Summary:

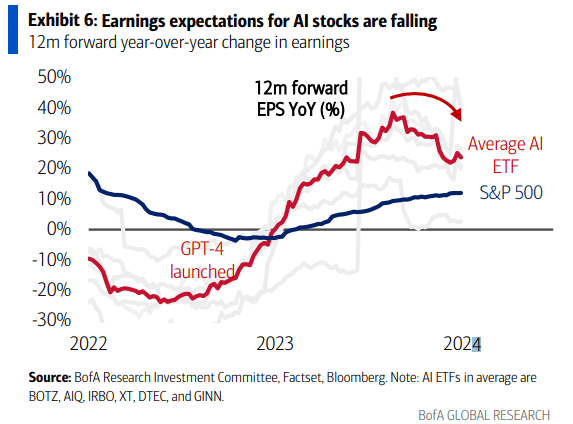

- AI stocks’ forward-12-month earnings growth estimates are falling, contrasting with rising S&P 500 EPS trends, allowing for some new entrants into the key theme.

- Cisco’s EPS revisions are mixed, but potential growth opportunities in AI could lead to a higher valuation amid subdued expectations.

- Cisco’s earnings, valuation, dividend yield, and free cash flow forecasts suggest the stock is undervalued while its technical situation is less sanguine.

- I highlight key price levels to monitor ahead of earnings due out next month.

raisbeckfoto

Ahead of the two busiest weeks of the second quarter reporting period, there is a stealthy cautious approach to the recently-red-hot AI theme. Bank of America Global Research reports that forward-12-month earnings growth estimates for AI stocks are falling. Contrast that to generally rising S&P 500 EPS trends. What’s more, firms adjacent to the AI theme still appear to be faring well in terms of profit expectations.

Cisco (NASDAQ:CSCO) has seen a mixed bag of sellside EPS revisions while both its FY 2024 and 2025 per-share operating profits are expected to dip. But I reiterate a buy rating as there could be nascent growth opportunities in AI. If we see that play out and upside from Splunk, then the firm’s low-double-digit P/E could easily be re-rated higher at least a few turns.

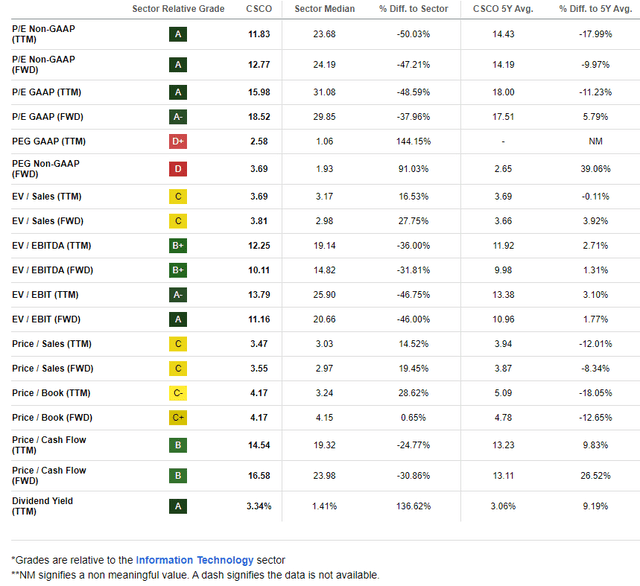

Still, the Communications Equipment industry stalwart has much to prove, particularly as shares have underperformed considerably this year and since my January analysis. As the corporate spending environment has been focused on AI and amid competitive pressures, investors have shied away from Cisco. But with a P/E now at a 10% discount to its long-term average, I see the stock as a decent bargain, and investors are paid to wait at the very least given the stock’s high 3.4% forward dividend yield.

AI Earnings Forecasts Dim Somewhat

BofA Global Research

Back in May, Cisco reported a solid set of Q3 results. Non-GAAP EPS of $0.88 topped the Wall Street consensus estimate of $0.82 while revenue of $12.7 billion, down 13% from a year earlier, was a modest $70 million beat. Though shares traded lower by 2.7% post-earnings, the tone was upbeat amid healthy profitability trends.

Its GAAP gross margin verified at 65.1% while its operating margin was high at 68.3%, an impressive expansion of 310 basis points. Total annualized recurring revenue summed to $29.2 billion, including $4.2 billion from the acquisition of Splunk. Higher subscription revenue, a more profitable product mix, and reduced freight costs help to support the quarter.

In terms of the outlook, the management team forecasted Q4 revenue of $13.4 billion to $13.6 billion, a midpoint below the consensus forecast of $13.54 billion. Non-GAAP EPS was seen in the $0.84 to $0.86 range for the quarter that just ended. The hope is that Cisco will benefit from share gains in its Ethernet-based AI buildouts for key AI hyperscalers. If so, then there could be a higher multiple assigned to the blue-chip stock. Not surprisingly, Cisco joined a group of firms investing in Canadian startup Cohere, part of a larger $1 billion global AI investment fund. That news came after Lenovo and Cisco inked an AI-related partnership in May.

What’s more, the company’s cybersecurity exposure should be a reliable growth spot, particularly following the hiccup from CrowdStrike (CRWD) last week. More demand for campus and data center switching are additional upside catalysts I expect to hear more about in the quarter about to be reported. As it stands, the options market has priced in a 4.8% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the August report.

Key risks include uncertainties regarding the integration of Splunk, increased competitive pressures that could ding margins, an overall reduction in corporate capex spending should the macro environment deteriorate, and weaker public spending is a risk, as Cisco is a major player in that area.

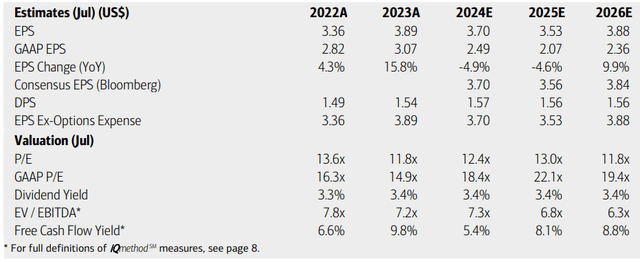

On the earnings outlook, analysts at BofA see EPS falling about 5% for the year just ended and a similar earnings contraction is anticipated for the out year. By 2026, though, per-share profit growth should be on the mend. The current Seeking Alpha consensus numbers are about on par with what BofA projects. As for Cisco’s top line, a decline to $53.7 billion is expected before a small 3% to 5% growth rate should ensue in FY 2025 and 2026.

Dividends, meanwhile, are forecast to hold near $1.60 annually (considering the current quarterly dividend is $0.40), so I don’t expect much increase in the yield. But with an EV/EBITDA multiple that is materially below that of the broader market and with a normalized free cash flow yield in the high single digits, shares are a decent value today.

Cisco: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume normalized operating EPS of $3.70 and apply an earnings multiple of 16, then CSCO should trade near $59, making the stock about 20% undervalued. I am using a higher multiple than its 5-year average P/E since it’s likely that Cisco is near trough earnings, which should generally warrant a higher-than-average valuation.

The stock also trades cheaply on a price-to-sales basis and is attractive from a free cash flow perspective.

CSCO: Sub-13 P/E, Cheap on Sales Too

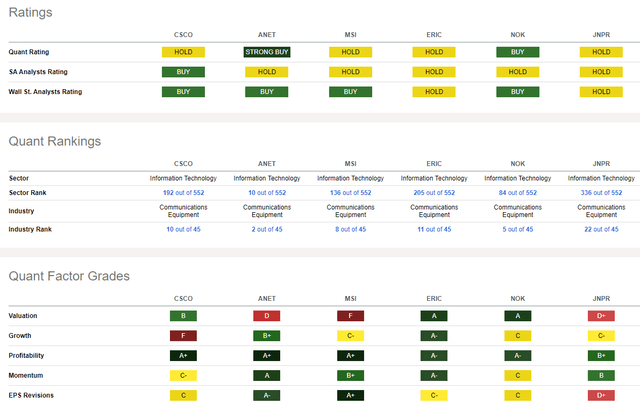

Compared to its peers, Cisco features a solid valuation rating while its recent growth trajectory has been weak. It’s important to point out that the company has topped earnings estimates in each quarter going back to at least mid-2019, so I expect another decent report in August.

Despite the poor growth rating, profitability readings are sanguine. What’s mixed, though, is the even mix of sellside upgrades and downgrades as well as soft share-price momentum.

Competitor Analysis

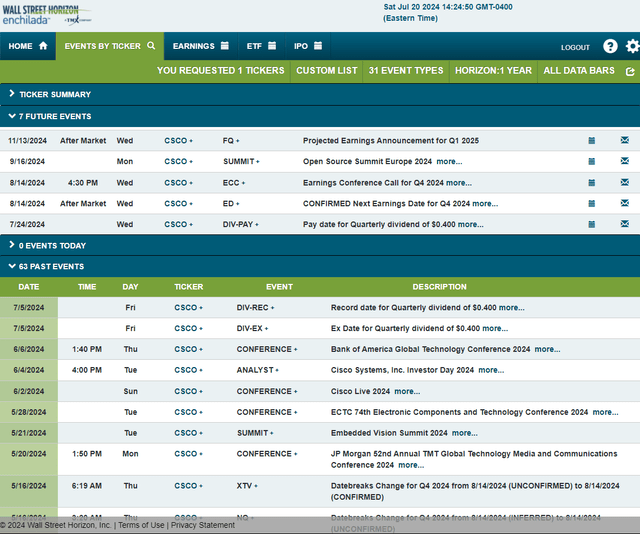

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2024 earnings date of Wednesday, August 14 AMC with a conference call immediately after the numbers cross the wires. You can listen live here.

The firm also pays a $0.40 quarterly dividend on July 24 and the management team is slated to present at the Open Source Summit Europe 2024 conference in September.

Corporate Event Risk Calendar

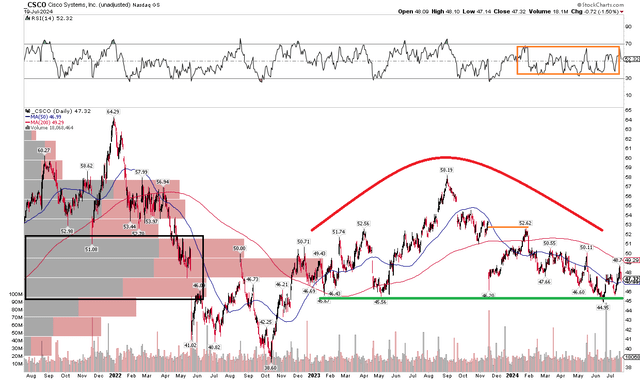

The Technical Take

With shares priced well on valuation, CSCO’s chart is not all that encouraging right now, a trend I described in January. But key support I pointed out last time continues to be in play around the $45 mark. Resistance may be seen at the falling 50-day moving average and at the early 2024 peak just below the $53 level. Even novice technicians can likely spot the potential bearish head and shoulders reversal pattern taking shape. If the $45 neckline breaks, then a test of the October 2022 low of $39 could easily be in play.

But take a look at the RSI momentum gauge at the top of the graph. It has merely been in the neutral 35 to 65 zone, suggesting that the bears don’t have a firm grip on the stock. What’s more, CSCO’s long-term 200-day moving average may be turning flat in its slope after a handful of quarters moving lower. That’s a decent sign, but we must also remember that shares have been a serial underperformer compared to the S&P 500.

Overall, the technicals are not impressive despite shares being priced attractively from a fundamental view.

CSCO: A Dangerous Rounded Top, Monitoring $45 Support

The Bottom Line

I reiterate a buy rating on Cisco. With some opportunities in the AI patch and a currently low valuation, the fundamental risk/reward looks intriguing to me. And while the chart situation is less than impressive, the firm’s history of topping EPS estimates is a decent backdrop ahead of the mid-August report.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.