Summary:

- Cisco has undergone a business transformation in the last five years that has gone largely unnoticed by investors.

- Cisco’s business is particularly sticky with customers given the high switching cost associated with its business.

- The stock is trading at a discount against multiple valuation metrics.

- We believe the stock could increase by more than 50% from current levels.

raisbeckfoto

Setting The Standard

They say that when it comes to job security, it’s best to find ways to make yourself into an indispensable asset. The same can be said of companies. Businesses with strategies that are easy to disrupt, or whose product has a low switching cost (such as internet providers, for example), are generally poor investments and difficult businesses to be in. Companies with an entrenched product and high cost of switching, however, are usually worth a closer look.

Cisco (NASDAQ:CSCO) is just such a business. The company is so ubiquitous throughout the communications hardware world that it sometimes gets lost in the background. Reflecting the near ‘gray man’ status of the company, the stock has been stuck in the doldrums for some time. We will make the case in this article that that could soon change, and that the stock has significant upside in the near to medium term.

Adapting To The Times

It’s easy to forget that Cisco was part of the high flying dot-com boom. After surviving the collapse of tech at the end of the 1990s, Cisco continued its steady penetration of the enterprise hardware communications market. Today, investors tend to view the company as a stodgy behemoth instead of a dynamic, flexible company.

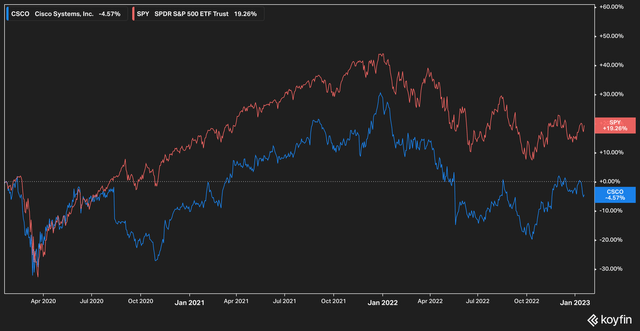

CSCO vs SPY returns, 3 yr (Koyfin)

We think this sentiment has been reflected in the stock’s performance over the last several years. In a three year timeframe, Cisco has returned a -4% (excluding dividends) compared to the S&P 500 (SPY) return of 19%. It’s not difficult to understand why Cisco struggled during COVID–as a communications hardware provider, the company seemed tailor-made to suffer in a worldwide supply chain snarl. Investors have been cautious with the stock ever since.

In the last quarterly call, however, management pointed out that these pressures are finally beginning to ease in a non-transitory way. The company also reported stellar earnings of $13.6 billion, posting 6% year-over-year growth when many analysts were expecting growth to be flat. Cisco’s order book is also filled to the brim with $31 billion in remaining performance obligations (RPOs) scheduled, $16 billion of which is expected to be recognized in the next 12 months.

These results are positive, but they belie a more fundamental shift under the hood in Cisco’s business.

While Cisco operates in multiple business segments, in the minds of most investors it is primarily a hardware company, making phones, routers, and the like. As such, the company has typically been ascribed a hardware-like multiple versus a higher, software-esque multiple.

Investors might be surprised to learn, then, that in the last quarter, 43% of Cisco’s revenue was generated on a subscription basis. This is a change from the past–management has executed an almost undercover transformation of the business. Hardware sales are typically one-and-done, with the upfront cost of buying, say, a phone recognized as revenue up front with some intermittent servicing costs incurred over the years. Delivery of these sales are, as we all now are painfully aware, reliant on a well-oiled supply chain and expose Cisco to the uncertainties of an increasingly de-globalized world.

The shift to recurring revenue at Cisco is, we think, a brilliant move on the part of management and not yet fully appreciated by investors.

The change is real. Subscription revenue growth far outpaced other segments. Of the $13 billion In total revenue, almost $4 billion was comprised of software sales, and 85% of that revenue was subscription-based–up from 78% in Q1 of 2021. While other units posted single-digit growth, subscription software revenue was up 11%.

What Do We Think Will Happen?

We believe the market has not yet priced in the changes that have occurred within Cisco’s business. As previously mentioned, the stock has been essentially flat over the past three years. We believe the market has discounted Cisco and created an attractive opportunity for investors.

Let’s break it down.

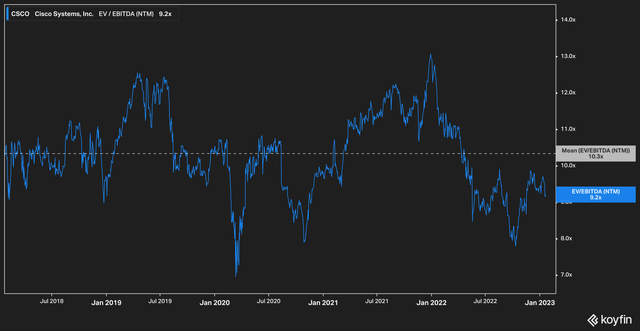

On a forward EV/EBITDA basis, Cisco is currently trading at a 9.2x multiple, which is below its average of 10.3x. We point out as well that while the it is less than a full point away from its average, the average is heavily influenced by the flash-recession multiple drop in early 2020. Factoring out that, the average multiple is a bit higher.

Cisco EV/EBITDA (Koyfin)

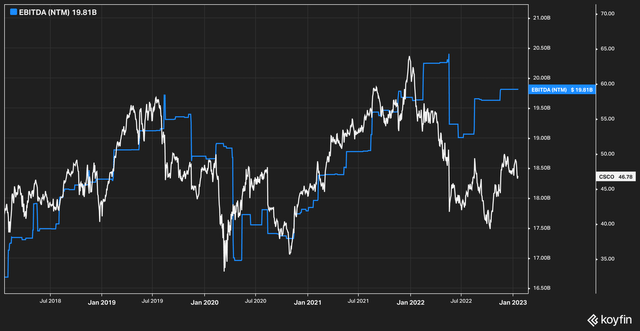

More compelling however, is the stock’s historical trading relationship with its forward EBITDA estimates. Historically, Cisco has traded in fair lockstep with its EBITDA estimates throughout the ups and downs of the market.

In January 2022, however, the relationship broke down.

CSCO Price / EBITDA (Koyfin)

This is to be expected–after all, the whole market sold off, with tech being hit particularly hard. Today, given the shift in Cisco’s business, the fact that a gap remains presents, in our view, a compelling opportunity for investors as we expect the historical relationship between price and EBITDA will be restored.

The opportunity is magnified in our view by the additional fact that Cisco’s NTM EBITDA estimates have not been flat–they have risen on a quarterly basis. This only enhances the possible upside in our view.

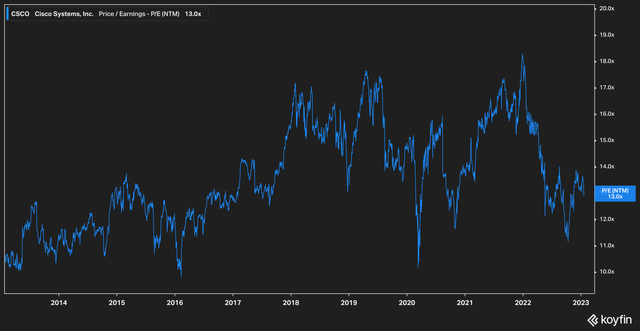

A quick review of Cisco’s historical forward price to earnings [FPE] ratio presents a compelling case as well.

CSCO FPE (Koyfin)

Cisco presents a bargain at the moment, trading at just 13x forward earnings. The stock has not consistently seen this level of valuation since 2017.

Now, one might point out that growth has hardly been stellar over the years. Total revenues over from 2017 until now have only grown by about 10% after all. What is it, you may ask, that demands a higher valuation than the historical average?

We would answer that question by pointing out just how much the business has changed that time frame.

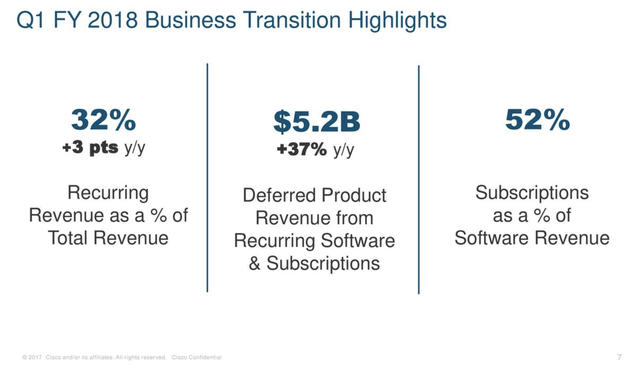

CSCO Q1 2018 Software Revenues (Koyfin)

Looking back at the Q1 of FY2018 (which is in calendar year 2017), only 52% of software revenue was subscription based. We remind readers that for Cisco today that figure is 85%.

Perhaps more important is that five years ago, recurring revenue represented only 32% of Cisco’s overall revenues. We again remind readers that today that figure stands 11% higher, at 43%–a not insignificant development given the astronomical size of Cisco’s overall revenues.

The Bottom Line

We believe that management has been largely successful at transforming Cisco’s business from one-time hardware and software support sales into a recurring revenue model. We also think there is still plenty of room to run overall. This is important because it establishes a degree of predictability into Cisco’s earnings and revenues that was not present before.

Cisco’s stock performance over the last few years demonstrates to us that this transformation has gone largely unnoticed by investors, and the stock is currently trading at historic discounts when considered historical EV/EBITDA, FPE, and price-to-EBITDA.

The stock currently trades around $46, a 13x multiple on earnings. We estimate a multiple of 18x FY2024’s earnings to be a better reflection of both Cisco’s historical average and the transformation happening within its business, giving us a price target of $69–approximately 50% from its current levels. Even this multiple may be conservative, as competitors Arista Networks (ANET) and Motorola (MSI) trade at 22x and 23x forward earnings, respectively. A similar multiple for Cisco would yield an $84 price target.

We think investors would do well to consider a place in their portfolio for Cisco.

Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.