Summary:

- Cisco’s focus on its core offerings has resulted in missed growth opportunities, particularly in AI.

- Although the company is now trying to enter the AI infrastructure market, it may have missed the industry’s aggressive growth phase.

- Cisco’s valuation multiples have been trading within a narrow range for years, indicating limited upside potential unless the company delivers extraordinary results. As a result, Cisco receives a “Hold” rating.

JasonDoiy

Introduction

Cisco (NASDAQ:CSCO) has remained true to its core, missing growth opportunities in the meantime. It is great at what it does, but it could have achieved a lot more, which investors still expect it to do.

It has been left out of the AI race and is now trying to enter the AI infrastructure space. I believe it is too late for the company to realize considerable earnings from this field, as AI users have started to question whether their investments are worth it due to monetization issues.

The company is struggling with competition in other non-core areas, and there is little to excite investors. Valuation multiples suggest that the stock is fairly valued. Therefore, Cisco receives a “Hold” rating.

Company Description

Cisco is well-known to many investors, especially those who were active investors during the dot-com bubble in 2000.

Its products and services were crucial when the internet was being adopted. Its products, ranging from modem access shelves to routers, enabled the use of the internet. As the internet rose, the stock rose, and as the internet fell, the stock fell significantly. It is still below its highs seen in 2000.

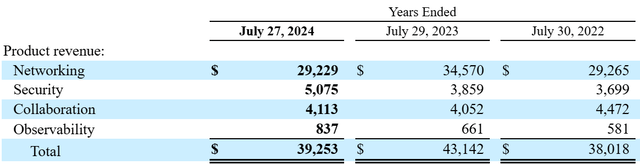

While the stock price has been volatile, the business remains largely the same. More than half of Cisco’s business is still networking equipment including routers, switches, gateways, and modems, while the security solutions and collaboration software the company provides make up 13% and 10.5% of total revenue, respectively. The smallest segment is observability, where the company provides network assurance, monitoring, and analytics offerings.

Cisco 2024 10K

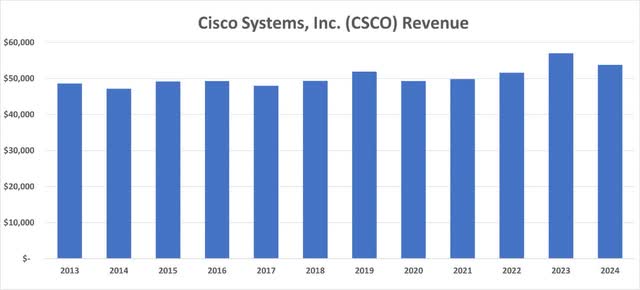

Revenue has remained strong thanks to Cisco’s established position. However, the company struggled to sustain its market share in a growing market, leading to stagnant revenue growth.

S&P Capital IQ

Performance Since Publication

I initiated coverage on Cisco on July 1st with a “Hold” rating. Since then, the stock has outperformed the broader S&P 500 index. The stock was up 11.6% (12.6% including dividends), while the S&P 500 was up 4.8%.

S&P Capital IQ

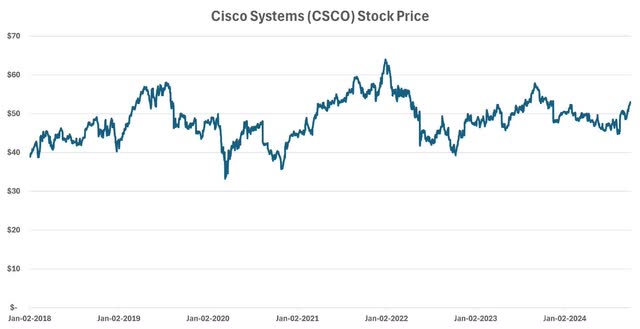

As seen above, this outperformance is mainly the result of the price jump in mid-August and the steady increase in September. The rise last month can be attributed to interest rate cuts and expectations of higher economic activity.

Cisco released its Q4 earnings on August 14th. Although revenue was down 10%, the company beat revenue and EPS estimates. The fiscal year 2025 revenue guidance midpoint was in line with the consensus.

In addition, the company announced plans to reduce its global workforce by about 7%. This was seen as the continuation of the tech sector layoffs we have been witnessing over the past few years. The company says this will allow it to invest in key growth opportunities.

The bigger news was around artificial intelligence, which we will discuss in the following section. Investor reactions have been positive in general.

Evaluation of Potential Drivers

In the previous article, we mentioned that the company failed to excite investors, and this was reflected in the stock price. Although the stock is up around 12% since then, this picture has not changed. It has mostly been flat since 2018.

S&P Capital IQ

We discussed four potential drivers of the business, which we will now reevaluate:

Firstly, the company continues to be overfocused on traditional enterprise IT solutions, instead of new high-growth technologies. It doesn’t seem easy for such a large business to change its revenue mix to adapt to new technologies. In addition, customers have been cautious about spending on these solutions due to high interest rates. Demand may increase as rates decline, however, I believe rates will remain higher for longer than most people think.

Secondly, the company doesn’t seem to have the competitive strength it used to have in the early 2000s. It is losing market share both in the core networking business against players like Arista Networks (ANET) and in the cybersecurity business against Palo Alto (PANW) and CrowdStrike (CRWD), despite the recent panic around CrowdStrike.

Lastly, and possibly more importantly, the company has been very late to venture into the AI space. Still, Piper Sandler analysts’ interpretation of the Q4 earnings shows that Cisco might continue shifting investments towards AI, potentially taking some share of that massive market.

This perspective gained strength as CFO Scott Herren spoke at the Goldman Sachs conference and reiterated expectations for $1 billion of AI product orders in fiscal year 2025. He noted that the company saw over 30% growth from hyperscalers in 2024.

Although Cisco’s products are not revolutionary, new switches, routers, and other networking products are needed for enterprises to make their infrastructure AI-ready.

I have two concerns here. First, I am still worried that the company will struggle to enter the AI infrastructure market this late. Secondly, even if it does successfully enter the market, I fear it may have already missed the aggressive growth period of the industry. Not only have data center investments lost the hype, but companies failing to monetize AI offerings have also slowed the adoption of this technology, making companies more cautious about investing millions in it.

Justifying an Upside Scenario Is Tough

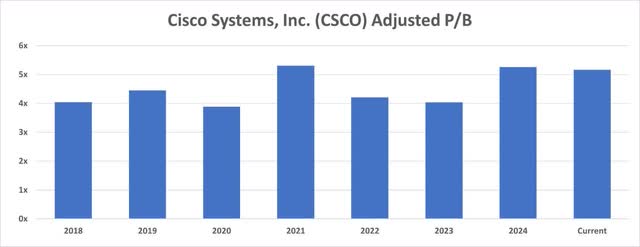

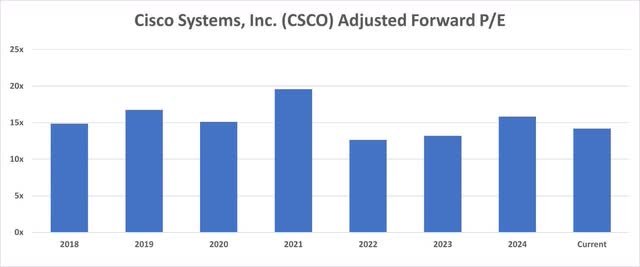

This section is very similar to my initial analysis. You can find the updated adjusted price-to-book (“P/B”) and price-to-earnings (“P/E”) charts below. Both of these charts show that the multiples have not moved much in the past seven years. Currently, the stock trades at the high end of the historical P/B range and the average of the historical P/E range.

S&P Capital IQ

S&P Capital IQ

These charts suggest that the market perception of this company’s growth has been very stable. The company needs to achieve the extraordinary to change this perception. Only then may the stock outperform the broader market in the long term, which I doubt will happen.

Conclusion

Cisco has had a very stable business over the years. While it added to its offerings, the business barely changed since the early 2000s.

The last few years could have been much better for the company if it shifted its focus to AI earlier. It is trying to make this push now when other companies and investors are questioning if investments in AI are worth it. I think Cisco is too late to become an important part of the AI infrastructure space.

As mentioned before, the company does little to excite the investors, and an evaluation of the stock’s valuation shows that it has been priced within a limited range of multiples over the last 7 years.

Therefore, I reiterate my “Hold” rating on Cisco. I believe there are better opportunities that can outperform the broader index in the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.