Summary:

- Cisco’s subscription model and webscale market traction are positive, but I remain cautious due to a potential worsening order environment.

- Cisco’s Q4 results exceeded expectations, with growth in software and key product areas, but concerns about a potential economic downturn and reduced IT spending remain.

- The strength of operating profits will primarily depend on the resilience of sales because networking companies have generally been hesitant to implement cost-cutting measures.

Sundry Photography

Thesis

While I maintain a positive long-term outlook for Cisco Systems, Inc.’s (NASDAQ:CSCO) subscription model performance and its growing traction in the webscale market, several factors are currently leading to my cautious stance and hold rating on the stock. Cisco and its networking peers continue to benefit from converting their substantial backlog of orders, but they might encounter a worsening order environment, potentially dampening sales growth, especially in the enterprise switching segments, with possible impacts beginning in the fourth quarter as telecom and cloud demand softens. I don’t see any near-term catalysts for higher valuation in the near-term and maintain my hold rating on the stock.

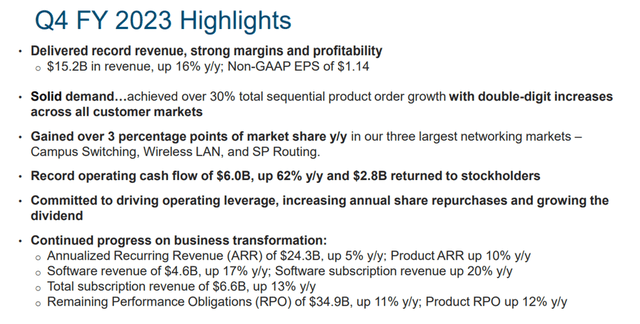

F4Q23 Review and Outlook

Cisco exceeded revenue expectations by 1% in its fiscal fourth quarter of 2023, driven by improved supply conditions, growth in software and key product areas. Fourth quarter orders were down 14% year-over-year but rose by 30% quarter-over-quarter. The software segment saw a 17% YoY revenue growth due to easing supply chain challenges and increased orders, with management highlighting the potential significance of enterprise software renewals in FY24. The FY24 guidance aligns with my expectations, indicating revenue pressure and strong margins as they enter the new fiscal year. Despite ongoing digestion in the Service Provider and Webscale segments, Cisco has not observed significant order cancellations and anticipates flat to low single-digit revenue growth for FY24, with higher earnings per share growth compared to revenue. Cisco has a backlog of around $15 billion, but the management noted that the backlog is expected to normalize in the first half of 2024.

As backlog normalizes by early to mid FY24. I anticipate that weaker macroeconomic conditions and competitive factors will eventually impact Cisco’s revenue growth. Although the backlog remains above historical levels, I believe it is important to acknowledge potential risks when visibility and lead times return to normal levels.

Challenging Environment Once Backlog Normalizes

The networking sector is experiencing a more cautious demand environment in the second half of the year. This is partly hidden by the ongoing conversion of backlogs, which are significantly higher than the historical average due to supply chain disruptions during the pandemic. Cisco achieved 10.5% sales growth in 2023, but it’s anticipated to slow down to 1.7% in 2024. Although the backlog has remained resilient and may prevent significant downward revisions in sales for the coming year, concerns about a potential economic downturn and reduced IT spending are limiting companies’ ability to raise its future outlooks. The industry’s focus is shifting towards new orders, but these are decreasing as customers receive and implement their backlogged orders. While the challenging comparisons in the first half of 2024 are already factored into consensus expectations, there is a risk of further reductions in 2024 estimates if orders do not return to normal levels over the next few quarters.

The slowdown in order activity is expected to affect various key end-markets, including cloud services, telecommunications, and enterprise solutions. In terms of specific products, sales in these end-markets are projected to significantly slow down. The most noticeable decline is expected in corporate networking equipment, such as switches, and routing equipment, as reported by Dell’Oro. It makes sense for companies to reduce investments in these areas, particularly in Wi-Fi, given the substantial increase in demand experienced from the fourth quarter of 2022 to the first half of 2023, which was driven by the need to support a more hybrid workforce.

AI’s Rise Unlikely a Broad Networking Catalyst in the Near Term

The rapid advancement of artificial intelligence may not immediately boost the prospects of traditional networking equipment manufacturers in the second half of the year, and its impact might only be modest in 2024. I believe that Cisco could see benefits as Ethernet technology plays a more significant role in AI-driven networks. It’s worth noting that AI and machine learning are not entirely new concepts or services for network companies, as they have already integrated intelligent features into their software offerings. Examples of this can be seen with Juniper Networks, Inc.’s (JNPR) Mist and Extreme’s Cloud IQ. However, companies may have only scratched the surface when it comes to AI enhancements, which could potentially be offered as a premium subscription service to complement hardware sales in the long term.

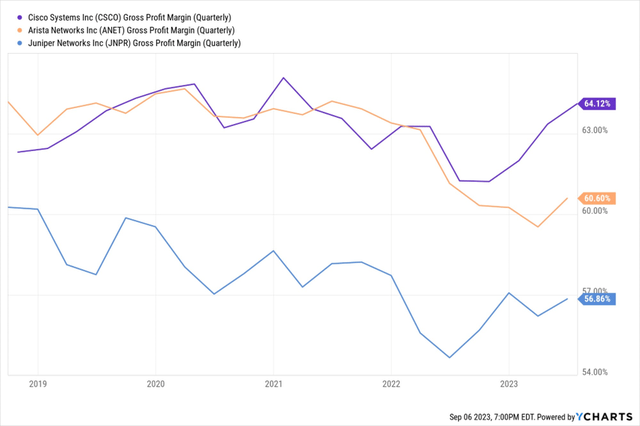

Gross Margin Relief as Costs Decline

There is potential for networking companies to achieve higher gross margins than what is currently expected in the second half of 2023 and in 2024. This improvement is likely to be driven by ongoing reductions in component and logistics costs. While gross margin projections for 2023-24 have increased somewhat in recent quarters, they still remain below levels seen before the pandemic. The decrease in component costs is a contributing factor towards better margins, but I believe margins could see further enhancements as price increases become more significant in driving sales. This, in turn, could lead to a modest improvement in operating margins. However, the strength of operating profits will primarily depend on the resilience of sales because networking companies have generally been hesitant to implement cost-cutting measures, unlike other sectors in the technology industry. While the absence of cost reductions may demonstrate confidence in near-term demand, it also means that there is a higher level of risk to earnings if sales deteriorate in 2024.

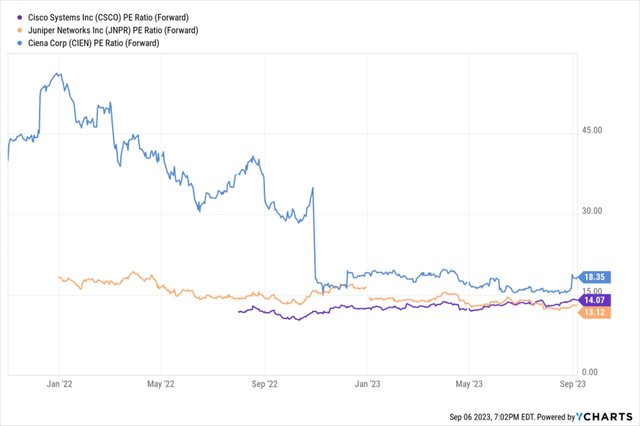

Valuation

Sliding valuations in the networking peer group suggest little confidence in forward EPS expectations. In the chart below, I compare CSCO with its two primary peers, Juniper Networks, Inc. and Ciena Corporation (CIEN). The price-to-earnings valuation for the group has fallen to 15x, a significant discount to their ∼20x pre-pandemic range. Earnings durability remains a concern due to moderating customer order activity, though companies will continue to work off the record backlog at least through the end of 2023 and potentially into 1H, which could help sustain companies’ earnings execution. I expect the P/E ratios to remain at lower levels until there’s better 2024 earnings visibility, which may not materialize until late 2023 when companies issue 2024 views. Cisco’s conservative FY24 guide suggests that the company anticipates minimal growth in its revenue due to the normalization of lead times and the gradual reduction of its backlog. Both the supply chain conditions and customer demand have been inconsistent, and I am concerned about topline deceleration. The company lowered guidance for 1Q24 as customers are taking time to process their orders. Hence, I reiterate my hold rating on the stock and recommend staying on the sidelines until there’s better topline visibility going forward.

Conclusion

Cisco has benefitted from its historically high order backlogs. However, the company is operating in a market environment where the customers are cautious when it comes to placing new orders, potentially affecting sales growth in the first half of the year. While the backlog provides some stability, concerns about a potential economic downturn and reduced IT spending are limiting companies’ ability to be optimistic about the future. I believe there are no near-term upside catalysts, and the PE ratios could remain depressed for the sector until further sales visibility appears going forward in 2024. Hence, I maintain a hold rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.