Summary:

- The narrative around Cisco Systems, Inc. has worsened following the most recent earnings release, and this is likely justified in the short term.

- There are risks involved with the company’s recently announced acquisitions, but the business is on a long path towards transformation.

- While most investors remain focused on the short-term revenue growth, Cisco is improving its profitability profile.

- Cisco stock remains attractively priced as a long-term investment opportunity.

Alexander Koerner

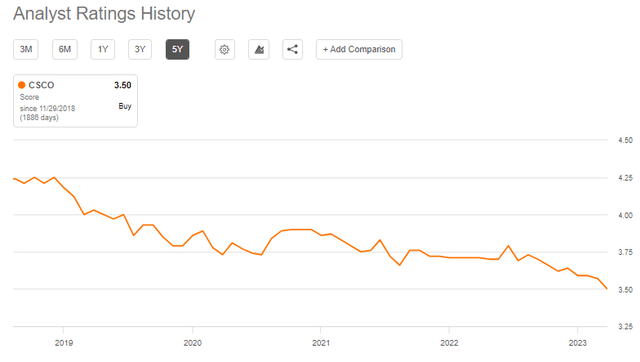

The sentiment around Cisco Systems, Inc. (NASDAQ:CSCO) has been on a slow and steady decline in recent years as the company is struggling to adapt to the new reality of cloud-based solutions.

Sell-side analysts’ consensus rating is usually a very good indicator of how investors are seeing the stock and in the case of CSCO things are not looking good.

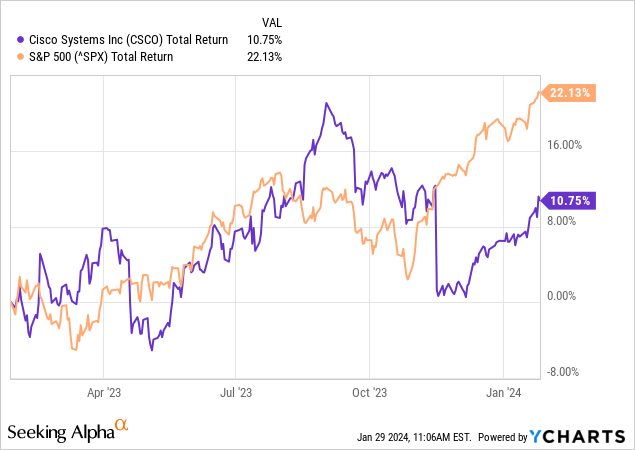

Throughout the last year, the stock was largely performing in-line with the broader equity market, until the company reported its first quarterly results for fiscal year 2024 in November of last year. Although both revenue and earnings came slightly above the estimates, new orders slowed down and the management’s guidance for the next year came well below the consensus.

Following the release, CSCO fell 12% and erased almost all of the gains made during 2023 (see below).

Since then the stock has somehow recovered, but as we see from the graph above – this has been largely due to the broader recovery in equities following the most recent quarterly refunding data by the U.S. Treasury.

Acquisitions And Forward Guidance

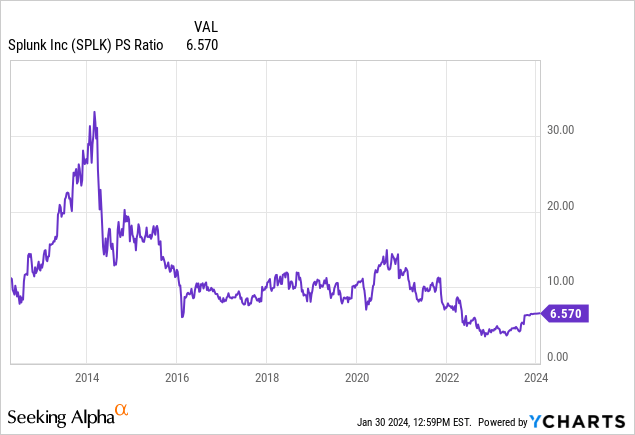

On top of all that, Cisco also announced its intention to acquire Splunk (SPLK) for a record high amount of $28bn. This sparked further speculation that Cisco’s legacy business is less relevant in the current reality and that the company is desperately trying to stay relevant. Not to mention the fact that such large deals rarely create shareholder value and are often followed by large asset impairments just a few years following the acquisition.

Although I won’t go into too much detail on the deal in this article, we should give Cisco’s management credit for pursuing this highly complementary deal at a time when SPLK is trading at far lower multiples when compared to just a few years ago.

Just a month later, the company announced yet another deal to acquire Isovalent – a company operating in cloud networking and security which will further accelerate Cisco’s efforts to establish itself as a leader in in secure networking capabilities for public clouds.

Even though both of these deals hold short to medium-term risks for shareholders, they are steps in the right direction as far as Cisco’s long-term strategy is concerned, and I covered this as part of my initial investment thesis.

Now when it comes to the disappointing guidance for fiscal year 2024, Cisco’s management has indicated that the company should return to more normal growth rates following the second quarter. On the revenue side, the drop was indeed significant with the management now expecting total revenue within the range of $53.8bn to $55bn, down from $57bn to $58.2bn as of the fourth quarter of FY 2023.

The impact on earnings is far less pronounced as we see from the two extracts below.

Our revenue guidance assumes, one quarter to two quarters of lower revenue and then a return to more typical sequential growth rates.

(…) Non-GAAP earnings per share is expected to be in the range of $3.87 to $3.93.

Source: Cisco Q1 2024 Earnings Transcript

Non-GAAP earnings per share is expected to range from $4.01 to $4.08.

Source: Cisco Q1 2024 Earnings Transcript (emphasis added).

Overall, the market reacted in line with these short-term developments, but beyond that Cisco’s share price looks very attractive at current levels.

Even More Attractively Priced

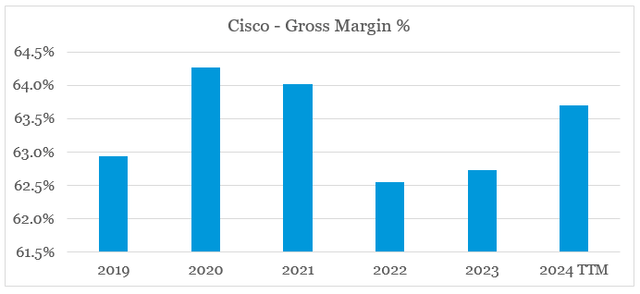

One very positive development during the last reported quarter was the notable improvement of Cisco’s margins and more specifically – the gross margin (see below).

prepared by the author, using data from SEC Filings

With gross margins of above 60% Cisco remains as one of the most profitable companies in the industry and the ongoing transition into a company with higher share of annual recurring revenue it is also in a good position to continue improving its gross profitability numbers.

As a matter of fact, gross margin is expected to continue improving throughout fiscal year 2024 when compared to a year ago.

I think gross margins, we’ve said will settle in somewhere in this 65% to 66% range. I think at this point, it looks like it will be closer to the higher end of that range for the second part of the year.

Source: Cisco Q1 2024 Earnings Transcript.

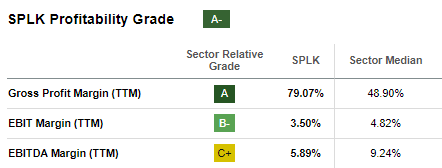

The Splunk deal would also have a positive impact on Cisco’s gross profitability given its gross margin 79%. Not to mention the Cisco’s ability to extract synergies and reduce the level of fixed costs at Splunk, this improving it bottom line.

Seeking Alpha

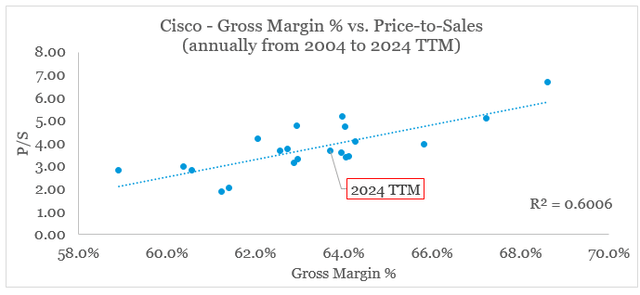

The reason why I am so fixated on gross profitability is that it is a key driver of Cisco’s price/sales multiple over the long-run. On the graph below, I have plotted Cisco’s annual gross margins from 2004 to the past twelve month period for the company on the x-axis and the corresponding P/S multiple for the period.

prepared by the author, using data from SEC Filings and Seeking Alpha

We could see that CSCO is now fairly priced based on its past gross margin figure and as this improves I would expect for the company to trade at higher sales multiples in the future.

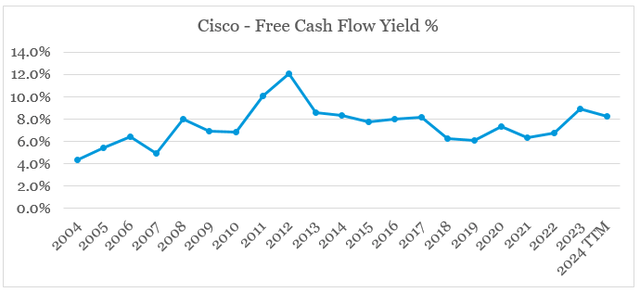

Even when we look at Cisco’s free cash flow, the company now trades at one of the most attractive free cash flow yields since FY 2017.

prepared by the author, using data from SEC Filings and Seeking Alpha

Conclusion

Although Cisco Systems, Inc.’s 2024 is likely to come below previous expectations in terms of total revenue and earnings, the company is making the right steps to transition its business model. Volatility through the next months is to be expected, but given the attractive pricing of the stock and the gradual transition of the business, I retain Cisco Systems, Inc. stock as a buy and could even add it to my list of high conviction ideas as 2024 progresses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the technology space?

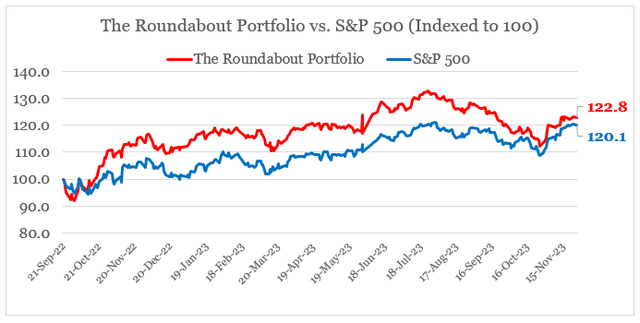

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.