Summary:

- Despite being constructive on the company’s Q4 2022 and its expansion into the network security domain, we’re bearish on Cisco Systems, Inc.

- We like Cisco’s position in the networking space, specifically with its growing focus on security and data center markets.

- Yet, we remain conservative on Cisco’s revenue growth towards 1H23 as businesses and enterprises figure out how they will spend their budget for 2023 with signs of a recession.

- A significant amount of Cisco’s revenue is derived from outside the US, around 42% in FY2021, subjecting the company to foreign exchange headwinds due to the strong US dollar.

- In the longer term, we are bullish on Cisco, but believe the company will face downside risks in the near term and recommend investors hold on to the stock.

Sundry Photography

We’re bearish on Cisco Systems, Inc. (NASDAQ:CSCO) under the current macroeconomic environment. We’re excited to see Cisco’s earning report for its first quarter of FY2023 (expected on 16 November), but believe weaker demand under current financial stresses will gate-keep Cisco’s financial performance.

Cisco is an IP-based networking company that provides an array of differentiated services for providers, enterprises, businesses, and commercial users. More recently, the company’s expanding its presence in the network security domain, and we expect this focus on security and data centers to serve as growth catalysts in the long run. In the near term, however, we believe the company will face weak demand as businesses and enterprises figure out how they will spend their 2023 budget. We expect enterprise customers that make up most of Cisco’s revenue will be more hesitant to spend their budget on network security under current macroeconomic volatility. We also believe Cisco itself will be directly pressured by the macroeconomic headwinds resulting from foreign exchange headwinds. We recommend investors wait for a better entry point on Cisco stock.

Enterprise spending decisions to gate-keep growth

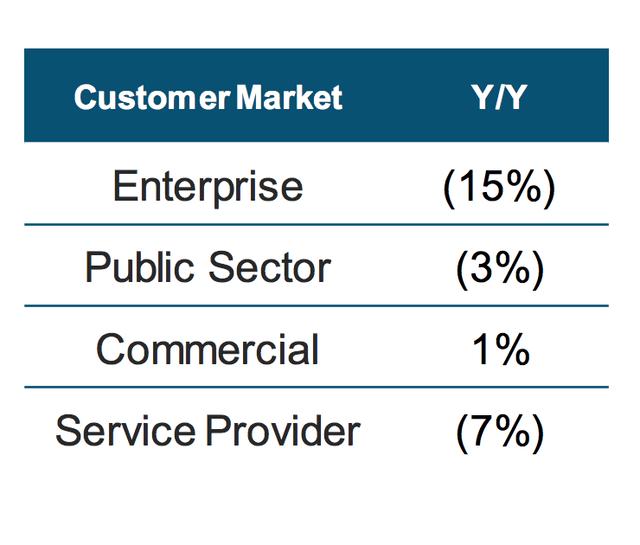

Cisco is among the largest players in the networking space, but we believe the company is not immune to macroeconomic headwinds impacting customer demand. The current macroeconomic environment is harsh, to say the least, with inflation at the highest it’s been in 40 years. Enterprises and businesses are facing increased financial stress, and we expect this to be reflected in their spending habits regarding network security and data centers. Enterprise customers reported a 15% Y/Y growth in fiscal Q4 2022, making it Cisco’s fastest-growing customer base. We expect corporate tech buyers to cut costs under inflationary pressures and rising interest rates. While we love Cisco’s business model, we believe the company is vulnerable to spending cuts from its customers under current financial stresses.

Cisco also derives a significant amount of its revenue from federal, state, and local government markets. We believe this makes the company exposed to stringent budget behavior by the U.S government. We expect Cisco to grow meaningfully once macroeconomic headwinds ease, but believe the stock price remains volatile in the near term.

The following table outlines Cisco’s customer market in its fiscal Q4 2022.

Foreign exchange headwinds are also taking a toll

A significant amount of Cisco’s revenue is derived from outside the U.S, around 42% in FY2021, subjecting the company to foreign exchange headwinds due to the strong U.S. dollar. We expect the company’s financial performance to be exposed to exchange rates of other currencies – euro, pound, renminbi, and yen – compared to the strong U.S. dollar. We maintain our belief that Cisco will grow in the long run but expect the stock to be pressured by FX headwinds toward 2023.

Long-term growth catalysts in the network security domain

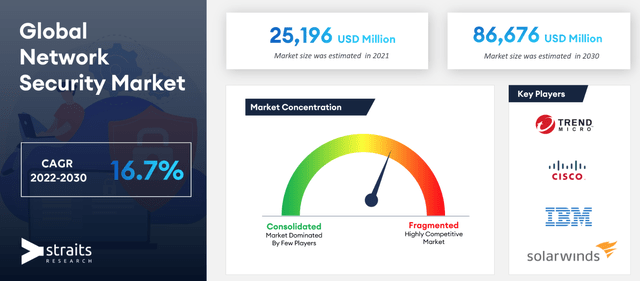

Cisco provides various products and services to service providers, enterprises, and businesses, but security and data centers take the cake for Cisco’s fastest-expanding markets. We’re constructive on Cisco’s rapid expansion in the network security domain. The network security domain is expected to grow significantly with a CAGR of 16.7% between 2022-2030.

The following image outlines the forecasted growth in the global network security market.

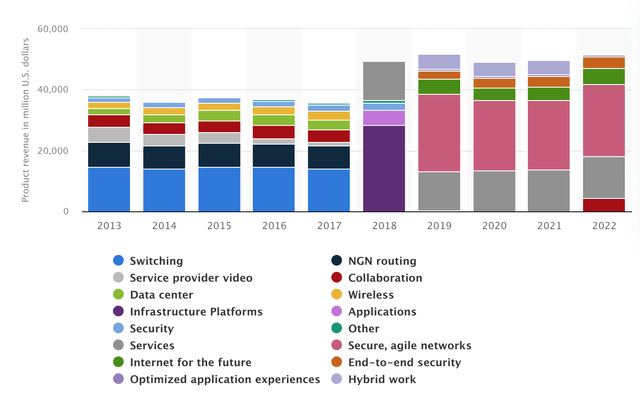

Since 2019, Cisco has been focusing its revenue growth on its secure, agile networks segment, and we expect the company to benefit from tailwinds for network security domains worldwide. The company’s network security includes products and services preventing unauthorized access to systems. The company’s data center products encapsulate Cisco Unified Computing Systems and Server Access Virtualization.

The following graph outlines Cisco’s revenue by segment over the past few years.

Not immune to competition

Cisco’s facing stiff competition from Arista Networks, Inc. (ANET), Juniper Networks, Inc. (JNPR), Hewlett Packard Enterprise Company (HPE), Huawei, and the Ethernet switch router market. We expect competition will force Cisco’s hand to offer discounts and deals to maintain its customer base. Competitors are revamping their product lines in the switch router market, and we believe Cisco needs to bring its A-game to keep up with the competition and maintain profitability.

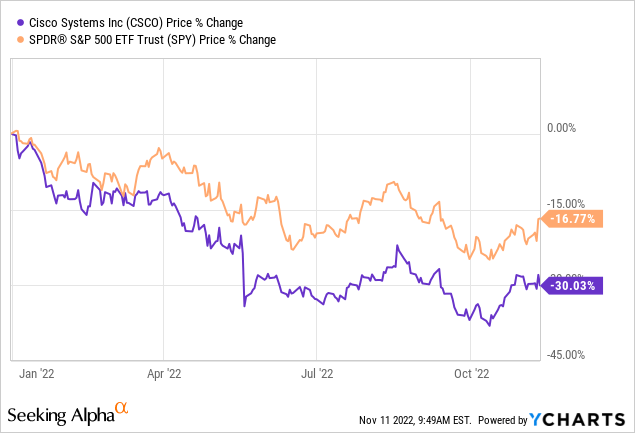

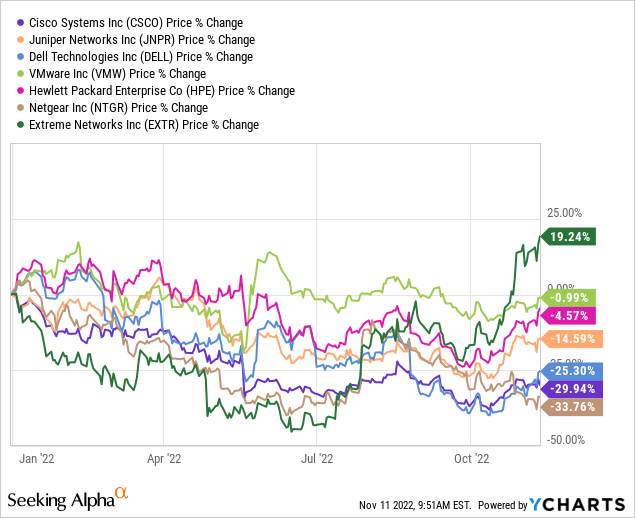

Stock performance

Cisco grew around 27% over the past five years. YTD, the stock is down about 30% alongside the larger tech peer group. The stock underperforms the S&P (SPY) index on the YTD metric, with SPY declining 17% over the same period. Cisco’s competition is also feeling the pressure of macroeconomic headwinds; Juniper is down around 15%, Arista Networks around 11%, Dell (DELL) around 25%, VMware (VMW) about 1%, Aruba (HPE) around 5%, NetGear (NTGR) around 34%, and Extreme Networks (EXTR) up almost 19%. YTD, Cisco underperforms the bulk of its competition. We expect the stock to drop further towards 2023 and recommend investors wait for a better entry point.

The following graphs outline Cisco’s YTD performance compared to the index and competition.

TechStockPros

TechStockPros

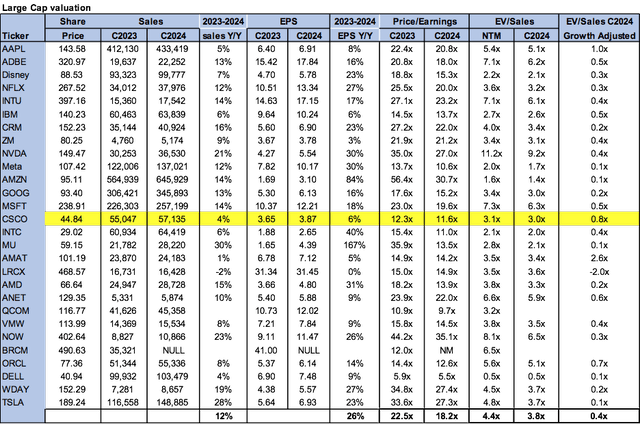

Valuation

Cisco is relatively cheap, but we believe there is more downside to be factored into the stock. On a P/E basis, Cisco is trading at 11.6x C2024 EPS of $3.87 compared to the peer group average of 18.2x. The stock is trading at 3.0x C2024 on an EV/Sales metric versus the peer group average trading at 3.8x. We’re bullish on Cisco in the long run but recommend investors wait to see how enterprise spending pans out toward the end of the year.

The following graph outlines Cisco’s valuation relative to the peer group.

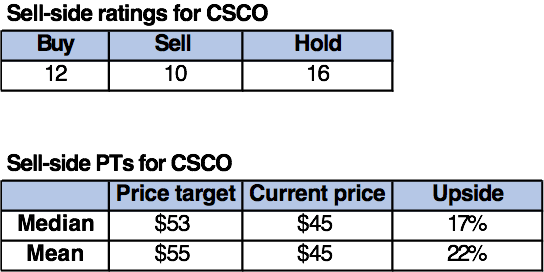

Word on Wall Street

Wall Street is divided on the stock. Of the 38 analysts covering the stock, 12 are buy-rated, 16 are hold-rated, and the remaining are sell-rated. We attribute the lack of a unified rating on Cisco to concerns over how near-term macroeconomic headwinds will impact the stock. Cisco is currently trading at $45. The median and mean price targets are set at $53 and $55, respectively, with a potential upside of 17-22%.

The following tables outline sell-side ratings and price targets for Cisco.

TechStockPros

What to do with the stock

We like Cisco’s position in the networking space, specifically with its growing focus on security and data center markets. We expect the security and data center markets to enjoy significant growth as the enterprise world becomes more digitized. Yet, we believe the near-term financial stresses will chokehold meaningful growth in the industry towards 2023. We expect more downside to be factored into Cisco stock in the near term and recommend investors wait for a better entry point.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.