Summary:

- As a value stock, Cisco appears increasingly attractive as market liquidity conditions normalize.

- The company ranks very high in terms of capital allocation prudence and this is going to serve long-term shareholders well.

- Cisco’s stock appears conservatively priced given the company’s strategic positioning and the ability to improve margins.

kynny

As valuations in the high-flying technology sector normalize and increased volatility persists, Cisco Systems, Inc. (NASDAQ:CSCO) once again faces a major test to its strategy.

For the most part, this strategy has been oriented towards sustainable growth and very conservative capital allocation – a feature that has become very rare in today’s tech sector.

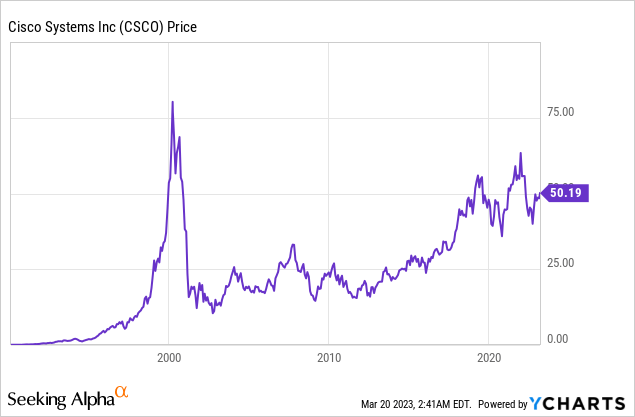

It is also a very different path to the one taken by the company prior to the dot-com bubble, when the share price reached astronomical levels.

For this reason, Cisco is one of the companies that is most often given as an example of what happens to future returns when investors lose their minds. Even though total revenue has nearly doubled and operating profit almost quadrupled since 2002, CSCO’s share price is still way-off from its early 2000s highs.

Although this should serve as a stark example to many growth investors today, it also tells the story of how Cisco has changed over the past two decades and why it is now better-positioned to preserve shareholder value.

The Benefits Of A Value Stock

After years of value stocks underperforming growth names, the former has somewhat become an equivalent of a failure. Most market participants have been busy chasing the highest returns possible regardless of the risks involved which ultimately left value stocks in the dirt.

As of late, however, the process of monetary policy normalization has given us a reason to re-evaluate this notion.

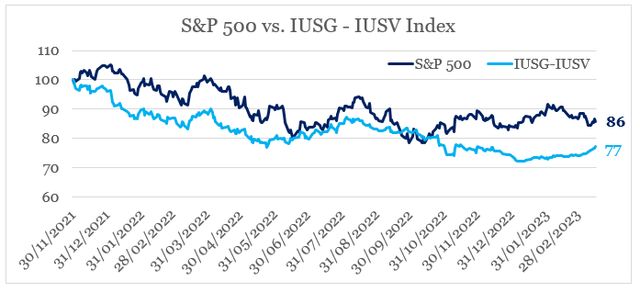

To illustrate that, I am using an index that takes a long-position in iShares Core U.S. Growth ETF (IUSG) and a short-position in iShares Core S&P U.S. Value ETF (IUSV). Thus, the index measures the performance of growth stocks relative to value.

Since the S&P 500 came off of its all-time high in late 2021, the IUSG-IUSV index has significantly underperformed the broader equity index. Since November of 2021, the IUSG-IUSV index has declined by 23% compared to a mere 14% decline for the S&P 500.

prepared by the author, using data from Seeking Alpha

This highlights the risks of having high exposure to growth when things turn sour. Therefore, should the market downturn continue to accelerate, companies with heavy exposure to the ISUG-IUSV index will be in a far worse position than value stocks.

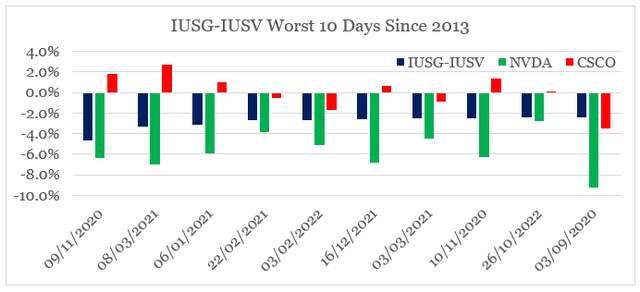

To illustrate that, we will compare Cisco’s performance to that of Nvidia (NVDA). Even though their underlying businesses are not directly comparable, the latter is one of the most heavily exposed large cap names to the growth index.

In the graph below, we see the 10 worst days for ISUG-IUSV index since 2013 and how each of the two companies mentioned above performed on these days. Not only was CSCO relatively unaffected, but it also acted as an important counterbalance to the highly negative returns experienced by the rest of the market.

prepared by the author, using data from Seeking Alpha

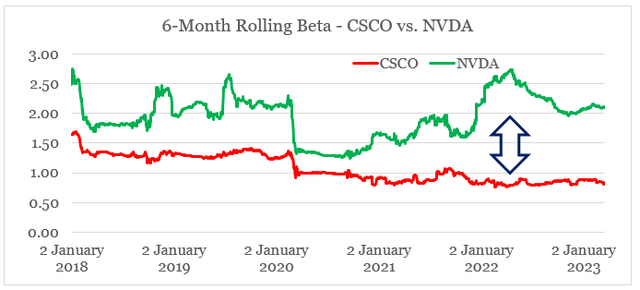

From another perspective, the beta coefficient with the S&P 500 also shows the enormous risk for investors holding high growth names. As broader equity market fell in 2022, CSCO beta actually fell while that of NVDIA noted a massive increase.

prepared by the author, using data from Seeking Alpha

The Merits Of Conservative Capital Allocation

All the share price movements we saw above should not be taken as a given and they tell a story of what these businesses have been doing over the past years and even decades.

As a starting point, Cisco has embraced a well-thought approach when it comes to capital allocation. Instead of pursuing the latest and hottest trends by expanding aggressively through M&A deals and rewarding management with irresponsibly high stock-based compensation packages, CSCO’s management focused on more prudent decisions aimed at rewarding long-term shareholders.

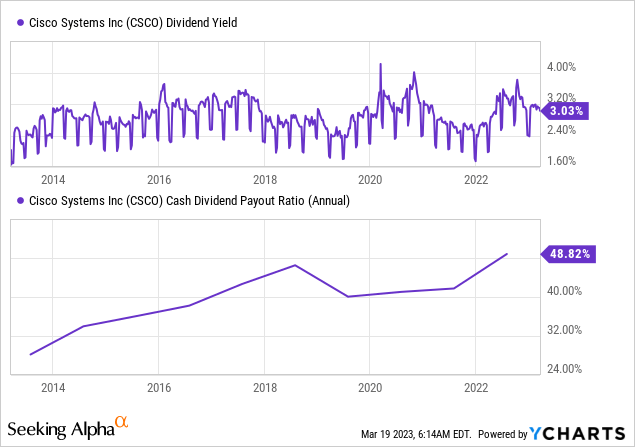

The initiation of a quarterly dividend was one major development that provided shareholders with a stable and growing passive income. At the moment CSCO’s forward dividend yield of 3.1% (note the dividend yield in the graph below does not account for the recent increase) is near the high-end of the past 10-year period.

The dividend payout ratio has gradually increased over the same period, bit it is still relatively low at less than 50%.

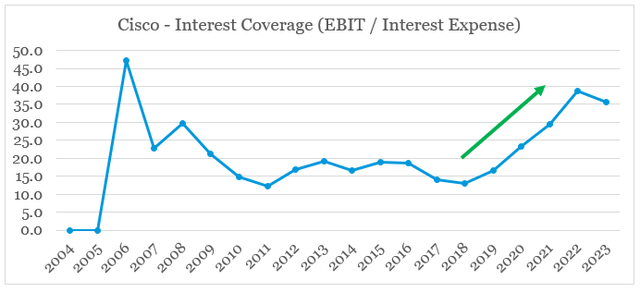

Over the past 10 years, Cisco has also reduced its debt load and its interest coverage ratio is now at very healthy levels.

prepared by the author, using data from SEC Filings

This significant improvement in the company’s financial health is important as interest rates increase at a time of looming recession on the horizon. More importantly, however, it would allow Cisco to be more active on the M&A front should the market continue to decline.

On the M&A side, I would say our strategy, as you would expect, has not changed. I think the market dynamics have changed, and I think that the longer valuations remain somewhat muted from their peaks. I think some of the companies are probably coming to more of a real position on what – how long these valuations may exist and were prior valuations even realistic in the first place. So we continue to stay aware of what’s going on. We continue to scan the marketplace, but our strategy remains the same.

Source: Cisco Q2 2023 Earnings Transcript

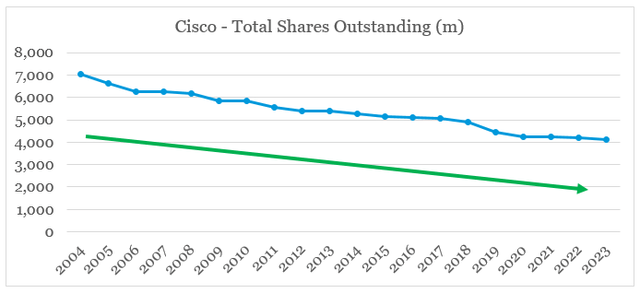

Last but not least, Cisco has consistently bought back shares over the years and thus reduced the total shares outstanding by nearly 45% since 2004.

prepared by the author, using data from SEC Filings

Margins And Competitive Positioning

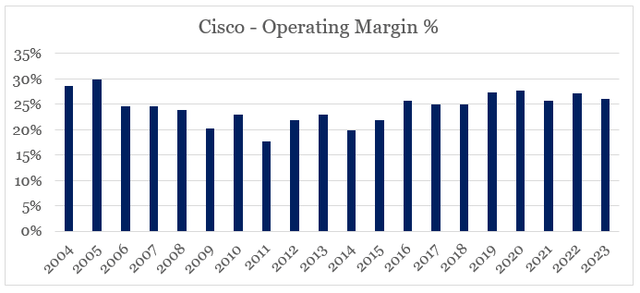

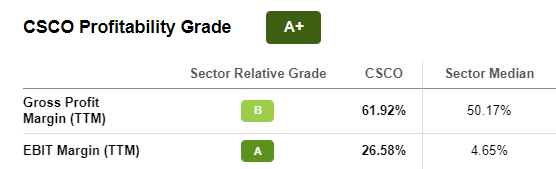

Although the compounded annual growth rate of sales is at mid-single digits for the past two decades, Cisco has retained its profitability and it is now one of the highest within the industry.

prepared by the author, using data from SEC Filings

Seeking Alpha

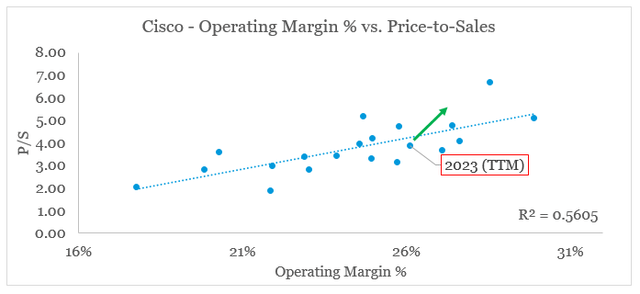

Having said that, as revenue growth accelerates in 2023 and price increases flow through the gross margin, Cisco is in a very good position to further improve its operating profitability.

For fiscal Q3, our guidance is: we expect revenue growth to be in the range of 11% to 13%;

(…)

So we do see gross margins improving, and it’s largely driven by – it’s less driven by cost. (…) It’s more driven by the fact that as we ship the backlog more and more of what we ship, reflects the price increases that we put in place last year. So I think you’ll see gross margins potentially continue to expand from where they are, maybe as much as 50 basis points in Q4.

Source: Cisco Q2 2023 Earnings Transcript

This is good news for shareholders as on top of the higher top-line figure, there is now a scope for an upward multiple repricing.

prepared by the author, using data from SEC Filings and Seeking Alpha

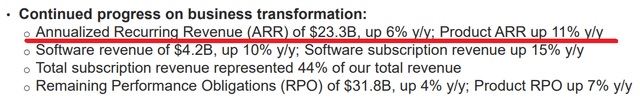

Margins would also continue to benefit from the higher share of recurring revenue that Cisco’s management has been targeting for nearly 10 years. The amount of recurring revenue now stands at more than 40% of the company’s total sales and is up significantly in recent years.

Cisco Investor Presentation

And we have $23 billion of ARR, which we can actually renew in the next 12 months. So if you go back 8 or 9 years ago, we might have had to take orders for 75% of our revenue in any given quarter. And now we have 44% of our revenue coming from the balance sheet and recurring revenue

Source: Cisco Q2 2023 Earnings Transcript

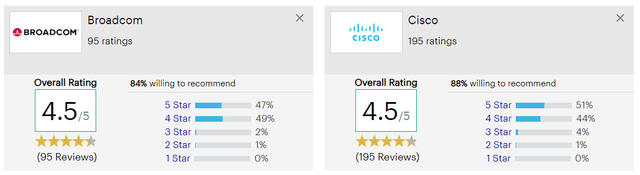

This is all encouraging in the light of increased competition in recent years. For example, in switching Cisco has been facing stiff competition from Broadcom (AVGO), which has successfully utilized a more M&A-centric approach.

Although AVGO’s high-performance switch silicon is often seen as superior to that what Cisco has in store, the latter remains the largest supplier of switches and routers more broadly.

Cisco could have chosen to make merchant silicon anytime since the late 2000s to blunt the attack coming from Broadcom, but didn’t until last year.

Source: nextplatform.com

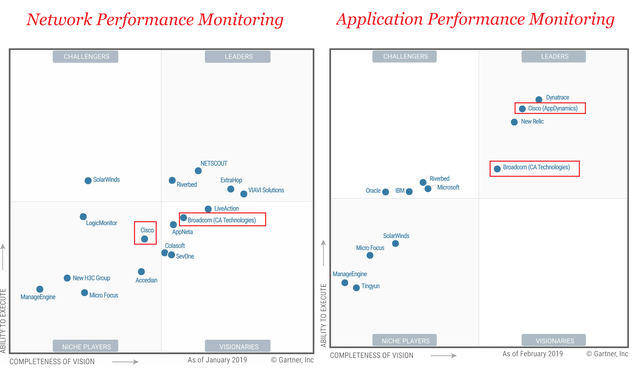

Broadcom’s aggressive M&A strategy has also given the company one of the leading positions in the Network Performance Monitoring space, where it is now on more equal footing with Cisco.

Gartner

Cisco, however, remains a clear leader in the highly lucrative application performance monitoring area, where its AppDynamics is among the top rated offerings. Cisco leadership in this area is also recognized by Gartner, with a wide gap to Broadcom’s acquired IP.

Gartner

As far as acquisitions are concerned, Cisco has done an excellent job at securing its leading position in the meeting solutions space by acquiring WebEx all the way back in 2007.

Cisco Website

The deal highlights the true long-term approach of the management and the vision of concentrating on more recurring revenue. As of 2021, Cisco is among the three distinct leaders in this space, together with Microsoft (MSFT) and Zoom (ZM).

Gartner

Investor Takeaway

Cisco is not your typical high-growth stock, although this is hardly a disadvantage during the current market environment. Moreover, the company is well-entrenched in key growth areas with high margins and a large share of annual recurring revenue. The company is conservatively priced and the long-term focus on capital allocation is an essential part for anyone with a long investment horizon.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the company’s SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

Looking for similar investment opportunities in the technology space?

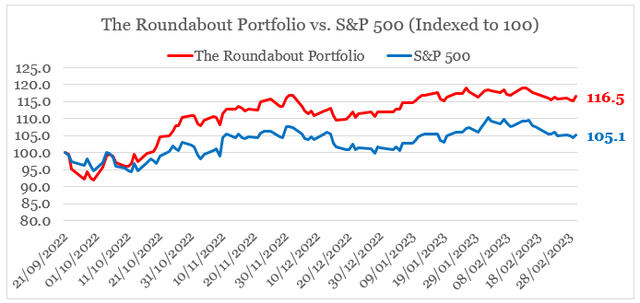

You can now gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.