Summary:

- Cisco’s stock price has risen 21% since my ‘Buy’ rating in August 2024, driven by strong AI, cloud, and security market focus.

- Product orders grew 20% YoY, signalling the end of inventory destocking, with AI orders projected to reach $1 billion in FY25.

- Cisco’s AI infrastructure investments and Splunk acquisition are expected to drive revenue growth, with a fair value of $65 per share.

- Despite a 5.6% revenue decline, Cisco’s strong order growth and strategic investments justify a continued ‘Buy’ rating.

raisbeckfoto

Since I upgraded Cisco (NASDAQ:CSCO) from ‘Sell’ to ‘Buy’ in August 2024, the stock price has increased by 21%, significantly outperforming the overall market. I highlighted the company’s focus on AI, cloud and security markets in my previous article. Notably, their product orders grew by 20% year-over-year in Q1 FY25, indicating the inventory destocking is fully behind them. I reiterate a ‘Buy’ rating with a fair value of $65 per share.

Product Order Recovery With Strong AI Growth

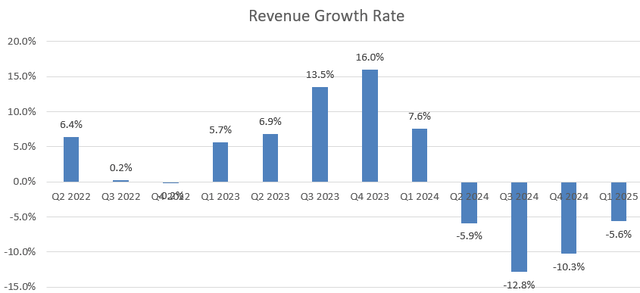

Cisco released its Q1 FY25 result on November 13th after the market close, reporting a 5.6% decline in revenue and 18% drop in adjusted EPS, due to a strong comparable period last year, as shown in the chart below.

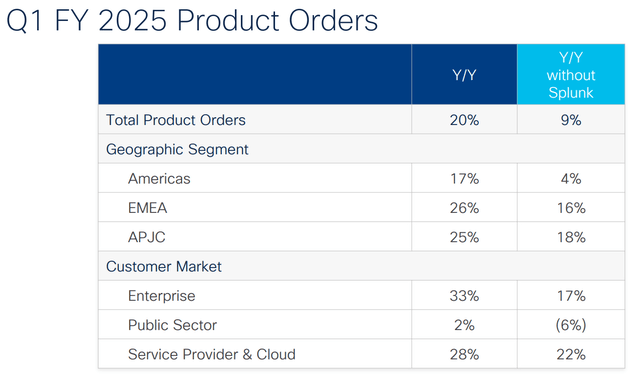

My biggest takeaway from the quarter is their strong recovery in product orders, growing by 20% year-over-year including Splunk and 9% excluding Splunk. As shown in the table below, the strong order growth is attributed to demand from both enterprises and service provider/cloud customers. As discussed in my previous article, Cisco has experienced industry-wide inventory destocking activities in recent quarters. The strong order growth suggests that the inventory destocking is fully behind them in FY25, in my view.

Cisco received over $300 million of AI orders during the quarter, and the management is guiding for $1 billion of AI orders for the full year of FY25. During the earnings call, the management noted that the company’s data center switching portfolio had its third consecutive quarter of double-digit order growth, as enterprise customers and hyperscalers continued to invest in data center and AI training/inference computing.

Outlook and Valuation

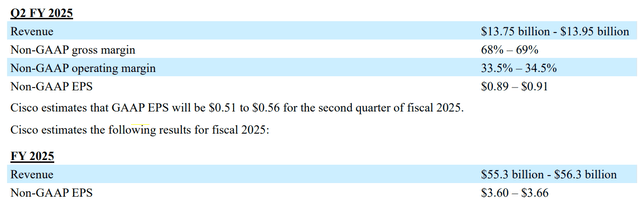

Cisco is guiding for around 3.7% year-over-year growth in revenue for FY25 at the mid-point, as detailed in the table below.

For the near-term growth, I am considering the following factors:

- I anticipate Cisco to continue investing in their AI infrastructure and network solutions for AI training and inference. In October 2024, Cisco unveiled plug-and-play use case and industry-specific AI PODs, making it easier for partners to sell and deploy AI infrastructure. In addition, the company expanded their AI family with new UCS C885A M8 servers designed for GPU-intensive AI workloads, in partnership with Nvidia (NVDA). In the near term, I anticipate AI workloads to continue fueling Cisco’s growth in both revenue and product orders.

- With the acquisition of Splunk, Cisco could potentially accelerate the integration of their security and networking portfolio. I think Splunk could provide a strong security foundation on top of Cisco’s existing networking portfolio.

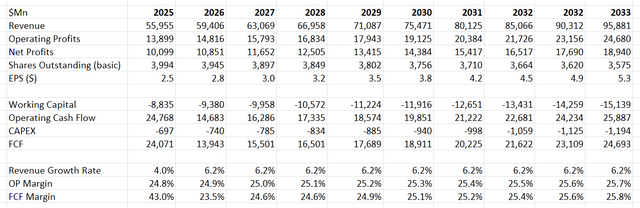

- I project Cisco will grow its organic revenue by 4.5% annually, assuming 5% growth in networking, 4% growth in security and 5% growth in services. The growth projection includes 2% growth from traditional networking and cybersecurity markets, and 2.5% additional growth from AI computing and infrastructure.

- I continue to project Cisco will allocate 5% of revenue towards M&A, contributing 170bps to the topline growth.

- As Cisco needs to invest heavily in their R&D to design AI-related networking portfolios, I anticipate the company will allocate more than 13% of total revenue to R&D resources. I forecast a 10bps annual margin expansion driven by the operating leverage in SG&A expenses. I estimate the total operating expenses will grow by 6% annually, resulting in a 10bps annual margin expansion.

- The WACC is calculated to be 8.8% assuming: risk-free rate 3.8%; beta 0.9; equity risk premium 7%; cost of debt 5%; equity $234 billion; debt $31 billion; tax rate 18%.

The DCF can be summarized as follows:

Discounting all the future FCF, the fair value is calculated to be $65 per share, as per my estimates.

Key Risks

In Q1, the weakness spot was in Cisco’s US federal government market, where product orders declined by 6% year-over-year without Splunk. The management attributed the weak growth to the change in administrations. I think the explanation makes sense, and the order growth will probably recover once the federal government reaches a new budget plan in the future.

Conclusion

It is encouraging to see Cisco has moved past the challenging inventory destocking phase, with strong product order growth, particularly in the AI market. I reiterate a ‘Buy’ rating with a fair value of $65 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.