Summary:

- Cisco’s Q1 2024 results indicate a significant deceleration in growth and a decline in FY 2024.

- The demand environment for the company’s core business has not improved, suggesting a lack of capitalizing on digitalization trends.

- Cisco remains confident in its ability to secure a significant share of the AI infrastructure market, but it remains a show-me story at the moment.

Alexander Koerner

Thesis

Earlier in September, my article on Cisco Systems, Inc. (NASDAQ:CSCO) covered the near-term outlook for the company and the moderating demand environment. In this update, I will be going over the company’s FY Q1 2024 results and discuss my outlook going forward. CSCO’s growth has decelerated significantly in the past fiscal year and the company has guided to a decline in FY 2024. The Q1 results did not show any signs of an improvement in the demand environment yet in the company’s core business. The moderating growth indicates that the company is not yet able to capitalize on the digitalisation trends yet. The management remains confident that it can achieve a sizeable share in the AI infrastructure market with its transition away from Ethernet technology; however, that still remains a show-me story at the moment. Hence, I reiterate my hold rating on the stock.

Q1 2024 Performance Does Not Inspire Confidence

CSCO posted revenue growth of 8% in the first quarter of 2024, compared to 16% in Q4 2023. The revenues from the Networking division increased by 10%, showing significant deceleration compared to the growth of approx. 25% seen in the previous two quarters. The sales from the services segment increased by 4% during the quarter. Although this moderate growth is an improvement compared to the past few quarters, it is unlikely that this points to a sustained upward trend in services demand and sales. The services division offers a wide range of services and support to Cisco’s existing customers, and its growth is primarily tied to the gradual expansion of the customer base.

With a gross margin of 65.2%, Cisco’s profitability remained strong and was in line with the guidance. Profitability has in recent quarters presumably been supported by robust growth in high-margin core activities, even as the share of Services revenues, margins of which are typically a few percentage points above those of the other activities, have seen some decline. Cisco has in recent quarters been able to maintain margins despite cost pressures related to components and wage costs, which suggests a certain degree of pricing power. The company has for a prolonged period had profit margins at around recent levels and those will presumably persist. Consolidation of the planned Splunk acquisition will have no material effect. Splunk’s gross margin is higher than Cisco’s, but the revenue addition of less than seven percentage points is insufficient to move the needle.

The order intake has fallen by 20%, primarily due to ongoing weakness in the service provider segment. The management mentioned that customers are currently focused on installing equipment that was delayed and shipped recently after supply normalized from pandemic-related disruptions. The weak order numbers have led Cisco to lower its full-year guidance. In the previous quarter, Cisco had projected flat to 2% growth for the full year, which already indicated a significant slowdown compared to the previous fiscal year. Now, the company expects a decline ranging from 3.5% to 5.5%, suggesting that growth prospects for the remainder of the fiscal year have worsened. While recent shipment volatility may have played a role, it appears that the fundamental demand trends for the core part of the business have not improved.

Cisco Confident in its AI Leverage

Demand for high-speed, low-latency networking gear will remain high over the next several quarters as the cloud’s AI wars will continue to drive the need to invest in AI infrastructure. While hyperscale cloud providers — Meta and Microsoft — still aim to trim capital expenses next year, the heightened AI competition will sustain healthy infrastructure investments in this area. Sales comps will get tougher following the strong AI investments in 2023. But the need to scale up and scale out the AI footprint with higher-priced gear won’t abate given the anticipated growth in AI workloads and large language models.

Cisco is confident in its ability to secure a significant share of the AI infrastructure market as it transitions towards Ethernet technology. Much of the foundational infrastructure in AI clusters will be connected via fiber optics, and the adoption of plug-and-play optical solutions is expected to reduce power consumption significantly. The combination of Silicon One and Pluggables allows Cisco to achieve a 68% reduction in power consumption compared to Infiniband in 400G networking. The company believes power reduction is an important attribute for Service providers. Cisco’s Silicon One technology offers industry-leading features while optimizing for power consumption, a trade-off that some competitors have had to make with their products. Silicon One chips have already gained adoption by five out of the six largest cloud service providers.

Valuation

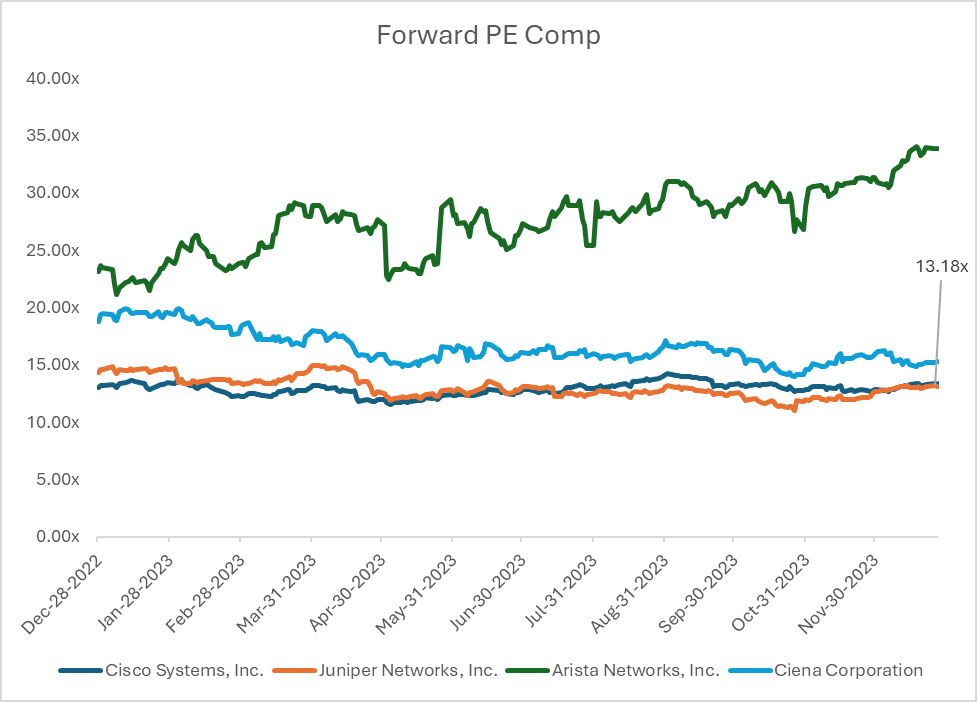

Valuation multiples have continued to slide in 2023, as the stocks lagged behind the performance of broader market indices. Although much of the negative sentiment around the stock has been reflected in the depressed multiples, I believe a lack of near-term earnings catalysts may limit a rebound in networking performance through 1H24. CSCO’s forward PE multiple has remained range-bound in the 11-15x range for most of 2023. The stock is currently trading at a forward PE of 13.1x, however, the current demand environment does not inspire much confidence for the multiple to go up. Hence, I maintain my hold rating on the stock and recommend staying on the sidelines at the moment.

Capital IQ

Conclusion

Cisco’s FYQ1 2024 result showed a slowdown in the demand environment for the company’s core business segments, which is unlikely to reverse in the near term in my view. Cisco has been taking strategic initiatives to shift to higher-growth activities and enhance the proportion of recurring revenues, however, the growth profile of the company indicates that none of the efforts have bear any fruit. Hence, I reiterate my cautious stance on the company and assign a hold rating to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.