSCO generates more than 40% of the total sales outside the Americas. Product revenue is the principal stream contributing almost three-fourths of the total.

Financials

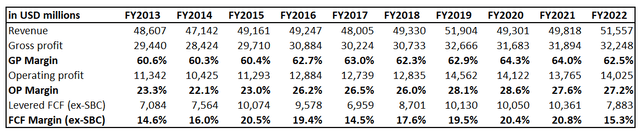

The company’s financial performance has been stellar over the past decade, with stable revenue and robust cost control, which we see by notably expanding margins. Cisco has consistently been a free cash flow [FCF] champion even if we deduct stock-based compensation [SBC].

To sustain its competitive advantages and improve efficiency, the company consistently reinvests a substantial part of sales into R&D. Over the past decade, CSCO invested in R&D far more than $60 billion. I like how the company balances investing in innovation and maintaining very shareholder-friendly capital allocation. Cisco’s share buybacks are massive and totaled about $80 billion over the past decade. Apart from buybacks, the company has a stellar dividend history with eleven consecutive years of dividend hikes. The current forward dividend yield looks attractive at 2.9%.

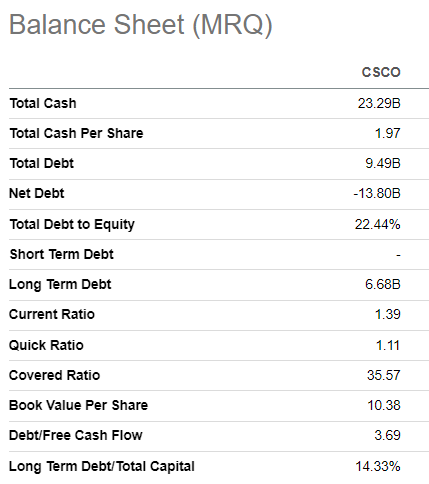

Cisco’s balance sheet is a fortress with an almost $14 billion net cash position. Financial leverage ratios are very low, and the covered ratio is above 35. Liquidity ratios are also in excellent shape. That said, I believe that dividend growth is safe and sustainable.

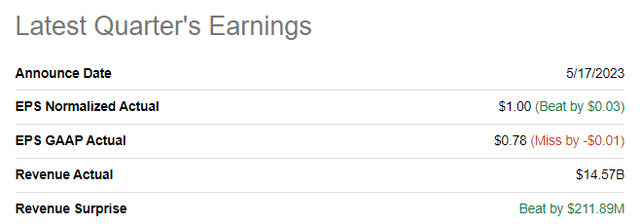

Seeking Alpha

The latest quarterly earnings were released on May 17, when the company topped consensus estimates. Revenue demonstrated solid growth momentum with a 13.5% YoY growth. A notable YoY sales growth was achieved across all geographic areas, a solid indicator amid the current harsh global macro environment. It is also crucial to emphasize that Cisco delivered double-digit growth in both software and in subscription revenue. Another bullish sign is that the management raised its full-year revenue and profit guidance for the third time during the latest earnings call.

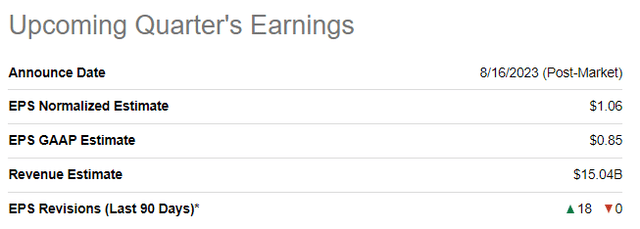

The upcoming quarter’s earnings release is approaching and scheduled for Wednesday, August 16 post-market. Consensus expects revenue at $15 billion, meaning a 14% YoY growth, and the strong momentum is still in place. The non-GAAP EPS is expected to follow the top line and expand from $0.83 to $1.06. Another bullish sign is that there were 18 upward EPS revisions over the past 90 days.

Overall, I like the stellar execution of the management, which I see in unmatched profitability metrics, which are still expanding despite the maturing stage of the business. Robust cost control becomes the most critical dimension for the management when the business gets closer to maturity, and Cisco’s management is strong in it. I also like the balance between investing in innovation, maintaining a robust balance sheet, and delivering value to shareholders with massive buybacks and dividend growth. Some skeptical opinions might be expressed that Cisco’s end market is close to full penetration, but it is only true for the developed world. According to statista.com, as of April 2023, there were 5.18 billion internet users worldwide, which amounted to 64.6 percent of the global population.

That said, the gap for reaching full penetration globally is still significant, which is the opportunity to drive growth for Cisco. And even in the developed world, new Internet-related technologies are emerging at a rapid pace, and the need for network capacity is also poised to grow. Therefore, secular shifts are still favorable for Cisco, and the company is well-positioned to continue its dominance in the industry.

Valuation

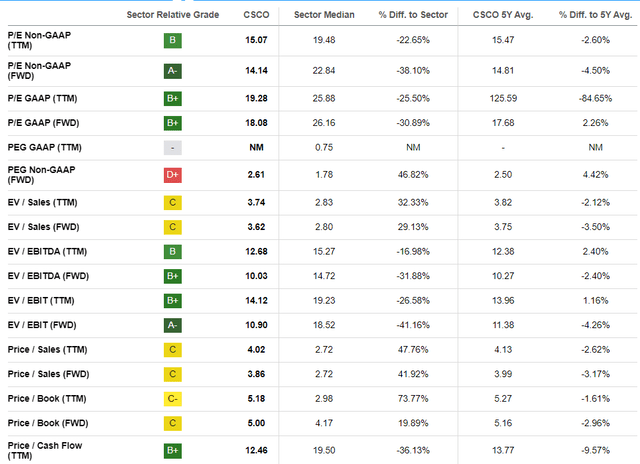

The stock price is up 12% year-to-date, which means broad market underperformance. Seeking Alpha Quant assigns the stock an average “C+” valuation grade, meaning the stock is fairly valued based on comparative multiples analysis. Based on the discrepancies with historical averages, I agree that based on valuation ratios, the stock price looks close to its fair value.

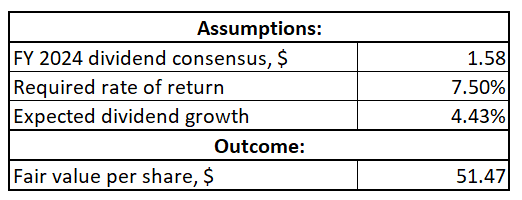

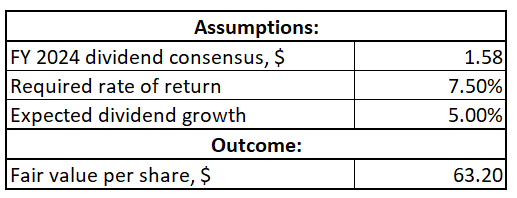

Since Cisco is a strong dividend stock, I continue my valuation analysis with the dividend discount model [DDM] approach. Due to the company’s stellar profitability and wide moat, I use a 7.5% WACC suggested by valueinvesting.io. The FY2024 divided is projected at $1.58 by consensus estimates. Dividend growth is always tricky, and I prefer to be on a safe site by selecting a long-term five-year CAGR of 4.43%.

Author’s calculations

Incorporating all the above assumptions into the DDM formula returns the stock’s fair value at $51.5, slightly below the current share price. That said, the stock might look slightly overvalued from the DDM perspective. But I would like to emphasize that Cisco’s ten-year dividend growth rate is much higher at 9.52%, and the DDM formula is susceptible to changes in dividend growth. For example, if I round up dividend growth to 5%, the stock’s fair price increases to $63, suggesting a 17% upside potential.

Author’s calculations

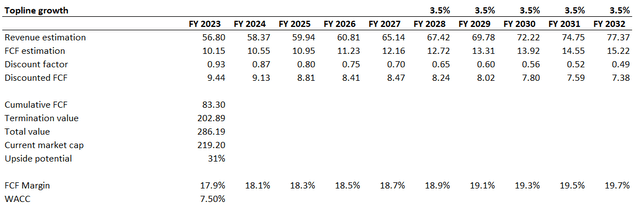

To cross-check, I want to proceed with discounted cash flow [DCF] approach with the same 7.5% discount rate. I have revenue consensus estimates projecting a 3.5% CAGR over the next five years. I expect Cisco to sustain this growth rate over the whole decade. I use last decade’s average of 17.9% for the FCF margin and expect it to expand by 20 basis points yearly.

Based on the DCF approach, the stock has a massive 31% upside potential. Let us also not forget the company’s substantial net cash position, which makes the business’s fair value close to $300 billion. To conclude this part, CSCO’s valuation looks very attractive.

Risks to consider

I see the current uncertain macro environment as the most significant risk for a giant and market leader like Cisco. While recession fears are easing, many red flags indicate that macro headwinds can be in place for multiple quarters. Global central banks’ rates are still high, and many of the world’s leading economies are still implementing rate hikes. Even Fed is still implementing rate hikes, and there is little certainty regarding the pivot in monetary policy timing. Eurozone, which is a significant market for the company, fell into recession in early summer. The war in Ukraine seems to be far from termination, which also adds vast uncertainty regarding the pace of the economic recovery in the Eurozone.

The uncertainty regarding the credit crunch is still high. While there were no notable bank failures since Q1, we also see some red flags here. Last week, Moody’s surprised the market by downgrading the credit rating of several mid-size banks and added that many big names like U.S. Bancorp (USB) and Bank of New York Mellon (BK) are under review for potential downgrades. That said, credit conditions will likely continue tightening, which is terrible for business activity levels and spending. Given the company’s fortress balance sheet, this would not be a big problem, but it might be a negative factor for the whole stock market, which will pressure CSCO’s stock price.

Bottom line

CSCO is a “Strong Buy” for investors seeking a low-risk decent dividend yield name. I like Cisco’s stellar profitability, which is still expanding despite the massive scale of the business. The global end market is still far from full penetration, meaning vast room for business growth exists. The stock is substantially undervalued, and the upside potential outweighs the potential risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CSCO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.