Summary:

- Cisco Systems is set to report earnings this Wednesday.

- I have low expectations for this quarter given recent layoffs and the weak IT spending cycle.

- I remain optimistic in the longer term thanks to a high-quality business model, attractive valuation, and growing software and cybersecurity operations.

robas

Networking infrastructure company Cisco Systems (NASDAQ:CSCO) is set to report earnings this Wednesday.

Back in April, I presented my long-term view and analysis of the company. I’d refer back to that for discussion of Cisco’s past and overall outlook.

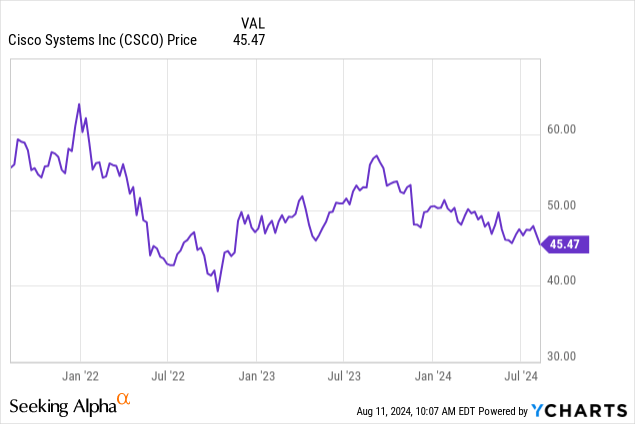

This article will zoom in on the latest developments and outlook for this earnings report and going forward. Since my last report, Cisco shares have slipped a few percent in subdued trading. In fact, for the past three years, shares have traded in a narrow range centered around the $50 price:

There hasn’t been much in the headlines recently that would move the stock price. However, under the surface, I believe there are some important developments that we should be keeping track of.

Layoffs Amid An Industry Cycle Slump

Earlier this month, reports surfaced that Cisco will be announcing a second round of layoffs in 2024. Previously, the company cut about five percent of its workforce, and this second round of layoffs will reportedly be in the same general range of job reductions.

Going into earnings, it’s hard to see this as a positive sign for this quarter’s results or the company’s guidance heading into fiscal year 2025.

In general, the information technology space has been hit with spending freezes and cutbacks over the past year. Back in 2020-2022, IT departments spent heavily to upgrade their networks and remote work capabilities. During the early days of the pandemic, companies had to shift a lot more of their order flows from in-store or in-person to digital and app-based solutions. So there was a huge spike in IT infrastructure spending. Now that the economy is reopened, and we’re seeing some momentum for return to the office, that reduces the urgency toward more immediate investment in IT. We’ve also seen accounts that companies may have bought too much networking gear during the pandemic and are still installing and deploying those past purchases before making additional orders.

More broadly, across the tech landscape, high interest rates have dampened the mood around capital expenditures. Unless it’s related to AI, most firms aren’t writing big checks for capex right now. A few years ago, capital was incredibly cheap. That was both in traditional borrowing, and also funding sources such as venture capital and SPACs. There were all sorts of ways to get access to unusually cheap cash and then plow a big chunk of that into IT gear. Those funding spigots are simply not open at the moment, however, so the hunch going into earning should be that Cisco is going to report fairly soft numbers. The layoff plans add further weight to that suggestion. I’m not expecting a particularly strong guidance picture for the company’s fiscal year 2025, either.

That said, the negativity is arguably already reflected in the stock price. Shares are selling at a discounted valuation, and expectations here are low.

Don’t forget that Cisco isn’t just a networking infrastructure company anymore. There’s more to it than routers and switches. Under the surface, Cisco is a large software company as well. In fact, as of last quarter (inclusive of the Splunk acquisition) Cisco now generates 54% of its revenues from subscription revenues. While the P/E ratio has remained low, the underlying business quality has steadily improved over the years. And Cisco has been pursuing verticals like cybersecurity that have much stronger growth opportunities than its core networking business.

Speaking of cybersecurity, there could be interesting things there in this quarter’s conference call. Let’s see if Cisco is able to take customers away from CrowdStrike (CRWD) following that firm’s historic service outage. Though, the sales cycle on these sorts of services tends to be fairly long, so that may be more of an end of 2024 or early 2025 story where Cisco is able to start profiting from CrowdStrike’s missteps. In any case, CRWD stock was selling for more than 20x enterprise value to sales prior to its recent plunge, whereas Cisco sells for about 3.5x EV/sales today. Cisco will likely never sell anywhere near the valuation of a high-growth pureplay cybersecurity firm, but there’s a huge valuation gap here and any momentum in one of Cisco’s verticals could lead to solid upside. Just look at the excitement around Dell Technologies (DELL) thanks to its small but fast-growing AI hardware sales division over the past 18 months.

I’ll also be watching to see how Cisco’s integration with Splunk is going. That deal closed in March 2024, and at a $28 billion price, it was a huge purchase. It will take Cisco many quarters to fully integrate Splunk into its operations and sales processes, but any updates on how this process is going will be appreciated. It’s not just about Splunk, either, but as a broader sign of whether Cisco is capable of using large scale M&A to drive inorganic growth in the business. Given Cisco’s robust cash flows and limited internal growth opportunities, M&A will be vital to the firm’s capital allocation going forward.

And I’ll be watching to see how Cisco is handling the AI opportunity. There has been a lot of talk about Cisco’s investments and partnerships in the space. I personally am somewhat skeptical about the value of AI for more generalized tech companies. There are a few firms that are making a killing in the AI space, but in general, it seems a lot of companies have a very small AI business and are trying to hype it up because that’s what’s in favor right now. Nothing I’ve seen would suggest that Cisco is going to be a leading player in near-term AI applications. By contrast, an area that could be more interesting for Cisco is in what’s called fog computing.

Here’s a Cisco blog post discussing the concept:

Fog computing is a term created by Cisco in 2014 describing the decentralization of computing infrastructure, or bringing the cloud to the ground.

Fogging enables repeatable structures in the edge computing concept so that enterprises can easily push compute power away from their centralized systems or clouds to improve scalability and performance.

The idea here being that cloud computing has gotten expensive for many clients. So, IT departments will be looking for a hybrid solution between on-premise computing with all its pitfalls and drawbacks, and that of cloud, which has gotten very expensive, particularly due to having just a couple of suppliers that control most of the cloud market and resultant pricing. Edge computing generally and fog commuting more specifically can process, scrub, and store a great deal of data closer to the end client rather than at a costly and centralized cloud source. Bringing the cloud to the ground, so to speak.

Cisco itself invented the concept and the terminology around a decade ago and has been driving initiatives to decentralize the cloud. Particularly with the rise of internet of things “IoT” applications and ever-more connected smart devices, there should be significant opportunity for building decentralized network infrastructure. This should lower costs, improve efficiency, and deliver improved network latency. Cisco, in turn, will have more opportunities to both sell networking equipment and also bundle in add-ons like software for network monitoring, cybersecurity and so on for all those new internet-connected access points.

Cisco’s Bottom Line

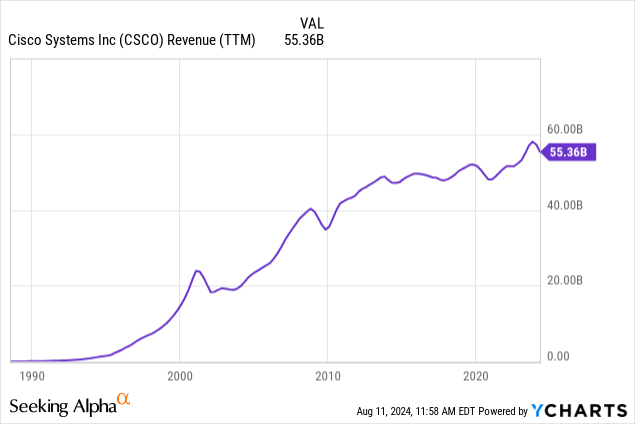

Cisco shares remain cheap both and absolute terms and in particular compared to the tech market. This is fully understandable. People are skeptical of Cisco’s long-term growth prospects. A quick glance at Cisco’s revenue chart should make this reasoning clear:

Cisco was an exponential revenue growth story in the 1990s, a solid growth story in the 2000s, and a virtually stagnant one between 2013 and 2021. Revenues popped to new all-time highs recently on the IT spending boom, but have since retreated off that peak. Investors are frustrated, and not without reason.

Cisco will continue to sell mountains of networking equipment every year, but that’s not much of a growth business nowadays. At some point, Cisco needs to reinvest that cash into things that grow more quickly, or, barring that, return nearly all its profits to shareholders via dividends and buybacks.

That said, Cisco’s collection of software and cybersecurity businesses looks reasonably attractive. There’s a perception gap here, where more than half of Cisco’s revenues are now subscription-based, yet the market is valuing it as a stuffy hardware company.

The risk, though, is that much of Cisco’s subscription revenues come from more competitive fields than that of the core networking operations. Cisco could also damage its competitiveness by cutting costs and headcount too aggressively.

Within the networking business, Cisco also needs to remain vigilant. There is meaningful competition there from the likes of Arista Networks (ANET) and Ubiquiti (UI) that can eat away at the margins, particularly on cutting-edge equipment. Cisco is the dominant player, but it should be wary of cutting into its core competitive strengths during its current layoff cycle.

Heading into earnings, Cisco is not likely to report particularly compelling numbers. I haven’t seen anything about Cisco specifically or the IT market more generally that would suggest that we’ve hit a turning point where sales momentum is going to recover. I wouldn’t expect that sort of inflection until 2025 or perhaps even longer if a recession hits.

However, for longer-term investors, the value proposition remains fairly clear. And while I am unsure that AI will move the needle for Cisco anytime soon, I do see possibilities in the edge/fog computing space and cybersecurity that could help improve sentiment over the next year or two. At 12.5x this year’s estimated earnings and with a 3.5% dividend yield, Cisco is a fine conservative tech option that should have limited downside and can profit from multiple bullish scenarios going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.