Summary:

- CSCO’s fall from grace has been difficult to watch, but the company has increased profitability, implemented a strong dividend growth program, and is buying back billions in stock.

- Despite declining shares, CSCO is positioned to benefit from AI spending and has an attractive valuation, making it a potential long-term investment opportunity.

- CSCO’s balance sheet, revenue diversification, and potential growth in the AI industry make it an exciting investment opportunity with strong dividend growth and buyback programs.

PM Images

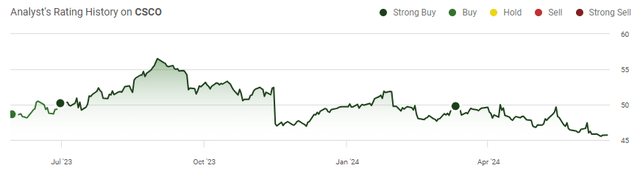

Cisco Systems (NASDAQ:CSCO) (NEOE:CSCO:CA) helped build the internet, was one of the largest companies in the world, and at one point, analysts were speculating that it could become the first $1 trillion company. CSCO’s fall from grace hasn’t been easy to watch, and it’s difficult to be a shareholder. This is a company that went from generating $18.93 billion in revenue during the 2000 fiscal year to growing their business over the next 23 years to $57 billion of annualized revenue. CSCO has increased profitability, implemented a strong dividend growth program, and is buying back billions in stock, but it has never returned to its dot-com highs. Some would say CSCO is a classic case of what can happen when bubbles burst, while I look at the numbers and am perplexed as to why more investors aren’t excited about CSCO at their 52-week lows. CSCO should be a direct and indirect winner from a product standpoint in the wave of AI spending, while also having an attractive valuation. Despite shares of CSCO declining by -17.18% over the past 5-years, and being down -9.18% in 2024, I believe the market’s perception of CSCO will change the same way it did with International Business Machines (IBM).

Seeking Alpha

Following up on my previous article about Cisco Systems

Things haven’t gotten better for CSCO since my last article was published on March 11th (can be read here). Since then, shares of CSCO have declined by -7.74%, which is basically the opposite of the S&P 500, which has appreciated by 7.25%. When CSCO’s dividend is factored in, the total return is 6.99%. I had discussed why CSCO was an opportunity because of its upcoming hardware, but my thesis has now expanded after looking into how much NVIDIA Corporation (NVDA) is expected to grow. While CSCO should be a direct winner from hardware upgrade cycles and an increased need for their services as cybersecurity becomes more commoditized, CSCO should also be an indirect winner from AI expansion. As more data centers come online and companies expand their footprints, CSCO should benefit because more networking equipment and security applications will be required. I think that the market is overlooking an opportunity, as CSCO could see multi-year tailwinds that correlate to top and bottom-line growth.

Seeking Alpha

Risks to investing in Cisco Systems

The largest risk to investing in CSCO is that the market’s perception doesn’t change. CSCO has been one of the worst-performing large-cap tech companies over the past 5-years, and the market doesn’t seem to get excited by anything CSCO does. Differentiating its revenue mix by adding in software and services didn’t move the needle, and the market seems unphased by CSCO’s capital allocation program which is comprised of dividend growth and buybacks. CSCO’s share price has never returned to the glory days of the early 2000s despite all the top and bottom-line growth that’s been created. Investors could easily be sideways in their investments for years to come or experience further capital erosion. Outside of opportunity cost, CSCO faces extensive competition from companies such as Arista Networks (ANET). We could experience negative growth in the future as CSCO’s competitors take market share away from them. Overall, CSCO hasn’t worked, and it’s anyone’s guess as to what it will take for the investment community to get excited about them.

Why I am more bullish on CSCO as a long-term investment than I was before

At the end of CSCO’s 2nd quarter, they were sitting on a pile of cash and an unleveled balance sheet. CSCO had $26.23 billion in on-hand liquidity between cash and short-term investments, with an additional $2.57 billion in long-term investments and $12.66 billion in total debt between long-term debt, short-term borrowings, and other accruals such as capital leases. CSCO had a net debt position where its liquidity outpaced its debt by $13.58 billion. CSCO has finally completed its acquisition of Splunk, for which they paid $157 per share, which was a $28 billion deal. CSCO’s balance sheet absorbed the deal well, and CSCO now has $33.21 billion of total debt, placing them in a net-debt position of $13.69 billion after their liquidity is accounted for. CSCO hasn’t even seen the impacts from this deal, and its net debt to EBITDA ratio is 0.82x ($13.69 billion / $16.68 billion) as they are still producing more EBITDA than their entire net debt balance.

Cisco Systems

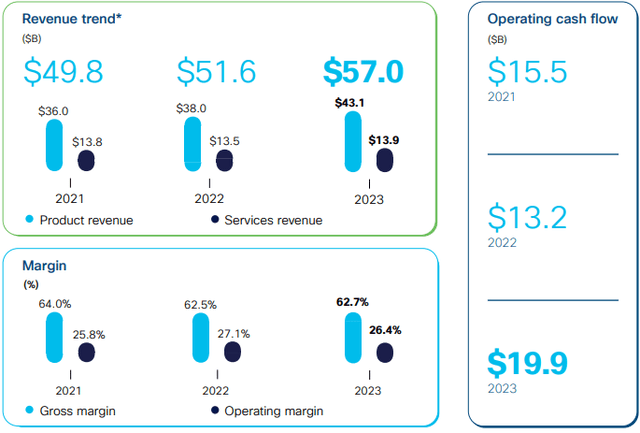

CSCO has worked tirelessly to not only diversify its revenue mix but to provide as much value to their customers as possible. CSCO closed its 2023 fiscal year, generating 24.39% of its revenue from services as CSCO offers clients cloud infrastructure, software, and security functionality. Splunk is a pioneer in digital systems with over 1,100 patents as they have built a leading enterprise security company. Splunk has entire platforms to monitor cloud activity, Enterprise Security solutions for IT security professionals, which is known as SOC, and asset and risk intelligence software for compliance monitoring. Splunk finished the 2023 fiscal year generating $4.22 billion in revenue and was free cash flow positive FCF having generated $997.8 million in FCF. The acquisition of Splunk will allow CSCO to expand its security and cloud capabilities while providing more value for its customers and opportunities to CSCO. There will be cross-synergies as CSCO customers will benefit from the expertise SPLUNK brings to the table, while Splunk customers will now have a massive hardware company whose products and services will work seamlessly with their security protocols. As we enter into an age if machine learning ML and artificial intelligence AI the requirements from hardware and software will only advance, and this acquisition will allow CSCO to remain a leader in corporate infrastructure, services, and security.

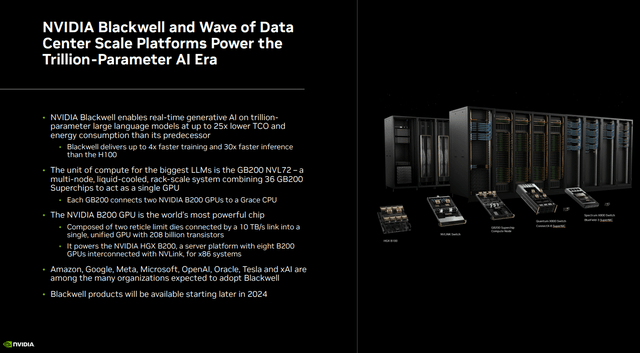

This could be one of the most exciting times for CSCO as a company because we’re experiencing a computing revolution. NVDA went from generating $26.97 billion of revenue in their 2022 fiscal year to $60.92 billion in 2023. In the trailing twelve months (TTM) NVDA has generated $79.77 billion in revenue, and the consensus estimate across 52 analysts is that NVDA will generate $120.01 billion of revenue in 2024. Companies cannot buy NVDA chips quickly enough, and they just introduced their Blackwell product line, which is expected to be widely adopted. Some projections indicate that NVDA will ship 1.5 million AI server units per year by 2027, and in their 2027 fiscal year, analysts are projecting NVDA will generate $182.14 billion. Between all of the companies acquiring chips for the AI renaissance, the amount of data center space needed will continue to expand. While CSCO will be a direct beneficiary of the AI wave due to a demand for AI networking products and services, CSCO will be an indirect beneficiary as well because as more data centers are built, more networking equipment will be needed. Networking hardware is essential because companies will need to ensure every server maintains secure and efficient connections to private networks and public internet. Modern data centers have large hardware requirements and complex software needs, and CSCO specializes in both. CSCO should see increased demand for its routers, switches, firewalls, access points, software, and services as more data center infrastructure is built, which will be beneficial for its top-line growth.

NVDIA

CSCO’s looks extremely attractive based on its valuation and dividend growth

It’s hard for me to be bearish on a company that has generated $55.36 billion in revenue during the TTM then turned around and produced $35.8 billion in gross profit, $14.82 billion in operating income, $12.12 billion in net income, and $12.41 billion in FCF. CSCO is operating at a 64.65% gross profit margin, and a 26.76% operating margin. On a pure profitability level, CSCO is producing a 21.88% profit margin and a 22.42% FCF yield. This isn’t a company that is frivolously spending, they continuously reward shareholders through buybacks and dividends. One of the exciting aspects is that CSCO is expecting the Splunk deal to be cash flow positive and gross margin accretive in the 2025 fiscal year. After the transition and synergies are worked through the system, CSCO expects the deal to be non-GAAP EPS accretive in the 2026 fiscal year. Currently, the street expects CSCO to generate $3.70 for the 2024 fiscal year, which ends in 2 weeks, which places CSCO at a 12.33 forward P/E. Analysts are expecting a dip in EPS during the 2025 fiscal year of about -$0.15, but that CSCO gets back to growth in their 2026 fiscal year. We have no idea how the Splunk deal will actually impact CSCO’s top and bottom line or how the AI race will unfold but paying 11.92 times 2026 earnings looks very attractive to me with all of the potential CSCO has over the next 2 years.

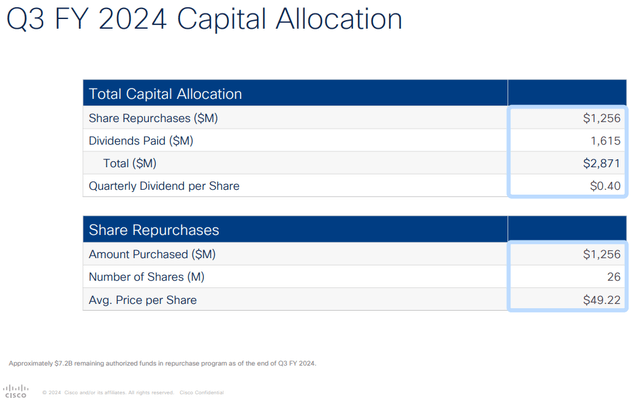

In addition to the inexpensive multiple on CSCO’s earnings, CSCO has been a dividend and buyback champion, returning billions to shareholders on an annual basis. In Q3 2024, CSCO allocated $2.87 billion to shareholders as they repurchased $1.26 billion worth of shares and paid $1.62 billion in dividends. CSCO purchased 26 million shares on the open market at an average price of $49.22, which is a few dollars higher than where shares are today. Since the close of their 2014 fiscal year, CSCO has repurchased 1.07 billion shares as they have bought back 21% of the company. CSCO still has $7.2 billion remaining in its buyback authorization, and there is no shortage of capital when it comes to its capital allocation plan. At this rate, CSCO is allocating 92.53% of its FCF to buybacks and dividends while retaining $927 million in FCF based on the TTM numbers. Every time CSCO repurchases shares, its EPS is positively impacted as its earnings are dispersed across a smaller number of shares, and the amount of capital needed for dividends decreases because there are fewer shares to pay a dividend to.

Cisco Systems

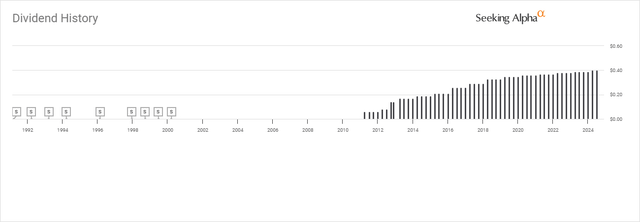

CSCO continues to be a dividend powerhouse as it pays a dividend of $1.60 per share, which puts its dividend yield at 3.5%. CSCO has increased its dividend for the past 12 consecutive years and has grown the annual dividend by 567% as it increased from $0.24 to $1.60 per share. CSCO’s dividend has grown at a 5-year average growth rate of 3.22%, and CSCO is paying investors 43.24% of their EPS, so there is a lot of room left for continued dividend growth. As earnings are projected to get back to growth next year, I am not worried about the dividend being impacted, especially since CSCO is projected to grow its earnings by high single digits YoY for the next 3 years coming out of the 2025 fiscal year.

Seeking Alpha

Conclusion

CSCO has been dead money for years, and Mr. Market doesn’t seem inspired by anything CSCO does. The Splunk acquisition hasn’t created excitement, nor has the robust capital appreciation plan. As an investor, it’s been difficult, but I am more bullish on CSCO than ever, as they should be a direct and indirect beneficiary of expanding CapEx allocations across the tech sector. The AI boom is just getting started, and there is going to be growing demand for data center infrastructure to support all the GPUs that are being purchased. CSCO should benefit directly from hardware upgrades as we move into an advanced age of computing and indirectly benefit as companies add more GPUs, they will need more networking equipment and services to manage and protect these assets. I wouldn’t be surprised if CSCO trades sideways for a bit, but I think CSCO is very undervalued, and the market will eventually treat it in a similar way to IBM.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.