Summary:

- Cisco announced job cuts and a strategic shift towards AI and cybersecurity, aiming for $1 billion in pre-tax savings.

- Product orders grew 14% year-over-year, indicating recovery from inventory destocking issues.

- Revenue guidance for FY25 suggests 4.1% growth; DCF analysis values Cisco stock at $55 per share, with downside risks including Splunk integration and limited revenue from growth areas.

Sundry Photography

I presented a ‘Sell’ thesis for Cisco (NASDAQ:CSCO) in my previous article published in March 2024, highlighting their internal issue of inventory destocking and sluggish demands from Telco/Cable markets. The company released its Q4 result on August 14th , showing a 10.3% decline in total revenue. The stock price has underperformed the S&P 500 since my last article. The company announced a second round of job cuts this year and a shift in focus towards growth areas such as AI and cybersecurity. I view these initiatives could act as near-term catalysts for Cisco’s earning growth. As the stock price is below its intrinsic value according to my DCF analysis, I am upgrading to ‘Buy’ rating with a fair value of $55 per share.

Job Cuts and Strategic Shift Towards AI and Security

Cisco announced a major restructuring plan, cutting 7% of total workforce with a total estimated pre-tax savings of $1 billion. Over the earnings call, the management emphasized a strategic shift towards growth areas including AI, Cloud and Cybersecurity.

I view the restructuring plan makes strategic sense for the following reasons:

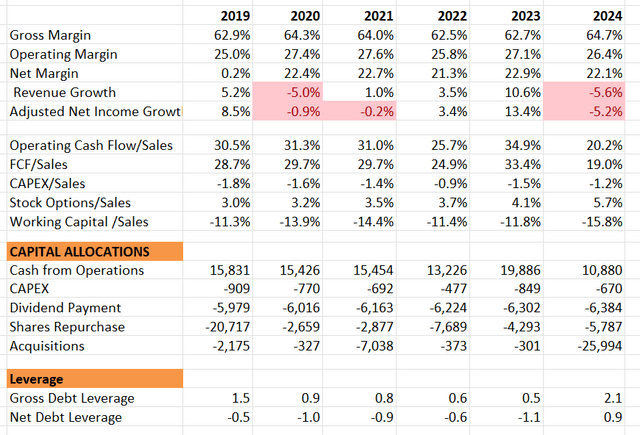

- As indicated in my previous article, Cisco has a significant portion of legacy networking and other hardware devices that have experienced very slow growth in recent years. As depicted in the table below, Cisco had an average revenue growth rate of only 1.6%. The substantial workforce reduction could allow the company to reallocate capital away from low-growth businesses and invest more in high-growth areas.

- The estimated cost savings will represent around 2.4% of total operating expenses. Once Cisco fully realizes these cost savings, I estimate the company could achieve more than 220 basis points of margin expansion for FY25.

- Cisco has some business portfolios in growth areas including AI, cloud and cybersecurity. The restructuring efforts could potentially redirect more internal resources to these growth markets, potentially accelerating topline growth in the future.

Robust Product Order Growth

As communicated over the earnings call, the product orders grew 14% year-over-year in the quarter. Excluding Splunk, its product orders increased by 6% year-over-year. As indicated in my previous article, Cisco experienced inventory destocking in the distribution channels last quarter. The strong order growth this quarter suggests that the inventory destocking issue is likely behind the company.

The strong recovery in the product orders is broad-based, encompassing both the U.S. market and Asia Pacific regions. The management called out the robust growth in the public sector.

With inventory destocking moderating, I anticipate Cisco will achieve normalized product order growth in the coming quarters. Additionally, Cisco’s investments in AI, cloud computing, and cybersecurity could further enhance overall order growth.

Outlook and Valuation Update

Cisco has guided for revenue to be between $55.0 billion and $56.2 billion for FY25, indicating around 4.1% year-over-year growth. I am considering the following moving pieces:

- While Cisco is shifting internal resources towards AI, the management only anticipates $1 billion in AI-related revenue for FY25, representing less than 2% of total revenue. It is evident that AI will not materially impact the overall topline growth in the near future.

- Services accounted for around 27% of total revenue, and are recurring in nature. I assume the service business will grow by 5% in the near term, aligned with the historical average. The growth rate includes 2%-3% from pricing growth and 2-3% from product sales growth.

- Networking: I assume the on-premises networking business to experience structural decline in the future, but this will be offset by growth in AI networking. I calculate Cisco will grow its networking business by 3%.

- For other growth areas such as cybersecurity, observability and collaboration, I forecast an additional 1% contribution to overall topline growth.

- As Cisco has been leveraging acquisitions to broaden its portfolio, I assume the company will allocate 5% of total revenue towards acquisition, contributing 170bps to the topline growth.

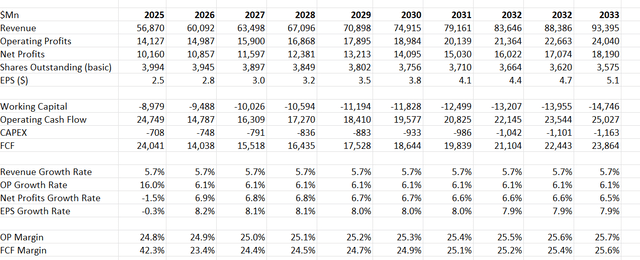

Considering all these factors, I anticipate Cisco will achieve 5.7% revenue growth in the near future.

Thanks to the restructuring and cost savings, I calculate that Cisco will deliver 220bps margin expansion in FY25. From FY26 onwards, I only model 10bps margin expansion primarily driven by the service business growth and pricing increase.

The DCF summary:

The WACC is calculated to be 7.5% assuming: risk free rate 3.8% ((US 10Y Treasury Yield)); beta 0.7 (SA); cost of debt 7%; equity risk premium 7%; equity $45.5 billion; debt $30 billion; tax rate 19%.

Discounting all the future FCF, the fair value of Cisco’s stock price is calculated to be $55 per share.

Downside Risk

I think the near-term risk for Cisco is the integration of Splunk, which Cisco completed in March 2024. Cisco plans to fully integrate Splunk’s product and distribution in the near future. While Cisco has significant experience with acquisitions, Splunk is a large deal, and it remains uncertain whether Cisco will face integration challenges.

In addition, While Cisco has been investing in cybersecurity, observability and AI, these growth areas only account for a small portion of total revenues. Consequently, it is unlikely that these investments will generate significant growth leverage in the near term.

End Notes

While I consider Cisco to be a low-growth company, I acknowledge and appreciate the company’s efforts to reduce operating costs and invest in growth areas such as AI, cybersecurity, and cloud computing. As a result, I am upgrading my rating to ‘Buy’ with a fair value estimate of $55 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.