Summary:

- Cisco, once a star during the dot-com bubble, has remained focused on traditional IT products and services.

- Over the last two decades, the company appears to have lagged behind its peers due to a lack of innovative offerings.

- With limited exposure to AI, an inability to innovate as customers migrated to the cloud, intense competition in cybersecurity, and weaker customers delaying IT investments, the company faces significant challenges.

- The stock fails to excite investors, and combined with flat multiples in recent years, I assign a “Hold” rating to the company.

Sundry Photography

Introduction

Companies rise and fall, and Cisco (NASDAQ:CSCO) has experienced this to a remarkable extent. It became the largest company in the world during the dot-com bubble, only to lose 80% of its market cap within a year.

Since then, Cisco has continued to be a crucial provider of IT systems, enabling enterprises to build their networks securely. However, over time, it seems to have lost the competitive edge it once had in the early 2000s.

Currently, the company is struggling as it failed to keep up with technological developments, competition is fierce, and the high rate environment makes customers delay orders.

The market has been very consistent pricing the stock, and I don’t see any catalyst that would change that. Therefore, I assign a “Hold” rating to Cisco.

Company Description

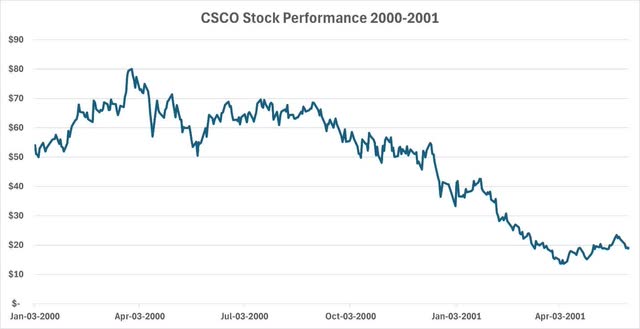

Cisco was once the most important company in the world. At the height of the dot-com bubble in March 2000, it became the most valuable company with a market cap of $500 billion and a stock price of $80.

It was not without a reason. Internet was being widely adopted. Cisco’s products, ranging from modem access shelves to routers, enabled people to use the Internet, which was the most important technological advancement at the time.

Undertaking such an important role, it was natural for investors to take an interest in the company, and the stock performed incredibly well. However, as most investors are aware, the dot-com boom turned out to be a bubble, and Cisco was among the stocks that experienced the largest decline.

The stock dropped 80% from March 2000 to March 2001.

At the time of this article’s writing, the company has a market cap of $191 billion and a stock price of around $47.5. The nature of the business has barely changed. The company still provides products and services that enable people and companies to have secure and agile access to the Internet and other networks.

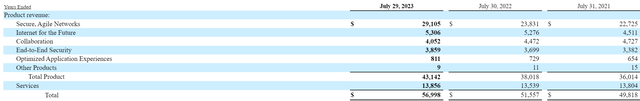

The company offers products under five different categories and different services.

Cisco offers products under five different categories, along with various services. The largest product category is Secure, Agile Networks, which is the core business of the company. In this category, Cisco provides switching, enterprise routing, wireless, and compute products. In 2023, this segment accounted for more than half of the company’s revenues.

The next three product categories are Internet for the Future, Collaboration, and End-to-End Security. Through these categories, Cisco provides optical networking, 5G, and optics products; collaboration tools including meeting solutions, devices, and communications platform as a service products; and cloud and application security solutions. Collectively, these categories accounted for nearly 23% of total revenue in 2023.

The last and the smallest product category is optimized application experiences. Under this category, Cisco provides solutions for full-stack observability and network assurance offerings.

In addition to its product offerings, Cisco has a services segment that provides support and maintenance services, ensuring customers’ products operate efficiently and remain up-to-date.

A table showing revenue generated from these categories over the last three years can be found below.

To summarize, Cisco sells various networking products to the IT industry in the US and internationally. Its sales mostly depend on companies investing in their IT capabilities.

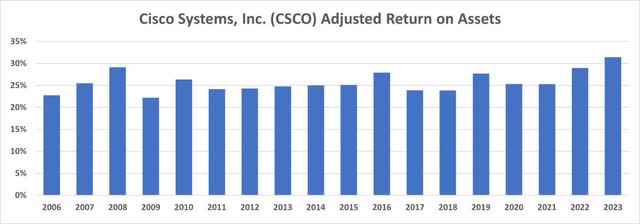

While the stock price volatility since 2000 was high as a result of the dot-com bubble, the company managed to maintain its adjusted return on assets [ROA] over the last two decades. Its adjusted ROA has usually been around 25%, with exceptions in 2008 and 2023.

Business Priorities and Potential Drivers

The company has determined strategic pillars to focus on for long-term growth. I believe some of these pillars may lead to profitable growth in the future.

First of all, the company is focusing on helping build the future of the Internet and secure networks. As technologies like artificial intelligence develop, the need for advanced cybersecurity solutions cannot be overstated. Utilizing its long history and established position, the company may benefit from increasing investments in this area.

Additionally, the rise in big data applications and artificial intelligence products has highlighted the need for better and larger infrastructure, including data centers. Cisco’s networking products may find buyers among companies enhancing this infrastructure. Currently, half of Cisco’s R&D spending is focused on artificial intelligence, cloud, and cybersecurity. (investor day – 2)

Another strategic pillar for the company is enabling hybrid work. Cisco is delivering secure access, safer workplaces, and enhanced collaboration experiences. With the transition to hybrid work gaining momentum after the pandemic, this area may continue to be a significant growth opportunity.

The Company Fails To Excite Investors

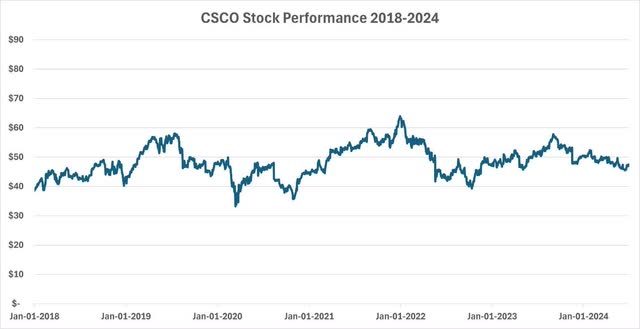

Unfortunately, the company has yet to deliver on these growth promises, leaving investors are disappointed. While the S&P 500 is at an all-time high, Cisco’s stock has been mostly flat for the last 6 years and fell 6% year to date.

There are several reasons for this. First of all, although the company highlighted this during their investor day, the company seems to have limited exposure to data centers, which have seen immense investments lately due to artificial intelligence advancements.

The business mix, as seen above, primarily involves traditional enterprise IT solutions. Cisco helps other companies build their own networking systems. Although the company will likely realize some additional earnings from efforts to improve infrastructure, its core business and competency are not directly tied to enabling artificial intelligence.

Its products are still critical but are not as exciting to investors as data center products, which have gotten the most attention.

In addition, the core networking business doesn’t seem to have the same competitive strength it had in the early 2000s. This business is losing market share to new entrants such as Arista Networks (ANET).

There are mainly two reasons for this. First of all, the company seemingly became too big to maneuver in changing market conditions. Over time, companies migrated their systems to the cloud from on-premise hardware. Cisco kept its focus on traditional solutions, which have seen stagnant growth.

Secondly, as mentioned, the company was late to venture into the AI space. While its peers has been focusing on artificial intelligence technology for months, Cisco is just now ramping up its investments in artificial intelligence.

Moreover, although cybersecurity applications seem to have a promising future, the competition in this area is fierce. Major pure-play players such as Palo Alto (PANW) and CrowdStrike (CRWD) continue growing and huge companies like Microsoft (MSFT) and IBM (IBM) already have established positions. Even for a large company like Cisco, it is a challenging market to gain significant share.

Lastly, the high-interest rate environment has led many enterprises to postpone their investment and large purchasing plans, including plans to upgrade their IT. This has resulted in lower demand for Cisco’s products. However, the situation may improve if the Fed starts cutting interest rates.

Consistent Multiples Make It Hard To Justify An Upside Scenario

The consensus seems to be that Cisco is undervalued. The average SA Analysts rating and Wall Street rating for the company is “Buy”, indicating its inexpensiveness.

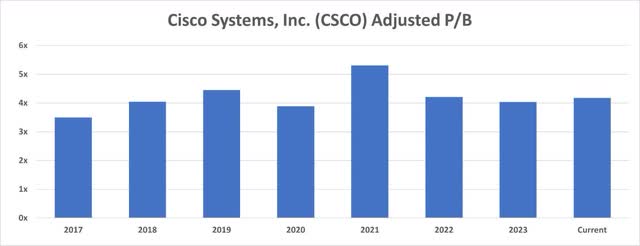

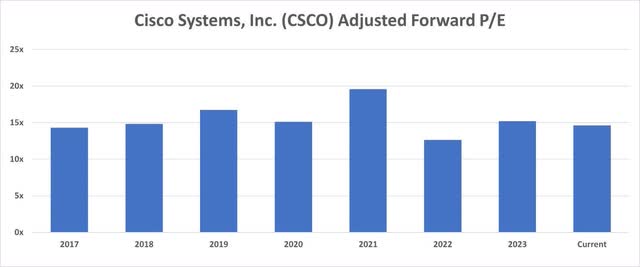

However, I will take a different perspective by using adjusted price-to-book and price-to-earnings multiples.

I am less concerned with how cheap the company is and more focused on how the market perceives and prices it. As long as the market doesn’t change its opinion, it does not matter what the fair value of the stock is.

The charts below show the adjusted P/B and P/E multiples since 2017.

Since 2017, the market has been pricing the company within a very narrow range of multiples. Currently, these multiples are both around the midpoint of these historical ranges.

This indicates that the market has a very consistent perception of Cisco, which is not easily changed. The company needs to demonstrate that it can achieve higher growth and become more profitable. However, current realities, including declining market share, limited exposure to high-growth areas such as artificial intelligence, and companies postponing their IT investments due to high interest rates, do not support a change in this market perception.

In summary, the company fails to excite investors.

Risk

The main risk with this thesis is that Cisco successfully ventures into AI and grows in areas that are intriguing to potential investors. This could lead to an appreciation of the stock price and outperforming the market index.

As the core business is focused more on traditional IT offerings, one effective way of achieving this is by acquiring other successful businesses. This could result in significant synergies thanks to Cisco’s substantial presence in technology markets.

The company is aware of this, which is why it recently closed the Splunk acquisition. This acquisition is expected to provide major benefits for the networking equipment and cybersecurity offerings, and has already added $4.2 billion in new revenue that is expected to increase to $5.6 billion in fiscal year 2025.

Although this is a sizeable one-off boost in growth, I am skeptical that this acquisition will make significant long-term contributions to earnings, impacting today’s fair valuation. I choose the cautious path of waiting and observing how Splunk is integrated and if it helps the company close the gap with its peers.

Conclusion

Once the largest company in the world, Cisco has failed to adapt to changing market conditions and has fallen from grace.

The company’s focus on the traditional IT sector, rather than high growth areas such as artificial intelligence, combined with a decline in market share of the core business, competition in cybersecurity, and the current high rate environment, has put pressure on the stock price. There is no strong catalyst to excite investors at this time.

Investors have been pricing the stock with consistent multiples for the last eight years, making this environment challenging for multiples expansion.

For these reasons, Cisco receives a “Hold” rating from The Alpha Oracle. If the company makes a significant venture into artificial intelligence, this thesis and the rating can be reviewed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.