Summary:

- Cisco has been a blue-chip IT company for decades.

- The current valuation of Cisco is attractive.

- With decent growth opportunities and a transformation to a recurring revenue model, Cisco is an interesting investment.

raisbeckfoto

Introduction

I am a dividend growth investor, and as one, I am always looking for new opportunities to invest in income-producing assets, mainly stocks. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The information technology sector is exciting. After the past year, it was hammered due to higher inflation and rates. I constantly look at the more stable companies within industries. These “boring” companies execute. I analyzed the company a year ago and rated it a HOLD. Cisco (NASDAQ:CSCO) has been a leading company in the sector for decades, and it is time to revisit it.

I will analyze Cisco using my usual methodology for analyzing dividend growth stocks. I use the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Cisco Systems designs, manufactures and sells Internet Protocol-based networking and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. The company also offers a switching portfolio that encompasses campus and data center switching. Enterprise routing portfolio interconnects public and private wireline and mobile networks, delivering highly secure and reliable connectivity to campus, data center, and branch networks. Wireless products include standalone wireless access points, controller appliance-based, switch-converged, and Meraki cloud-managed offerings, and compute portfolio including the cisco unified computing system, hyperflex, and software management capabilities, which combine computing, networking, and storage infrastructure management and virtualization.

Fundamentals

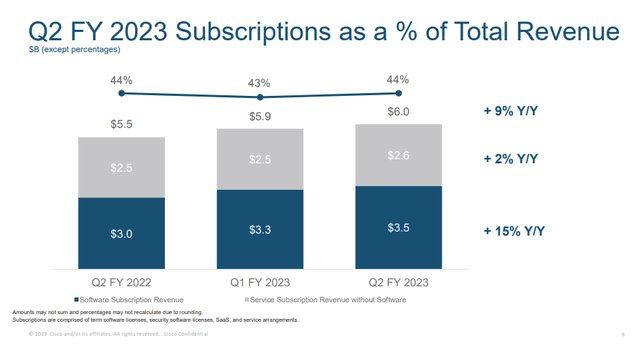

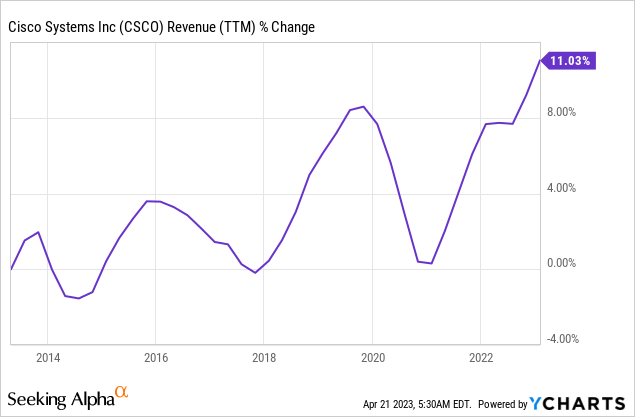

Revenues are up 11% over the last decade. This is not a fast-growing company, and you can also see that the sales are cyclical. However, there is a change in the business model as the company is shifting toward subscription-based revenues. It should help the sales to be less volatile. Subscriptions now account for 44% of the sales, and recurring revenues are up 6% year over year. In the future, as seen on Seeking Alpha, the analyst consensus expects Cisco to keep growing sales at an annual rate of ~6% in the medium term.

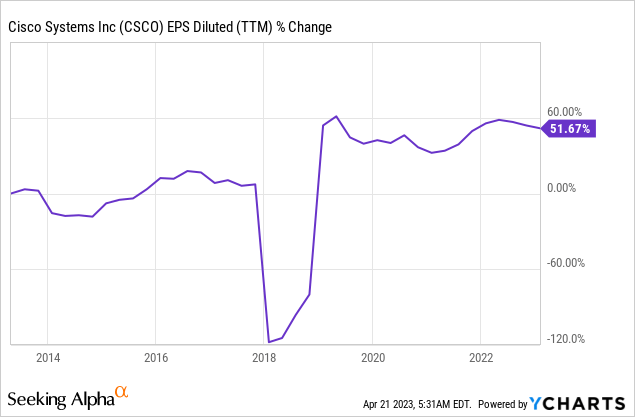

The EPS (earnings per share) has grown much faster. A 50% increase in EPS is not very high compared to the IT industry, but it is almost five times faster than sales growth. EPS growth has been fueled by sales growth, cost reductions, and share repurchase plans. In the future, as seen on Seeking Alpha, the analyst consensus expects Cisco to keep growing EPS at an annual rate of ~8% in the medium term.

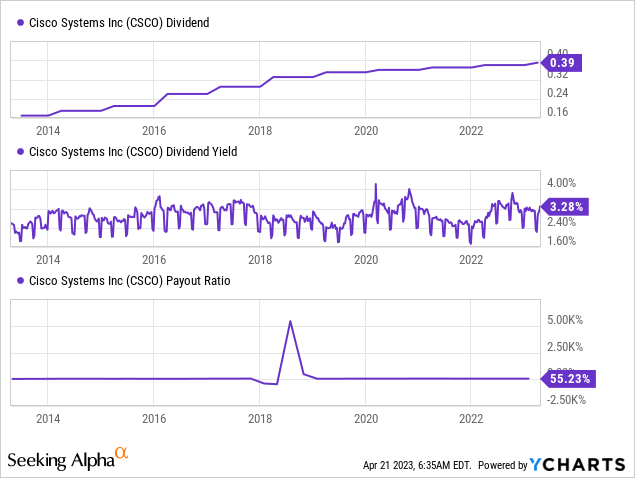

The dividend is another solid metric when it comes to Cisco. The company has been paying a growing dividend for the past eleven years and has never reduced it. The current dividend yield is 3.3%, and investors enjoyed an additional increase in February. In the medium term, investors should expect the dividend to increase at a pace in line with the EPS growth. The current dividend seems safe, with a payout ratio of 55%. Using non-GAAP figures, the P/E ratio sits below 50%, implying that a dividend cut is extremely unlikely.

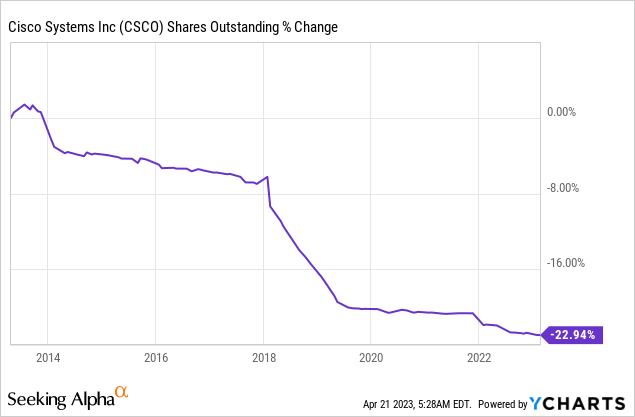

In addition to dividends, the company also returns capital to shareholders via buybacks. Buybacks support EPS growth as they lower the number of outstanding shares. For Cisco, the buybacks over the last decade have decreased the number of shares by 23%. Buybacks are highly efficient when the share price is attractive. Thus, Cisco’s buybacks have a significant positive impact.

Valuation

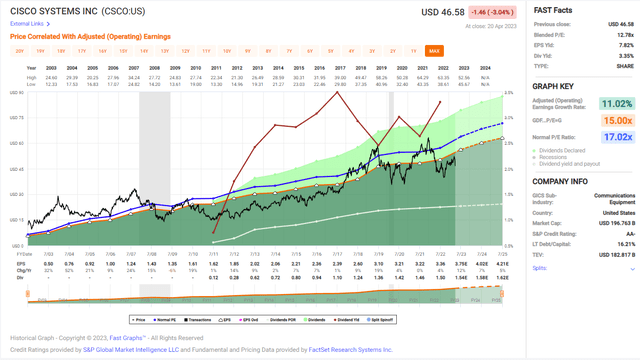

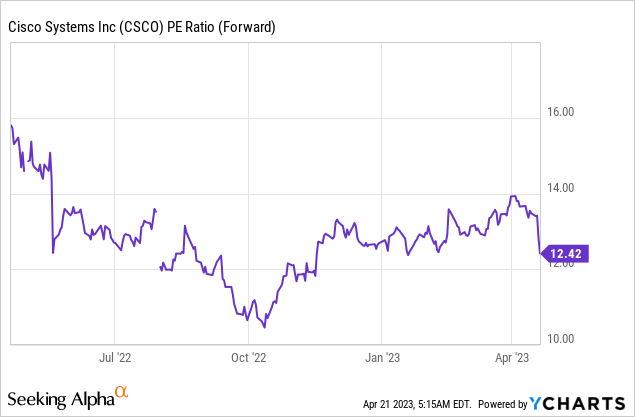

The company’s P/E (price to earnings) ratio stands at 12.4 when considering the EPS forecasts for 2023. Paying 12 times earnings for a company with decent fundamentals makes sense. Moreover, the graph below shows that the current valuation aligns with the average valuation over the past twelve months. While suffering from limited growth, Cisco is a solid company that still increased its sales, EPS, and dividends. Therefore, the valuation seems attractive.

The graph below from Fastgraphs also implies that the shares of Cisco are attractive at the current valuation. The average P/E ratio of the company has stood at 17 over the past two decades. The average growth rate stands at 11% during the same period. The current growth rate is slower at 8%, yet the valuation is also significantly lower. Therefore, I believe that Cisco is attractive from a historical perspective from the valuation point of view.

Opportunities

Even when IT budgets tighten, higher demand for cybersecurity is a significant growth driver for Cisco. Enterprises seem to know that shifting towards the cloud and digitalization process is acute to maintain market share and growth. Therefore, they must keep investing in security to protect their core business. As hacking groups from Russia and elsewhere attempt to harm American and European targets, the demand for Cisco’s products will grow.

Another growth opportunity for Cisco is the company’s transformation from an almost all-hardware company to a software and hardware company. The company’s software sales are growing, shifting 44% of its sales to subscription-based sales. This shift will lower the volatility and cyclicality of its sales. It will allow the company to plan further ahead as it won’t need to replace 100% of its sales every year to maintain last year’s sales.

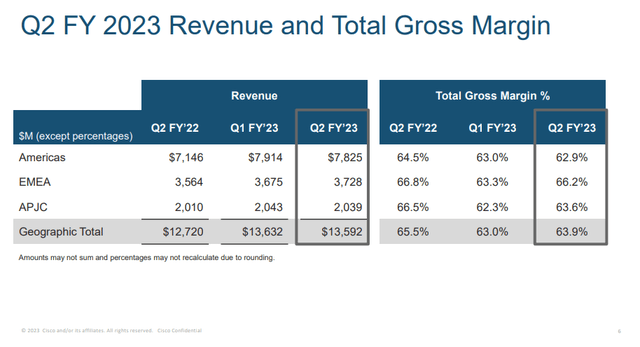

Diversification is another key to the company’s future growth and resilience. The company has earned almost 50% of its sales outside of America. While the United States remains the company’s largest market, its ability to grow into newer markets opens an opportunity for future growth. In addition, as the chart below shows, the margins outside of the Americas are even higher, making international expansion even more lucrative.

Risks

International growth, a significant growth opportunity in the long term, has slowed down in the short term. Over the last twelve months, the company grew international sales by only 3.4% compared to 9.5% growth in the United States. The company’s slow global growth may delay its future expansion and, if it continues, may challenge the current EPS and sales estimates.

Moreover, we see that the company is also struggling to keep increasing the share of its subscription revenues. While 44% of the company’s sales are subscription-based, this is the figure we saw a year ago. Therefore, the gains from the more lucrative and profitable business model may be delayed in the short term.

In addition, Cisco is operating in a very competitive environment. The cybersecurity realm is competitive as new products and services are launched by competitors. Cisco has to constantly keep investing in offering high-end products and services to its clients and attracting new ones. Cisco should also avoid bad publicity and weaknesses in its systems. If a Russian hacking group targets American agencies using a vulnerability in Cisco’s systems, that is a significant risk to the reputation.

Conclusions

Cisco is a decent company across the board. It offers investors solid fundamentals with sales, EPS, and dividend growth. The current valuation is attractive, and investors can capitalize on future growth opportunities. There are risks to investment in Cisco, and investors cannot expect speedy growth, but Cisco offers a great package.

I am raising my rating of Cisco from HOLD to BUY as the situation has improved since I analyzed the company last year. The growth rate has increased, and the valuation is more attractive. Therefore, I believe that dividend growth investors seeking steady income from the IT sector should consider the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.