Summary:

- The regional banking crisis is likely to top the U.S. into a mild to average recession this year.

- Stocks might sell off as much as 30% in the coming months. But Super SWANs like Cisco Systems and Comcast Corporation are great ways to ride out the coming economic storm.

- Both are A or AA-rated recession-resistant businesses with steady cash flow, rock-solid balance sheets, adaptable management, and good to very good risk management.

- Both offer 3+% yielding relatively safe dividends that grow every year.

- But only one is so undervalued that it could more than double in three years and generate 100% higher inflation-adjusted income and wealth in the next 30 years. The last time this recession blue-chip was this undervalued, it delivered over 1200% returns in the following ten years.

tiero

This article was published on Dividend Kings on Monday, March 20th.

—————————————————————————————

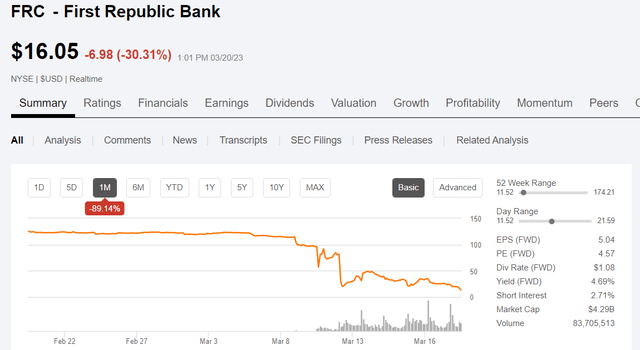

The 2023 banking crisis continues with First Republic Bank (FRC) likely to be dead…or acquired by May 20th.

Why is FRC down 30% on Monday (59% at one point)? Because JPMorgan Chase (JPM) is reported to be discussing potentially diluting investors by as much as 88%.

- in exchange for converting $30 billion in deposits into permanent capital.

- if all of it were to turn into stock FRC would be worth $2.4.

The good news is that financial stress remains below-average in America. The bad news is that might change in a hurry.

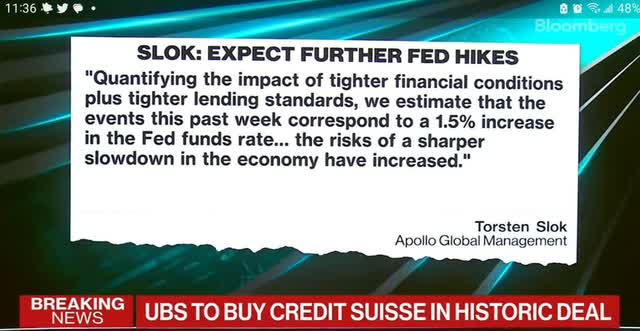

Apollo Global Management estimates the banking crisis, via a sharp reduction in credit, is effectively like the Fed just hiked rates by 1.5%.

Goldman thinks it’s 0.25% or 0.5%, but we also can’t forget that QT is also going on.

- banks borrowing from the Fed doesn’t count as QE.

- since that money is being used to shore up balance sheets, not for lending or investment.

The Atlanta Fed estimates QT is effectively like the Fed Funds rate is 0.75% higher than it actually is. The San Francisco Fed estimates 2%.

With the bond market now estimating a 70% chance the Fed hikes to 4.75% on Wed, we’re looking at an effective Fed funds rate of 5.75% to 8.25%.

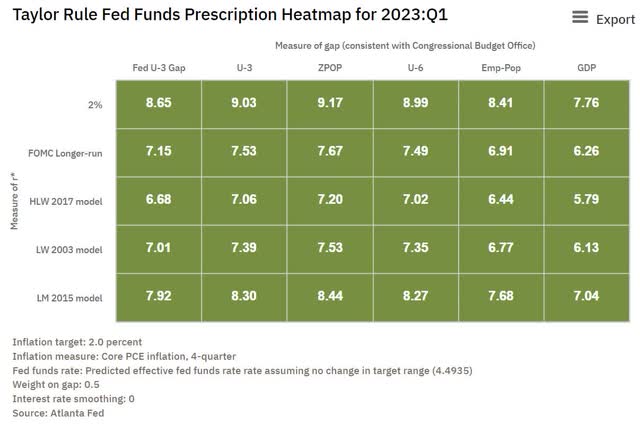

The good news is that if the Fed leaves rates at 4.75% for long enough, the Taylor Rule says inflation is guaranteed to be beaten…eventually.

The bad news? The Fed will have effectively gone from 0% to 5.75% (possibly 8.25%) in 15 months.

Not even Paul Volker, during his 20% rate hiking scorched earth campaign hiked rates that quickly.

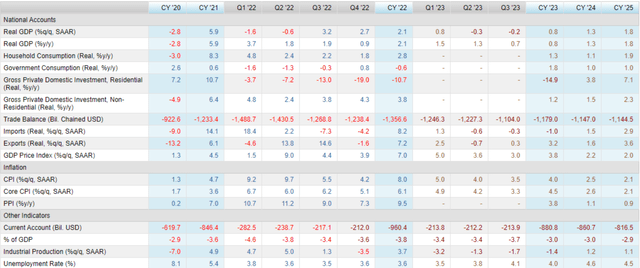

The bond market thinks the recession will begin between July and September. And depending on whether or not the Fed cuts rates or leaves them high, it could prove longer and deeper than currently expected.

Then again, economists currently expect the 2023 recession to be the mildest in U.S. history, with a peak decline of about 0.5% and full-year growth of 0.8% this year.

In other words, even if the recession is worse than expected (how could it not be), it might still be mild, like the 2001 recession with a peak decline of just 0.4%.

The average recession since WWII is a 1.4% GDP contraction; if we get one of those, stocks might be in for some pain.

S&P Bloomberg Bear Market Bottom Consensus Estimates

| Earnings Decline | S&P Trough Earnings | X Blue-Chip Consensus PE of 16.8 | Decline From Current Level | Peak Decline From Record Highs |

| 0% | 227 | 3821 | 2.4% | -20.7% |

| 5% | 216 | 3630 | 7.3% | -24.7% |

| 10% (consensus) | 205 | 3439 | 12.2% | -28.6% |

| 13% (average since WWII) | 198 | 3324 | 15.1% | -31.0% |

| 15% | 193 | 3248 | 17.1% | -32.6% |

| 20% | 182 | 3057 | 22.0% | -36.6% |

(Source: DK Research Terminal, Bloomberg)

The Bloomberg consensus expects the market to drop about 15% IF we avoid the historical 13 to 15 trough P/E.

- If the Fed cuts aggressively enough and ends QT, then MAYBE stocks end up bottoming at 3300 to 3400.

If not? Then the S&P potentially drops about 30% from here.

The good news is that world-beater dividend blue-chips have never been better prepared for a recession.

- $7 trillion in cash on the balance sheet.

- 1.22 net debt/EBITDA (leverage) vs. 3.0 or less safe according to rating agencies.

Several Dividend Kings members recently asked me for updates on two defensive high-yield blue-chips, Cisco Systems, Inc. (NASDAQ:CSCO) and Comcast Corporation (NASDAQ:CMCSA).

Let me show you why both are potentially wonderful recession Super SWAN options, but why one is the better recession blue-chip buy.

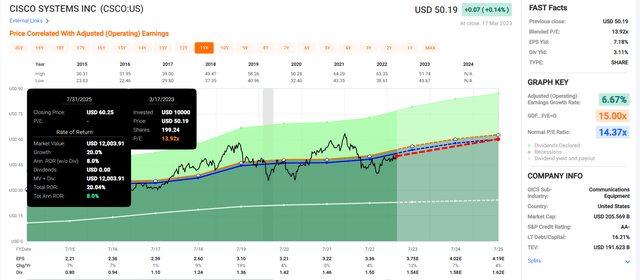

Why Cisco Is A True High-Yield Ultra SWAN For This Recession

Bottom line up front.

Summary Facts

- DK quality rating: 96% very low risk 13/13 Ultra SWAN tech utility

- Fair value: $53.87

- Current price: $50.83

- Historical discount: 6%

- DK rating: potential good buy

- Yield: 3.1%

- Long-term growth consensus: 7.3%

- Long-term total return potential: 10.4%

CSCO isn’t a particularly fast-growing company, but it’s an effective tech utility whose earnings didn’t fall during the Pandemic.

- During the Great Recession, EPS fell just 6%.

Cisco’s routers and new subscription-focused recurring revenue business model are so critical to global corporations that it would take a virtual apocalypse for its dividend to be at high risk or for the company to fail.

FactSet Research Terminal

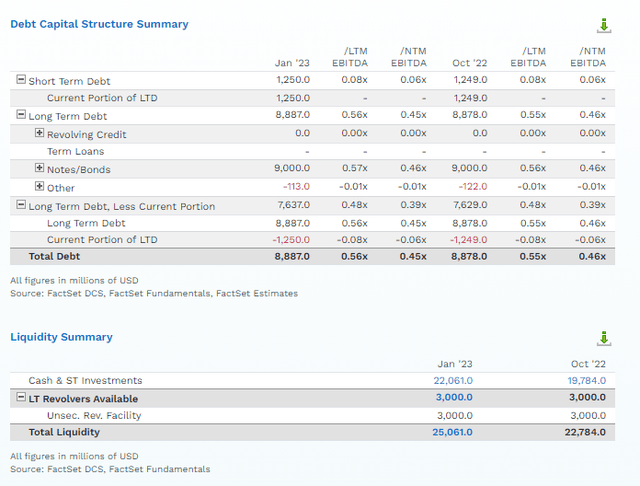

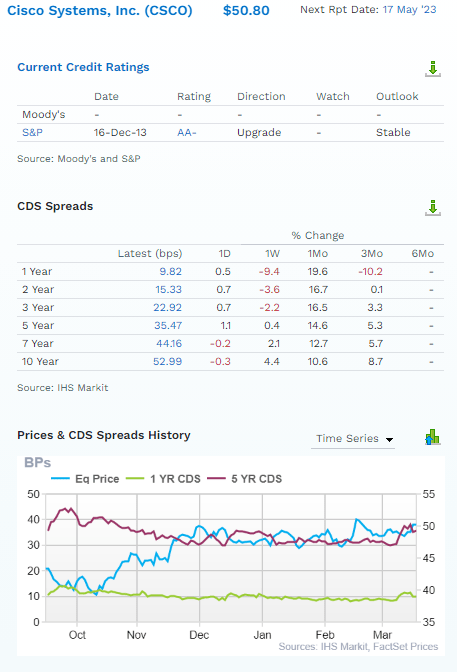

This is an AA-rated company with a 0.55% risk of defaulting on its bonds (and going bankrupt) in the next 30 years, according to S&P.

- A+ equivalent rating from Moody’s = 0.6%.

What if you don’t trust the rating agencies? The ones that called First Republic an A-rated company last week and now call it B+?

- Bankruptcy risk rising from 2.5% to 25% in a week.

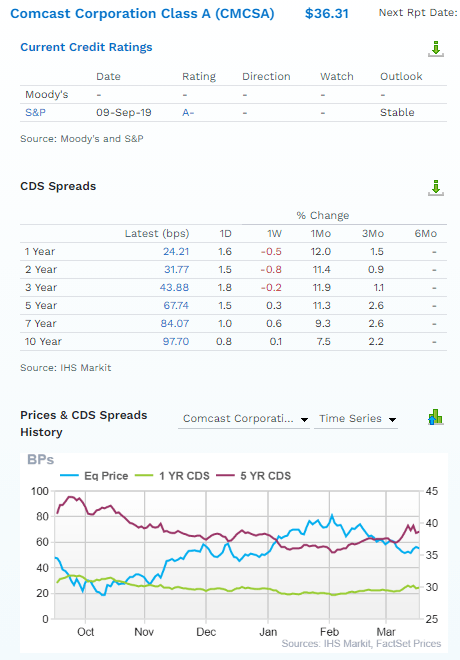

Well, then the bond market has you covered. Through credit default swaps, publicly traded default insurance, we can see in real-time what the “smart money” on Wall Street thinks about a company’s fundamental risk.

These are multi-million dollar insurance policies so bond investors are putting their money where their mouths are.

And right now, the bond market estimates CSCO’s fundamental 30-year default risk at 1.65%, the equivalent of an A stable credit rating.

That fundamental risk has been steady for months, including the recent banking crisis-induced chaos.

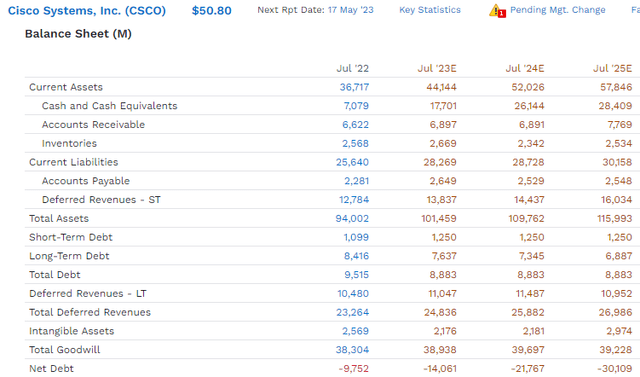

Cisco has $9 billion in debt and $22 billion in cash. It could pay off its debt at any time, but its average interest rate is 4.8% or just 2.5% adjusted for long-term inflation.

- deeply negative real rates using today’s inflation rate.

With cash returns on invested capital of 31%, it would be silly for CSCO to pay off its debt when it can service it so easily.

The interest coverage ratio is 36X vs. 8+ safe for this industry according to rating agencies.

In fact, according to S&P, Cisco could quadruple its debt and still retain an investment-grade credit rating.

But CSCO isn’t expected to take on any more debt. Rather it’s expected to grow its net cash pile to $30 billion by mid-2025.

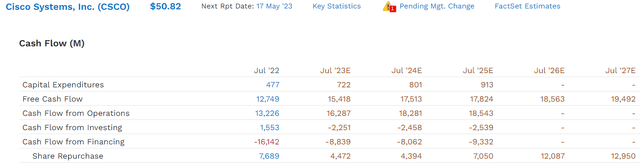

Cisco’s capital-light business model allows it to enjoy 26% free cash flow margins, slightly better than Apple’s (AAPL).

Its free cash flow in 2023 is expected to grow by 21% to $15.5 billion and nearly $20 billion by 2027.

It’s expected to buy back $41 billion in stock by 2027, and yet still grow its net cash pile by $16 billion.

Cisco spends 41% of its free cash flow on dividends, compared to a safe payout ratio of 60%.

That leaves it $9.2 billion per year in post-dividend free cash flow. It can use that for buybacks, M&A, debt repayments, or just pile up cash, which is now yielding at an attractive rate.

- Cisco’s dividend cut risk in an average recession: 0.5%.

- risk in a severe recession: 1.3%.

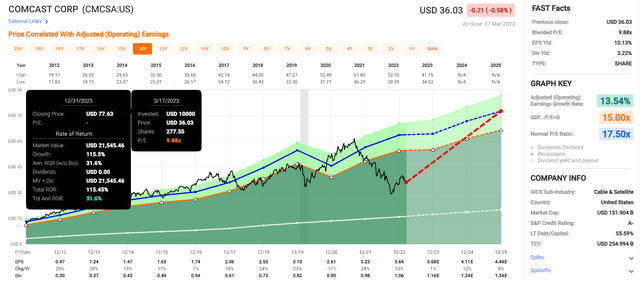

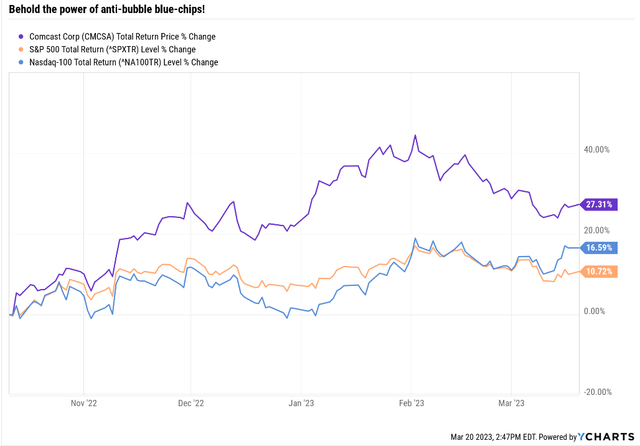

Why Comcast Is A Better High-Yield Blue-Chip For This Recession

Bottom line up front.

Summary Facts

- DK quality rating: 86% very low risk 12/13 Super SWAN telecom

- Fair value: $66.80

- Current price: $36.03

- Historical discount: 46%

- DK rating: potential Ultra Value Buffett-style “fat pitch” buy

- Yield: 3.2%

- Long-term growth consensus: 9.5%

- Long-term total return potential: 12.7%

Comcast isn’t just a strong buy; it’s a potential Buffett-style “fat pitch” ultra value buy.

Why? Because it’s an anti-bubble blue-chip bargain, trading at 7.2X cash-adjusted earnings.

- Pricing in -2.6% long-term growth.

- private equity is paying 12X cash-adjusted earnings right now.

- Comcast is a bargain by private equity standards.

As long as CMCSA grows at 0% or faster, it’s mathematically impossible to lose money buying it today. As long as Comcast doesn’t shrink the dividend will always be safe, and it’s just a question of how much money you’ll make, not whether you’ll make money.

Comcast’s core cable business enjoys significant competitive advantages but will likely slow growth as competition for incremental customers heats up. NBCUniversal isn’t as well positioned but holds unique assets, including core content franchises and theme parks, that should help ease the transition away from the traditional television business. Overall, we expect Comcast will deliver modest growth with strong cash flow for the foreseeable future.” – Morningstar

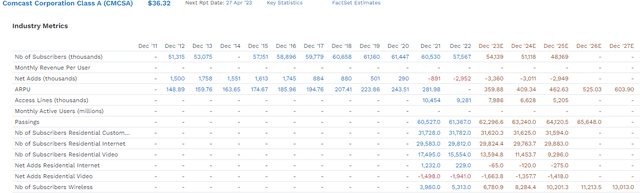

Wall Street freaked out recently over the weakness in Comcast’s core businesses.

Cable subscribers peaked in 2020 and have been falling steadily. Wireless subscribers have been growing steadily but cord-cutting is here to stay.

But guess what? Comcast’s growth thesis was never about turning around cord-cutting.

It was about maximizing revenue per user, which was $149 in 2012 and is expected to reach $604 by 2027.

- 10% annual growth in ARPU.

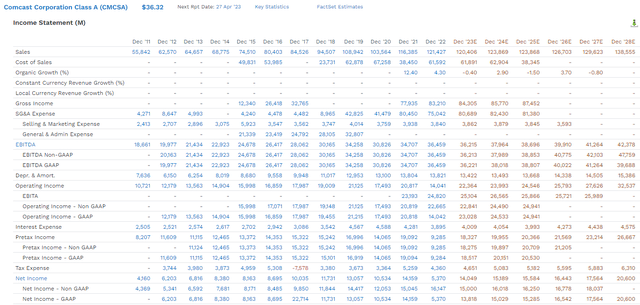

Comcast has been growing its sales at 5.5% since 2011 and is expected to slow to about 3%.

But its bottom line is expected to grow much faster thanks to cost-cutting and buybacks.

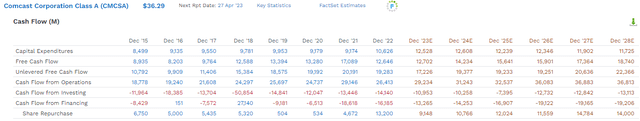

Comcast’s free cash flow is expected to grow from $13 billion in 2023 to $19 billion in 2028.

- 7.9% annual growth in free cash flow.

And thanks to $72 billion in consensus buybacks over the next five years, per-share earnings and free cash flow are expected to grow even faster.

- $72 billion in buybacks is 50% of the current share count.

- 12.9% annual share reduction at current valuations.

How fast is Comcast expected to grow in the coming years?

- EPS: 9.5%

- dividends: 7.3%

- free cash flow/share: 16.1% CAGR

Does a company growing at 9% to 16% deserve to trade at 7.2X cash-adjusted earnings? Absolutely not.

And here’s why Comcast is a potentially wonderful recession anti-bubble blue-chip.

Incredible Value + Good Growth + Low Risk

FactSet Research

Note how Comcast’s fundamental risk was steady or even falling as it hit bottom in October.

How can you tell the wheels aren’t falling off the bus? When management, analysts, rating agencies, and the bond market all say they aren’t, chances are good that paying 4X cash-adjusted earnings for a company growing at high single digits is a smart idea.

CMCSA is up 27% in five months, but in October, it hit the lowest P/E in its history.

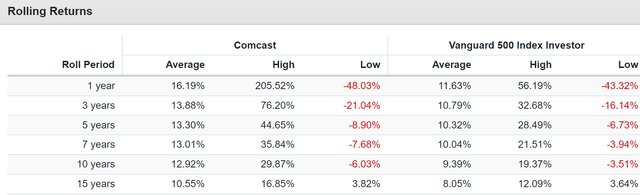

The Last Time Comcast Was This Undervalued

The last time Comcast was this undervalued, it more than tripled in a year.

- 447% return in 3 years

- 533% in five years

- 753% in seven years

- 1,265% in 10 years

- 934% in 15 years

You don’t need to buy crypto to earn crypto-like long-term returns…you just need world-beater blue-chip bargains like Comcast.

Bottom Line: Both Cisco And Comcast Are Solid Recession Blue-Chips, But Comcast Is The Better Buy Today

Let me be clear: I’m NOT calling the bottom in CMCSA or CSCO (I’m not a market-timer).

Even Super SWANs or Ultra SWANs can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck.

- in the short term; luck is 25X as powerful as fundamentals.

- in the long term, fundamentals are 33X as powerful as luck.

While I can’t predict the market in the short term, here’s what I can tell you about CSCO and CMCSA.

Both are world-beater blue-chips with strong balance sheets, relatively recession-resistant business models, and a wonderful record of raising dividends.

- Cisco began paying a dividend 11 years ago, has raised it every year, and never came close to cutting it.

- Comcast began paying a dividend 14 years ago, raised it every year, and never hinted at cutting it.

Long-Term Consensus Return Potential

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential |

| ZEUS Income Growth (My family hedge fund) | 4.3% | 9.9% | 14.2% |

| Vanguard Dividend Appreciation ETF | 2.0% | 11.3% | 13.3% |

| Schwab US Dividend Equity ETF | 3.6% | 9.4% | 13.0% |

| Comcast | 3.2% | 9.5% | 12.7% |

| Nasdaq | 0.8% | 10.9% | 11.7% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% |

| Cisco | 3.1% | 7.3% | 10.4% |

| S&P 500 | 1.7% | 8.5% | 10.2% |

| REITs | 3.9% | 6.1% | 10.0% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% |

(Sources: DK Research Terminal, FactSet, Morningstar)

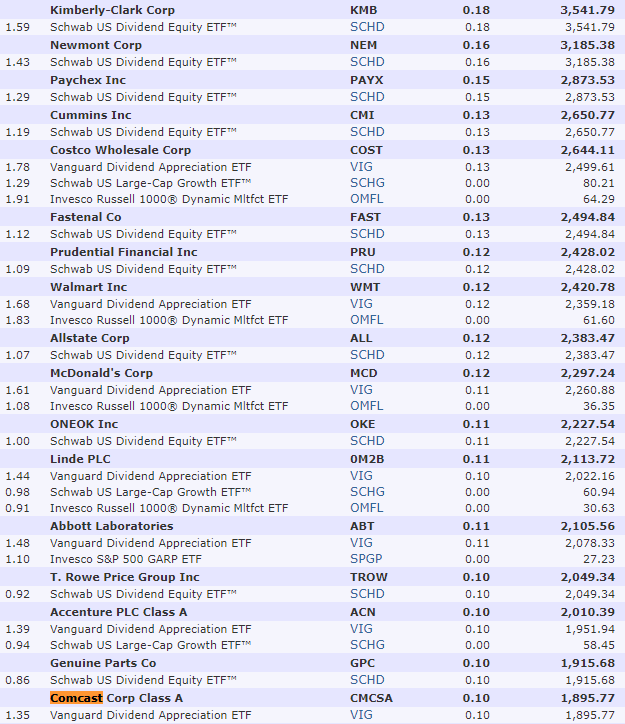

But ultimately, Comcast is not just a much more undervalued stock but a higher-yielding one with superior long-term growth potential.

- 2.3% better long-term return potential = 100% more inflation-adjusted income and wealth-generating potential.

If the battle of the high-yield recession dreams blue-chips, Comcast is the clear winner, though anyone who owns or buys Cisco today isn’t likely to be too disappointed in the coming years.

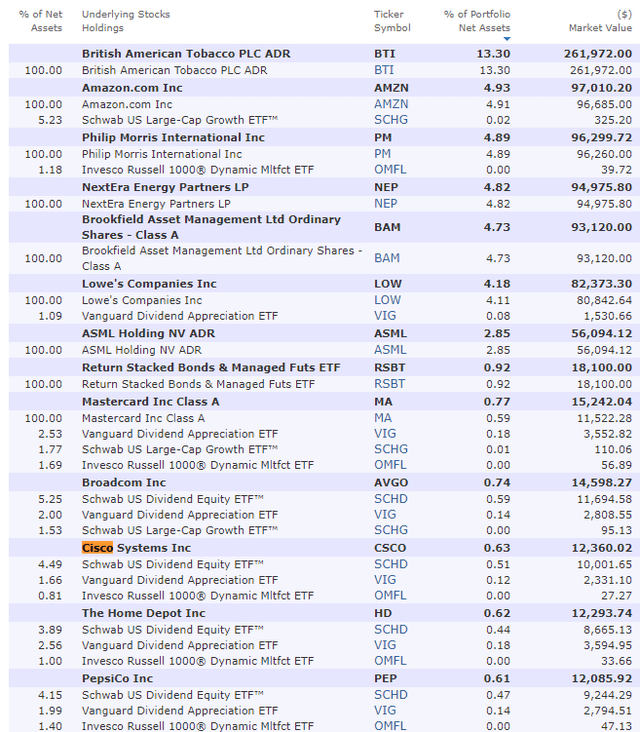

I own $12,400 worth of Cisco via 3 ETFs.

I own $1,900 worth of Comcast via VIG.

Morningstar

I own a lot more Cisco myself because it’s in three of my family fund’s five ETFs.

For anyone looking to buy individual stocks, you can’t go wrong with either, but Comcast is the one I recommend today.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own $14,000 worth of CSCO and CMCSA via ETFs.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my $2 million family hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.