Summary:

- Cisco Systems is undervalued in terms of its AI relevance, presenting an investment opportunity.

- Overall, I expect the networking device sector to play a crucial role in the deployment of AI, as exemplified by Cisco’s recent collaboration with Nvidia.

- Furthermore, Cisco is also well positioned to integrate AI features into its network switches and observability business, leading to potential growth.

raisbeckfoto

Cisco Systems, Nvidia, and Artificial Intelligence

Cisco Systems, Inc. (NASDAQ:CSCO) currently trades at an FWD P/E of around 13x, a stark contrast to the elevated multiples many AI (artificial intelligence) stocks boast. It’s precisely the goal of this article to argue that such a low valuation reflects an underestimation of CSCO stock’s AI relevance and thus creates an investment opportunity.

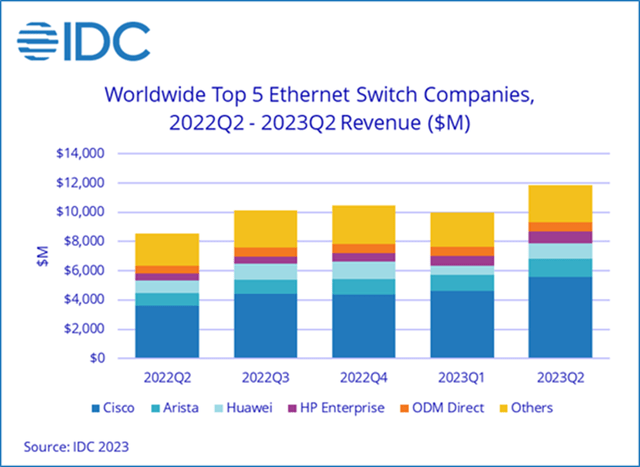

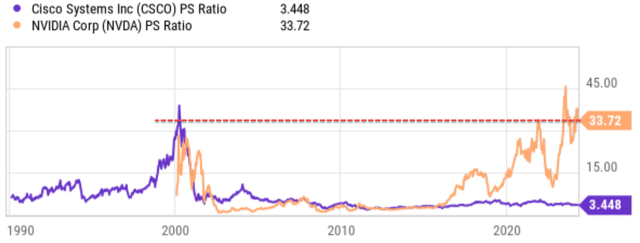

CSCO is known for its leading role in Internet protocol-based networking devices, in particular switches, as you can see from the next chart below. These devices enjoyed peak glory during the dot.com to a similar degree as Nvidia’s AI chip is enjoying now. As you can see from the second chart below, CSCO used to trade at 30-plus times its sales, the multiple that NVDA demands now (compared to CSCO’s current 3.4x PS ratio).

In the remainder of this article, I will argue that CSCO’s AI potential is drastically underestimated.

First, I will take a broader view and argue that the whole networking device sector’s role is underestimated. A good reflection of this point of view is the recent establishment of the Ultra Ethernet Consortium (where the CSCO company is a member). I think their mission statement pointed out the crucial role more eloquently and concisely than I ever can. So I will just directly quote it below:

Networking Demands of Modern AI Jobs Networking is increasingly important for efficient and cost-effective training of AI models. Large Language Models (LLMs) such as GPT-3, Chinchilla, and PALM, as well as recommendation systems like DLRM and DHEN, are trained on clusters of thousands of GPUs.

Then specific to CSCO, I view it as well positioned to capitalize on the above trend given its scale and leading technologies. The recent collaboration between Cisco and Nvidia provides a good example illustration of such strength. More specifically, CSCO and NVDA announced plans in February 2024 to deliver AI infrastructure solutions. The highlights of these solutions are quoted below with emphasis added by me:

Cisco and Nvidia’s purpose-built Ethernet networking-based solutions will be sold through Cisco’s vast global channel, offering professional services and support through key partners who are committed to helping businesses deploy their GPU clusters via Ethernet infrastructure.

The collaboration has attracted key customers like ClusterPower, a cloud services provider in Europe, to help drive data center operations with innovative AI/ML solutions that are foundational for its client infrastructure and services.

CSCO stock: Wall Street underestimated its EPS growth potential

Looking ahead, I see plenty of similar opportunities for CSCO to leverage its scale, reach, and technological expertise. Two possibilities came to the top of my list. First, for its network switches, I see opportunities for integrating AI features so that the configuration and management of the network can become automated – and even become self-healing. This would be a tremendous opportunity to improve network uptime, reliability, and IT personnel efficiency. The second one involves its observability (i.e., network monitoring) business, especially its ThousandEyes network services. These services have been enjoying robust growth recently, and I see good reasons for the momentum to continue, especially when some AI features are integrated. A key potential is the use of Cisco’s ThousandEyes for advanced anomaly detection so that ThousandEyes can analyze vast amounts of network data to identify unusual patterns that might indicate potential problems more quickly and accurately than traditional methods.

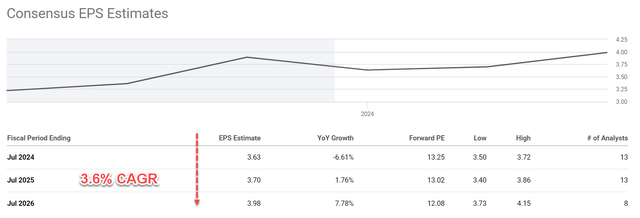

Despite these opportunities, Wall Street has a quick gloomy projection for its growth. The chart below describes consensus EPS estimates for CSCO stock in the next few years. As seen, the consensus EPS estimates point to a compound annual growth rate (“CAGR”) of 3.6% only over the next three years. To wit, the consensus EPS estimate is $3.63 for FY 2024 and $3.98 for FY 2026 (by the way, the implied FWD P/E at that time would be only 12.08x).

Next, I will explain why this protection is too pessimistic.

CSCO stock: My growth projection

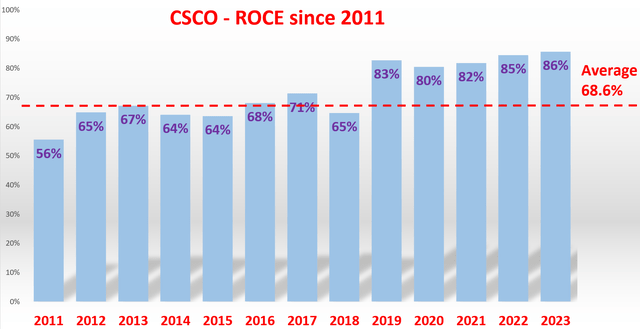

My method for estimating CSCO growth rates is based on its ROCE and reinvestment rates. It’s detailed in my other articles and I will just quote the results here:

The method involves the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). The ROCE for CAT has been around ~80% in recent years since 2019 as seen in the chart below. And the average is about 68.6% in the longer term.

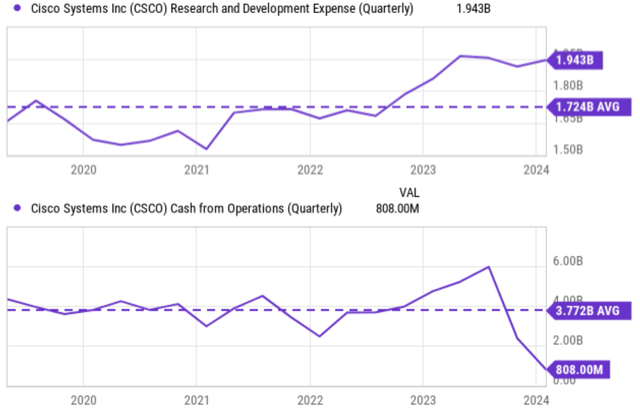

In terms of its RR (reinvestment rate), CSCO has been reinvesting aggressively in recent years as you can see from the chart below. Cisco’s R&D expenses have been increasing steadily over the past few years. In 2020 and 2021, the expenses were slightly above $1.50 billion on a quarterly basis. This figure has risen to $1.94 billion as of the last quarter. Overall, the average R&D expenses over the past few years were $1.72B, about half of its average cash from operations (around $3.7 billion as seen in the bottom panel).

I’m not sure how sustainable this can be in the longer term (say over a decade). So I will assume a more typical and sustainable level of RR of 10%. At its current ROCE of 80%-plus, a 10% RR could lead to ~8% organic growth (80% ROCE x 10% RR = 8%). Note this number is the real and organic growth rate without inflation and/or acquisition (more on this later). Adding an inflation factor (say ~2%) and considering growth from acquisitions could easily push the growth rate into the teens.

CSCO stock return projections

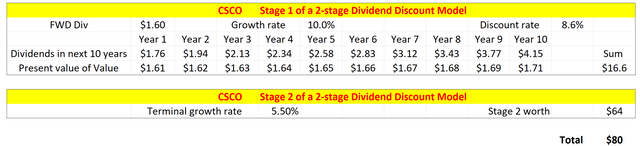

The combination of growth catalysts and low P/E ratios has resulted in a very systemic return profile. To get a sense of the asymmetry here, I will use the discounted dividend model (“DDM”) to assess its fair price. CSCO has been consistently paying out a good portion of its earnings (around 40% on average) for more than a decade. Thus, I think it’s a good assumption that its dividends provide a good approximation of its true owner’s earnings. More specifically, I will use the following two-stage DDM model:

There are a total of three key parameters in the two-stage DDM: The discount rate, the growth rate in stage 1, and the terminal growth rate. For the discount rate, I relied on the so-called WACC, the weighted average cost of the capital model. The discount rate for CSOC is about 8.5% on average in recent years following this model.

For the growth rate in the first stage, I will use 10% as estimated above. For its terminal growth rate, I will assume its RR normalizes to 5% (in line with other mature tech stocks in the large-cap space) and ROCE to 68% (which is its long-term average ROCE If you recall). Thus the terminal growth rates would be around 5.5% (about 3.5% of real growth plus 2% of inflation escalator).

With these inputs, the table below summarizes the results from the two-stage DDM. Note my calculations use its FWD dividend of $1.6. The fair price for CSCO ended up being around $80, far above its current market price of ~$48.

Other risks and final thoughts

In terms of downside risks, a slowdown in IT spending would be a key macroeconomic risk for CSCO (and the whole sector as well). As a cyclical sector, economic downturns can lead to more severe impacts on the demand for networking equipment. Competition intensification is another key risk. If you recall from an earlier chart, the networking equipment market is crowded with established players like Huawei, Juniper Networks, and Arista Networks, as well as new entrants vying for market share. All these players will be competing for the new growth areas enabled by the AI potential. CSCO is well positioned on this front, in my view, but competition always creates uncertainties and margin/price pressure.

Finally, CSCO also faces some ongoing integration challenges. As aforementioned, when we consider Cisco’s growth, acquisition needs to be included because it has made regular acquisitions over the years. Successfully integrating these acquisitions and achieving synergies can be a challenge.

As an ongoing example, it’s acquiring Splunk Inc. (SPLK). Regulatory approval for the buyout is running ahead of schedule and the deal could close sooner than expected. Whether these acquisitions could achieve the expected synergistic benefits remains to be seen.

My final verdict is that the return potential far outweighs the downside risk. As such, my thesis is that Cisco Systems presents a compelling buy thesis under current conditions. Its expertise and reach in networking devices, highlighted by its collaboration with Nvidia to deliver AI infrastructure solutions, positions it well in the rapidly evolving AI landscape. I see several growth areas in the years ahead for CSCO by incorporating AI features into its core businesses. Yet, it’s trading at a very low FWD P/E ratio compared to other AI-related stocks. Thus, CSCO’s AI potential is vastly underestimated in my view and creates a highly asymmetric reward/risk profile.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.