Summary:

- Cisco Systems, Inc., a leader in the hardware landscape, is positioned to capitalize on the expected surge in global AI expenditure by 2026.

- The technical outlook of Cisco’s stock reveals bullish momentum, with a potential breakthrough above the $54 mark possibly triggering a significant surge in its share price.

- If the price breaks below $29, it will invalidate the bullish parameters on the chart and result in a downside breakout of the ascending broadening wedge pattern.

Alexander Koerner

Cisco Systems, Inc. (NASDAQ:CSCO), an industry giant in the hardware landscape appears to be a lucrative investment opportunity. Advanced AI model training requires significant resources such as high-powered servers, GPUs, and large amounts of memory, placing Cisco and its hardware, software, and efficient Silicon One chips at the forefront of a rapidly expanding multibillion-dollar market. As global AI expenditure is expected to dramatically increase by 2026, Cisco is well-positioned to capitalize on the surge in demand for specialized AI training services and related hardware needs.

This article presents an in-depth analysis of Cisco’s stock price, forecasting its future trajectory. The current trading price of Cisco appears to offer an excellent investment opportunity, as both fundamental and technical analyses reveal bullish momentum. Moreover, the company’s resilience and robust financial health further bolster this prospect. It has been observed that Cisco’s stock is trading at a pivotal point; a breakthrough above the $54 mark could potentially trigger a significant surge in its share price.

A Strategic Investment in the Rapidly Evolving AI Sector

Investing in Cisco Systems seems to be a promising opportunity, given its central role in the hardware requirements for AI model training. Training such advanced models require substantial investment in high-powered servers, GPUs, and large amounts of memory. With Cisco being the market leader in providing hardware and software for connecting servers and data centers, its influence in the AI hardware sector is not to be ignored. The company’s latest line of Silicon One chips, the G200 and G202, specifically target the AI workload domain, offering high-speed performance and efficient power usage, thereby making them desirable for AI developers.

Further underlining Cisco’s potential is the growth in global spending on AI, expected to reach $154 billion this year and to double by 2026. While AI networking chips constitute only a fraction of this spending, it still represents a multibillion-dollar opportunity for Cisco. This growth in AI is anticipated to drive demand for specialized AI training services, and therefore for chips like Cisco’s Silicon One products. As AI evolves, networking chips will play an increasingly crucial role, underscoring the company’s potential value.

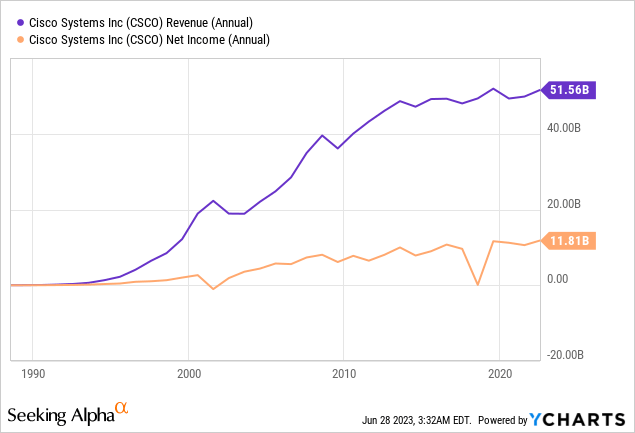

Cisco’s business dominance, scale, and extensive software services give it the ability to generate steady revenue and profits. Even in a highly commoditized market, Cisco’s performance remains robust. Despite a slowdown in fiscal 2022 due to supply chain constraints, the company rebounded in fiscal 2023, guiding a revenue growth in the range of 10% to 10.5% for the year. Moreover, Cisco offers stability and predictability with 12 times forward earnings and a dividend yield of 3.1%, making it an appealing blue-chip tech stock for investors to hold through varying market conditions. The following chart illustrates the significant annual increase in revenue and net income over the past thirty years, highlighting a robust upward trend.

The company’s latest earnings report showcased another quarter of accelerating growth. For Q3 of fiscal 2023, Cisco’s revenue rose 14% year over year, beating analysts’ estimates. Despite this impressive growth, the stock price has only slightly increased, offering potential investors a chance to buy at a reasonable value. Moreover, the company has displayed resilience in the face of operational challenges. During the previous fiscal year, supply chain disruptions affected its hardware production. Nevertheless, it has managed to overcome these issues and witnessed accelerated growth in the secure and agile networks division. Additionally, demand for the new campus and data switches, enterprise routers, and wireless products remain strong, thereby driving growth despite macroeconomic challenges. Although there were weak points, Cisco’s strengths have significantly offset them, ensuring continued growth for the company.

Understanding the Emergence of Bullish Trends

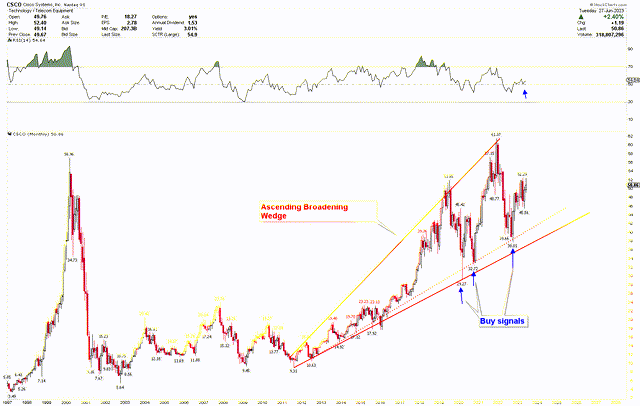

Both the fundamental and technical analysis for Cisco show promising signs of bullish momentum. However, the current market price provides a ripe opportunity for investors to buy in at a lower level. Observing the monthly chart below, from the point where Cisco was valued at $9.31 in 2011, and its rise to 2021 high of $61.37, an ascending broadening wedge formation becomes noticeable, signifying increased market volatility. This pattern shows expanding price ranges due to the diverging trend lines of the wedge.

A strong buying signal is seen when the price dips to the lower level of the wedge before rallying back upwards. Since the 2011 lows, three such opportunities have arisen at prices of $29.27, $32.72, and $38.01, marked by blue arrows. This bullish price structure leads to significant upward movements whenever the price reaches these buying zones, as reflected by the sharp shadows at the lower boundaries. Adding to this bullish perspective, the RSI remains above the 50 mark, indicating strength in the market.

Cisco Monthly Chart (Stockcharts.com)

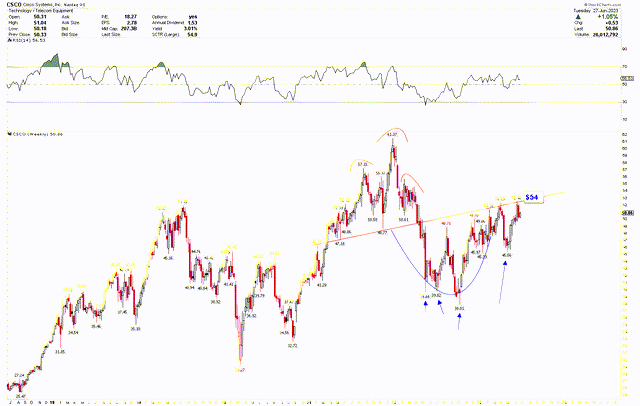

The weekly chart reveals an important detail – the price is in the process of testing a significant resistance line, characterized by the neckline of the previous head and shoulders pattern. This pattern previously led to a market downturn, but a rounding bottom has formed on rebounding from this low, now testing the critical pivot of $54. The market is poised for a significant rally should this pivot be breached. Moreover, a triple bottom formation, with lows at $39.66, $39.82, and $38.01, marked by blue arrows, suggests strong bullish momentum, with potential for higher prices. These triple bottoms will be activated if the market price breaks above $54.

Cisco Weekly Chart (stockcharts.com)

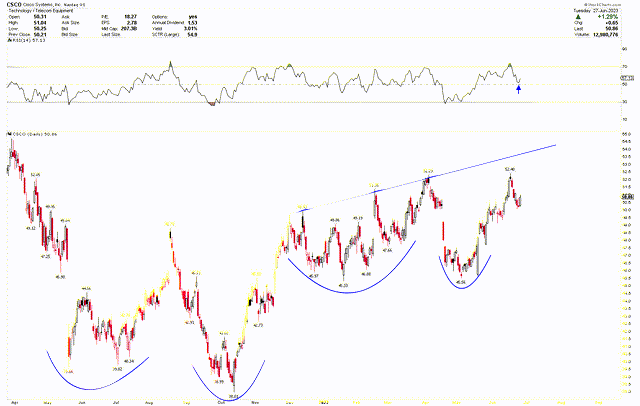

The short-term chart reveals an even clearer picture of bullish forces at play, underscored by the rounding bottom. Given that the monthly, weekly, and daily charts all illustrate bullish momentum, the market is primed for a breakout. If a breakout above $54 materializes, it’s plausible that the market may surge to new heights. The key reversals from the lows on the daily chart mostly show bullish hammers. The continuous emergence of bullish hammers on the daily charts serves as a strong indication of bullish forces prevailing in the market. Consequently, the probability of a breakout above $54 becomes higher. Considering these bullish factors, the current price offers a prime opportunity for long-term investments.

Cisco Daily Chart (stockcharts.com)

Market Risk

Cisco operates in a highly competitive industry with several prominent companies vying for the same market share. Competitors might develop superior technologies or more cost-effective solutions which could adversely affect Cisco’s business. If competitors are successful in capturing a significant portion of the market, it could negatively impact Cisco’s revenues and profitability. Moreover, the technology industry is characterized by rapid and frequent changes. This means that the products and services that are popular and profitable today may not be so tomorrow. If Cisco is unable to keep up with these changes and innovate its product portfolio accordingly, it may lose market share, affecting its financial performance.

From a technical perspective, Cisco is bolstered by the ascending broadening wedge pattern. However, should the price breach the $30 level, it could trigger a significant downward trend, nullifying the bullish formations. Furthermore, it is worth noting that the pivotal level of $54 has not been breached yet, and this level represents the neckline of the previously observed head and shoulders pattern, which is typically associated with bearish trends. As long as this pivotal level remains intact, the market continues to be in a consolidation phase, thereby increasing the risk of potential downside movements.

Bottom Line

In conclusion, Cisco Systems presents a compelling investment opportunity in the current market environment, given its prominent role in the AI hardware sector, impressive financial health, and solid technical analysis projections. The company’s significant contributions to the hardware requirements of AI model training and its innovative Silicon One chips underline its potential in a rapidly growing market. Its resilience in navigating operational challenges, ability to maintain robust performance amidst competition, and consistent generation of steady revenue underscore its stability. Furthermore, the bullish momentum reflected in the technical analyses enhances its appeal to investors. As the price currently tests the $54 level, a potential breakout above this point is anticipated to propel the stock price to significantly higher levels, supported by the presence of a triple bottom formation at the ascending broadening wedge’s support. Therefore, investors are advised to consider purchasing the stock at its current level, with the expectation of a higher price in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.