Summary:

- As Cisco is about to report its Q3 2023 results, the market does not seem to fully appreciate the business momentum.

- I take a closer look at revenue and earnings growth, as well as some important short-term nuances.

- Decisions regarding capital allocation could give us some valuable clues on where is the business headed.

Justin Sullivan

Cisco Systems, Inc. (NASDAQ:CSCO) is about to release its third quarter earnings for its current fiscal year. There are a number of areas that investors should keep a close eye on.

On the other hand, as I always say – quarterly results contain too much noise, and even though they could provide some meaningful insights for the long run, we should always be careful not to fall victim of transitional events.

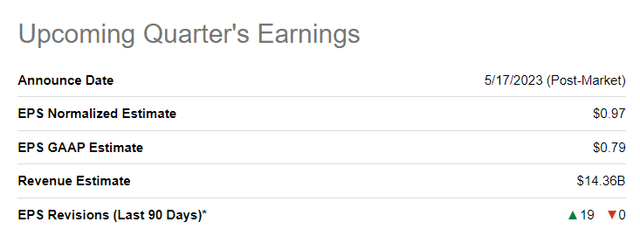

Over the past three-month period, CSCO has undergone a period of upward EPS revisions, with 19 analysts upgrading their earnings estimates for the quarter.

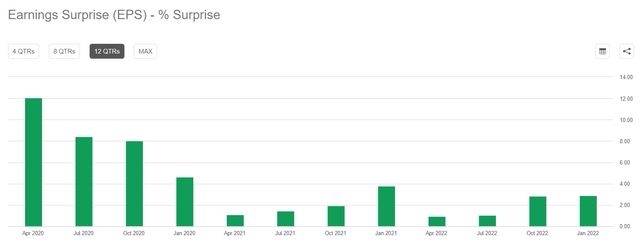

As I recently showed, Cisco’s recent business momentum is at odds with the company’s share price performance, which is lagging behind. On a quarterly basis, the company also has consistently performed better than expected, which partially explains the flurry of analysts rushing to upgrade their estimates.

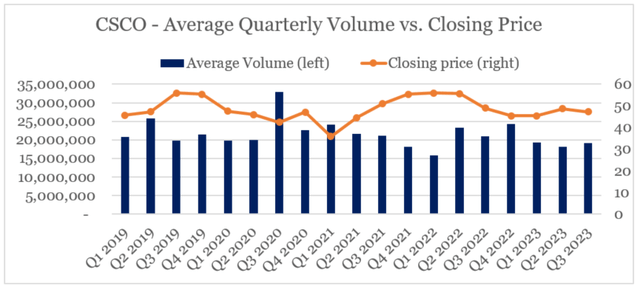

What’s also important to note is that the quarterly trading volume of CSCO has been near record lows over the past few three-month periods, and in contrast to Q1 of 2022 and Q3 of 2019, this time around Cisco’s share price has not experienced a sharp increase.

Prepared by the author, using data from Seeking Alpha

In a nutshell, investors are not particularly excited about Cisco’s performance, even though the analysts are turning more optimistic on the company’s prospects. As critical as I am of analysts’ ability to forecast long-term movements in share prices, this is a good set-up of those looking to take advantage of temporary weaknesses in share price.

The Business Momentum

During the most recent quarter, CSCO has exceeded its previous guidance and the management was highly optimistic for the business momentum to continue.

Our Q2 financial results were strong as we again exceeded the high-end of our guidance ranges

Source: Cisco Q2 2023 Earnings Transcript

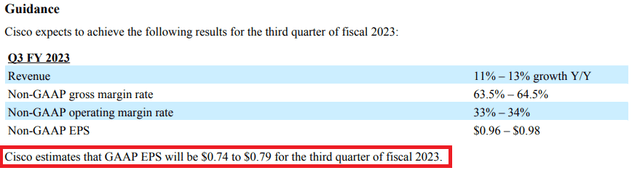

On a quarterly basis, the upcoming results are expected to deliver double-digit revenue growth and non-GAAP EPS at almost $1.

For fiscal Q3, our guidance is: We expect revenue growth to be in the range of 11% to 13%; we anticipate the non-GAAP gross margin to be in the range of 63.5% to 64.5%; our non-GAAP operating margin is expected to be in the range of 33% to 34%; and our non-GAAP earnings per share is expected to range from $0.96 to $0.98.

Source: Cisco Q2 2023 Earnings Transcript

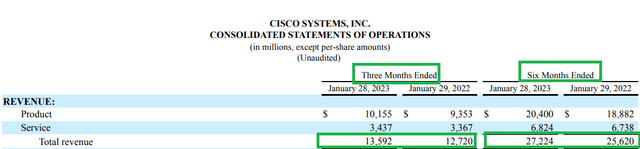

To put this into perspective, year-on-year total revenue growth for the last quarter was roughly 7% and the same figure for the first half of the fiscal year was even lower at only 6%.

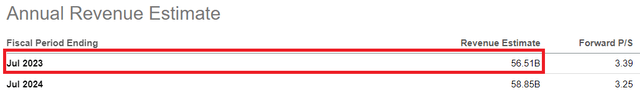

Full fiscal year guidance also saw a significant improvement during the past quarter, with annual revenue growth now likely to improve in double digits as well.

There is also a significant change to our full year fiscal ’23 revenue and non-GAAP earnings per share guidance driven by these same factors. For fiscal year ’23, we are raising our expectations for revenue growth to be in the range of 9% to 10.5% year-over-year. Non-GAAP earnings per share is expected to range from $3.73 to $3.78.

Source: Cisco Q2 2023 Earnings Transcript

Based on these numbers, FY 2023 revenue should come within the range of $56.2bn and $57bn. At the same time, the already upgraded analyst estimates are standing near the lower-end of this guidance, which illustrates the cautious approach by Wall Street and the scope for yet another better-than-expected quarter.

A Closer Look At Segments

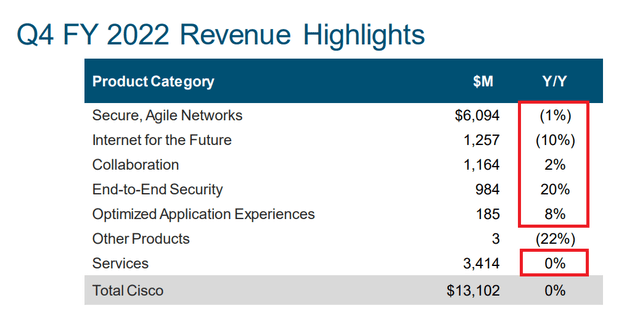

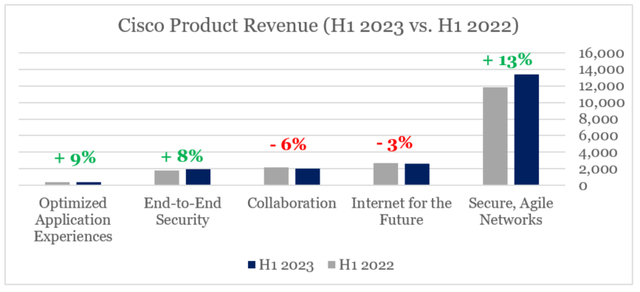

On a segmented basis, it’s Cisco’s Secure, Agile Networks that provided the strongest tailwind for the company’s Product Revenue.

Prepared by the author, using data from SEC Filings

In spite of the stiff competition in the space, the 13% increase in Secure, Agile Networks was driven by the company’s Catalyst 9000 offering in campus switching.

As a matter of fact, it was the two largest and most important product segments – Secure, Agile Networks, and Internet for the Future that saw an improvement during the first half of the fiscal year. On a quarterly basis, these two segments declined by 1% and 10% respectively in the last quarter of FY 2022.

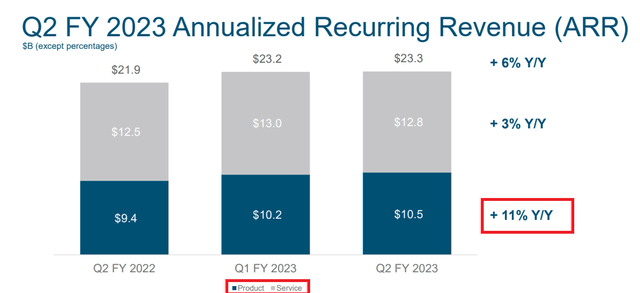

All that has resulted in a major uplift of Cisco’s annual recurring revenue in the product segment, which highlights the importance of the campus and data center switching for the company and the dynamics between the two groups.

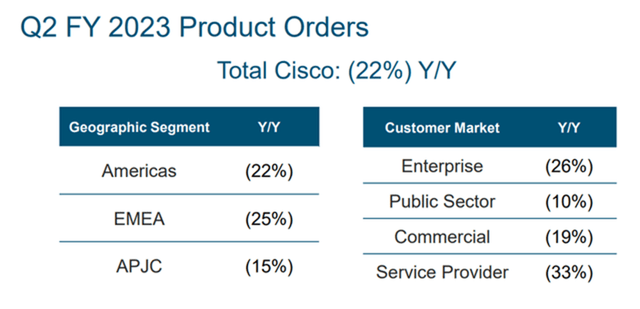

Having said that, product orders are now normalizing, and during the upcoming results, management should provide some useful information on this dynamic going forward.

While total product orders were down 22%, they compared against 34% growth in Q2 fiscal ’22, which is one of the largest quarters for product orders in our history. We saw year-over-year declines across our geographies and customer markets. Sequentially, total product order growth was in line with our historical growth rates.

Source: Cisco Q2 2023 Earnings Transcript

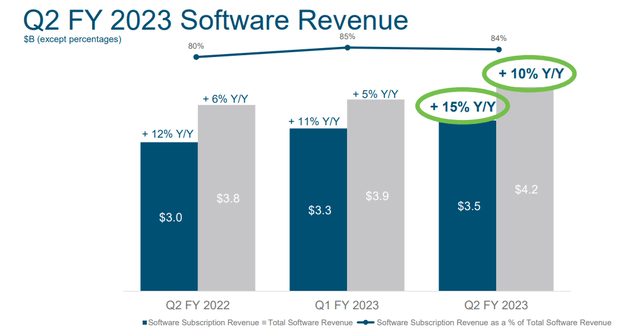

Having said that, there’s also a significant software revenue component attached to Cisco’s backlog that should not be ignored when processing the large drop in orders we saw above.

The one piece that’s missing in your equation is, as we ship the backlog, remember, we said there is more than $2 billion of software in there. A lot of that software is ratable. So, as soon as we ship it, it doesn’t all drop into the revenue stream. It ends up dropping into deferred revenue and being recognized over time. So, there is a – you have to consider not just the reduction in backlog, what’s the uptick in the revenue guide, but also how much of this is going to contribute to growth in deferred revenue.

Source: Cisco Q2 2023 Earnings Transcript

In that regard, software revenue is highly likely to continue to experience significant tailwinds, especially when it comes to software subscription part.

What To Expect From Capital Allocation

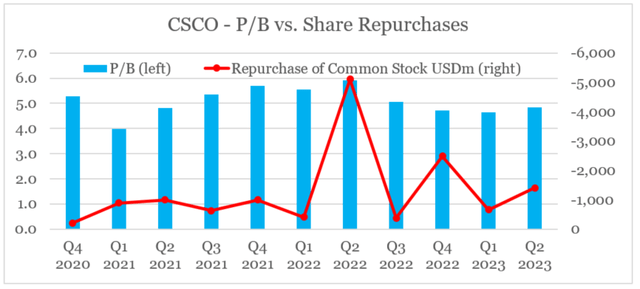

Cisco ended the last quarter with $13.4 billion in remaining stock repurchase authorization, which leaves scope for increased stock buybacks during the third and fourth quarter of this fiscal year.

The reason being that Cisco’s stock has fallen in recent months and the management has been engaging in more share repurchases since the company’s P/B ratio has fallen off from its recent highs (with the exception of Q2 2022).

Prepared by the author, using data from SEC Filings and Seeking Alpha

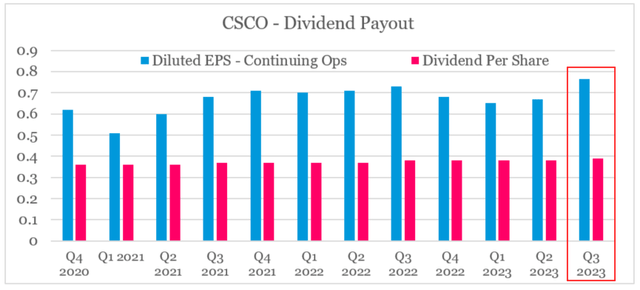

In terms of dividends, the company is in a good position to continue increasing its dividend payments, even though caution will be rewarded due to the uncertain macroeconomic environment.

The reason why I’m saying that is because, for the upcoming quarter, management expects GAAP EPS to come within the range of $0.74 and $0.79, which is a significant improvement on the EPS numbers for the past few quarters and a more than 8% improvement year-on-year if it comes at the high end of the guidance.

Having said that, average quarterly dividend payout ratio during the Q4 2020 to Q2 2023 period has been 57%, but based on the above GAAP EPS numbers for Q3 2023 and the 3% dividend increase announced last quarter, CSCO’s dividend payout would fall to 51% based on the mid-point of the guidance.

Prepared by the author, using data from Seeking Alpha

Overall, this is a strong indicator that CSCO’s management could continue to cautiously increase its quarterly dividend, provided that the macroeconomic environment does not deteriorate.

Investor Takeaway

Cisco is in a good position to report yet another strong quarterly results, however, it would be the forward-looking statements that investors would be most interested in. The business momentum for FY 2023 is likely to continue, but the question of sustainability through the next fiscal year remains. In the meantime, the business is transitioning into a more recurring revenue stream, and decisions regarding capital allocation could give us some valuable clues for the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the company's SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

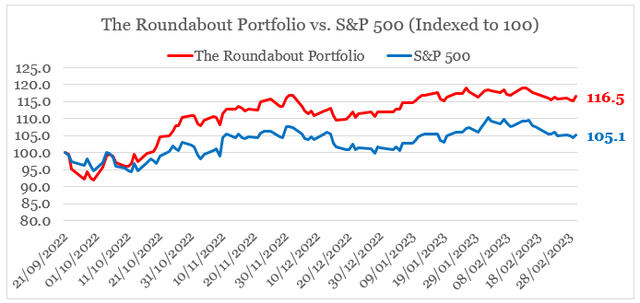

Looking for better positioned high quality businesses in the technology space?

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.