Summary:

- Cisco presents a mixed investment proposition with concerns about its 2024 outlook and historical lackluster dividend growth.

- The company’s recent earnings report showed impressive revenue growth, but its long-term average growth rate falls short of industry standards.

- Heightened inventory levels, pose a risk of delayed growth resumption. The price may stay suppressed for longer here.

jejim

Overview

As much as I want to like Cisco, I do not see any compelling reasons to add shares here. CSCO did happen to make the 2024 Dogs Of The Dow list and I do believe in following that strategy. However, I don’t think CSCO makes a good buy since the price already trades near fair value. In addition, the dividend is secure, but the dividend growth has really lacked in the last decade. Therefore, since the income potential and capital appreciation possibility are both lacking, I will probably pass on CSCO as of now.

Cisco Systems (NASDAQ:CSCO) specializes in the design, manufacturing, and sale of networking products based on Internet Protocol, catering to the communications and information technology sector across the Americas, Europe, Africa, and Asia. The company’s diverse portfolio includes campus and data center switching, enterprise routing for connectivity in wireline and mobile networks, wireless solutions like access points and controllers, and a compute portfolio featuring the Cisco Unified Computing System, HyperFlex, and software management capabilities.

Additionally, Cisco offers forward-looking products encompassing routed optical networking, 5G, and more. A lot of their services and products are in a lot of people’s daily lives. This alone convinces me that with the right direction, there could be a lot more value here one day. The dividend has been raised for 12 consecutive years in a row. As of now, though, you may find value in simply collecting the dividend from CSCO since it’s traded in the same range for an extended period of time and has enough cash to cover distributions.

Financials

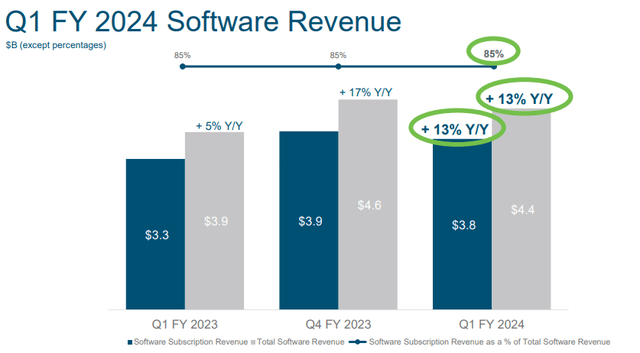

Cisco reported mixed results in their latest earnings release, showcasing a revenue of $14.67 billion, marking an impressive 7.6% year-over-year increase and surpassing expectations by $40 million. Notably, the quarter reported a substantial uptick in total software revenue, witnessing a 13% year-over-year growth, with software subscription revenue following suit with a commendable 13% increase. Business wide, though, the average revenue growth over a 5-year period was only 2.5%.

A lot of other profitability metrics show lackluster growth as well. For example, over a 5-year period, the operating cash flow has only grown at a rate of 5.5% compared to the sector median of 11x. EBIT growth has only reached 3.6% compared to the sector median of 7.9$%

Cisco Investor Presentation

The recurring revenue for Cisco reached $24.5 billion, demonstrating a noteworthy 5% year-over-year surge. Additionally, the product ARR experienced a remarkable 10% year-over-year upswing, underlining the company’s success in sustaining and expanding its recurring revenue streams. Cisco’s strong financial position is further emphasized by its robust remaining performance obligations (RPO), which stand at $34.8 billion, reflecting a significant 12% year-over-year growth.

2024 Outlook

Looking ahead, CSCO provided guidance for the second quarter of fiscal year 2024. They are anticipating revenue in the range of $12.6 billion to $12.8 billion. What stands out is that these figures are below the original $14.2B that analysts were expecting. The current earnings per share projections for the same period are as follows: GAAP EPS ranging from $0.59 to $0.64 and non-GAAP EPS in the range of $0.82 to $0.84.

For the entire fiscal year 2024, Cisco projects revenue to fall between $53.8 billion and $55.0 billion. The earnings per share expectations for this period are as follows:

- GAAP EPS in the range of $2.97 to $3.08

- non-GAAP EPS, ranging from $3.87 to $3.93.

Even though revenue may fall, CSCO seems to have great profitability metrics. For example, using the chart attached, you can see how CSCO’s net income margin outperforms at 23.4% compared to the sector median of only 2.14%.

Management can expect the acquisition of SPLK to officially completed soon. The acquisition was agreed upon for $28 billion. The company anticipates the completion of this deal by the end of the third quarter of 2024. Cisco and Splunk work well together to help companies maintain things in both hybrid and multi-cloud setups. This teamwork ensures that customers can run their digital businesses smoothly by making sure their applications work well. With their big reach, ability to see a lot of data, and a strong foundation of trust, Cisco and Splunk are in a good spot to support customers in using AI wisely.

Dividend & Valuation

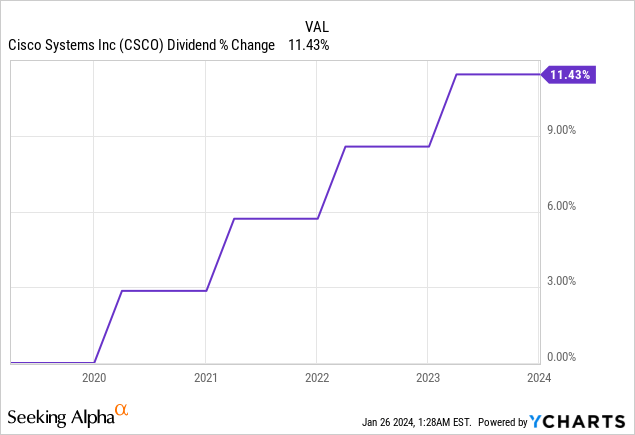

As of the latest declared quarterly dividend of $0.39/share, the current starting dividend yield is about 3%. Cisco has increased their dividend payouts for 12 consecutive years while maintaining a very conservative payout ratio of 37.5%. Despite increasing the dividend for 12 years in a row, the dividend growth itself has been lackluster. Over a 5-year period, the dividend CAGR (compound annual growth rate) is only 3.4%. The yield is already low at 3%, so I would like to see a stronger history of raises.

Zooming out over a 10-year time frame, the dividend CAGR looks a bit better at 8.6% but in my opinion this is still weak. On a positive note, the dividend payout ratio of 37.5% leaves plenty of room for future raises.

In terms of valuation, it seems that CSCO is trading near fair value. The current P/E is 16.6x, while the 5-year average is closer to 17.6x. The sector median is 29.06x for reference. The average Wall St. price target of $54.07/share represents a small upside of only 3.3%. However, the price target range goes as high as $76/share and as low as $43/share.

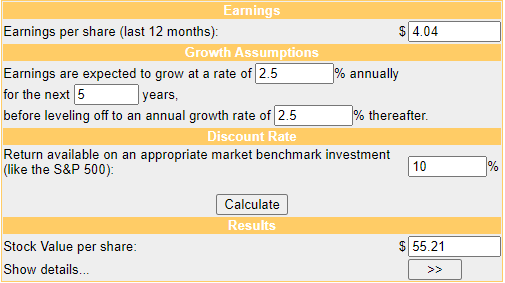

In order to get another estimated fair price value, we can run a DCF (discounted cash flow) calculation. The EPS estimate for 2024 is 3.88 and the estimate for 2025 is 4.04. Since the average revenue growth over the last five-year period has been 2.5% annually, I think it’s a fair input here. Using these metrics, we can determine that CSCO’s estimated fair value sits around $55.21/share.

Money Chimp

From the current price level, this would only represent a potential upside of 5.5%. Even when combined with the 3% dividend, your projected annual return is still less than 10% a year, which. This kind of return would underperform the average returns the S&P 500 (SPY) has provided. Therefore, I’m struggling to justify adding shares at this level.

Risks

During the most recent earnings call, the managers highlighted a challenging outlook for Q2 and Q3 of this year. The expected difficulty is attributed to a significant increase in inventory levels that were dispatched to their major clients. Luckily, management is transparent in acknowledging this as a contributing factor to the expected sluggish growth in the coming quarters.

While the leadership seeks to reassure us that the subdued growth is a temporary phase, it may not be eventually. The heightened inventory levels represent a substantial adjustment for major clients, and the process of digestion and utilization may take an extended period. This extended timeline for absorption introduces a potential delay in the resumption of robust growth for the company.

Takeaway

Cisco Systems (CSCO) presents a mixed investment proposition. While the company boasts a diverse portfolio and anticipates the completion of strategic Splunk acquisition, several concerns dampen its appeal. The 2024 outlook, with revenue projections below expectations, suggests a potential prolonged downturn in the stock price. Additionally, the historical lackluster dividend growth and modest upside potential in valuation metrics make CSCO less appealing to investors seeking substantial returns.

Financially, while Cisco’s recent earnings report showcased an impressive revenue increase, the long-term average growth rate falls short of industry standards. Despite commendable profitability metrics, the company’s growth trajectory raises questions. The challenges highlighted in the recent earnings call, particularly the expected difficulties in Q2 and Q3 due to heightened inventory levels, pose a risk of delayed growth resumption. Given these considerations, potential investors may find it prudent to explore alternative opportunities offering more compelling prospects for growth and income in the current market landscape.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.