Summary:

- Cisco Systems, the world’s largest communication equipment company, is undervalued but may not be a good long-term investment due to structural issues and loss of market share.

- Despite diversifying its operations and switching to a subscription-based model, Cisco’s large size and low barriers to entry in its sectors have allowed competitors to erode its market share.

- While the company is expected to maintain profitability and deliver solid dividends, it lacks growth potential and its stock price may continue to trade below its intrinsic value.

raisbeckfoto

Investment Thesis

Many articles have been published claiming that Cisco Systems (NASDAQ:CSCO) – the biggest communication equipment company in the world – is undervalued and represents a potential opportunity for true value investors.

Don’t get me wrong, also in my analysis, Cisco ended up being undervalued if compared to the current prices, however, I dug deeper asking myself – why is it trading at such depressed prices? But what I found out made me believe that Cisco Systems is not such a great long-term investment after all.

It’s not just market inefficiency, for once, the market might be right as the cause seems to be structural. Over the last decade, Cisco has been losing considerable market share, and in the coming years, I think it’s likely to continue this negative path.

Industry Overview

Cisco Systems has helped shape the Internet revolution since the mid-to-late 1990s, becoming the largest company in the world at the height of the dot-com bubble with a market capitalization of $500 billion. But since the early 2000s, the tech industry has been going full throttle, with old guards like Cisco falling behind younger and more innovative players.

Over the years, Cisco has diversified its operations into different fields – namely Secure Agile Networks, Internet for the Future, Collaboration, End-to-End Security, and Optimized Application Experiences – and just recently has started to switch its traditional business model to a more modern subscription-based one, as many of its competitors have already done.

Despite the business model revolving around one simple task – delivering the necessary means to operate on a reliable and secure Internet network – the number of solutions offered by Cisco has increased enormously over time.

Approaching the network industry on such a large scale, leveraging on the interconnection created by its cross-segment products, has permitted Cisco to become the giant it is today, however, what has been its strength in the past is now its greatest weakness.

Large size is good to capitalize on economies of scale but at the same time can drag down companies making their business model less flexible and unable to adapt to rapid changes, something that happens very frequently on the internet.

Most of the segments in which the company operates are characterized by low barriers to entry, facilitating the entrance of new competitors which, rather than aiming to serve the entire industry like Cisco, focus on their own niche bringing continuous innovations.

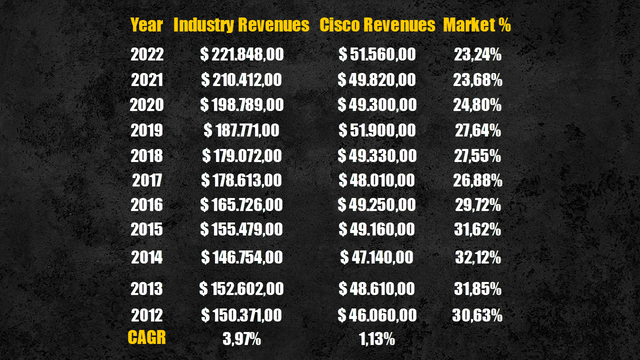

Just read one of Cisco’s 10Ks to see how many competitors it has. Other than direct rivals in the networking industry like Arista Networks (ANET), Cisco faces competition from many software companies – like Cloudflare (NET) and Datadog (DDOG) in the security segment and Zoom Video (ZM) in the collaboration segment. Even its own clients can represent potential competitors like Amazon and Microsoft with their public cloud solutions, and the list goes on.

Cisco

Like drops of water can hollow out a mountain over time, collectively, all these players from different fields have eroded Cisco’s market share in the last decade.

Revenues Projection

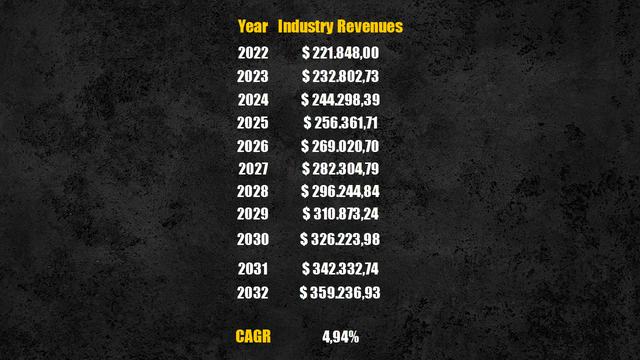

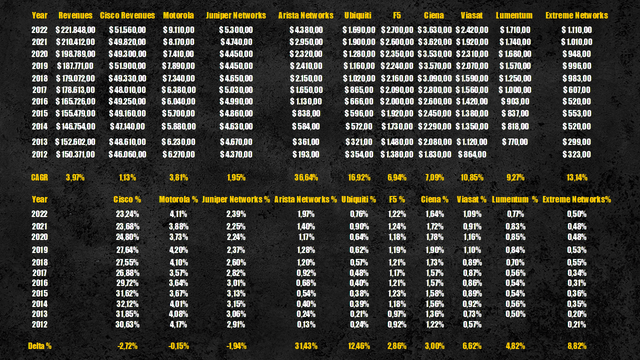

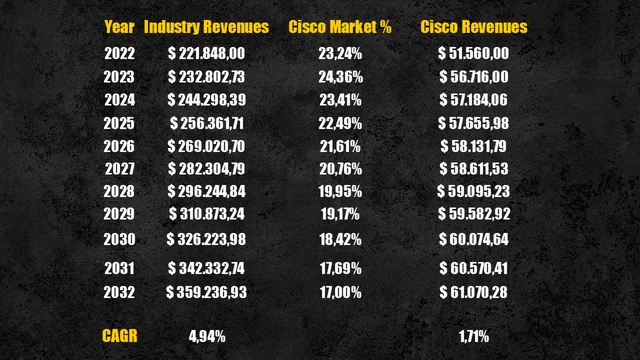

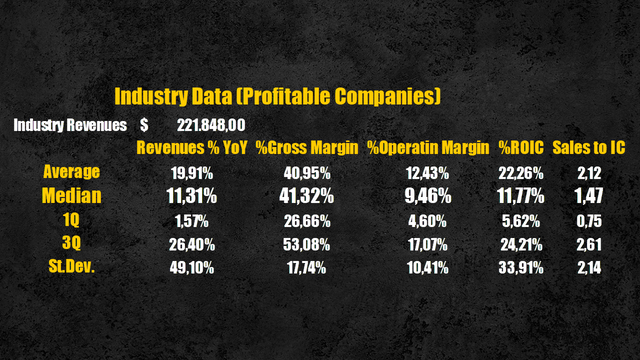

The communication equipment industry generated $221 billion in revenues in 2022, with Cisco at the forefront, reaching $51 billion in revenues equal to a market share of 23.2%.

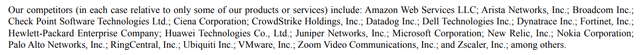

Communication equipment revenues are expected to grow at a CAGR of 4.94% for the next 10 years, based on how much and how well, collectively, the companies operating in the industry have reinvested for growth.

Communication Equipment industry expected growth rate (Personal Data)

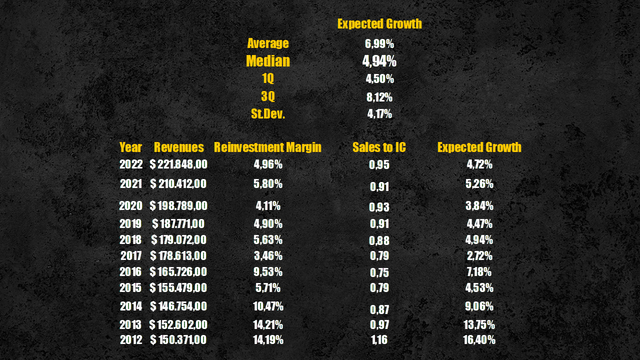

With these assumptions, the industry’s revenues are expected to reach nearly $360 billion by 2032.

Communication Equipment industry revenues projection (Personal Data)

Dwelling on Cisco, if we go back 10 years, with 46$ billion in revenues it accounted for 30.6% of the total market in 2012, which compared to current levels means a decline of 24%.

Cisco historical market share (Personal Data)

You might think it’s due to the overall market growing faster than Cisco – which is partially true given a 3.94% CAGR for the industry against Cisco’s CAGR of 1.13% – but among the 10 largest US communication equipment companies, only Cisco, Motorola (MSI), and Juniper Networks (JNPR) – top 3 biggest by revenue – saw their market shares declining, while all other companies, including Arista Networks, increased their leadership.

Tope 10 Communication Equipment companies market shares (Personal Data)

While the nimbler smaller player made their way stripping off market shares from the biggest companies, the latter struggled to maintain their undisputed control and I see this trend persisting in the coming years.

Cisco has been losing market share year over year, and in my narrative, I projected its market dominance in terms of revenues to decline roughly another quarter to 17%.

Analysts are praising Cisco for having entered the AI race by introducing dedicated chips and implementing generative AI into its applications, seeing the hyped AI as a potential catalyst for future growth.

However, chips aside – which have a minor impact on the bottom line being part of the Internet of the Future segment accounting for 12% of total revenue collectively – Cisco is only taking advantage of the new AI technologies to improve its products, but as it is doing it, all of its competitors can do the same, and as the saying goes “If everybody is special, then no one is”.

For FY 2023, the management has raised its guidance to 10% growth in revenues, but for FY 2024 they expect to return to a more modest single-digit revenue growth rate.

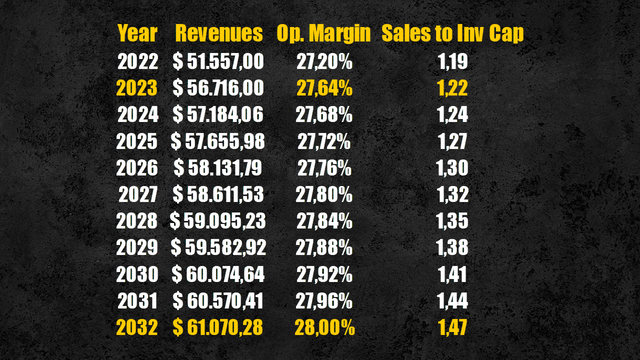

Therefore, assuming Cisco’s market share will keep declining in the future, sitting at 17%, total revenues are expected to be $61 billion by 2032.

Cisco revenues projection (Personal Data)

Efficiency & Profitability

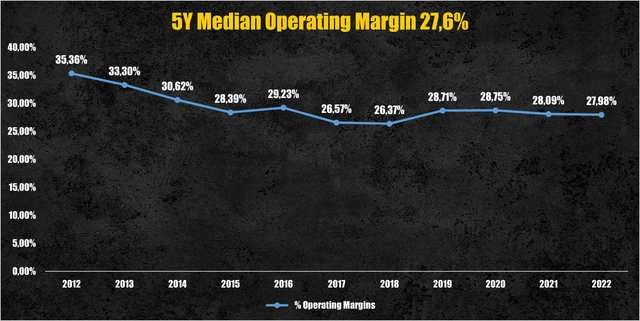

Moving on to efficiency and profitability, here Cisco’s size and economies of scale come to help, achieving a 5-year median operating margin of 27.6%.

Cisco operating margin (Cisco)

Going into the future, despite having assumed its market share to decline, I can see Cisco maintaining nice levels of profitability – on par with its historical values – as the company focuses more on achieving greater operational efficiency rather than growth.

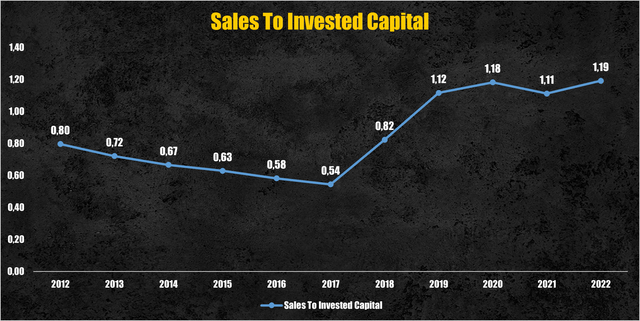

And speaking about efficiency, since 2018 Cisco’s sales to invested capital ratio – showing how much revenues have been generated for each dollar reinvested by the company – has considerably improved from 0.82 to 1.19, as capital investments declined over time.

Cisco sales to invested capital tatio (Personal Data)

As Cisco doesn’t have to support growth but rather will witness its business shrinking a little, I expect it to keep improving its efficiency, achieving a sales to invested capital ratio of nearly 1.5 by 2032, on par with the industry median value.

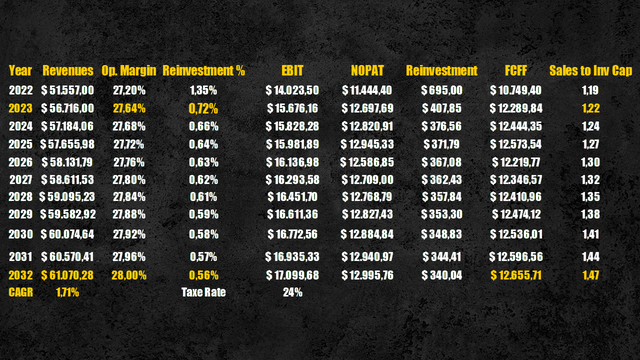

Cisco future efficiency & profitability (Personal Data)

Communication Equipment industry data (Personal Data)

Cash Flows Projection

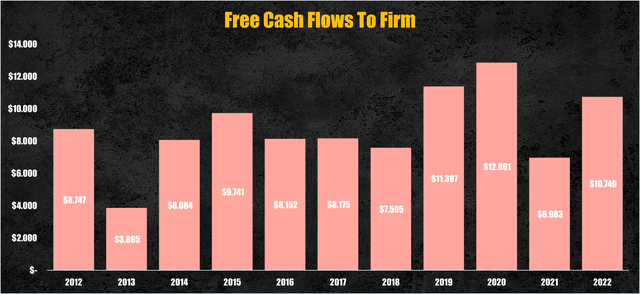

With no surprise for a mature company like Cisco, it has delivered solid and consistent free cash flows to the firm (FCFF) to its shareholders – along with a growing dividend and constant share repurchases – sitting at $10 billion in 2022.

Cisco FCFF (Personal Data)

With the assumptions made so far, Cisco is expected to keep delivering concrete results with FCFF in the range of $12 billion in the coming years.

Cisco FCFF projection (Personal Data)

Valuation

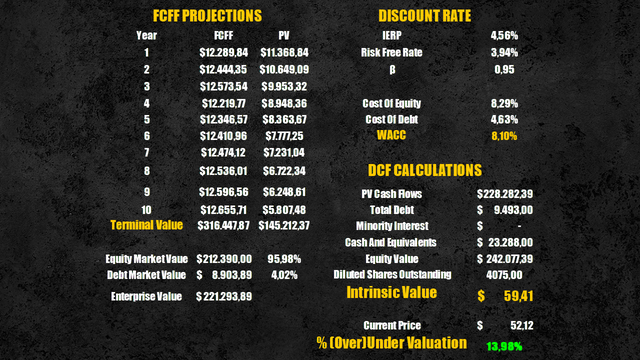

Applying a discount rate of 8.1%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $242 billion or $59 per share.

Compared to the current prices, Cisco’s stock seems undervalued by 13.98%.

Cisco intrinsic value (Personal Data)

Conclusion

As said in the introduction, despite my depressing assumptions of Cisco’s market share declining even further, at today’s prices it still results undervalued representing a potential investment opportunity.

However, in this case, Mr Market is probably right. Cisco is trading at cheap prices, but market inefficiency cannot be blamed for it.

Stock markets tend to reward companies able to meet investors’ expectations in terms of growth and profitability, and while Cisco still retains good levels of profitability – as I expect it to keep delivering solid dividends to its shareholders – in the long run it completely lacks any growth attribute.

To conclude, based on my analysis, Cisco seems undervalued at current prices, but with almost no catalyst for significant growth, Cisco’s stock price might continue to trade below its intrinsic value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.