Summary:

- Cisco Systems is set to report its Q3 2024 earnings later this week, and the market does not seem to expect much.

- The quarter will be an important one as demand is expected to gradually normalize in the second half of 2024.

- Long-term investors should remain laser-focused on profitability, and there are some important puts and takes in that area.

zhudifeng

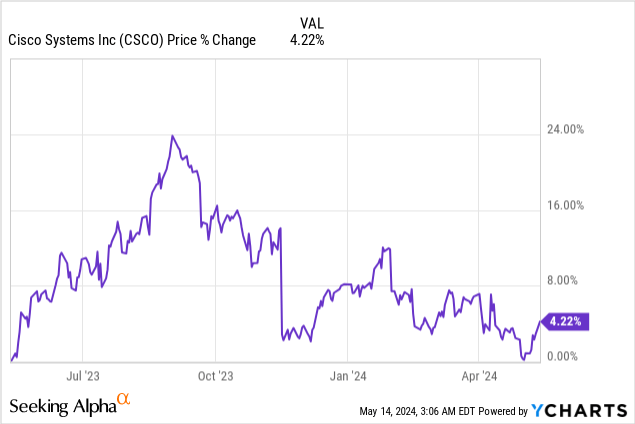

Cisco Systems, Inc. (NASDAQ:CSCO) is about to report its fiscal Q3 2024 earnings later this week, and it appears that the market has capitulated when it comes to expectations about the second half of the year.

The stock is now almost flat for the past year, as it fell sharply when Q1 2024 results were released in November of last year.

Although CSCO reported better-than-expected results during the fiscal Q1 2024 release in November of last year, it was the much weaker guidance for the whole fiscal year that spooked investors.

Seeking Alpha

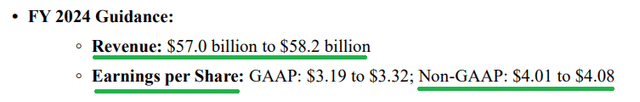

Initial revenue guidance for FY 2024 stood within the range of $57bn to $58.2bn, with Non-GAAP Earnings Per Share expected to be slightly above $4.

By the end of Q2 2024, the revenue outlook has come down massively to a range $51.5bn to $52.5bn (see below), but at the same time the EPS figure did not experience such a drastic downward revision.

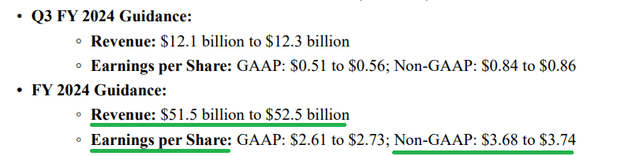

Based on this outlook, CSCO now trades at a forward Price/Earnings ratio of 13 based on the Non-GAAP numbers and at around 18 based on the GAAP figures. As cheap as this sounds, sell-side analysts are now the most skeptical on the stock they have been in 5-years (see below).

This could make the upcoming quarter a critical inflection point for Cisco’s share price if management delivers.

Cisco Q3 Earnings – A Pivotal Quarter For Growth?

As Cisco’s management slashed its growth projections for FY 2024 twice – both in Q1 and Q2, it appears that the market had already priced-in a very negative scenario the first time around. That is why, the share price response to Q2 2024 results was relatively muted, even though full fiscal year guidance was reduced once more.

With analysts’ ratings already at multi-year lows, it appears that the odds of a better-than-expected quarter are stacked in favor of Cisco’s management.

More importantly, however, it was normalization of order intakes in recent quarters that have caused the sharp downward revision in revenue guidance for FY 2024. Cisco’s management has previously made clear that abnormal deliveries in prior quarters are the reason for the current sales slowdown.

The bottleneck that we previously saw in the supply chain has now shifted downstream to implementation by our customers and partners. Our order lead times and backlog have largely returned to normal levels. As deliveries rose, the channel inventory we track at our distributors also steadily declined during this time. Simply put, customers are now taking time to onboard and deploy these heightened product deliveries.

Source: Cisco Q1 2024 Earnings Transcript.

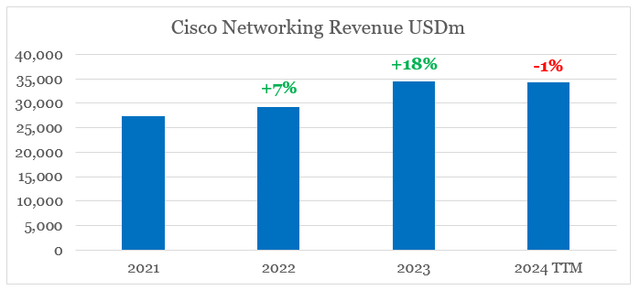

This is clearly illustrated by the annual revenue figures of Cisco’s Networking segment, which grew 18% in FY 2023 and is so far down by only 1% in the past 12-month period.

prepared by the author, using data from SEC Filings

The current expectation is that the second half of FY 2024 would see a reversal of this trend, which makes the current quarter significant.

We expect product order growth rates to increase in the second half of the fiscal year. We also remain very confident in the foundational strength of our business and future growth opportunities given the criticality of our technologies.

Source: Cisco Q1 2024 Earnings Transcript.

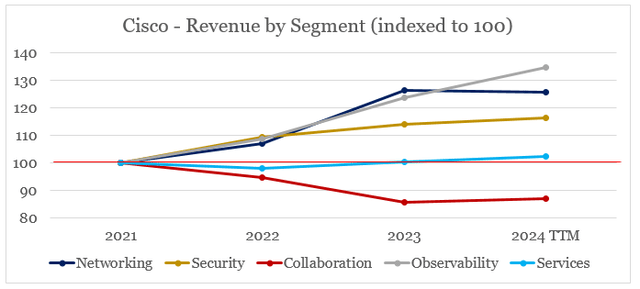

Networking still makes-up 60% of revenue, and the decline in the past 6-months was indeed preceded by an unusually strong demand in FY 2023. Therefore, any hints of revenue growth in the segment normalizing in Q3 2024 would be highly anticipated.

prepared by the author, using data from SEC Filings

The quarter would also be the first one to include more information regarding Splunk, which so far has not been included in Cisco’s management outlook. The acquisition would be a major step towards scaling up Cisco’s high-growth Observability segment and would have a notable impact on the fourth quarter guidance.

Focusing On CSCO’s Profitability

Although the market remains primarily concerned with Cisco’s top-line growth figures, profitability is far more important for long-term investors as the company gradually transitions its legacy business model.

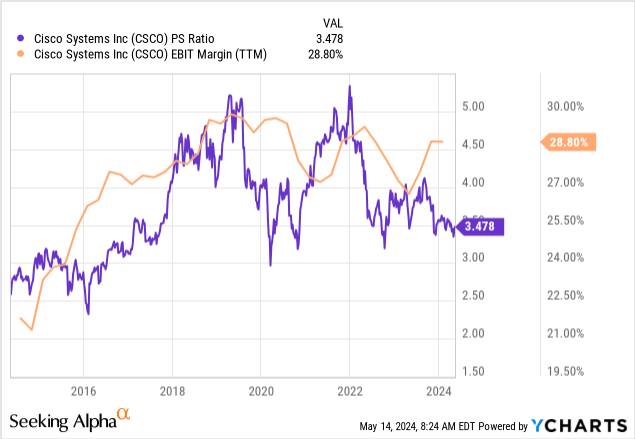

As CSCO share price fell recently, its Price/Sales multiple is now at multi-year lows (see below). Operating margin, however, has gone in the other direction, which is another positive sign for anyone buying the stock at current levels.

Operating margin is likely to take a hit in the following quarters as the loss making Splunk is being integrated. This, however, is likely to be transitional as economies of scale are realized.

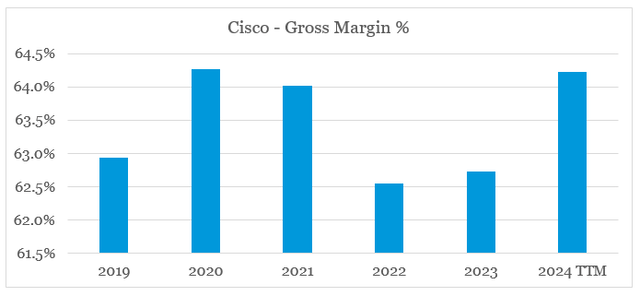

As a matter of fact, Splunk had a gross margin of 73% in FY 2022 which is significantly higher than Cisco’s current gross margin of 64%. Based on that alone, during Q3 2024 we are likely to see gross and operating margins going in different directions. Although this might be interpreted negatively by the market in the near-term, it’s an important development for Cisco’s long-term profitability.

prepared by the author, using data from SEC Filings

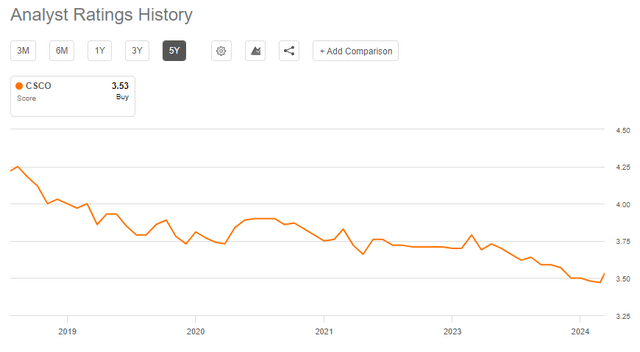

Progress made in transitioning the business towards a subscription-based business model would also be an important part of the upcoming earnings release. Significant progress was made during the last reported quarter in terms of increasing the share of annual recurring revenue, which now represents 50% of Cisco’s total revenue.

Conclusion

Cisco is now in a very good position to exceed the market expectations in Q3 of 2024 as well as its guidance for the last quarter of the fiscal year. Sell-side analysts seem to have capitulated recently, and CSCO now trades at very conservative levels that do not seem to price in a notable improvement in revenue. Beyond the near term, shareholders should remain focused on the ongoing transition of the company’s legacy business and the profitability tailwinds that come with that.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

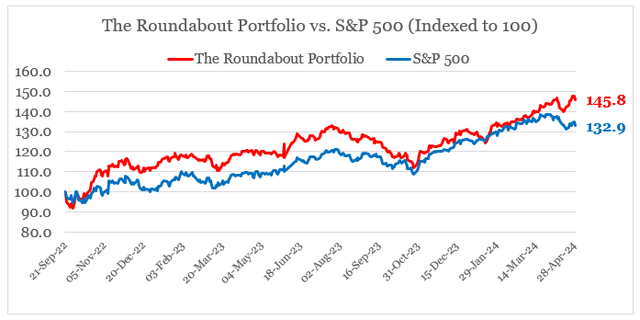

Looking for more high quality businesses in the technology space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.