Summary:

- Cisco Systems’ recent financial results were strong, but the planned acquisition of Splunk for $28 billion adds operational and financial risk without adding significant value.

- The acquisition brings together two leaders in network security and observability, strengthening Cisco’s competitive position, primarily in observability and AI capabilities.

- I am not expecting the Splunk acquisition to turn Cisco’s losing market share trend around, as Splunk is also seeing its growth slow meaningfully and is losing share.

- While this acquisition could boost growth for Cisco ever so slightly, I am not expecting it to cause a massive growth acceleration as a whole for Cisco.

- Cisco’s risk-reward profile does not look attractive as the financial and operational risks no longer outweigh the potential reward. Therefore, I moved my CSCO rating from buy to hold and recommend investors to stay on the sidelines or look for more attractive opportunities in the market.

Alexander Koerner

I move my rating on Cisco Systems, Inc. (NASDAQ:CSCO) from buy to hold following its most recent financial results and the recently announced intent to acquire cybersecurity and observability company Splunk Inc. (SPLK) for $28 billion. I believe this acquisition meaningfully increases the operational and financial risk profile while adding little value to Cisco’s existing operations, as Splunk is poised to lose market share to cloud-native competitors and reports slowing growth rates. Therefore, I believe the reward no longer outweighs the risks for Cisco stock.

Before we get into the Splunk acquisition, I first want to revisit Cisco’s existing business by taking a quick look at its most recent financial performance. I last covered Cisco in February and rated shares a Buy, as I liked the risk-reward profile with shares trading 16% below my price target.

For those unfamiliar with Cisco, it is good to know that the company designs, manufactures, and sells networking hardware, telecommunications equipment, and other high-tech products and services. Cisco’s product portfolio includes routers, switches, firewalls, wireless access points, cloud-based collaboration tools, etc. However, Cisco is most known for its enterprise networking products, which provide the backbone for many corporate and government organizations around the world.

Over the years, the company has also expanded its product offerings to include cybersecurity solutions, cloud-based services, and software-defined networking solutions, which are the segments that are most important to its growth outlook as the legacy hardware and networking equipment businesses drive very little growth due to market saturation.

In addition to focusing on new markets like cybersecurity to drive growth, Cisco has also been shifting its focus from hardware-based solutions to software and services to adapt to changing customer needs and improve its revenue reliability and customer retention.

FY23 marked a record year for Cisco and fundamentally the business is in good shape

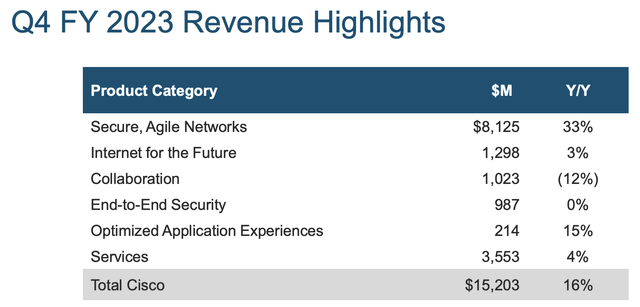

Cisco reported its fiscal Q4 results on August 16 and delivered revenue roughly in line with the consensus, coming in at $15.2 billion, up an excellent 16% YoY. This brings the year’s revenue total to $57 billion, up 11% YoY, which really is a very respectable performance, especially when considering the challenging operating environment with IT and hardware spending under pressure. In fact, this is the highest growth rate reported by the company in over a decade.

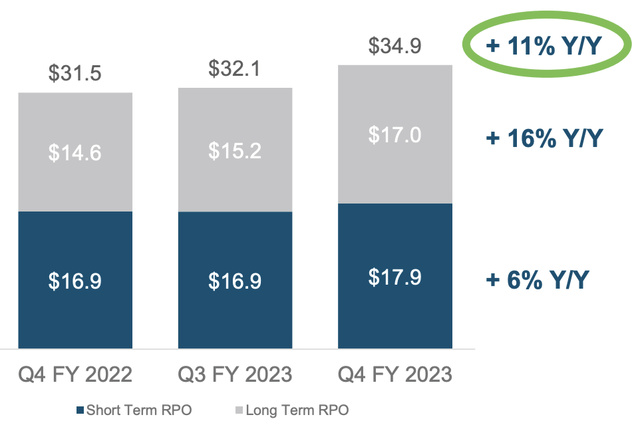

Furthermore, Cisco continued to see strong customer demand in Q4, as orders were up 30% sequentially, driven by double-digit growth across all end markets. However, we have seen some order weakness during the year, with orders still down 14% YoY from record levels in 2022. Yet, this is no reason for concern, with RPO coming in at $34.9 billion, up 11% YoY. Furthermore, ARR (annual recurring revenue) now stands at $24.3 billion, up 5% YoY with product ARR growth of 10%. This gives the company a strong, reliable revenue stream at any time and increases revenue predictability, lowering the risk profile.

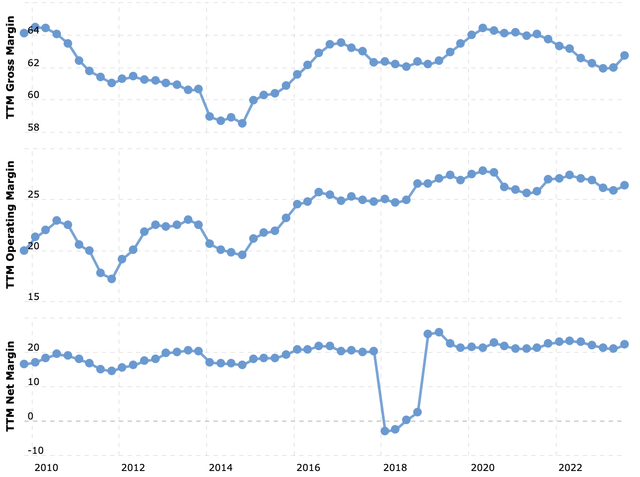

Moving to the bottom line result, the company reported mixed margins for the full year despite a strong Q4 performance. The Q4 gross margin was up 260 basis points to 65.9%, also driving up the operating margin to 35.4%, up 300 basis points YoY. This shows a very solid margin performance driven by strong top line growth. However, the FY23 margin profile was less impressive in terms of the YoY performance, with an FY23 gross margin of 64.5% and operating margin of 33.5%, both down 10 basis points YoY and sitting right around the 5-year average as margins have shown little improvement since 2016.

Cisco margins over the years (Macrotrends)

Still, the company’s margins are nothing to complain about, as one thing it can do is drive significant cash flows. FY23 marked another record operating cash flow of $19.9 billion, up 50% YoY, driven primarily by strong results, linearity, collections, and the deferral of the Q4 federal tax payment due in Q1 now. As a result of a strong top line and margin performance, EPS was up 16% in FY23 to $3.89.

Overall, the financial results highlight a strong operational performance and very few surprises. Therefore, my investment thesis from February for Cisco itself remains largely intact, and I continue to appreciate management’s growth and business improvement efforts. Cisco remains focused on two key aspects to drive long-term growth and value.

First of all, management aims to grow its market share across all categories. While I appreciate this optimistic goal, the company has been losing market share across multiple categories in recent years and will continue to do so. However, where I do see significant potential to gain market share is Networking. In networking, Cisco remains a leader and I do not expect this to change, as highlighted by this Q4 earnings call commentary:

With the release of the calendar Q1 results, we gained over 3 percentage points of market share year-over-year in our three largest networking markets: Campus switching, wireless LAN and SP routing.

However, this market is expected to grow at a meager CAGR of 3.7% through 2030, not representing overly impressive growth. Even if Cisco is able to keep gaining market share, I am not expecting this part of the business to grow at a CAGR of above 5%. Of course, this is still very respectable growth for a very mature operation.

Second, management wants to focus investments on AI, cloud, and cybersecurity, which is something I can get behind. And while I am not bullish on the company’s potential in cybersecurity (which I will discuss later on) and cloud AI applications, the company’s networking equipment, ASIC design, and scalable fabric for AI position it favorably to indirectly benefit from the AI boom through the growing hyperscaler infrastructures.

In June, the company launched a next-generation Silicon One switching ASIC to support large-scale GPU clusters for AI and ML workloads, allowing it to benefit from investments in AI. Furthermore, to date, Cisco has reported orders of over $0.5 billion of AI Ethernet fabrics, indicating strong growth. I believe this exposure to be a good growth driver in the medium term, fueling my mid-single-digit growth outlook.

Finally, through this growth, Cisco should be able to keep driving impressive cash flows, which can be used to reward shareholders through a growing dividend and continued share repurchases, completing the compelling investment thesis. In its fiscal FY23, Cisco returned $10.6 billion to shareholders through 6.3 billion in quarterly cash dividends and 4.3 billion in share repurchases.

Shares now yield a respectable 2.9% on a conservative payout ratio of 40%, indicating the dividend is well covered by the company’s cash flows, making it sustainable. This should allow the dividend to grow roughly in line with its sales at mid-single-digits, which I believe is a solid dividend outlook.

However, moving to the essential part of this article, while I like Cisco as a business, especially at current valuation levels, I cannot say the same about its M&A plans and cybersecurity focus. This brings me to the recently announced Splunk acquisition.

Cisco Splunk deal

Back in September, Cisco announced that it intends to acquire Splunk for $28 billion, all in cash. The announcement initially led to a slight drop in Cisco’s share price mainly due to concerns over Cisco’s ability to integrate Splunk’s business into its own. Cisco’s M&A track record has so far led to quite a lot of skepticism toward this deal.

Cisco has been very active in M&A over the last decade as highlighted by this list, all in order to boost its growth as its legacy business is very mature and slowly growing. However, all these acquisitions, primarily focused on digital security, have done little good for the company’s growth as its revenue growth CAGR of below 2% over the last decade is little to cheer about. Of course, integrating a large existing business into your own will always come with its challenges and risks, which is why shareholders are weighing the risks against the return. So, how does this weigh out?

Well, from a top-down view and looking at both businesses’ operations, the deal actually makes a lot of sense and could strengthen both businesses if executed correctly. Splunk is a software platform designed for searching, monitoring, and analyzing machine-generated data. It is particularly useful for collecting and indexing large volumes of data from various sources, such as servers, applications, network devices, sensors, and more. The platform’s flexibility, scalability, and ability to handle diverse data types have made it popular in various industries, including IT, security, finance, healthcare, and more.

Splunk is commonly used for log and event management, security information and event management (SIEM), and other data analysis and visualization tasks through its Splunk Security and Splunk Observability platforms. Most likely of key interest to Cisco is Splunk’s SIEM product, which equips Security Operations Center (SOC) teams with the logging, analytics, and search capabilities they need to effectively respond to cyber threats, which makes Splunk a pronounced player in the cybersecurity space and a great addition to Cisco’s existing network security business. As a result, the deal brings together AI and data management capabilities, specifically valuable for cybersecurity.

Furthermore, Splunk’s’ leading platforms open it up to two fast-growing TAMs in observability and digital security, together amounting to $63 billion. It’s these industries Cisco is interested in as it wants to expand its cybersecurity offering, which is why the deal makes a lot of sense.

However, the deal gets more disputable when we look at Splunk’s product suite compared to competitors like Palo Alto Networks (PANW) and CrowdStrike Holdings (CRWD). I earlier discussed the value and importance of Splunk’s SIEM product to Cisco. However, Splunk is facing significant competition from Palo Alto in this space, which arguably has the superior product. XSIAM is Palo Alto’s alternative to Splunk’s SIEM product, and this leverages AI to rapidly detect and respond to a greater number of threats than was previously possible, practically enabling it to act as an autonomous SOC.

Whereas Palo Alto targeted to deliver $100 million in sales from this product in the first year, it has already reported $200 million in the first three quarters, massively outperforming expectations as the value offered by the platform is quite impressive. Simply put, going by customer reviews, Splunk might start losing market share quite rapidly on this front as it is struggling to compete in terms of technology, decreasing the value of the deal to Cisco.

And it is more than just the SIEM technology where Splunk is having difficulty competing. The company is generally having trouble competing with AI-native cybersecurity competitors like CrowdStrike and Zscaler (ZS), who are rapidly increasing their platform offerings.

Meanwhile, Cisco has been rapidly losing market share in cybersecurity over the last decade. The company has failed to keep up with the competition and is still mainly not cloud-native. Its market share has fallen from mid-teens in 2014 to just 6.9% in the last year. Adding another business facing significant competition and losing market share to relatively new competitors with dominant technology to boost growth and its presence in cybersecurity is then highly questionable, to say the least. Needham analyst Alex Henderson described this perfectly by saying the following:

We see the deal as a merger of two legacy players in a category where new competition is emerging from strong platform Security names such as CrowdStrike and Palo Alto.

As a result, I am not expecting the Splunk acquisition to turn Cisco’s losing market share trend around, as Splunk is also seeing its growth slow meaningfully and is losing share to the competition. The likes of CrowdStrike, SentinelOne (S), Palo Alto, and Zscaler are rapidly developing and releasing new security modules offering similar functionalities to Splunk but are simply superior, as highlighted by the meaningfully higher rating CrowdStrike products get from customers. And while Splunk is often praised for its loyal customer base, in the end, I don’t expect these customers to stick with Splunk if competitors offer a structurally better platform and greater value. From this standpoint, I believe the deal provides plenty of reasons to doubt its value.

Finally, regarding the financials, I am skeptical. Splunk is expected to deliver revenue of slightly below $4 billion this fiscal year, ending January 2024, meaning it would add around 7% in revenue to Cisco’s expected $58 billion. While this might not sound overly meaningful, what is positive is that this 7% is expected to grow meaningfully stronger over the next couple of years, with analysts pointing to a double-digit CAGR through 2026, far above the 2-3% CAGR of Cisco. Furthermore, Splunk’s revenue is largely recurring, improving Cisco’s financial profile and revenue stability.

However, while this acquisition could boost growth for Cisco ever so slightly (although I have my doubts regarding Splunk’s growth outlook amid market share losses and increasing competition), I am not expecting it to cause a massive growth acceleration as a whole for Cisco. Also, the deal is quite impactful on the bottom line financials of Cisco, with Splunk still reporting GAAP operating losses, partly due to significant SBC costs.

On a more positive note, Cisco has reported that it will keep its dividend and buyback program intact, which should somewhat limit shareholder impact. Also, the deal will be paid fully in cash, which means it will not result in any shareholder dilution. Cisco has a strong cash position with over $26 billion, which is almost enough to fully fund the acquisition. The remaining two billion to close the deal will likely be generated by Cisco as the deal is pending. Going by the current numbers and outlook, Cisco should be able to generate free cash flow in access of $10 million before the deal is closed, while dividend obligations only amount to $3.2 billion. This gives the company plenty of cash to maintain its dividend and buyback program while fully paying for the Splunk acquisition without taking on significant amounts of debt or diluting shareholders.

However, the depleting cash position on the balance sheet will impact the company’s profitability as it loses a significant amount in interest rate benefits. Combined with the operating losses from Splunk, this creates a downbeat bottom line outlook, potentially decreasing EPS by $0.30. Luckily, management expects Splunk operations to drive positive cash flow after one year and contribute to non-GAAP earnings per share in the second year, which should limit the deal’s financial impact.

All things considered, I am struggling to see the real value of the deal today. Cisco is paying 32 times free cash flow for Splunk, only to see its bottom line deteriorate initially. And honestly, while I try to focus on the future and not on the past, Cisco’s terrible M&A history is giving me little confidence in the successful and smooth integration of the business, which I do not see adding much to Cisco overall. Yes, it should strengthen its position in cybersecurity temporarily, but Splunk’s growth has been slowing for a reason, and in the cybersecurity arena, it is losing to more innovative cloud and AI native competitors like CrowdStrike, Palo Alto, and Zscaler. Cisco might very well have paid a premium for a losing party again, resulting in it still lagging behind competitors. Therefore, with or without this deal, I do not see much potential in the company’s cybersecurity future and expect further market share losses in the medium term as Palo Alto, in particular, has a better product offering.

CSCO outlook

Cisco management guides for Q1 revenue to be in the range of $14.5 billion to $14.7 billion, up 13% at the midpoint, continuing its strong FY23 performance. Furthermore, margins are also expected to remain higher, in line with Q4, with the guidance of a gross margin between 65% and 66% and an operating margin in the range of 34% to 35%. This should result in EPS of $1.02 to $1.04, up 26% at the midpoint.

For FY24, Cisco now expects to report revenue in the range of $57 billion to $58.2 billion, up just 1%, seeming a little cautious, which is understandable considering economic uncertainties. However, margins are expected to remain higher, reflected by an EPS expectation of between $4.01 and $4.08, up 4% at the midpoint.

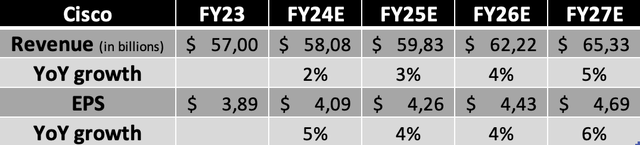

Based on this guidance from management and my analysis of Cisco’s business, I now expect the following financial results through Cisco’s fiscal FY27. This reflects a slightly lower revenue expectation after a strong performance in the last two years and a lowered EPS expectation due to limited room for margin improvement.

Please note these estimates do not include the impact of the Splunk acquisition, as this one still needs to be completed. However, if completed later next year, I expect it to have a positive contribution to Cisco’s growth outlook in the medium term of around 1-1.5 percentage points (on top of the $4-$5 billion revenue contribution) and a more significant effect on EPS growth from fiscal FY26 onward due to the negative first-year EPS effect discussed earlier but improving profitability in the following years.

Financial projections (Author)

Is Cisco stock a buy, sell, or hold?

Cisco Systems, Inc. shares are currently valued at a forward P/E of slightly over 13x, which is far from expensive and sits approximately 10% below its 5-year average. However, the revenue growth outlook is also far from impressive, and with little room for margin expansion, the same can be said about its EPS growth, limiting potential share price appreciation.

Of course, the company is an industry giant with a relatively reliable revenue stream and shareholder-focused management. Furthermore, I remain fairly positive about Cisco’s existing business and do believe the company has meaningful global strength. Nevertheless, I don’t believe a valuation premium is warranted here. Awarding the company a 14x earnings multiple (slightly below the 5-year average), I calculate a $60 12-month price target, leaving it with approximately 10.5% upside.

This brings me to the acquisition of Splunk, which I believe offers little value while adding significantly more operational and financial risk. It will drain the company’s cash position and negatively impact its bottom line, while growth is also slowing down for Splunk.

From this standpoint, the Cisco Systems, Inc. risk-reward profile does not look attractive as the financial and operational risks no longer outweigh the potential reward. Therefore, I moved my Cisco rating from buy to hold and recommend investors to stay on the sidelines or look for more attractive opportunities in the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.