Summary:

- Cisco Systems is expected to report fiscal Q4 results with a non-GAAP EPS of $1.06 and revenue of $15.04 billion, representing significant growth.

- The company is undergoing a product-based transformation and has seen increasing expectations for its Q4 earnings.

- Cisco’s valuation is attractive, with a reasonable forward multiple and strong technical strength.

- But patience is key, as with any transformation.

Sundry Photography

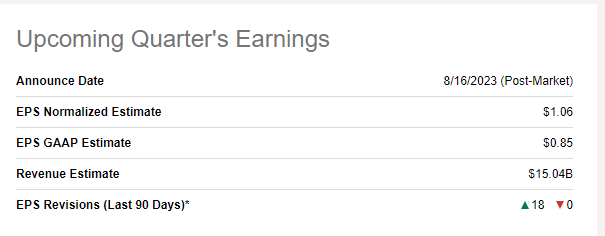

Cisco Systems, Inc. (NASDAQ:CSCO) is expected to report results for its fiscal Q4 that ended July 30th, 2023, post-market on Wednesday, August 16th. Analysts expect Cisco to report a non-GAAP EPS of $1.06 on revenue of $15.04 billion. Should Cisco meet these numbers, it would represent an EPS growth of ~28% and revenue growth of ~15%. That’s quite impressive for what is considered a slow-growing company.

CSCO Earnings Preview (seekingalpha.com)

In my last coverage of Cisco, I called the company a “tech-utility,” as it has a blend of attractive traits including a steady dividend, reasonable valuation, and a product-based transformation in progress. Since my “Hold” rating on the stock about 3 months ago, the stock has returned 8.50% (including dividend) while the market has returned about 5.50%.

With that background out of the way, let’s preview Cisco’s Q4 without any further ado.

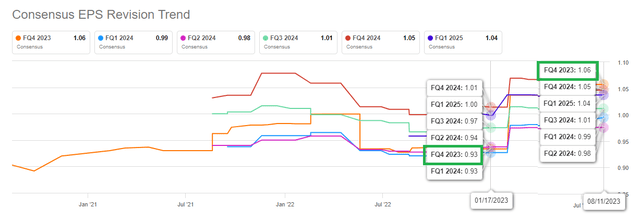

Steadily Increasing Expectations

Since the beginning of 2023, FY 2023 Q4’s EPS expectations have gone up nearly 15% from 93 cents a share to $1.06/share. Cisco played a direct part in this as the company raised its Q4 (and full year) guidance when it reported its Q3 earnings.

CISCO Q4 EPS Revisions (seekingalpha.com)

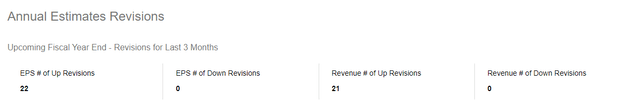

22/22 EPS revisions have been to the upside and 21/21 revenue revisions have been to the upside. Suffice it to say, Cisco is going into the earnings report with a lot of expectations.

Q4 Revisions Count (seekingalpha.com)

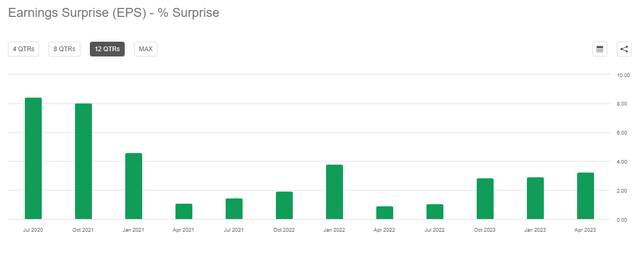

Beat or Miss? I Say A Small Beat on Both

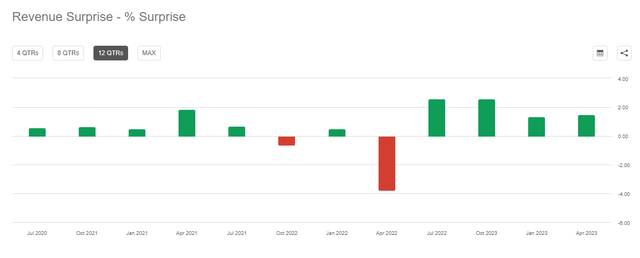

Over the last 12 quarters, Cisco has beaten EPS estimates 12 times and revenue estimates 10 times. Although that’s quite an impressive streak, the beats have been by a small margin, with the average EPS beat being 4%. Revenue beats (coupled with two small misses) have been by an even smaller margin. So, history strongly suggests that Cisco is likely to beat both EPS and revenue by a small margin.

CSCO EPS Surprise (seekingalpha.com) CSCO Revenue Surprise (seekingalpha.com)

Main Stories – Product Shift and Expenses

- As I’ve highlighted in a few of my past articles, Cisco is in the midst of a turnaround, trying to reduce its dependence on services and transform into a product and subscription-based organization. To this effect, Cisco reported an 18% jump in its Software (Product) revenue YoY in Q3 and I expect Q4 to show similarly impressive figures as the company starts reaping the slow but sure rewards of subscription-based software products. As Seeking Alpha has noted here, strong enterprise demand is expected to help the Q4 numbers.

- I expect Cisco to continue showing weakness in its networking division, which has long been the bread and butter of the company. While this may make the headlines should the company report below expectations, I urge investors to not panic as this is expected as part of the strategic shift into being product and subscription-based. I also expect the collaboration segment to continue getting weaker, given continuing domination of Slack (CRM) and Microsoft Teams (MSFT).

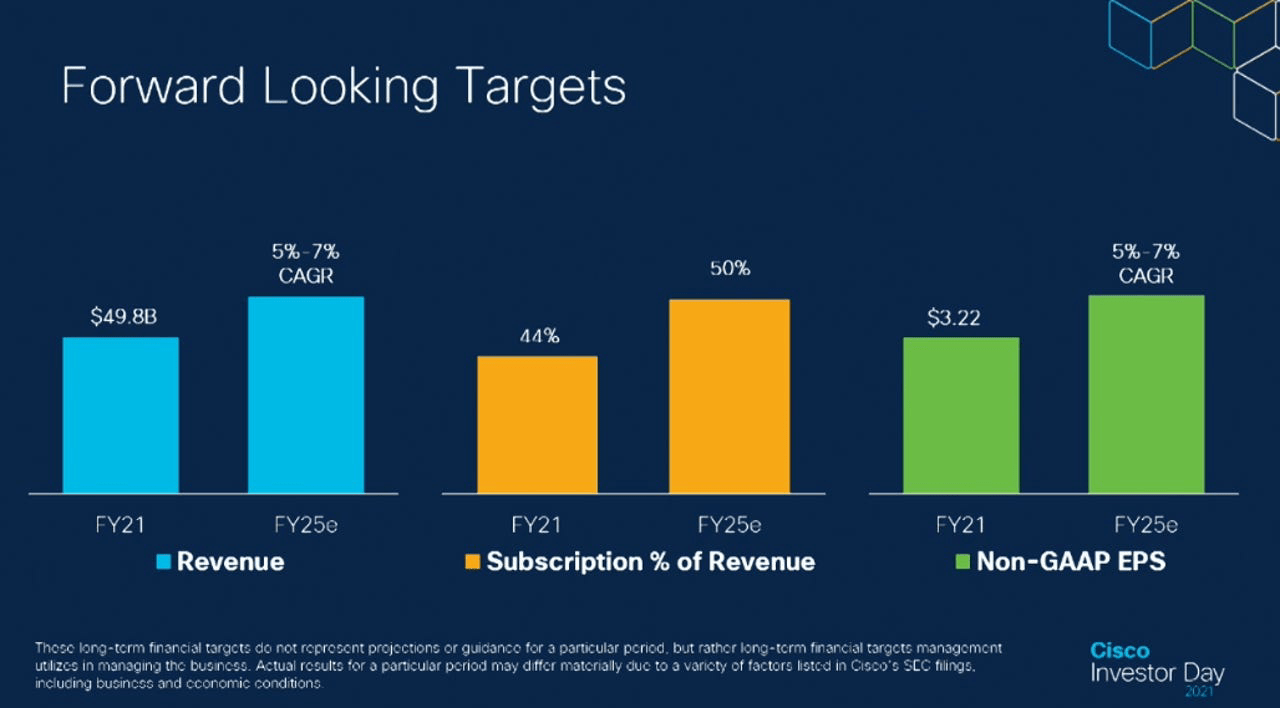

- As a company, Cisco has targeted to have 50% of its revenue to be subscription based, enabling it to target a 5% to 7% cumulative annual growth rate in both revenue and Non-GAAP EPS. I will be paying close attention to the revenue mix to track the company’s progress toward these goals. As a reminder, product and subscription-based revenue generally has much higher profit margin compared to service-based revenue.

- Finally, I will be paying close attention to operating expenses, which jumped 17% YoY in Q3. A dollar saved is worth a lot more than a dollar earned, thanks to Uncle Sam. Hence, while Cisco strives to balance out its revenue stream, it is equally important for the company to not over-indulge in expenses (both investments and employees).

CSCO 2025 Target (investor.cisco.com)

Valuation – Continues To Be Attractive

- A forward multiple of 14 is reasonable enough on its own, but even more so when you factor in an expected earnings growth of 7%/yr over the next 5 years. Add in the near 3% yield, the stock is likely among the cheapest in the $200 billion+ market-cap club.

- Given the company’s 2022 revenue of ~$52 billion, the company overall is trading at 4 times sales. This number is alright with me personally, given the stickiness of its current products and services and the transformation in progress.

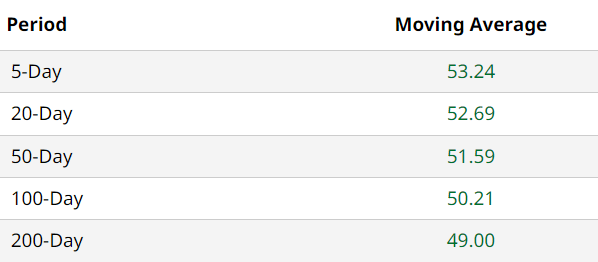

Technical Strength – In My Sweet Spot

Cisco’s stock has moved past all the commonly used moving averages. I like a few things about the stock here technically. First, the stock is about 8% higher from the 200-Day moving average. This makes me believe there is slow but sure momentum upward while also providing the stock a strong base that is not too far from the current price should things turn south. To elaborate on the latter point, sometimes, stocks tend to go way too high, too fast. Palantir Technologies (PLTR) comes to mind of the stocks I’ve analyzed recently where the 200-Day moving average was 100% below the current price, which leads to technical gaps to be filled. Should Cisco report a dud in Q4 or its guidance, I don’t expect the stock to fall too much beyond $50.

CSCO Moving Avg (barchart.com)

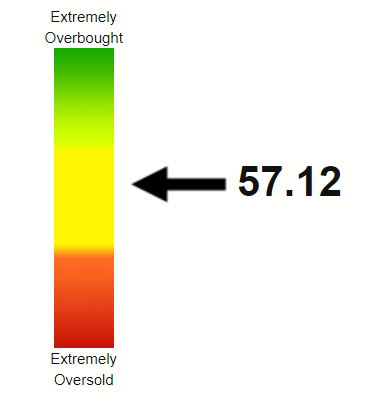

Second, the stock’s Relative Strength Index (“RSI”) of 57 is close to my sweet spot of 60. This tells me the stock has just enough momentum but also has plenty of room to the upside technically.

CSCO RSI (stockrsi.com)

Conclusion

I expect Cisco Systems, Inc. to report solid fiscal Q4 and full-year results, but I don’t believe the market will get too excited. This is a tongue-in-cheek comment, but it appears like Cisco and its investors are still paying the penalty for the stock’s overvaluation during the dot-com bubble. But it may also be a seriously long case of multiple compression affecting a stock, as no matter what the company does, the market seems to turn the other way. This may not be such a bad thing for those who are patient and accumulating shares when cheap. I am not predicting a Microsoft-like turnaround for Cisco Systems, Inc. here, but the early signs are promising.

What do you think of Cisco’s upcoming Q4 results and its work-in-progress transformation in general? Please leave your comments below.

Disclaimer: I do not currently hold a position in Cisco but may trade it on either the long or short side for leading up to and after earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.